17+ Bsa aml kyc requirements info

Home » about money loundering idea » 17+ Bsa aml kyc requirements infoYour Bsa aml kyc requirements images are ready. Bsa aml kyc requirements are a topic that is being searched for and liked by netizens today. You can Get the Bsa aml kyc requirements files here. Find and Download all royalty-free photos and vectors.

If you’re searching for bsa aml kyc requirements pictures information related to the bsa aml kyc requirements interest, you have visit the right blog. Our site always provides you with hints for seeking the highest quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

Bsa Aml Kyc Requirements. What is the CDD rule. Another report by CipherTrace showed that a third of the top 120 exchanges have weak KYC crypto processes. This research guide or source tool is a compilation of key AML laws rules and guidance applicable to mutual funds ie open end investment companies as defined in Section 5a1 of the Investment Company Act of 1940Several statutory and regulatory provisions impose AML obligations on mutual funds. Regulatory authorities have been charging hefty fines to financial institutions that fail to meet all the compliance requirements of AML KYC and BSA.

Fourth Aml Directive And Electronic Identity Verification Business Benefits Sharing Economy Financial Services From pinterest.com

Fourth Aml Directive And Electronic Identity Verification Business Benefits Sharing Economy Financial Services From pinterest.com

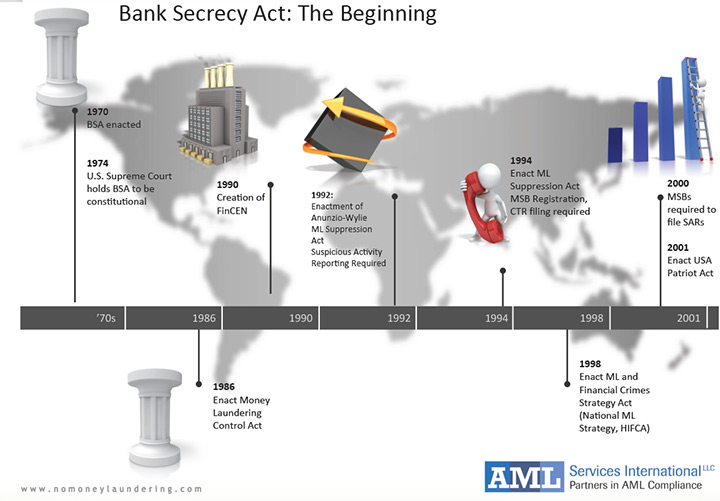

This is part of what is known as the customer onboarding process. Fundamentals section and ensuing chapters address specific requirements of the Bank Secrecy Act BSA the USA PATRIOT Act and the Office of Foreign Assets Control OFAC. Another report by CipherTrace showed that a third of the top 120 exchanges have weak KYC crypto processes. For banks they needed to be following rules on AML anti-money laundering and combating any potential financing of terrorist activities. Under the Bank Secrecy ActBSA financial institutions are required to assist US. 0 - Disclaimer.

Neither Shufti Pro nor the authors of this document shall be held responsible liable or accountable for the contents of.

And further found that two-thirds lack strong KYC policies But What is AML Anyway. It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. And further found that two-thirds lack strong KYC policies But What is AML Anyway. Chief Compliance Risk and BSA Officers are all too familiar with the extensive regulations US PATRIOT Act FATF FinRa CFT. KYC regulation are enforced by many different countries at many different levels of requirements.

Source: amlregtech.com

Source: amlregtech.com

In general the BSA requires that. Under the Bank Secrecy ActBSA financial institutions are required to assist US. 2 0 1 9 1. Banks must uphold KYC and AML regulations or risk the security of their institutions. Regulatory authorities have been charging hefty fines to financial institutions that fail to meet all the compliance requirements of AML KYC and BSA.

Source: pinterest.com

Source: pinterest.com

And further found that two-thirds lack strong KYC policies But What is AML Anyway. Another report by CipherTrace showed that a third of the top 120 exchanges have weak KYC crypto processes. In general the BSA requires that. See questions 31 32 and 33. Government agencies in detecting and preventing money laundering such as.

Source: pinterest.com

Source: pinterest.com

Anti Money Laundering AML Know Your Customer KYC and Know Your Customers Customer Vendor Counterparty etc. 2 0 1 9 1. The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. The information in this guide is current as of January 5 2021. To meet compliance rules banks at a minimum should follow.

Source: pinterest.com

Source: pinterest.com

2 0 1 9 1. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. Under the Bank Secrecy ActBSA financial institutions are required to assist US. It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

Source: amlregtech.com

Source: amlregtech.com

Under the Bank Secrecy ActBSA financial institutions are required to assist US. Section 352 of the USA PATRIOT ACT amended the BSA to require financial institutions including broker-dealers to establish AML programs. All financial institutions and financial businesses subject to the BSA regulations are required to maintain risk-based AML Programs with certain minimum requirements to guard against money laundering. These are followed by sections that delve into many of the practical considerations of maintaining effective AMLCFT Compliance Programs such as Risk Assessments. For banks they needed to be following rules on AML anti-money laundering and combating any potential financing of terrorist activities.

Source: pinterest.com

Source: pinterest.com

2 0 1 9 1. Broker-dealers can satisfy this requirement by implementing and maintaining an AML program that complies with SRO rule requirements. Who do AML laws apply to. 2 0 1 9 1. Anti Money Laundering AML Know Your Customer KYC and Know Your Customers Customer Vendor Counterparty etc.

Source: acamstoday.org

Source: acamstoday.org

KYC regulation are enforced by many different countries at many different levels of requirements. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. Government agencies in detecting and preventing money laundering such as. This gap exposes online lending startups to risks of anti-money laundering AML investigations and penalties. The BSA imposes a range of compliance obligations on firms operating within US jurisdiction including a requirement to implement a risk-based AML program with appropriate customer due diligence CDD and screening measures and to perform a range of reporting and record-keeping tasks when dealing with suspicious transactions and customers.

Source: pinterest.com

Source: pinterest.com

Chief Compliance Risk and BSA Officers are all too familiar with the extensive regulations US PATRIOT Act FATF FinRa CFT. This article will cover what online lenders need to know about KYCCDD the elements of a successful program how to meet FinCEN rules for establishing customer identity and preventing money laundering and how to mitigate the risks. The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. Anti Money Laundering AML Know Your Customer KYC and Know Your Customers Customer Vendor Counterparty etc. Customer Identification Program CIP Phase.

Source: sk.pinterest.com

Source: sk.pinterest.com

The BSA requires traditional banks credit unions and thrifts as well as non-bank financial institutions securities dealers and money services businesses to perform anti-money laundering checks and to keep specific records of events that could signal the occurrence of money laundering. In fact in 2020 alone financial institutions across the world have been penalized with a staggering 104 billion in fines and penalties. 0 - Disclaimer. The BSA requires traditional banks credit unions and thrifts as well as non-bank financial institutions securities dealers and money services businesses to perform anti-money laundering checks and to keep specific records of events that could signal the occurrence of money laundering. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

Source: pinterest.com

Source: pinterest.com

Customer Identification Program CIP Phase. AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. Customer Identification Program CIP Phase. KYC regulation are enforced by many different countries at many different levels of requirements. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA.

Source: acamstoday.org

Source: acamstoday.org

AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive 4AMLD which covers everything from KYC requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing. Indonesia - AML KYC Regulations Do c u me n t Hi s to r y I ssu e Da t e V e rsi o n Co mme n t s 1 5. All financial institutions and financial businesses subject to the BSA regulations are required to maintain risk-based AML Programs with certain minimum requirements to guard against money laundering. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. The BSA imposes a range of compliance obligations on firms operating within US jurisdiction including a requirement to implement a risk-based AML program with appropriate customer due diligence CDD and screening measures and to perform a range of reporting and record-keeping tasks when dealing with suspicious transactions and customers.

Source: trulioo.com

Source: trulioo.com

The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. AML compliance is a lot more comprehensive and actually includes KYC compliance as one of its requirements. The term Anti-Money Laundering or AML refers to a set of procedures and legal regulations that are in place to identify and prevent profit from illegal activities. These are followed by sections that delve into many of the practical considerations of maintaining effective AMLCFT Compliance Programs such as Risk Assessments. An AML program must be in writing and include at a minimum.

Source: pinterest.com

Source: pinterest.com

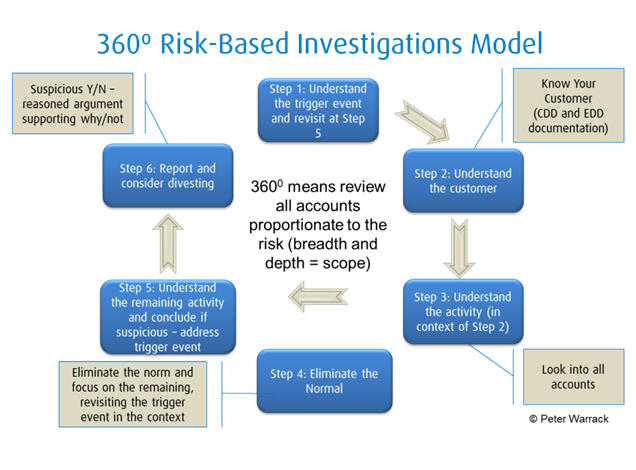

KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements. An AML program must be in writing and include at a minimum. The information in this guide is current as of January 5 2021. This research guide or source tool is a compilation of key AML laws rules and guidance applicable to mutual funds ie open end investment companies as defined in Section 5a1 of the Investment Company Act of 1940Several statutory and regulatory provisions impose AML obligations on mutual funds. Banks must uphold KYC and AML regulations or risk the security of their institutions.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml kyc requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information