16+ Bsa aml monetary penalties list info

Home » about money loundering Info » 16+ Bsa aml monetary penalties list infoYour Bsa aml monetary penalties list images are ready. Bsa aml monetary penalties list are a topic that is being searched for and liked by netizens now. You can Download the Bsa aml monetary penalties list files here. Get all royalty-free photos.

If you’re looking for bsa aml monetary penalties list images information related to the bsa aml monetary penalties list topic, you have pay a visit to the right site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

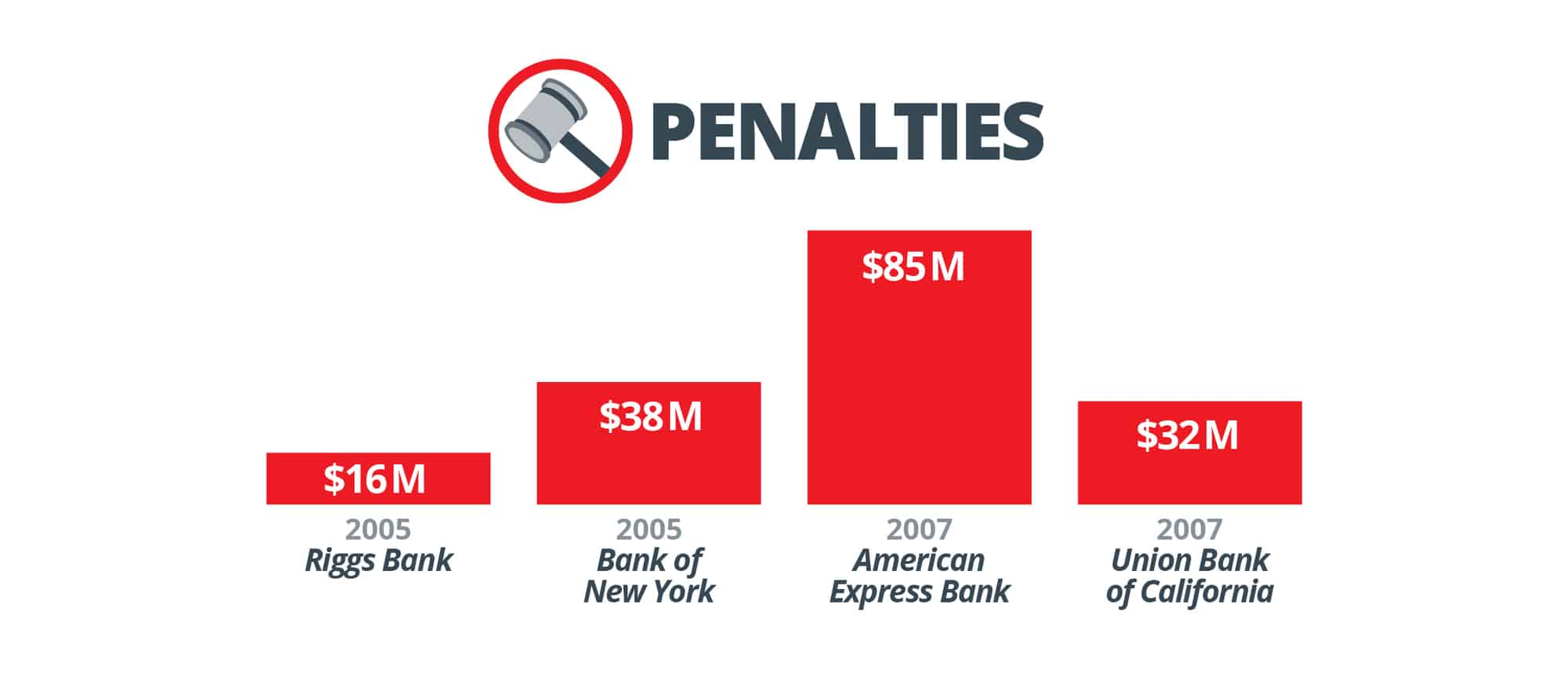

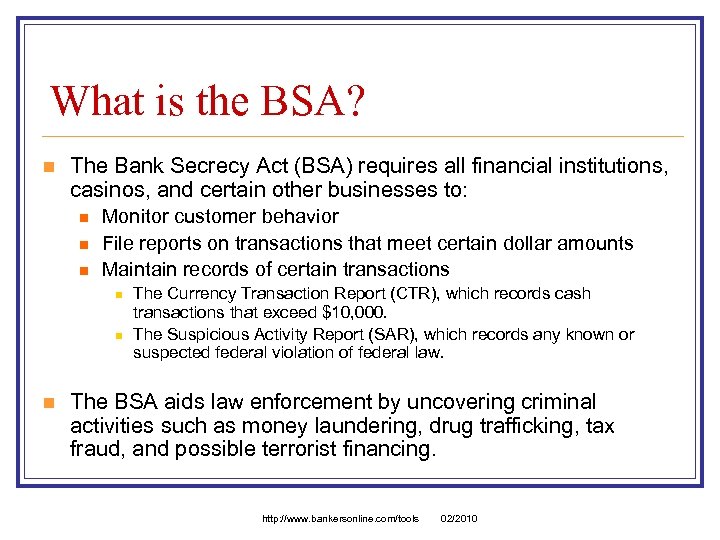

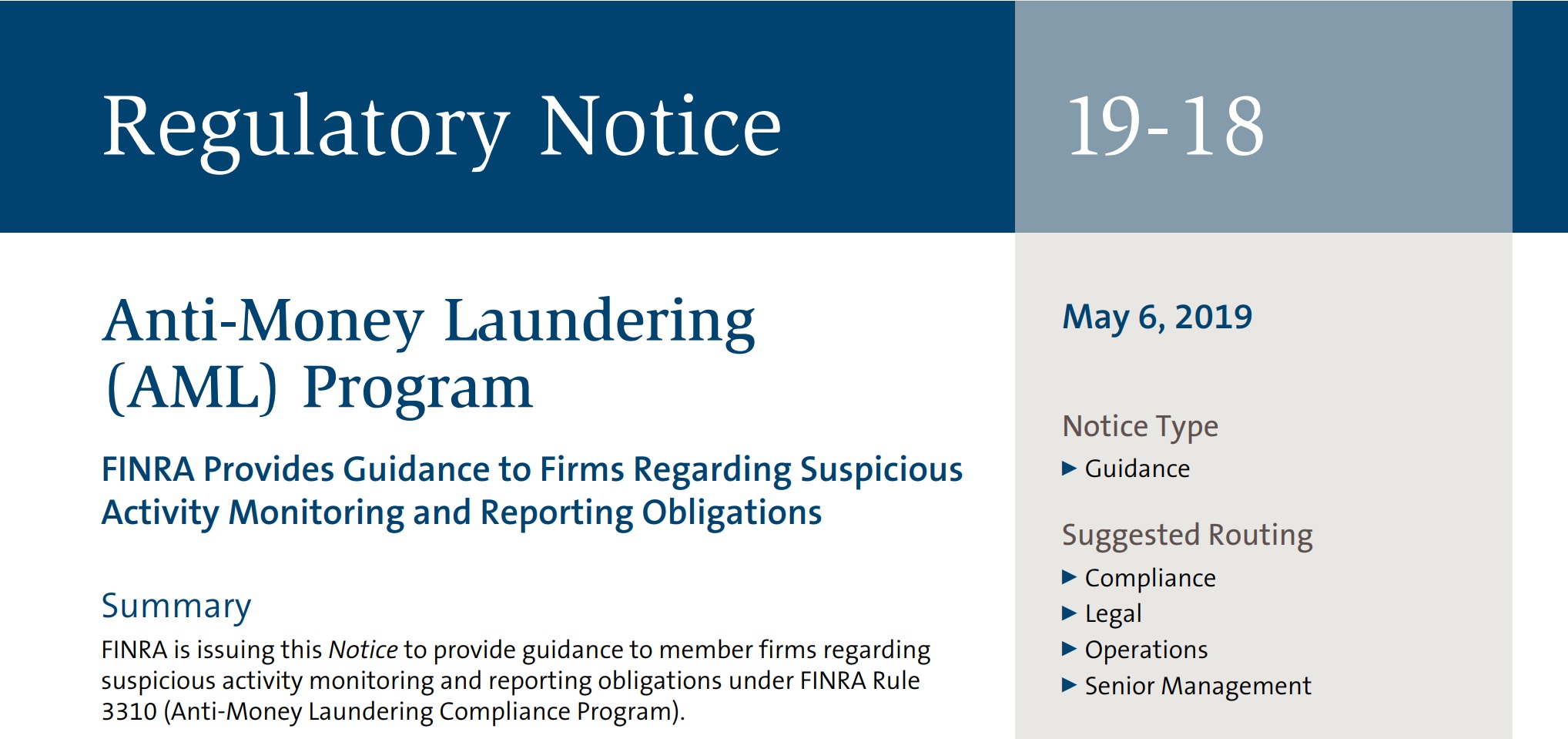

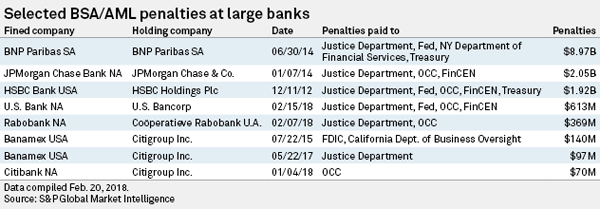

Bsa Aml Monetary Penalties List. And iii although referrals regarding BSA. Penalties include heavy fines and prison sentences. The primary conclusions of the detailed Report are that i referrals by the IRS to the Financial Crimes Enforcement Network FinCEN for potential Title 31 penalty cases suffer lengthy delays and have little impact on BSA compliance. FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies.

Bsa Violation Civil Penalties Increase Nafcu From nafcu.org

Bsa Violation Civil Penalties Increase Nafcu From nafcu.org

MoneyGrams DPA was extended and an additional 125 million forfeited for. In this post we report on the enforcement actions recently lodged against Standard Chartered PLC and the Industrial Commercial Bank of China Ltd. The six largest monetary penalties in connection with BSAAML violations were assessed in the last six years of this 14-year period ie 2010 through 2015. The BSA was amended to incorporate the. Penalties include heavy fines and prison sentences. But the penalties imposed by the involved regulators are different.

But the penalties imposed by the involved regulators are different.

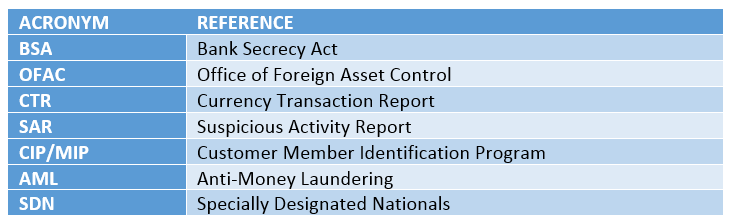

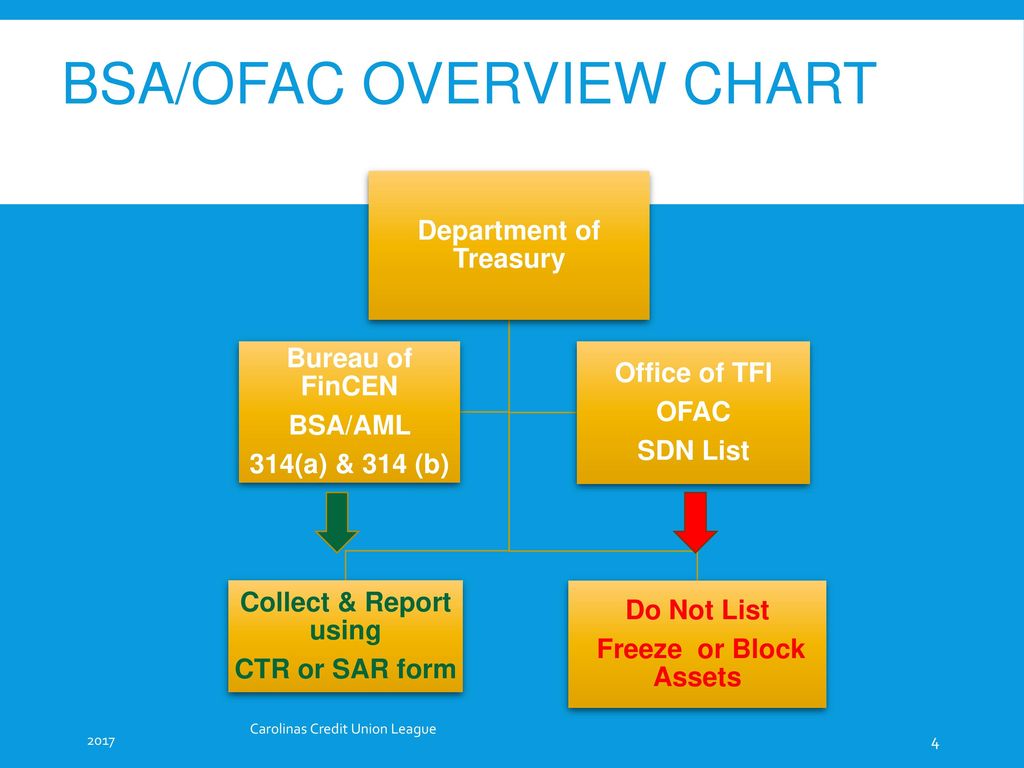

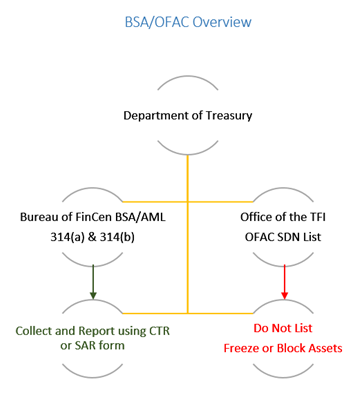

The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. UBS 2018. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the extent of its domestic operations. Since the Patriot Act was enacted at the end of 2001 US regulators have imposed more than 5bn in monetary penalties against financial institutions in connection with alleged violations of Bank Secrecy Act BSA and Anti-Money Laundering AML regulations. In the BSAAML sphere JPMorgan Chase Bank NA. BSA-AML Civil Money Penalties.

Source: verafin.com

Source: verafin.com

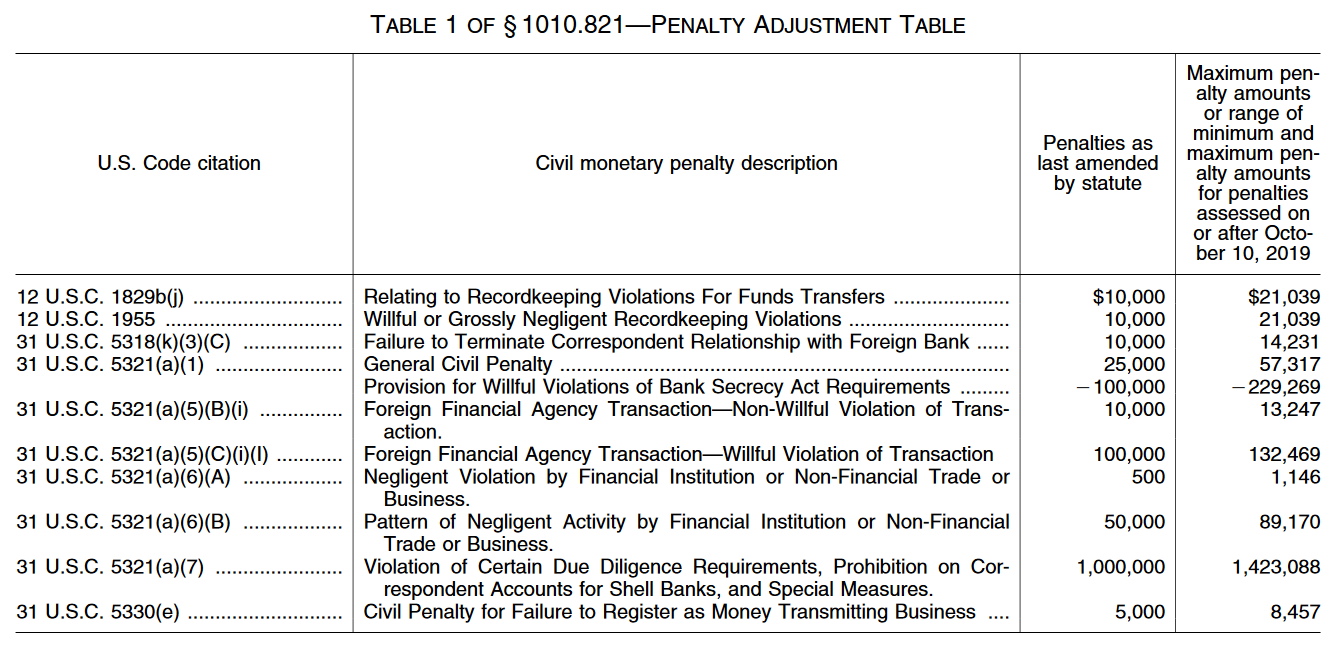

Standard Chartered Bank 2019. And iii although referrals regarding BSA. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. This Federal Financial Institutions Examination Council FFIEC Bank Secrecy Act BSA Anti-Money Laundering AML Examination Manual provides guidance to examiners for carrying out BSAAML and Office of Foreign Assets Control OFAC examinations. There are also penalties for a bank which discloses to its client that it has filed a SAR about the client.

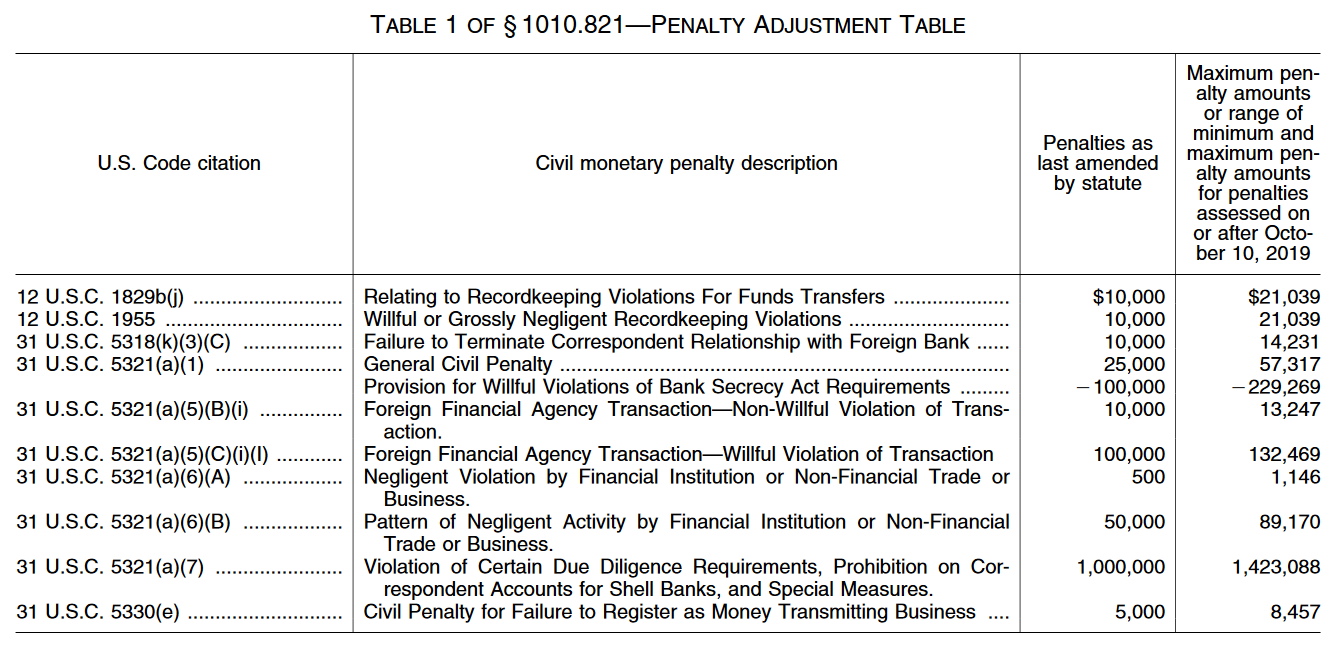

Penalty for these violations11 FinCEN determined that the maximum penalty in this matter is 20914455412 FinCEN may impose a civil money penalty of 57317 for each willful violation of AML program requirements assessed on or after October 10 201913 The BSA states tha Congress Passes the Anti-Money Laundering Act of 2020 Significant Changes to the Bank Secrecy Act Ahead to allow larger rewards for reporting violations that lead to civil penalties. Under the BSA penalties may be imposed on each branch or location found to be violation of AML regulations and for each day that the violation occurs. MoneyGrams DPA was extended and an additional 125 million forfeited for. MoneyGram 2018. FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies.

Source: slideplayer.com

Source: slideplayer.com

DOJ for repeated BSAAML failures. Therefore the manual also provides guidance on identifying and. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA.

Source: slideplayer.com

Source: slideplayer.com

Penalties include heavy fines and prison sentences. To provide additional incentives for reporting BSAAML violations the Act enhances existing BSA whistleblower provisions which have never been implemented to allow larger rewards for reporting violations that lead to civil penalties or criminal fines exceeding 1000000. IRC 6038D requires that all US. The six largest monetary penalties in connection with BSAAML violations were assessed in the last six years of this 14-year period ie 2010 through 2015. Under the BSA penalties may be imposed on each branch or location found to be violation of AML regulations and for each day that the violation occurs.

Source: complyadvantage.com

Source: complyadvantage.com

The Bank entered into an NPA with BSA undertakings and agreed to pay over 30 million to resolve allegations that it helped launder bribes as part of the FIFA scandal. Thought Id start with a brief summary of Penalites to try to make an impression on the importance of understanding and adhering to our Bank Secrecy PolicyProcedures. In this post we report on the enforcement actions recently lodged against Standard Chartered PLC and the Industrial Commercial Bank of China Ltd. Standard Chartered Bank 2019. The cases are arranged in reverse chronological order and include the name and asset size when known of.

Source: present5.com

Source: present5.com

No BSAAML monetary penalty exceeded 1 of a financial institutions total equity capital in that period. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the extent of its domestic operations. This Federal Financial Institutions Examination Council FFIEC Bank Secrecy Act BSA Anti-Money Laundering AML Examination Manual provides guidance to examiners for carrying out BSAAML and Office of Foreign Assets Control OFAC examinations. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. An effective BSAAML compliance program requires sound risk management.

Source: regtechconsulting.net

Source: regtechconsulting.net

DOJ for repeated BSAAML failures. I know there are list of penalties assessed against banks with the reasons why as well as against bank officer directors and even employees - most being monetary. FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies. UBS 2018. This stance may have been in part an effort to avoid placing further strains on institutions weathering the financial crisis.

Source: complyadvantage.com

Source: complyadvantage.com

Ii the IRS BSA Program spent approximately 97 million to assess approximately 39 million in penalties for Fiscal Years FYs 2014 to 2016. There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs. Ii the IRS BSA Program spent approximately 97 million to assess approximately 39 million in penalties for Fiscal Years FYs 2014 to 2016. JPMC entered into a deferred prosecution agreement and was assessed over 2 billion in penalties in an action that gave rise to. To provide additional incentives for reporting BSAAML violations the Act enhances existing BSA whistleblower provisions which have never been implemented to allow larger rewards for reporting violations that lead to civil penalties or criminal fines exceeding 1000000.

Source: complianceonline.com

Source: complianceonline.com

MoneyGrams DPA was extended and an additional 125 million forfeited for. And iii although referrals regarding BSA. The bank also settled civil charges on. Represented the first criminal BSA charge ever brought against a United States broker-dealer. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs.

Source: nafcu.org

Source: nafcu.org

Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. The bank also settled civil charges on. This Federal Financial Institutions Examination Council FFIEC Bank Secrecy Act BSA Anti-Money Laundering AML Examination Manual provides guidance to examiners for carrying out BSAAML and Office of Foreign Assets Control OFAC examinations. Therefore the manual also provides guidance on identifying and. BSA Related Regulations.

Source: m.bankingexchange.com

Source: m.bankingexchange.com

And iii although referrals regarding BSA. The BSA was amended to incorporate the. Thought Id start with a brief summary of Penalites to try to make an impression on the importance of understanding and adhering to our Bank Secrecy PolicyProcedures. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. Ii the IRS BSA Program spent approximately 97 million to assess approximately 39 million in penalties for Fiscal Years FYs 2014 to 2016.

Source: nafcu.org

Since the Patriot Act was enacted at the end of 2001 US regulators have imposed more than 5bn in monetary penalties against financial institutions in connection with alleged violations of Bank Secrecy Act BSA and Anti-Money Laundering AML regulations. No BSAAML monetary penalty exceeded 1 of a financial institutions total equity capital in that period. There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs. And iii although referrals regarding BSA. The primary conclusions of the detailed Report are that i referrals by the IRS to the Financial Crimes Enforcement Network FinCEN for potential Title 31 penalty cases suffer lengthy delays and have little impact on BSA compliance.

Source: yumpu.com

Source: yumpu.com

I know there are list of penalties assessed against banks with the reasons why as well as against bank officer directors and even employees - most being monetary. Penalty for these violations11 FinCEN determined that the maximum penalty in this matter is 20914455412 FinCEN may impose a civil money penalty of 57317 for each willful violation of AML program requirements assessed on or after October 10 201913 The BSA states tha Congress Passes the Anti-Money Laundering Act of 2020 Significant Changes to the Bank Secrecy Act Ahead to allow larger rewards for reporting violations that lead to civil penalties. Thought Id start with a brief summary of Penalites to try to make an impression on the importance of understanding and adhering to our Bank Secrecy PolicyProcedures. The cases are arranged in reverse chronological order and include the name and asset size when known of. An effective BSAAML compliance program requires sound risk management.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml monetary penalties list by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas