20+ Bsa aml red flags info

Home » about money loundering idea » 20+ Bsa aml red flags infoYour Bsa aml red flags images are available in this site. Bsa aml red flags are a topic that is being searched for and liked by netizens today. You can Download the Bsa aml red flags files here. Download all free photos and vectors.

If you’re looking for bsa aml red flags images information connected with to the bsa aml red flags keyword, you have come to the ideal blog. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

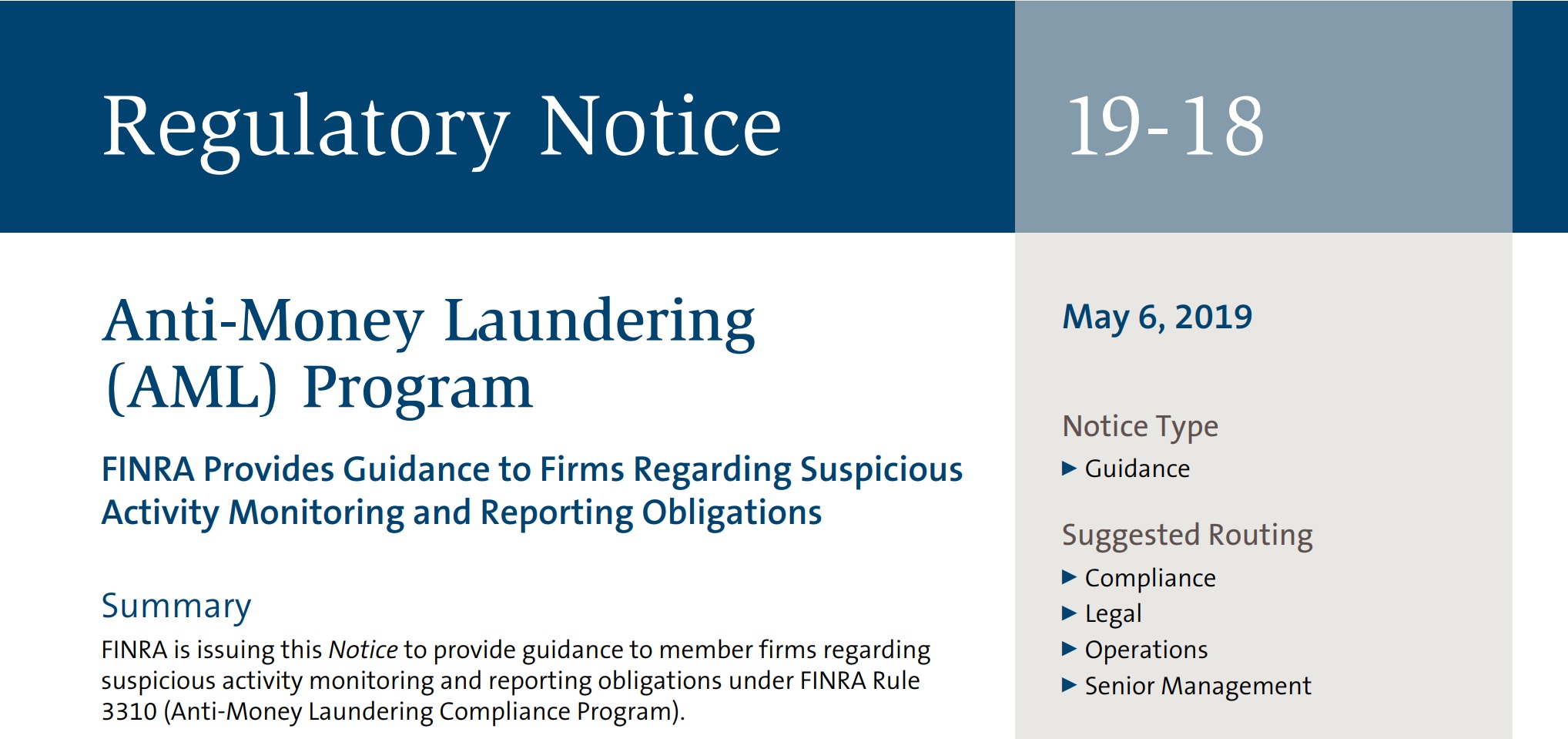

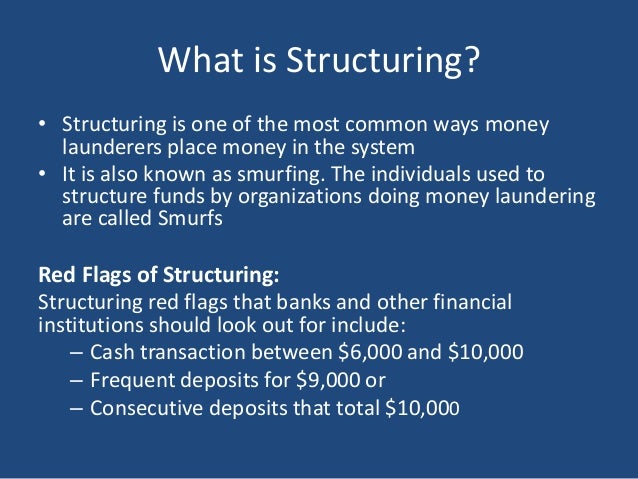

Bsa Aml Red Flags. Red Flags of Money Laundering. However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal. Many financial institutions have invested. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing.

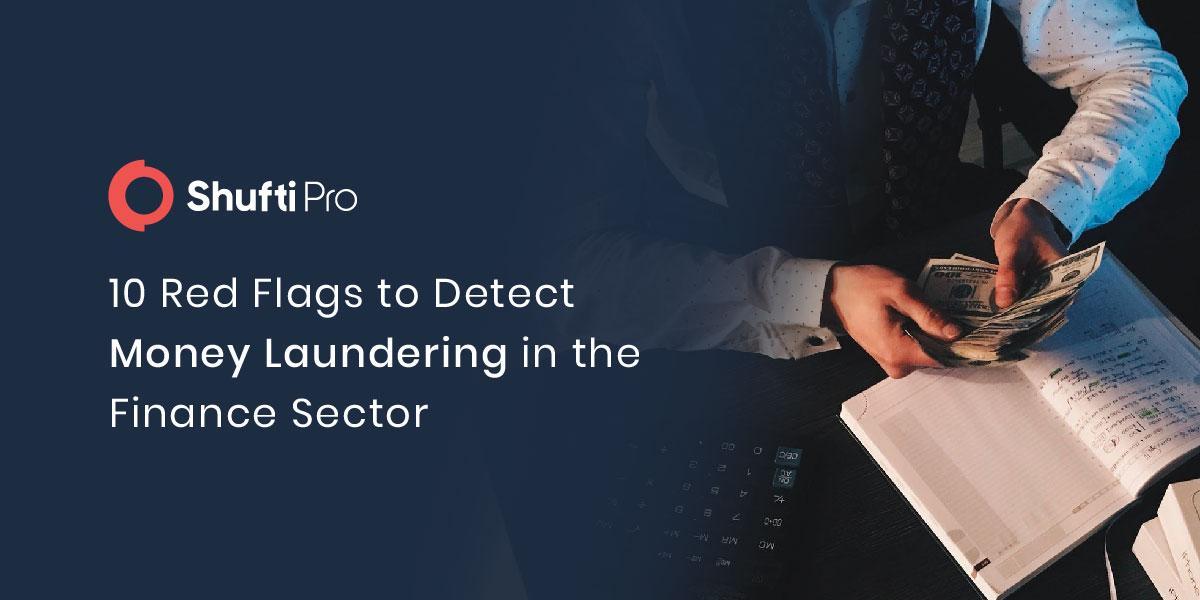

10 Red Flags To Detect Money Laundering In The Finance Sector From shuftipro.com

10 Red Flags To Detect Money Laundering In The Finance Sector From shuftipro.com

Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. A third party attempts to fill out paperwork without consulting the customer. Employee at a bank 449MUSA Looking to connect with other users of the FIS E-Funds Red Flags history to discuss how you track and log for CIP purposes. The Basel Committee on Banking Supervision is a committee of central banks and bank supervisors and regulators from numerous jurisdictions that meets at the Bank for International Settlements BIS in Basel Switzerland to discuss issues related to prudential banking supervision. FFIEC BSA-AML Examination Manual Terrorist Financing Red Flags Verafin is the industry leader in enterprise Financial Crime Management solutions providing a cloud-based secure software platform for Fraud Detection and Management BSAAML Compliance and Management High-Risk Customer Management and Information Sharing. FIS E-Funds- Red Flags.

I have been told in the past that the Qualifile product previously known as Chexsystems does not meet the CIP requirements but the ID verification IDV and Red Flags.

Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Many financial institutions have invested. Use of cashiers checks or money orders from different banks to make policy payments or other payment methods unusual for that particular customer. BSA COMPLIANCE RED FLAGS Behavior-Based System Is Ineffective in Anti-Money Laundering Monitoring The Bank Secrecy Act BSA and Anti-Money Laundering AML have been the most important compliance matters in the financial industry since 911. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. 2002 red flag 1 The customer exhibits unusual concern regarding the firms compliance with government reporting requirements and the firms AML policies particularly with respect to his or her identity type of business and assets or is reluctant or refuses to reveal any information concerning business activities or furnishes unusual or suspect identification or business documents.

Source: store.lexisnexis.com

Source: store.lexisnexis.com

Attendees will learn how to identify the red flags of money laundering in an account within your institution. The following patterns of customer behavior are red flags for potentially suspicious activity. Purchase of an insurance product inconsistent with the customers needs. I have been told in the past that the Qualifile product previously known as Chexsystems does not meet the CIP requirements but the ID verification IDV and Red Flags. Cheques letters of credit bills of exchange.

Source: pinterest.com

Source: pinterest.com

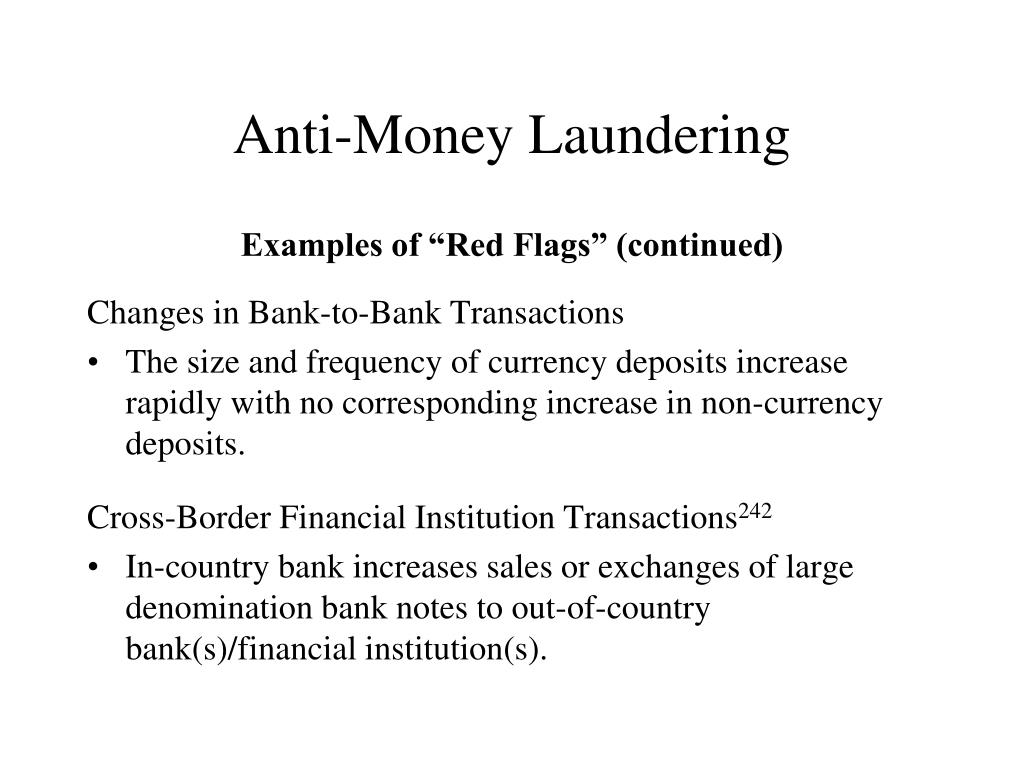

This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Red Flags of Money Laundering. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The twenty new Red Flags include the following behavioral indicators. Company transactions both deposits and withdrawals that are denominated by unusually large amounts of cash rather than by way of debits and credits normally associated with the normal commercial operations of the company eg.

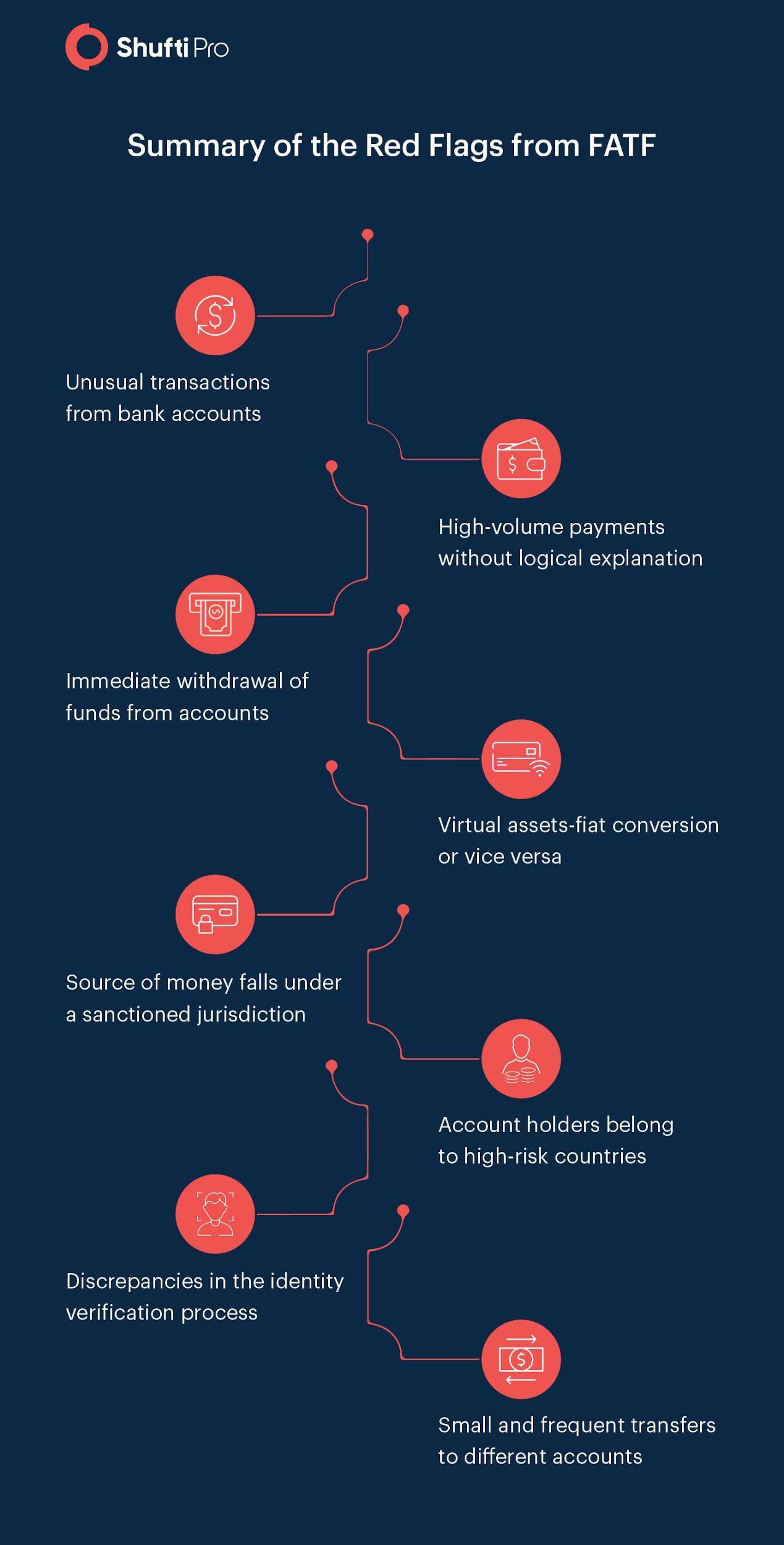

Source: shuftipro.com

Source: shuftipro.com

Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Red Flags of Money Laundering. A third party attempts to fill out paperwork without consulting the customer. Cheques letters of credit bills of exchange. However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal.

Source: amlology.org

Source: amlology.org

A red flag simply warns you your employees and your BSA Compliance Officer that suspicious activity has occurred and requires further investigation and possibly reporting to. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Two the presence of a red flag is not conclusive evidence of criminal activity. FFIEC BSA-AML Examination Manual Terrorist Financing Red Flags Verafin is the industry leader in enterprise Financial Crime Management solutions providing a cloud-based secure software platform for Fraud Detection and Management BSAAML Compliance and Management High-Risk Customer Management and Information Sharing. FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red.

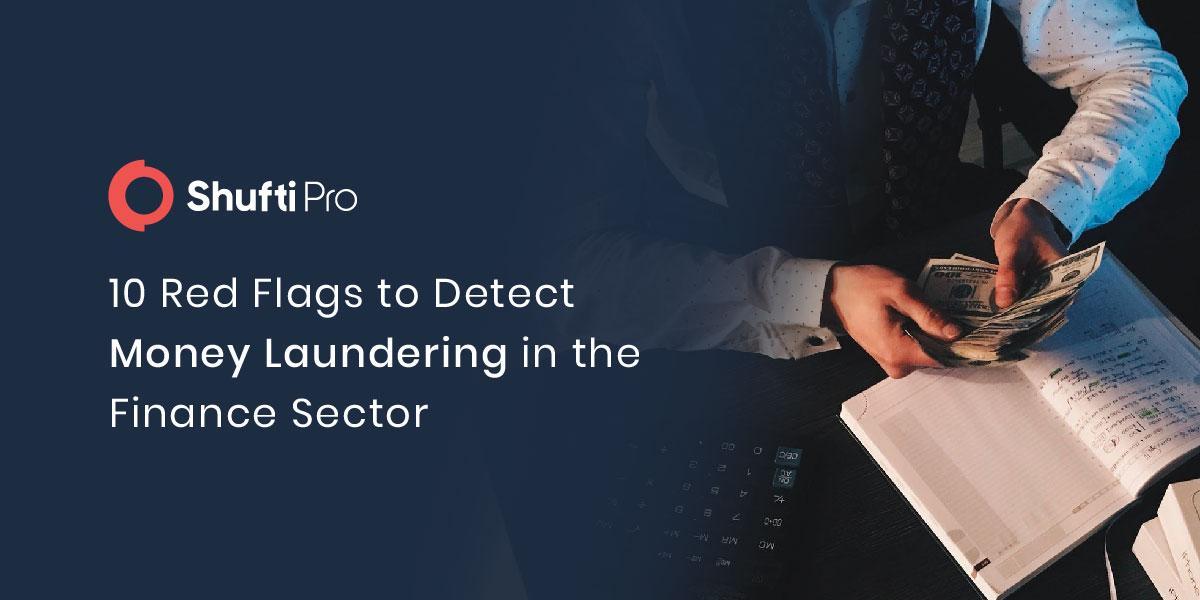

Source: shuftipro.com

Source: shuftipro.com

BSA COMPLIANCE RED FLAGS Behavior-Based System Is Ineffective in Anti-Money Laundering Monitoring The Bank Secrecy Act BSA and Anti-Money Laundering AML have been the most important compliance matters in the financial industry since 911. Purchase of an insurance product inconsistent with the customers needs. Depositing cash by means of numerous credit slips by a customer such. Company transactions both deposits and withdrawals that are denominated by unusually large amounts of cash rather than by way of debits and credits normally associated with the normal commercial operations of the company eg. A third party speaks on behalf of the customer a third party may insist on being present andor translating.

Source: acamstoday.org

Source: acamstoday.org

A red flag simply warns you your employees and your BSA Compliance Officer that suspicious activity has occurred and requires further investigation and possibly reporting to. Avoiding Recordkeeping and Reporting Requirements Member asks about record-keeping or reporting requirements. The following patterns of customer behavior are red flags for potentially suspicious activity. Latest news reports from the medical literature videos from the experts and more. 2002 red flag 1 The customer exhibits unusual concern regarding the firms compliance with government reporting requirements and the firms AML policies particularly with respect to his or her identity type of business and assets or is reluctant or refuses to reveal any information concerning business activities or furnishes unusual or suspect identification or business documents.

Source: slideshare.net

Source: slideshare.net

Latest news reports from the medical literature videos from the experts and more. The Basel Committee on Banking Supervision is a committee of central banks and bank supervisors and regulators from numerous jurisdictions that meets at the Bank for International Settlements BIS in Basel Switzerland to discuss issues related to prudential banking supervision. Ad AML coverage from every angle. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Ad AML coverage from every angle.

Source: regtechconsulting.net

Source: regtechconsulting.net

The Basel Committee on Banking Supervision is a committee of central banks and bank supervisors and regulators from numerous jurisdictions that meets at the Bank for International Settlements BIS in Basel Switzerland to discuss issues related to prudential banking supervision. Cheques letters of credit bills of exchange. Employee at a bank 449MUSA Looking to connect with other users of the FIS E-Funds Red Flags history to discuss how you track and log for CIP purposes. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Use of cashiers checks or money orders from different banks to make policy payments or other payment methods unusual for that particular customer.

Source: issuu.com

Source: issuu.com

Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. BSA COMPLIANCE RED FLAGS Behavior-Based System Is Ineffective in Anti-Money Laundering Monitoring The Bank Secrecy Act BSA and Anti-Money Laundering AML have been the most important compliance matters in the financial industry since 911. FFIEC BSA-AML Examination Manual Terrorist Financing Red Flags Verafin is the industry leader in enterprise Financial Crime Management solutions providing a cloud-based secure software platform for Fraud Detection and Management BSAAML Compliance and Management High-Risk Customer Management and Information Sharing.

Source: elliptic.co

Source: elliptic.co

This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Depositing cash by means of numerous credit slips by a customer such. Latest news reports from the medical literature videos from the experts and more. A red flag simply warns you your employees and your BSA Compliance Officer that suspicious activity has occurred and requires further investigation and possibly reporting to. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing.

Source: slideshare.net

Source: slideshare.net

FIS E-Funds- Red Flags. FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red. The Basel Committee on Banking Supervision is a committee of central banks and bank supervisors and regulators from numerous jurisdictions that meets at the Bank for International Settlements BIS in Basel Switzerland to discuss issues related to prudential banking supervision. FIS E-Funds- Red Flags. Depositing cash by means of numerous credit slips by a customer such.

Source: arcriskandcompliance.com

Source: arcriskandcompliance.com

Attendees will learn how to identify the red flags of money laundering in an account within your institution. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Ad AML coverage from every angle. The following patterns of customer behavior are red flags for potentially suspicious activity. A third party attempts to fill out paperwork without consulting the customer.

Source: slideserve.com

Source: slideserve.com

2002 red flag 1 The customer exhibits unusual concern regarding the firms compliance with government reporting requirements and the firms AML policies particularly with respect to his or her identity type of business and assets or is reluctant or refuses to reveal any information concerning business activities or furnishes unusual or suspect identification or business documents. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Company transactions both deposits and withdrawals that are denominated by unusually large amounts of cash rather than by way of debits and credits normally associated with the normal commercial operations of the company eg. Ad AML coverage from every angle. Avoiding Recordkeeping and Reporting Requirements Member asks about record-keeping or reporting requirements.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml red flags by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information