19++ Bsa aml rules ideas

Home » about money loundering Info » 19++ Bsa aml rules ideasYour Bsa aml rules images are ready in this website. Bsa aml rules are a topic that is being searched for and liked by netizens today. You can Get the Bsa aml rules files here. Download all free vectors.

If you’re searching for bsa aml rules pictures information connected with to the bsa aml rules interest, you have pay a visit to the right site. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Bsa Aml Rules. 12 CFR 3268b2 FDIC. Supplementary BSAAML materials including laws regulations directives references and guidance. Latest news reports from the medical literature videos from the experts and more. Amount of the payment order.

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

Special information sharing procedures. Financial system against illicit foreign actors. This sweeping legislation will affect financial institutions their clients and law enforcement and. As we have blogged this bill now law contains historic changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. Amount of the payment order. Its size and type of business and that includes certain minimum requirements.

Special information sharing procedures.

Financial system against illicit foreign actors. 4 12 CFR 20863b 2115m and 21124j Federal Reserve. Ad AML coverage from every angle. Although nonbanking institutions are not regulated for BSAAML and sanctions compliance to the same degree that banks are they are widely perceived as vulnerable to illicit activity and therefore subject to significant scrutiny. Which is subject to approval by the banks board of directors. Final Rule contains explicit customer due diligence requirements and includes a new requirement to identify and verify the identity of beneficial owners of legal entity customers subject to certain exclusions and exemptions Effective Date.

Source: slideshare.net

Source: slideshare.net

In addition to the Bank Secrecy Actanti-money laundering BSAAML compliance program requirements banks must comply with other program reporting and recordkeeping requirements. This sweeping legislation will affect financial institutions their clients and law enforcement and. How to use the BSAAML InfoBase. Special information sharing procedures. Minor weaknesses deficiencies and technical violations alone are not indicative of an inadequate CIP.

Source: probank.com

Source: probank.com

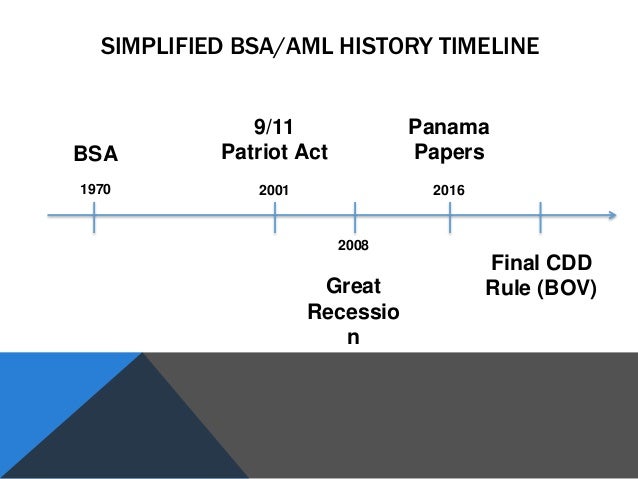

12 CFR 3268b2 FDIC. The Bank Secrecy Act BSA initially adopted in 1970 establishes the basic framework for AML obligations imposed on financial institutions. Its size and type of business and that includes certain minimum requirements. 12 CFR 7482b2 NCUA. Latest news reports from the medical literature videos from the experts and more.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Amount of the payment order. Specifically a whistleblower can file a complaint with the Occupational Safety and Health Administration OSHA and if OSHA does not issue a decision within 180 days the whistleblower can file a claim in federal district court. Supplementary BSAAML materials including laws regulations directives references and guidance. 12 CFR 3268b2 FDIC. For each payment order in the amount of 3000 or more that a bank accepts as an originators bank the bank must obtain and retain the following records 31 CFR 1020410 a 1 i.

Source: tcaregs.com

Source: tcaregs.com

Enforcement agencies include FinCEN DOJ and OFAC as well as federal state and local regulators. Its size and type of business and that includes certain minimum requirements. Minor weaknesses deficiencies and technical violations alone are not indicative of an inadequate CIP. 12 CFR 2121c2 OCC. Which is subject to approval by the banks board of directors.

Source: regtechconsulting.net

Source: regtechconsulting.net

It does not compel or preclude an enforcement or other supervisory action as appropriate in a. The Bank Secrecy Act BSA initially adopted in 1970 establishes the basic framework for AML obligations imposed on financial institutions. On September 15 2020 the Financial Crimes Enforcement Network FinCEN issued a final rule that requires state chartered non-depository trust companies including private trust companies PTCs to implement anti-money laundering AML programs. Latest news reports from the medical literature videos from the experts and more. 12 CFR 3268b2 FDIC.

Source: slideshare.net

Source: slideshare.net

Which is subject to approval by the banks board of directors. Amount of the payment order. And special standards of diligence prohibitions and special measures set forth in 31 CFR Chapter X Part 1020. 12 CFR 7482b2 NCUA. Latest news reports from the medical literature videos from the experts and more.

Source: infosightinc.com

Source: infosightinc.com

The Bank Secrecy Act BSA initially adopted in 1970 establishes the basic framework for AML obligations imposed on financial institutions. Banks and other financial institutions must ensure they meet the compliance obligations it involves. Which is subject to approval by the banks board of directors. The CIP must be incorporated into the banks BSAAML compliance program 3 12 CFR 20863b2 2115m2 and 21124j2 Federal Reserve. How to use the BSAAML InfoBase.

Source: slideplayer.com

Source: slideplayer.com

Date of the payment order. The Bank Secrecy Act BSA initially adopted in 1970 establishes the basic framework for AML obligations imposed on financial institutions. Amount of the payment order. Approach to AML Rule Thresholds By Mayank Johri Amin Ahmadi Kevin Kinkade Sam Day Michael Spieler Erik DeMonte January 12 2016 Introduction Institutions are constantly facing the challenge of managing growing alert volumes from automated transaction monitoring systems new money laundering typologies to surveil and more. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy.

Source:

The Bank Secrecy Act BSA initially adopted in 1970 establishes the basic framework for AML obligations imposed on financial institutions. This sweeping legislation will affect financial institutions their clients and law enforcement and. Date of the payment order. Approach to AML Rule Thresholds By Mayank Johri Amin Ahmadi Kevin Kinkade Sam Day Michael Spieler Erik DeMonte January 12 2016 Introduction Institutions are constantly facing the challenge of managing growing alert volumes from automated transaction monitoring systems new money laundering typologies to surveil and more. Minor weaknesses deficiencies and technical violations alone are not indicative of an inadequate CIP.

Source: compliancecohort.com

Source: compliancecohort.com

12 CFR 7482b2 NCUA. On September 15 2020 the Financial Crimes Enforcement Network FinCEN issued a final rule that requires state chartered non-depository trust companies including private trust companies PTCs to implement anti-money laundering AML programs. Latest news reports from the medical literature videos from the experts and more. How to use the BSAAML InfoBase. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy.

Source: slideplayer.com

Source: slideplayer.com

Ad AML coverage from every angle. This statement supersedes the Interagency Statement on Enforcement of BSAAML Requirements issued by the Agencies in July 2007 and is intended to set forth general policy guidance. Although nonbanking institutions are not regulated for BSAAML and sanctions compliance to the same degree that banks are they are widely perceived as vulnerable to illicit activity and therefore subject to significant scrutiny. Supplementary BSAAML materials including laws regulations directives references and guidance. Enforcement agencies include FinCEN DOJ and OFAC as well as federal state and local regulators.

Source: amltrainer.com

Source: amltrainer.com

Approach to AML Rule Thresholds By Mayank Johri Amin Ahmadi Kevin Kinkade Sam Day Michael Spieler Erik DeMonte January 12 2016 Introduction Institutions are constantly facing the challenge of managing growing alert volumes from automated transaction monitoring systems new money laundering typologies to surveil and more. BSA is the primary US. Latest news reports from the medical literature videos from the experts and more. Specifically a whistleblower can file a complaint with the Occupational Safety and Health Administration OSHA and if OSHA does not issue a decision within 180 days the whistleblower can file a claim in federal district court. Final Rule contains explicit customer due diligence requirements and includes a new requirement to identify and verify the identity of beneficial owners of legal entity customers subject to certain exclusions and exemptions Effective Date.

Source: complyadvantage.com

Source: complyadvantage.com

It does not compel or preclude an enforcement or other supervisory action as appropriate in a. Anti-money laundering AML law and has been amended to include certain provisions of Title III of the USA PATRIOT Act to detect deter and disrupt terrorist financing networks. Banks and other financial institutions must ensure they meet the compliance obligations it involves. On September 15 2020 the Financial Crimes Enforcement Network FinCEN issued a final rule that requires state chartered non-depository trust companies including private trust companies PTCs to implement anti-money laundering AML programs. Final Rule contains explicit customer due diligence requirements and includes a new requirement to identify and verify the identity of beneficial owners of legal entity customers subject to certain exclusions and exemptions Effective Date.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml rules by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas