12+ Bsa aml beneficial ownership ideas

Home » about money loundering idea » 12+ Bsa aml beneficial ownership ideasYour Bsa aml beneficial ownership images are available. Bsa aml beneficial ownership are a topic that is being searched for and liked by netizens today. You can Get the Bsa aml beneficial ownership files here. Get all royalty-free photos.

If you’re searching for bsa aml beneficial ownership images information connected with to the bsa aml beneficial ownership interest, you have pay a visit to the right blog. Our site always provides you with hints for viewing the highest quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Bsa Aml Beneficial Ownership. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Beneficial Ownership exemptions for Leases BSAAML Beneficial Ownership Beneficial Ownership exemptions for Leases Manager at a bank 778MUSA A question came up here at my bank regarding the Beneficial Ownership exemption for accounts that finance the purchase or leasing of equipment. As a reminder the Beneficial Ownership Rule requires covered financial institutions to verify and identify each natural person with a 25 or greater equity interest in a legal entity customer. The FFIECs manual overview of the beneficial ownership requirements largely follows the FinCEN Rule and FAQ guidance we previously have described.

Anti Money Laundering Program 5 Pillars Of Success From amltrainer.com

Anti Money Laundering Program 5 Pillars Of Success From amltrainer.com

Key changes include expansion of the BSA mission to include national security increased emphasis on risk-based strategies new frameworks for reporting and sharing information including feedback loops a mandatory whistleblower reward program and creation of beneficial. Beneficial Ownership exemptions for Leases BSAAML Beneficial Ownership Beneficial Ownership exemptions for Leases Manager at a bank 778MUSA A question came up here at my bank regarding the Beneficial Ownership exemption for accounts that finance the purchase or leasing of equipment. Office of Foreign Assets Control. Under the Act a beneficial owner is defined as any person who i owns a 25 equity stake or ii exercises substantial control over the entity. As all financial institutions are aware in May of 2018 the Financial Crimes Enforcement Network FinCEN customer due diligence CDD Rule went into effect amending pre-existing Bank Secrecy Act BSA regulations. The Act does not define what constitutes substantial control and it is unclear.

Appendix 1 Beneficial Ownership.

Under the control prong the beneficial owner is a single individual with significant. Latest news reports from the medical literature videos from the experts and more. Latest news reports from the medical literature videos from the experts and more. As a reminder the Beneficial Ownership Rule requires covered financial institutions to verify and identify each natural person with a 25 or greater equity interest in a legal entity customer. RISKS ASSOCIATED WITH MONEY LAUNDERING AND TERRORIST FINANCING Guidance to examiners on money laundering and terrorist financing risks associated with products services customers and geographic locations. As part of an institutions BSAAML compliance program a financial institution should establish and maintain CDD procedures that are reasonably designed to identify and verify the identity of beneficial owners 2 of an account as appropriate based.

Source: regtechconsulting.net

Source: regtechconsulting.net

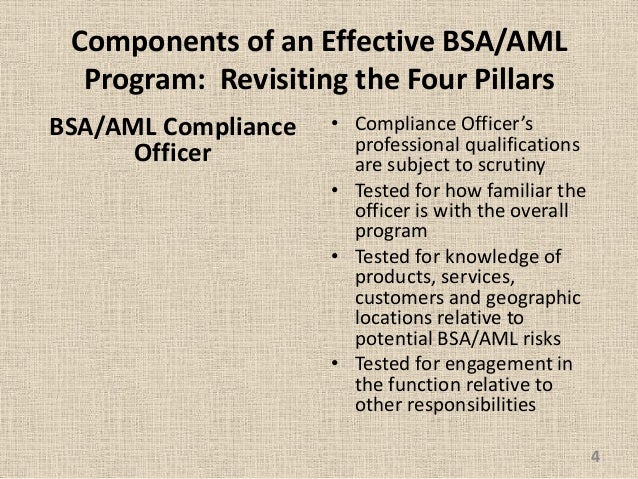

Under the control prong the beneficial owner is a single individual with significant. Assessing the BSAAML Compliance Program. Guidance to examiners on assessing BSAAML compliance program structures management of foreign branches and parallel banking. The Beneficial Ownership Rule. Ad AML coverage from every angle.

Source: slideplayer.com

Source: slideplayer.com

Latest news reports from the medical literature videos from the experts and more. Risks Associated with Money Laundering and Terrorist Financing. See 31 CFR 1010230e1. The FFIECs manual overview of the beneficial ownership requirements largely follows the FinCEN Rule and FAQ guidance we previously have described. RISKS ASSOCIATED WITH MONEY LAUNDERING AND TERRORIST FINANCING Guidance to examiners on money laundering and terrorist financing risks associated with products services customers and geographic locations.

Source: yumpu.com

Source: yumpu.com

Under the Act a beneficial owner is defined as any person who i owns a 25 equity stake or ii exercises substantial control over the entity. 4 See 31 CFR 1010230d1 If a trust owns directly or indirectly through any contract arrangement understanding relationship or otherwise 25 percent or more of the equity interests of a legal entity customer the beneficial owner. BSAAML and OFAC sanctions. Risks Associated with Money Laundering and Terrorist Financing. This rule was enacted in part to help solidify customer due diligence.

Source: slideplayer.com

Source: slideplayer.com

The FFIECs manual overview of the beneficial ownership requirements largely follows the FinCEN Rule and FAQ guidance we previously have described. Under the ownership prong a beneficial owner is each individual if any who directly or indirectly through any contract arrangement understanding relationship or otherwise owns 25 percent or more of the equity interests of a legal entity customer. Developing Conclusions and Finalizing the Exam. Obtained the identifying information for each beneficial owner of a legal entity customer as required eg. The AML changes are significant widespread and extremely detailed.

Source: verafin.com

Source: verafin.com

Within a reasonable time after account opening verified enough of the beneficial owners identity information to form a reasonable belief as to the beneficial owners true identity. BSAAML and OFAC sanctions. Within a reasonable time after account opening verified enough of the beneficial owners identity information to form a reasonable belief as to the beneficial owners true identity. Name date of birth address and identification number. Guidance to examiners on assessing BSAAML compliance program structures management of foreign branches and parallel banking.

Source: slideshare.net

Source: slideshare.net

Assessing Compliance with BSA Regulatory Requirements. Developing Conclusions and Finalizing the Exam. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Latest news reports from the medical literature videos from the experts and more. See 31 CFR 1010230e1.

Source: verafin.com

Source: verafin.com

Obtained the identifying information for each beneficial owner of a legal entity customer as required eg. See 31 CFR 1010230. Under the Act a beneficial owner is defined as any person who i owns a 25 equity stake or ii exercises substantial control over the entity. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. As part of an institutions BSAAML compliance program a financial institution should establish and maintain CDD procedures that are reasonably designed to identify and verify the identity of beneficial owners 2 of an account as appropriate based.

Source: slideshare.net

Source: slideshare.net

Under the ownership prong a beneficial owner is each individual if any who directly or indirectly through any contract arrangement understanding relationship or otherwise owns 25 percent or more of the equity interests of a legal entity customer. BSAAML and OFAC sanctions. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. As all financial institutions are aware in May of 2018 the Financial Crimes Enforcement Network FinCEN customer due diligence CDD Rule went into effect amending pre-existing Bank Secrecy Act BSA regulations. Under the control prong the beneficial owner is a single individual with significant.

Source: regtechconsulting.net

Source: regtechconsulting.net

Assessing the BSAAML Compliance Program. And bring the United States into compliance with international anti-money laundering and countering the financing of terrorism standards. Under the control prong the beneficial owner is a single individual with significant. Assessing Compliance with BSA Regulatory Requirements. Latest news reports from the medical literature videos from the experts and more.

Source: amltrainer.com

Source: amltrainer.com

And bring the United States into compliance with international anti-money laundering and countering the financing of terrorism standards. Under the control prong the beneficial owner is a single individual with significant. Appendix 1 Beneficial Ownership. BSAAML and OFAC sanctions. The FFIECs manual overview of the beneficial ownership requirements largely follows the FinCEN Rule and FAQ guidance we previously have described.

Appendix 1 Beneficial Ownership. This rule was enacted in part to help solidify customer due diligence. As a reminder the Beneficial Ownership Rule requires covered financial institutions to verify and identify each natural person with a 25 or greater equity interest in a legal entity customer. Assessing the BSAAML Compliance Program. See 31 CFR 1010230e1.

Source: complianceonline.com

Source: complianceonline.com

Appendix 1 Beneficial Ownership. See 31 CFR 1010230. Beneficial Owners Beneficial ownership is determined under both a control prong and an ownership prong. Guidance to examiners on assessing BSAAML compliance program structures management of foreign branches and parallel banking. Latest news reports from the medical literature videos from the experts and more.

Source: acamstoday.org

Source: acamstoday.org

The FFIECs manual overview of the beneficial ownership requirements largely follows the FinCEN Rule and FAQ guidance we previously have described. Key changes include expansion of the BSA mission to include national security increased emphasis on risk-based strategies new frameworks for reporting and sharing information including feedback loops a mandatory whistleblower reward program and creation of beneficial. As a reminder the Beneficial Ownership Rule requires covered financial institutions to verify and identify each natural person with a 25 or greater equity interest in a legal entity customer. The Act does not define what constitutes substantial control and it is unclear. See 31 CFR 1010230.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml beneficial ownership by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information