18+ Bsa aml sar info

Home » about money loundering Info » 18+ Bsa aml sar infoYour Bsa aml sar images are ready. Bsa aml sar are a topic that is being searched for and liked by netizens now. You can Find and Download the Bsa aml sar files here. Find and Download all free images.

If you’re looking for bsa aml sar pictures information related to the bsa aml sar keyword, you have visit the ideal blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

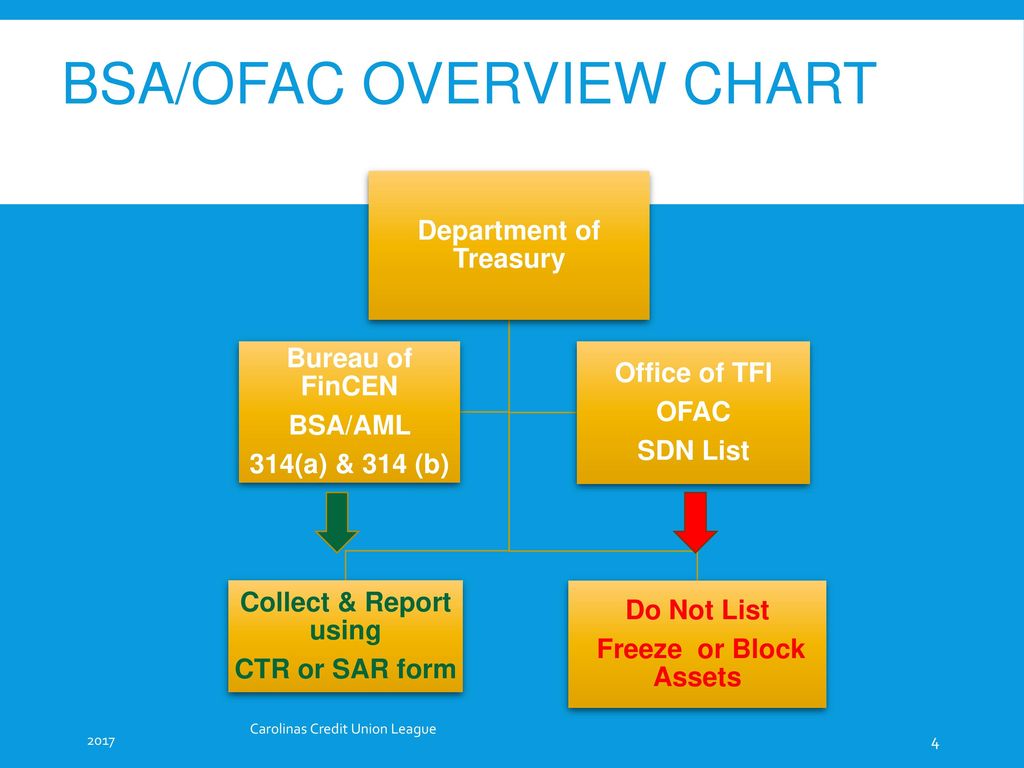

Bsa Aml Sar. I n October 2016 the Financial Crimes Enforcement Network FinCEN published an advisory document with frequently asked questions concerning cyber-events and cyber-enabled crime to financial institutions. At the top of the screen across the banner from left to right users can get to the Infobase Home Page the Online BSAAML Manual Examination Procedures References and the FFIEC Home Page. Assessing Compliance with BSA Regulatory Requirements. Under the Anti-Money Laundering Act of 2020.

Bsa Aml Ofac Staff Training Ppt Download From slideplayer.com

Bsa Aml Ofac Staff Training Ppt Download From slideplayer.com

FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative section of the SAR. The Act requires Treasury to evaluate how it might streamline SAR and CTR requirements and processes. The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported. Under the Anti-Money Laundering Act of 2020. They have no other activity and purpose for most withdrawals is not known. Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports.

SARs are an important source of intelligence not only in economic crime but also in criminal activities.

Upon further review we have identified a 6000 cash withdrawal and a 15000 cash withdrawal. FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative section of the SAR. Begin any SAR investigation based on SAR Referrals from branches Money. I n October 2016 the Financial Crimes Enforcement Network FinCEN published an advisory document with frequently asked questions concerning cyber-events and cyber-enabled crime to financial institutions. Financial system against illicit foreign actors. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a.

Source: regtechconsulting.net

Source: regtechconsulting.net

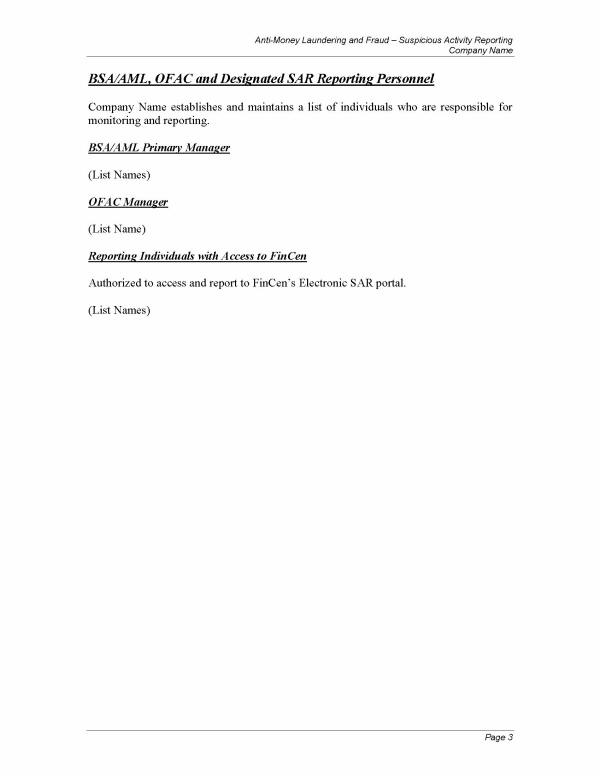

The Financial Crimes Enforcement Network FinCEN a bureau of the Department of Treasury adopted the AML Program Rule and the SAR. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a. Cybersecurity and BSAAML. FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative section of the SAR. Ensure CTRs are prepared for timely filing and forwarded to the BSAAML Manager.

Source: slideplayer.com

Source: slideplayer.com

Four takeaways on BSAAML reform. Assessing the BSAAML Compliance Program. In this post we review several provisions of the AMLA section entitled. The Financial Crimes Enforcement Network FinCEN a bureau of the Department of Treasury adopted the AML Program Rule and the SAR. At the top of the screen across the banner from left to right users can get to the Infobase Home Page the Online BSAAML Manual Examination Procedures References and the FFIEC Home Page.

Source: slideplayer.com

Source: slideplayer.com

A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. It covers the components of a SAR monitoring and reporting system and how to answer the. SARs alert law enforcement agencies to potential cases such as money laundering or terrorist financing. The Financial Crimes Enforcement Network FinCEN a bureau of the Department of Treasury adopted the AML Program Rule and the SAR.

FFIEC BSAAML Appendices - Appendix K Customer Risk Versus Due Diligence and Suspicious Activity Monitoring. SAR Filing 2020 American Bankers Association Page 40 Introduction This course describes the Bank Secrecy Act BSA requirements for a bank to file a Suspicious Activity Report SAR and why federal law limits sharing information about SARs. Ensure CTRs are prepared for timely filing and forwarded to the BSAAML Manager. In this post we review several provisions of the AMLA section entitled. Begin any SAR investigation based on SAR Referrals from branches Money.

Source: mortgagemanuals.com

Source: mortgagemanuals.com

Ensure CTRs are prepared for timely filing and forwarded to the BSAAML Manager. Financial system against illicit foreign actors. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. Developing Conclusions and Finalizing the Exam. In this post we review several provisions of the AMLA section entitled.

As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. ABA will continue partnering with law-makers federal banking regulators law enforcement groups and bankers to find common sense improvements to the current framework that will support law enforcement while minimizing unnecessary regulatory burdens. Four takeaways on BSAAML reform. At the top of the screen across the banner from left to right users can get to the Infobase Home Page the Online BSAAML Manual Examination Procedures References and the FFIEC Home Page. VP at a bank 306MUSA We have identified potential structuring from a customers account 9000 cash withdrawals.

Source: regtechconsulting.net

Source: regtechconsulting.net

The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported. Deferred prosecution agreements in the course of BSAAML matters. The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported. Assessing the BSAAML Compliance Program. Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports.

Source: mortgagemanuals.com

Source: mortgagemanuals.com

The BSAAML Analyst is responsible for review and analysis of alerts transactions trends and reports and supports the day-to-day operations of the BSAAML function of the bank. Under the Anti-Money Laundering Act of 2020. Begin any SAR investigation based on SAR Referrals from branches Money. The Act requires Treasury to evaluate how it might streamline SAR and CTR requirements and processes. ABA will continue partnering with law-makers federal banking regulators law enforcement groups and bankers to find common sense improvements to the current framework that will support law enforcement while minimizing unnecessary regulatory burdens.

Deferred prosecution agreements in the course of BSAAML matters. Deferred prosecution agreements in the course of BSAAML matters. It covers the components of a SAR monitoring and reporting system and how to answer the. At the top of the screen across the banner from left to right users can get to the Infobase Home Page the Online BSAAML Manual Examination Procedures References and the FFIEC Home Page. The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported.

VP at a bank 306MUSA We have identified potential structuring from a customers account 9000 cash withdrawals. The BSAAML Analyst is responsible for review and analysis of alerts transactions trends and reports and supports the day-to-day operations of the BSAAML function of the bank. The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported. Nonetheless a law enforcement inquiry may be relevant to a banks overall risk assessment of its customers and accounts. Assessing Compliance with BSA Regulatory Requirements.

Source: complianceonline.com

Source: complianceonline.com

Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. SARs alert law enforcement agencies to potential cases such as money laundering or terrorist financing. When filing suspicious activity reports SAR it is important for financial institutions to review. It covers the components of a SAR monitoring and reporting system and how to answer the. Developing Conclusions and Finalizing the Exam.

Source:

Source:

Financial system against illicit foreign actors. It covers the components of a SAR monitoring and reporting system and how to answer the. FFIEC BSAAML Appendices - Appendix K Customer Risk Versus Due Diligence and Suspicious Activity Monitoring. The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported. FFIEC BSAAML Examination Manual 63 2272015V2 Mere receipt of any law enforcement inquiry does not by itself require the filing of a SAR by the bank.

Source: slideplayer.com

Source: slideplayer.com

A little over six months since the passage of the Anti-Money Laundering Act of 2020 AMLA 2020 part of the massive National Defense Authorization Act NDAA the full implications of the legislation are still emerging. The SAR includes a number of check boxes to record the instrument typespayment mechanisms involved in the suspicious activity and types of suspicious activity being reported. FFIEC BSAAML Appendices - Appendix K Customer Risk Versus Due Diligence and Suspicious Activity Monitoring. Deferred prosecution agreements in the course of BSAAML matters. The Act requires Treasury to evaluate how it might streamline SAR and CTR requirements and processes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml sar by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas