17++ Breach of money laundering regulations 2017 ideas in 2021

Home » about money loundering Info » 17++ Breach of money laundering regulations 2017 ideas in 2021Your Breach of money laundering regulations 2017 images are ready. Breach of money laundering regulations 2017 are a topic that is being searched for and liked by netizens now. You can Download the Breach of money laundering regulations 2017 files here. Get all royalty-free vectors.

If you’re looking for breach of money laundering regulations 2017 pictures information related to the breach of money laundering regulations 2017 topic, you have visit the ideal site. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

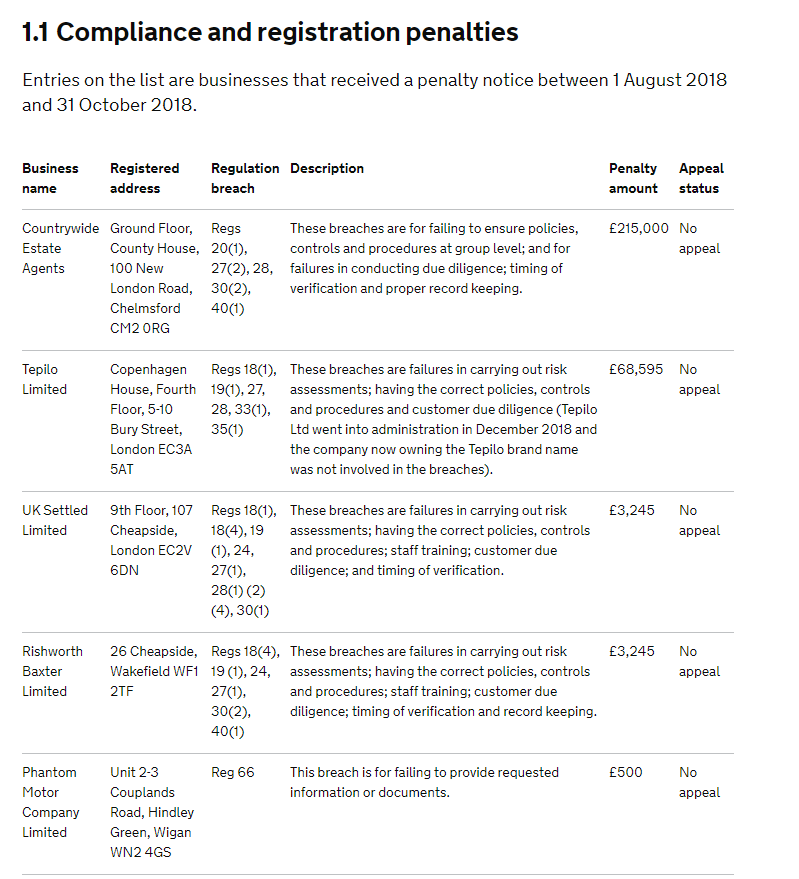

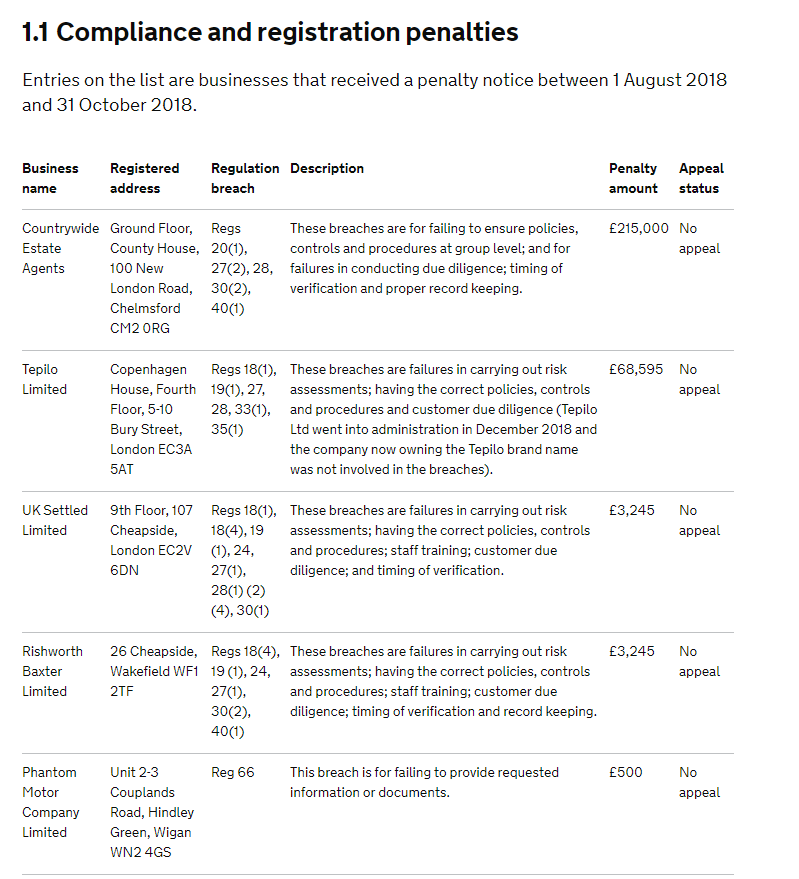

Breach Of Money Laundering Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. They apply to a wide range of businesses identified as most vulnerable to the risk of being used for money laundering and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime. POCA 2002 sets out the main money laundering offences and provides for the confiscation.

Estate Agents Hit With Surprise Hmrc Inspections Vinciworks Blog From vinciworks.com

Estate Agents Hit With Surprise Hmrc Inspections Vinciworks Blog From vinciworks.com

Tue 21 Feb 2017 1212 EST. POCA 2002 sets out the main money laundering offences and provides for the confiscation. Or b is knowingly a beneficial owner of a relevant firm is guilty of a criminal offence. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. 13 A person who is guilty of a. The 2017 Regulations apply to.

They also confirm firms may outsource CDD but.

2 In considering the partys history of compliance regard need only be had to the partys compliance with and breaches of those laws of which the. The monetary value of a penalty issued under the 2017 regulations may be part of a larger penalty that incorporates breaches of the 2007 regulations as well. Tue 21 Feb 2017 1212 EST. They also confirm firms may outsource CDD but. Or b is knowingly a beneficial owner of a relevant firm is guilty of a criminal offence. 12 A person who in breach of the prohibition in paragraph a acts as a manager or officer of a relevant firm or as a relevant sole practitioner.

Source: dia.govt.nz

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Money Laundering Regulations 2017. The idea of cash laundering is very important to be understood for these working within the financial sector. HMRC will also publish the total. Money laundering 2017 key changes The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers.

Source: researchgate.net

Source: researchgate.net

It is a course of by which soiled money is converted into clean money. M the partys history of compliance in the five years before the breach with the Anti-Money Laundering Regulations 2017 and similar laws in other jurisdictions. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017. The 2017 Regulations apply to. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017.

Source:

12 A person who in breach of the prohibition in paragraph a acts as a manager or officer of a relevant firm or as a relevant sole practitioner. However you should be aware that the presence of one or. POCA 2002 sets out the main money laundering offences and provides for the confiscation. Money laundering 2017 key changes The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. The 2017 Regulations apply to.

Source: vinciworks.com

Source: vinciworks.com

The requirements of the UK anti-money laundering regime are set out in the Proceeds of Crime Act 2002 POCA 2002 the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 the regulations and the Terrorism Act 2000. 2 In considering the partys history of compliance regard need only be had to the partys compliance with and breaches of those laws of which the. 12 A person who in breach of the prohibition in paragraph a acts as a manager or officer of a relevant firm or as a relevant sole practitioner. 13 A person who is guilty of a. Potential breaches of money laundering rules after concerns raised last.

Source: moneylaundering.com

Source: moneylaundering.com

POCA 2002 sets out the main money laundering offences and provides for the confiscation. The sources of the cash in precise are felony and the cash is invested in a manner that makes it look like clean money and hide the id of the criminal part of the. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. Potential breaches of money laundering rules after concerns raised last. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017.

Source:

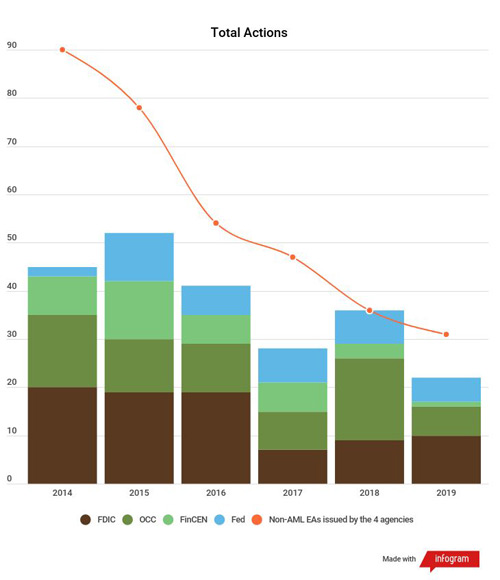

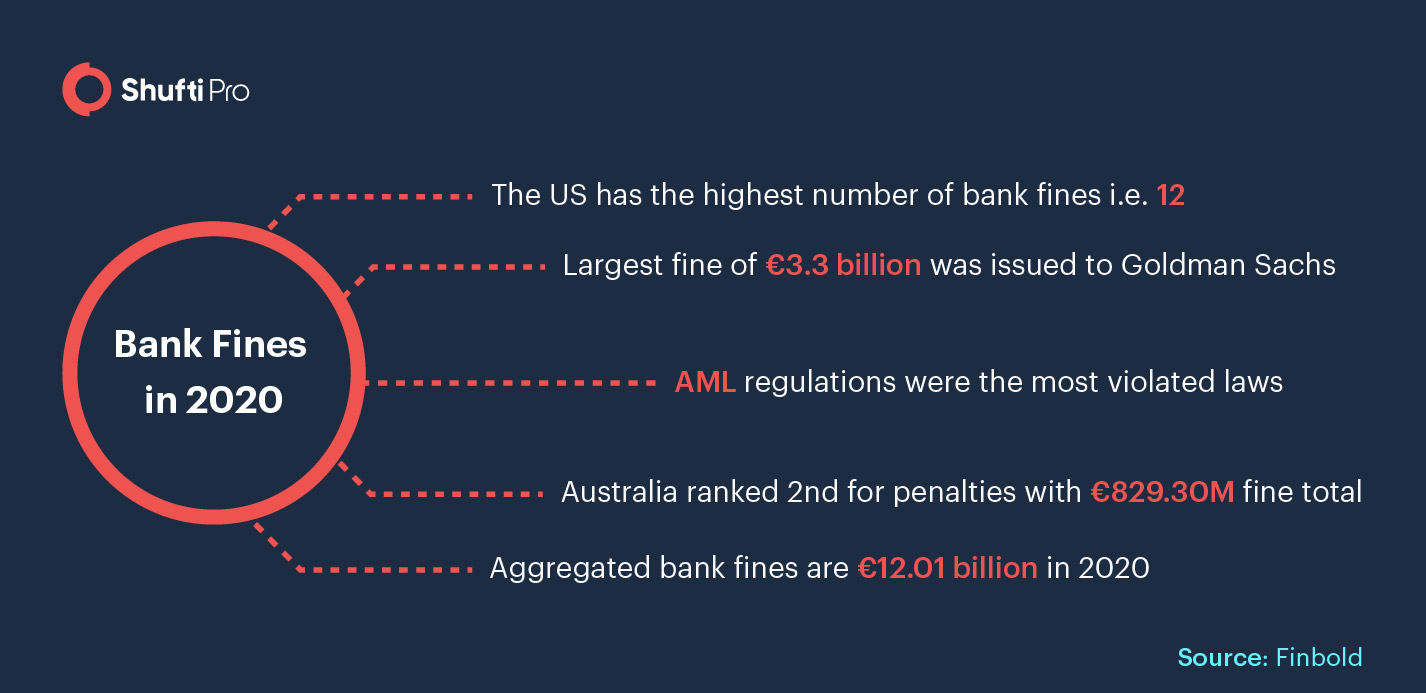

HMRC will also publish the total. M the partys history of compliance in the five years before the breach with the Anti-Money Laundering Regulations 2017 and similar laws in other jurisdictions. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Money laundering 2017 key changes The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. Maximum Penalty For A Breach Of The Money Laundering Regulations 2017 on August 07 2021.

Source: researchgate.net

Source: researchgate.net

Maximum Penalty For A Breach Of The Money Laundering Regulations 2017 on August 07 2021. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. The monetary value of a penalty issued under the 2017 regulations may be part of a larger penalty that incorporates breaches of the 2007 regulations as well. This note explains the civil penalties that can be imposed under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI. Maximum Penalty For A Breach Of The Money Laundering Regulations 2017 on August 07 2021.

Source: ec.europa.eu

Source: ec.europa.eu

Tue 21 Feb 2017 1212 EST. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. It is a course of by which soiled money is converted into clean money. Potential breaches of money laundering rules after concerns raised last. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017.

Source: awdc.be

Source: awdc.be

By the FCA into its compliance with UK money laundering regulations. HMRC will also publish the total. Money laundering 2017 key changes The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. 12 A person who in breach of the prohibition in paragraph a acts as a manager or officer of a relevant firm or as a relevant sole practitioner. M the partys history of compliance in the five years before the breach with the Anti-Money Laundering Regulations 2017 and similar laws in other jurisdictions.

Source: iclg.com

Source: iclg.com

12 A person who in breach of the prohibition in paragraph a acts as a manager or officer of a relevant firm or as a relevant sole practitioner. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Credit and financial institutions auditors insolvency practitioners accountants and tax advisers legal professionals trust or company service providers estate agents high value dealers earning at least 10000 on a trade of goods and gambling providers. Or b is knowingly a beneficial owner of a relevant firm is guilty of a criminal offence. The monetary value of a penalty issued under the 2017 regulations may be part of a larger penalty that incorporates breaches of the 2007 regulations as well.

Source: thejakartapost.com

Source: thejakartapost.com

HMRC will also publish the total. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017. The requirements of the UK anti-money laundering regime are set out in the Proceeds of Crime Act 2002 POCA 2002 the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 the regulations and the Terrorism Act 2000. By the FCA into its compliance with UK money laundering regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017.

Source: shuftipro.com

Source: shuftipro.com

This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. 12 A person who in breach of the prohibition in paragraph a acts as a manager or officer of a relevant firm or as a relevant sole practitioner. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. POCA 2002 sets out the main money laundering offences and provides for the confiscation. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into.

Source: researchgate.net

Source: researchgate.net

Or b is knowingly a beneficial owner of a relevant firm is guilty of a criminal offence. They apply to a wide range of businesses identified as most vulnerable to the risk of being used for money laundering and. 2 In considering the partys history of compliance regard need only be had to the partys compliance with and breaches of those laws of which the. POCA 2002 sets out the main money laundering offences and provides for the confiscation. Credit and financial institutions auditors insolvency practitioners accountants and tax advisers legal professionals trust or company service providers estate agents high value dealers earning at least 10000 on a trade of goods and gambling providers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title breach of money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas