19+ Bsa aml fines info

Home » about money loundering Info » 19+ Bsa aml fines infoYour Bsa aml fines images are ready. Bsa aml fines are a topic that is being searched for and liked by netizens now. You can Download the Bsa aml fines files here. Find and Download all royalty-free images.

If you’re searching for bsa aml fines pictures information linked to the bsa aml fines topic, you have come to the right blog. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Bsa Aml Fines. Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. These were just some of the headlines on January 15 2021 when the Financial Crimes Enforcement Network or FinCEN the branch of the Treasury Department that is responsible for regulating and enforcing the anti-money laundering laws and regulations did in fact fine Capital One NA 390000000 for both willful and negligent violations of the Bank Secrecy Act BSA and its. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Anti Money Laundering Aml Ppt Download From slideplayer.com

Anti Money Laundering Aml Ppt Download From slideplayer.com

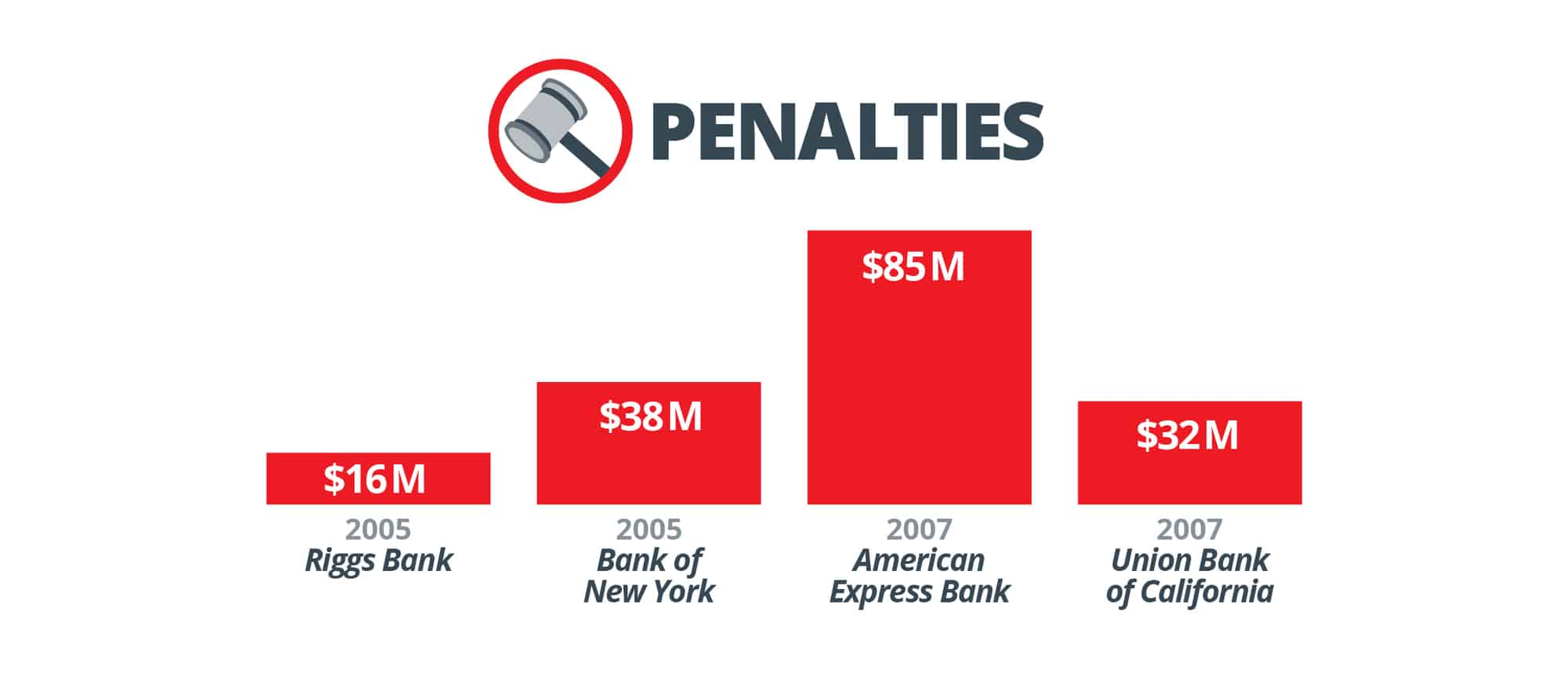

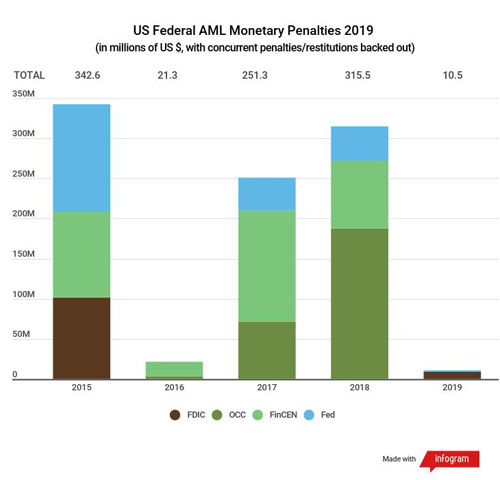

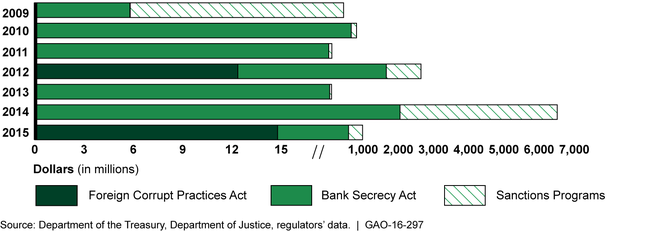

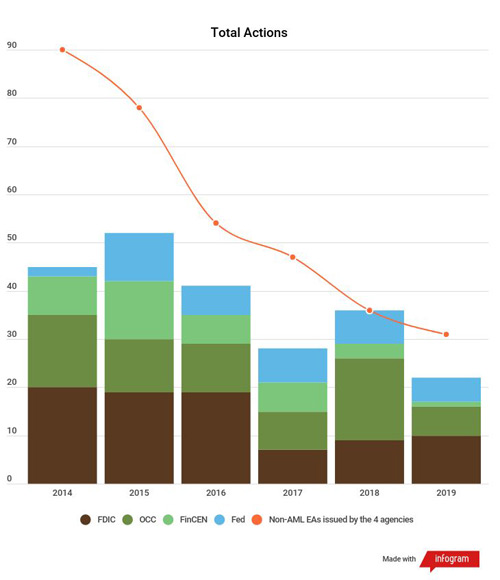

BSAAML Civil Money Penalties So Far in 2018 From the Office of the Comptroller of the Currency OCC The OCC has levied a total of 195 million in CMPs since the start of the year including 125 million in fines just in the last week. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. If research is to be believed institutions across the globe have not done enough in the anti-money laundering AML compliance area. BSA-AML Civil Money Penalties. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. Ad AML coverage from every angle.

Data from consultancy Duff Phelps revealed that AML fines in the first six months of 2020 reached US706 milli.

Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely. BSAAML regulatory requirements were expanded to confront a broader set of criminal activities including terrorist financing. Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely. In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate box es in the Suspicious Activity. 12 cases of AML non-compliance were reported and the sum of all these fines was 939 billion. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations.

Source: verafin.com

Source: verafin.com

Risks Associated with Money Laundering and Terrorist Financing. Department of Justice issued a 185 million civil money penalty against US. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. Assess the adequacy of the banks systems to manage the risks associated with private banking activities and managements ability to implement effective due diligence monitoring and reporting systems. Bank Secrecy Act BSA.

Source: nafcu.org

Department of Justice issued a 185 million civil money penalty against US. The US was ranked number 1 with the highest number of bank fines enforced in 2020. Latest news reports from the medical literature videos from the experts and more. Lessons Not Well Learned. Swedish SEB Bank Fined for Poor Anti-Money-Laundering Measures The Swedish Financial Supervisory Authority FSA fined SEK 1 billion the US 107 million for failing to provide adequate anti-money laundering AML measures at its subsidiaries in the Baltic countries of Swedens SEB bank.

Source: moneylaundering.com

Source: moneylaundering.com

12 cases of AML non-compliance were reported and the sum of all these fines was 939 billion. Latest news reports from the medical literature videos from the experts and more. 89 billion was the highest fine ever issued levied by the US DoJ against a French Bank in 2015. BSA-AML Civil Money Penalties. Department of Justice issued a 185 million civil money penalty against US.

Source: verafin.com

Source: verafin.com

Ad AML coverage from every angle. Risks Associated with Money Laundering and Terrorist Financing. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance. The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporat The report found that AML fines in the initial six months of 2020 reached a total of 706m compared with last years aggregate of 444m. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US.

Source: slideplayer.com

Source: slideplayer.com

The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporat The report found that AML fines in the initial six months of 2020 reached a total of 706m compared with last years aggregate of 444m. The cases are arranged in reverse chronological order and include the name and asset size when known of. Data from consultancy Duff Phelps revealed that AML fines in the first six months of 2020 reached US706 milli. The US was ranked number 1 with the highest number of bank fines enforced in 2020. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs.

In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate box es in the Suspicious Activity. Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely. The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporat The report found that AML fines in the initial six months of 2020 reached a total of 706m compared with last years aggregate of 444m. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. Assess the adequacy of the banks systems to manage the risks associated with private banking activities and managements ability to implement effective due diligence monitoring and reporting systems.

Source: complyadvantage.com

Source: complyadvantage.com

In 2001 with the passage of the USA PATRIOT Act the AML framework in the United States and the BSA itself were significantly amended in recognition of the changed landscape of financial crimes and systems. If research is to be believed institutions across the globe have not done enough in the anti-money laundering AML compliance area. These were just some of the headlines on January 15 2021 when the Financial Crimes Enforcement Network or FinCEN the branch of the Treasury Department that is responsible for regulating and enforcing the anti-money laundering laws and regulations did in fact fine Capital One NA 390000000 for both willful and negligent violations of the Bank Secrecy Act BSA and its. Ad AML coverage from every angle. 2020 AML Fines Cross 2019 Total.

Source: gao.gov

Source: gao.gov

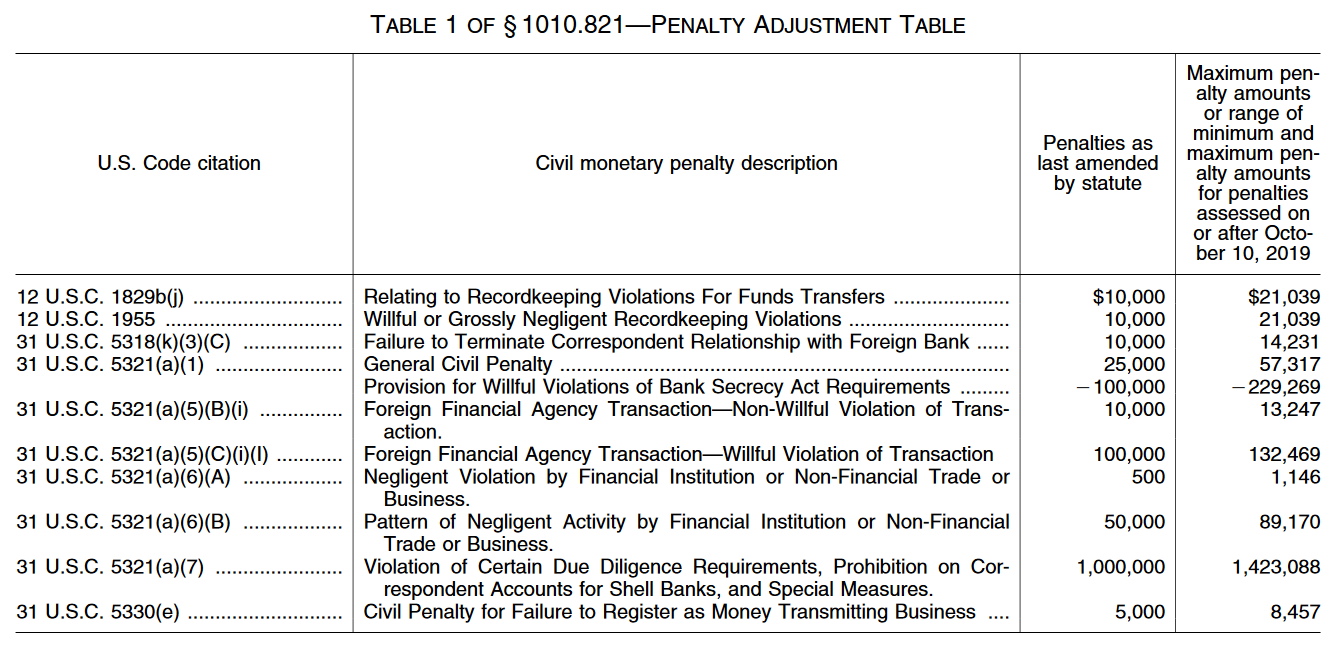

FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. The cases are arranged in reverse chronological order and include the name and asset size when known of. The Act significantly increases penalties for BSAAML violations for both companies and individuals. BSA-AML Civil Money Penalties. Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely.

Source: nafcu.org

Source: nafcu.org

The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporat The report found that AML fines in the initial six months of 2020 reached a total of 706m compared with last years aggregate of 444m. The US was ranked number 1 with the highest number of bank fines enforced in 2020. Ad AML coverage from every angle. 12 cases of AML non-compliance were reported and the sum of all these fines was 939 billion. Data from consultancy Duff Phelps revealed that AML fines in the first six months of 2020 reached US706 milli.

Source: nafcu.org

Source: nafcu.org

In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate box es in the Suspicious Activity. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. Latest news reports from the medical literature videos from the experts and more. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. These were just some of the headlines on January 15 2021 when the Financial Crimes Enforcement Network or FinCEN the branch of the Treasury Department that is responsible for regulating and enforcing the anti-money laundering laws and regulations did in fact fine Capital One NA 390000000 for both willful and negligent violations of the Bank Secrecy Act BSA and its.

Source: in.pinterest.com

Source: in.pinterest.com

The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporat The report found that AML fines in the initial six months of 2020 reached a total of 706m compared with last years aggregate of 444m. If research is to be believed institutions across the globe have not done enough in the anti-money laundering AML compliance area. BSAAML Civil Money Penalties So Far in 2018 From the Office of the Comptroller of the Currency OCC The OCC has levied a total of 195 million in CMPs since the start of the year including 125 million in fines just in the last week. Risks Associated with Money Laundering and Terrorist Financing. Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely.

Source: moneylaundering.com

Source: moneylaundering.com

Department of Justice issued a 185 million civil money penalty against US. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. Latest news reports from the medical literature videos from the experts and more. The US was ranked number 1 with the highest number of bank fines enforced in 2020. Data from consultancy Duff Phelps revealed that AML fines in the first six months of 2020 reached US706 milli.

Source: nafcu.org

Source: nafcu.org

Latest news reports from the medical literature videos from the experts and more. For repeat BSAAML violations the Act allows for an additional civil penalty of either i three times the profit gained or loss avoided if practicable to calculate or ii two times the otherwise applicable maximum penalty for the violation. Risks Associated with Money Laundering and Terrorist Financing. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. BSA-AML Civil Money Penalties.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml fines by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas