14++ Bsa aml structuring info

Home » about money loundering idea » 14++ Bsa aml structuring infoYour Bsa aml structuring images are available in this site. Bsa aml structuring are a topic that is being searched for and liked by netizens today. You can Download the Bsa aml structuring files here. Get all royalty-free vectors.

If you’re searching for bsa aml structuring images information connected with to the bsa aml structuring interest, you have visit the right blog. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

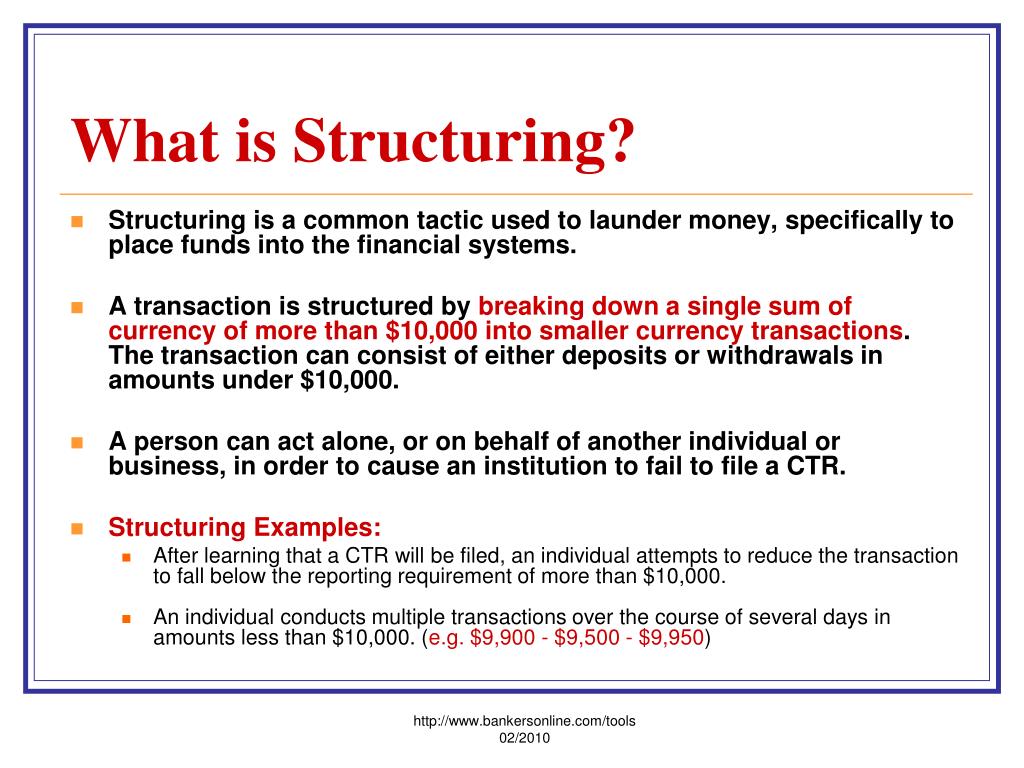

Bsa Aml Structuring. The Audit Narrative is an essential component of our work. These laws are part of the Bank Secrecy Act discussed below. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA.

Suspicious Activity Anti Money Laundering Ppt Download From slideplayer.com

Suspicious Activity Anti Money Laundering Ppt Download From slideplayer.com

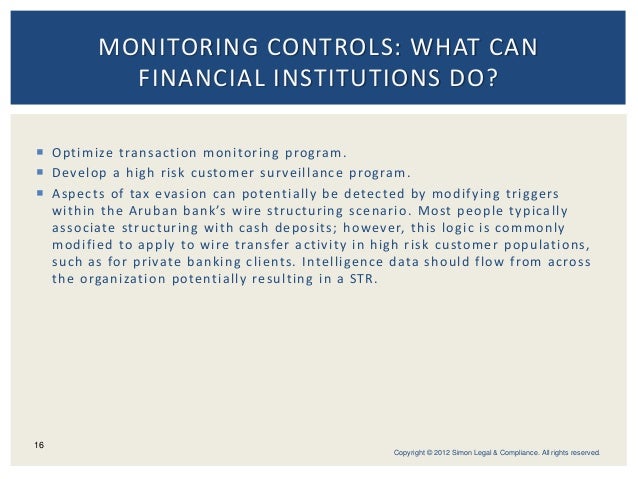

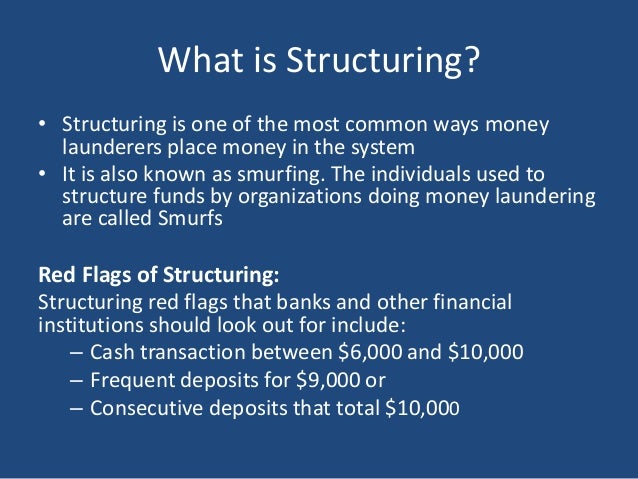

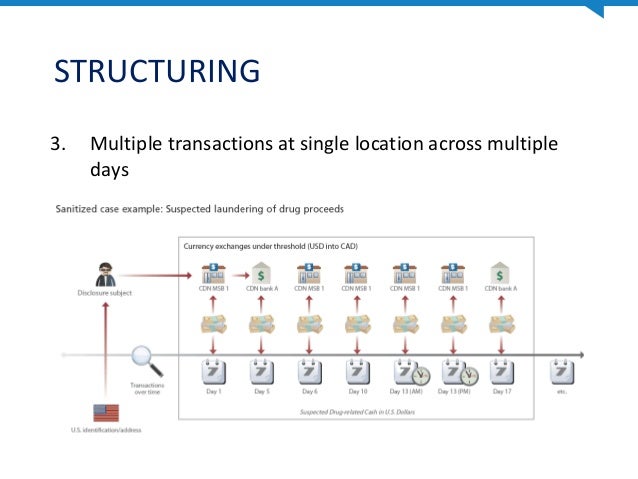

Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. Under the BSA no person shall for the purpose of evading the CTR Currency Transaction Reporting. Structuring is the practice of conducting financial transactions in a specific pattern calculated to avoid the creation of certain records and reports required by the Bank Secrecy Act BSA andor IRC 6050I Returns relating to cash received in trade or business etc. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. Even if structuring has not occurred the bank should review the transactions for suspicious activity. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement.

The Bank Secrecy Act BSA is celebrating its 50th birthday today.

Established on October 26 1970 it has become one of the most important anti-money laundering AML tools in the United States and has set the pace for worldwide AML efforts. Financial system against illicit foreign actors. BSAAML Compliance and Management Strengthen regulatory compliance and enhance your ability to detect investigate and report potentially suspicious activity with Verafins targeted analytics and end-to-end BSAAML solutions. Structuring FFIEC BSAAML Examination Manual G2 2272015V2 necessary to determine the nature of the transactions prior account history and other relevant customer information to assess whether the activity is suspicious. 31 USC 5324 Structuring transactions to evade reporting requirement prohibited is self-implementing meaning that penalties can be assessed against a structured transaction without having an implementing regulation. Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg.

Source: slideshare.net

Source: slideshare.net

Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. Established on October 26 1970 it has become one of the most important anti-money laundering AML tools in the United States and has set the pace for worldwide AML efforts. The Bank Secrecy Act BSA is celebrating its 50th birthday today.

Source: pinterest.com

Source: pinterest.com

A structured transaction is a series of smaller transactions which are broken up to avoid the 10000 reporting requirements for the Bank Secrecy Act BSA. A person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring. Government in cases of suspected money laundering and fraud. BSAAML Compliance and Management Strengthen regulatory compliance and enhance your ability to detect investigate and report potentially suspicious activity with Verafins targeted analytics and end-to-end BSAAML solutions.

Source: slideshare.net

Source: slideshare.net

Financial institutions to collaborate with the US. Completion of these procedures may require communication with other regulators. Review the structure and management of the BSAAML compliance program. Structuring FFIEC BSAAML Examination Manual G2 2272015V2 necessary to determine the nature of the transactions prior account history and other relevant customer information to assess whether the activity is suspicious. Structuring is the practice of conducting financial transactions in a specific pattern calculated to avoid the creation of certain records and reports required by the Bank Secrecy Act BSA andor IRC 6050I Returns relating to cash received in trade or business etc.

Source: goldinglawyers.com

Source: goldinglawyers.com

Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg. C is designed whether through structuring or other means to evade any requirement in the Bank. Bank Secrecy Act BSA Anti-Laundering Money AML The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg.

Source: slideplayer.com

Source: slideplayer.com

As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring. The consumer has a large balance with the Bank. 31 CFR 1010314 Structured transactions defines structuring to include causing or attempting to cause a domestic financial.

Source: slideplayer.com

Source: slideplayer.com

A person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more. Lets take a look at how its changed over the five decades since its inception to keep up with the. Structuring FFIEC BSAAML Examination Manual G2 2272015V2 necessary to determine the nature of the transactions prior account history and other relevant customer information to assess whether the activity is suspicious. A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. C is designed whether through structuring or other means to evade any requirement in the Bank.

Source: slideplayer.com

Source: slideplayer.com

A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. Completion of these procedures may require communication with other regulators. Established on October 26 1970 it has become one of the most important anti-money laundering AML tools in the United States and has set the pace for worldwide AML efforts. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. 31 CFR 1010314 Structured transactions defines structuring to include causing or attempting to cause a domestic financial.

Source: taxcontroversy.com

Source: taxcontroversy.com

The consumer has a large balance with the Bank. Completion of these procedures may require communication with other regulators. The Bank Secrecy Act BSA is celebrating its 50th birthday today. Even if structuring has not occurred the bank should review the transactions for suspicious activity. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement.

Source: slideshare.net

Source: slideshare.net

A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. C is designed whether through structuring or other means to evade any requirement in the Bank. It represents a detailed walkthrough of each BSAAML process and results in the assessment of the applicable control designs. A involves funds derived from illegal activity.

Source: slideserve.com

Source: slideserve.com

A structured transaction is a series of smaller transactions which are broken up to avoid the 10000 reporting requirements for the Bank Secrecy Act BSA. Lets take a look at how its changed over the five decades since its inception to keep up with the. Structuring FFIEC BSAAML Examination Manual G2 2272015V2 necessary to determine the nature of the transactions prior account history and other relevant customer information to assess whether the activity is suspicious. C is designed whether through structuring or other means to evade any requirement in the Bank. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring.

Source: slideserve.com

Source: slideserve.com

Even if structuring has not occurred the bank should review the transactions for suspicious activity. Even if structuring has not occurred the bank should review the transactions for suspicious activity. Money Laundering Opinions of Note. Review the structure and management of the BSAAML compliance program. Completion of these procedures may require communication with other regulators.

Source: slideplayer.com

Source: slideplayer.com

Review the structure and management of the BSAAML compliance program. Completion of these procedures may require communication with other regulators. It represents a detailed walkthrough of each BSAAML process and results in the assessment of the applicable control designs. The Bank Secrecy Act BSA is celebrating its 50th birthday today. Established on October 26 1970 it has become one of the most important anti-money laundering AML tools in the United States and has set the pace for worldwide AML efforts.

Source: present5.com

Source: present5.com

The consumer has a large balance with the Bank. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. Money Laundering Opinions of Note. A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. The consumer has a large balance with the Bank.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml structuring by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information