10++ Bsa aml examination procedures info

Home » about money loundering Info » 10++ Bsa aml examination procedures infoYour Bsa aml examination procedures images are available in this site. Bsa aml examination procedures are a topic that is being searched for and liked by netizens today. You can Download the Bsa aml examination procedures files here. Find and Download all free photos.

If you’re searching for bsa aml examination procedures pictures information connected with to the bsa aml examination procedures topic, you have come to the right site. Our website always provides you with hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Bsa Aml Examination Procedures. Core Examination Suspicious Activity Reporting Examination Procedures 39. Bank Secrecy ActAnti-Money Laundering BSAAML Examiner Training is a comprehensive training package for entry-level BSA examiners as well as seasoned examiners needing a refresher. If included within the scope of the examination determine appropriate OFAC compliance examination activities. Identify the banks BSAAML risks and develop the examination scope and plan.

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore From bookstore.gpo.gov

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore From bookstore.gpo.gov

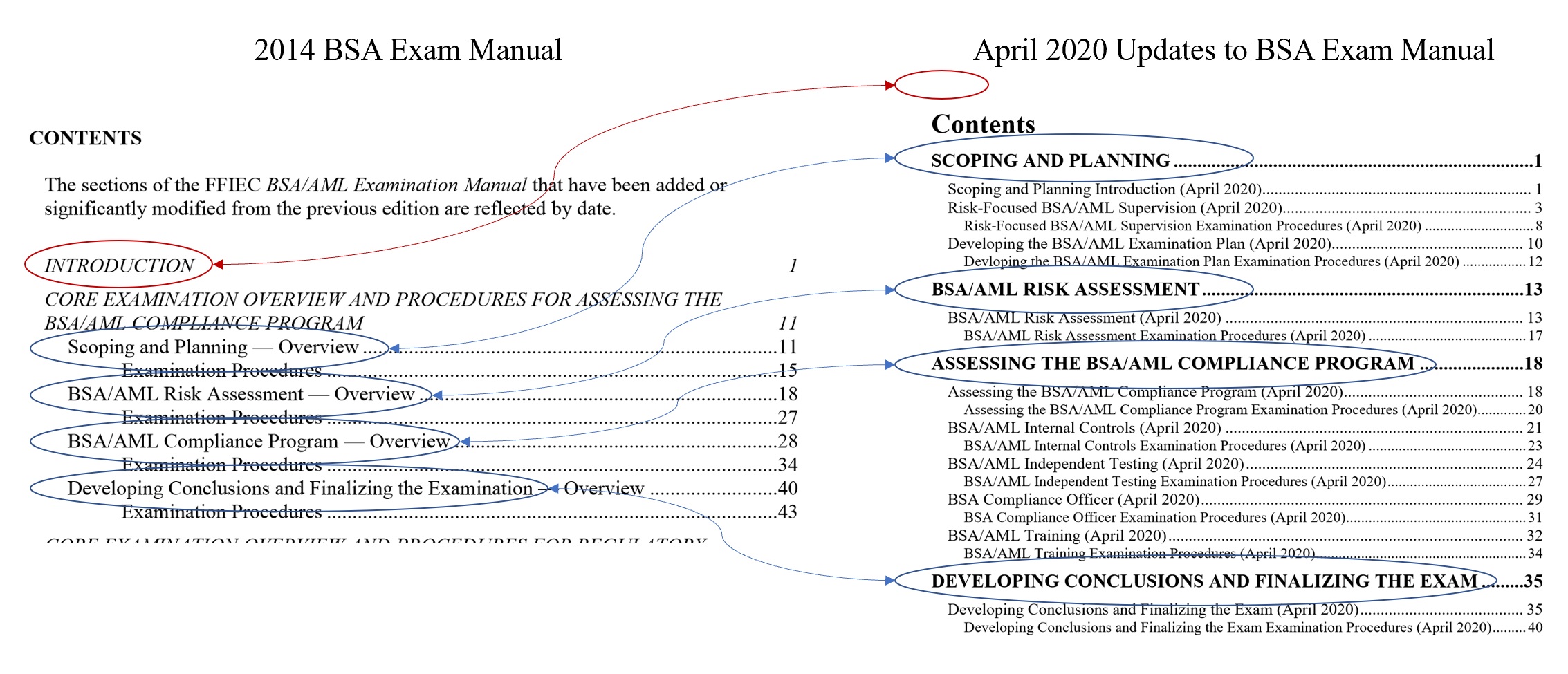

The manual consists of the following sections. The scope of the BSAAML examination including the examination and testing procedures necessary to assess the adequacy of the banks BSAAML compliance program the banks compliance with BSA regulatory requirements and the banks adherence to and the appropriateness of its policies procedures and processes. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. Developing conclusions and finalizing the exam examination procedures Objective. The Federal Financial Institutions Examination Council FFIEC released four updates to the Bank Secretary ActAnti-Money Laundering BSAAML Examination Manual which provides guidance to examiners for. Develop an appropriate supervisory response.

Core Examination Procedures focus on.

The scope of the BSAAML examination including the examination and testing procedures necessary to assess the adequacy of the banks BSAAML compliance program the banks compliance with BSA regulatory requirements and the banks adherence to and the appropriateness of its policies procedures and processes. The manual is structured to allow examiners to tailor the BSAAML examination scope and procedures to the specific risk profile of the banking organization. For sections with examination procedures the Online link under Examination Procedures allows you to view the examination procedures online. Core Examination Cur This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. If included within the scope of the examination determine appropriate OFAC compliance examination activities. Developing conclusions and finalizing the exam examination procedures Objective.

Source: docplayer.net

Source: docplayer.net

Develop an appropriate supervisory response. Determine the examination activities necessary to assess the adequacy of the banks BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. Formulate conclusions about the adequacy of the banks BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. The federal banking agencies generally allocate more resources to higher-risk areas and fewer resources to lower-risk areas. For sections with examination procedures the Online link under Examination Procedures allows you to view the examination procedures online.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

The manual is structured to allow examiners to tailor the BSAAML examination scope and procedures to the specific risk profile of the banking organization. The scope of the BSAAML examination including the examination and testing procedures necessary to assess the adequacy of the banks BSAAML compliance program the banks compliance with BSA regulatory requirements and the banks adherence to and the appropriateness of its policies procedures and processes. The federal banking agencies generally allocate more resources to higher-risk areas and fewer resources to lower-risk areas. And communicate BSAAML examination findings to the bank. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program.

Source: docplayer.net

Source: docplayer.net

Core Examination Cur This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. BSAAML Compliance Program Structures Overview FFIEC BSAAML Examination Manual 155 2272015V2 EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR CONSOLIDATED AND OTHER TYPES OF BSAAML COMPLIANCE PROGRAM STRUCTURES BSAAML Compliance Program Structures Overview Objective. Developing conclusions and finalizing the exam examination procedures Objective. Core Examination Overview and Procedures for Assessing the BSAAML. The Federal Financial Institutions and State Regulators updates sections and related examination procedures in the BSAAML Examination Manual.

Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual Manual. The manual consists of the following sections. This examination process includes determining examination staffing needs including technical expertise and selecting examination procedures to be completed. RISK-FOCUSED BSAAML SUPERVISION EXAMINATION PROCEDURES. The Manual provide s instructions to examiners when assessing the adequacy of a banks BSAAML compliance program relative to.

Source: regtechconsulting.net

Source: regtechconsulting.net

If included within the scope of the examination determine appropriate OFAC compliance examination activities. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Specific examination procedures will depend on factors such as the banks risk profile size or complexity the quality of its independent testing any changes to its BSAAML compliance officer or department expansionary activities and new innovations and technologies. The manual is structured to allow examiners to tailor the BSAAML examination scope and procedures to the specific risk profile of the banking organization. Several updated sections and related examination procedures to the.

Source: docplayer.net

Source: docplayer.net

For sections with examination procedures the Online link under Examination Procedures allows you to view the examination procedures online. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. Core Examination Procedures focus on. The Federal Financial Institutions and State Regulators updates sections and related examination procedures in the BSAAML Examination Manual. Specific examination procedures will depend on factors such as the banks risk profile size or complexity the quality of its independent testing any changes to its BSAAML compliance officer or department expansionary activities and new innovations and technologies.

Source: docplayer.net

Source: docplayer.net

The program focuses on introducing BSA regulatory compliance examination and is available on demand. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The examination staffing needs including any subject matter expertise BSA and non-BSA. Core Examination Procedures focus on. The Federal Financial Institutions Examination Council FFIEC released four updates to the Bank Secretary ActAnti-Money Laundering BSAAML Examination Manual which provides guidance to examiners for.

Source: researchandmarkets.com

Source: researchandmarkets.com

Bank Secrecy ActAnti-Money Laundering BSAAML Examiner Training is a comprehensive training package for entry-level BSA examiners as well as seasoned examiners needing a refresher. The scoping and planning process should include determining BSAAML examination staffing needs including technical expertise and identifying the BSAAML examination and testing procedures to be completed. RISK-FOCUSED BSAAML SUPERVISION EXAMINATION PROCEDURES. And communicate BSAAML examination findings to the bank. BSAAML Compliance Program Structures Overview FFIEC BSAAML Examination Manual 155 2272015V2 EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR CONSOLIDATED AND OTHER TYPES OF BSAAML COMPLIANCE PROGRAM STRUCTURES BSAAML Compliance Program Structures Overview Objective.

Source: yumpu.com

Source: yumpu.com

The program focuses on introducing BSA regulatory compliance examination and is available on demand. The specific examination procedures performed to assess the banks compliance with BSA regulatory requirements depend on the banks risk profile size or complexity quality of independent testing changes to the banks BSAAML compliance officer or department expansionary activities new innovations and technologies or other relevant factors. The scoping and planning process should include determining BSAAML examination staffing needs including technical expertise and identifying the BSAAML examination and testing procedures to be completed. The program focuses on introducing BSA regulatory compliance examination and is available on demand. The scope of the BSAAML examination including the examination and testing procedures necessary to assess the adequacy of the banks BSAAML compliance program the banks compliance with BSA regulatory requirements and the banks adherence to and the appropriateness of its policies procedures and processes.

Source: docplayer.net

Source: docplayer.net

BSAAML Compliance Program Structures Overview FFIEC BSAAML Examination Manual 155 2272015V2 EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR CONSOLIDATED AND OTHER TYPES OF BSAAML COMPLIANCE PROGRAM STRUCTURES BSAAML Compliance Program Structures Overview Objective. This examination process includes determining examination staffing needs including technical expertise and selecting examination procedures to be completed. The program focuses on introducing BSA regulatory compliance examination and is available on demand. Formulate conclusions about the adequacy of the banks BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. Core Examination Overview and Procedures for Assessing the BSAAML.

Source: is4banks.com

Source: is4banks.com

The Manual provide s instructions to examiners when assessing the adequacy of a banks BSAAML compliance program relative to. The federal banking agencies generally allocate more resources to higher-risk areas and fewer resources to lower-risk areas. Determine the examination activities necessary to assess the adequacy of the banks BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. Core Examination Suspicious Activity Reporting Examination Procedures 39.

Source: docplayer.net

Source: docplayer.net

The scoping and planning process should include determining BSAAML examination staffing needs including technical expertise and identifying the BSAAML examination and testing procedures to be completed. The program focuses on introducing BSA regulatory compliance examination and is available on demand. BSAAML Compliance Program Structures Overview FFIEC BSAAML Examination Manual 155 2272015V2 EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR CONSOLIDATED AND OTHER TYPES OF BSAAML COMPLIANCE PROGRAM STRUCTURES BSAAML Compliance Program Structures Overview Objective. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. Core Examination Suspicious Activity Reporting Examination Procedures 39.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

And communicate BSAAML examination findings to the bank. The program focuses on introducing BSA regulatory compliance examination and is available on demand. Develop an appropriate supervisory response. BSAAML Compliance Program Structures Overview FFIEC BSAAML Examination Manual 155 2272015V2 EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR CONSOLIDATED AND OTHER TYPES OF BSAAML COMPLIANCE PROGRAM STRUCTURES BSAAML Compliance Program Structures Overview Objective. Developing conclusions and finalizing the exam examination procedures Objective.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml examination procedures by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas