13++ Bsa aml system validation info

Home » about money loundering Info » 13++ Bsa aml system validation infoYour Bsa aml system validation images are available. Bsa aml system validation are a topic that is being searched for and liked by netizens now. You can Download the Bsa aml system validation files here. Find and Download all royalty-free images.

If you’re searching for bsa aml system validation pictures information linked to the bsa aml system validation topic, you have pay a visit to the right site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

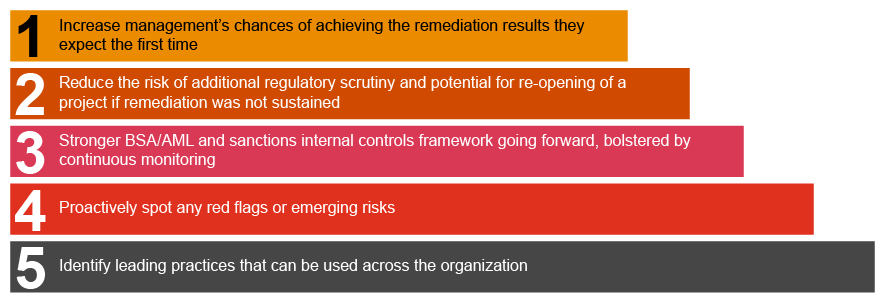

Bsa Aml System Validation. Governance System and Data. It is always best to complete the model validation in a test environment. Advisory around effective know your customer KYC procedures including an evaluation of systems controls policies individual responsibility and. However we also offer versatile and high-quality expense-efficient alternatives which can be tailored to meet your specific independent validation needs.

Bank Secrecy Act Workshop Bsa Aml Training For Banks From probank.com

Bank Secrecy Act Workshop Bsa Aml Training For Banks From probank.com

These may include reports or automated programs used to. Each part on their own is not effective in demonstrating that the model is working. Examples of critical changes that may prompt an AML-system validation include the following. Changes to the customer base. DCGs BSAAML model validations are designed to help banks tackle these challenges head-on and mitigate their BSAAML-related risks. Identify large currency transactions aggregate daily currency transactions record monetary instrument sales and funds transfer transactions and provide analytical and trend reports.

Our standard BSAAML system validation engagements are competitively priced and include a review of both the effectiveness of your parameters and the quality of your data.

Upgrade or change to core systems. It is always best to complete the model validation in a test environment. Our standard BSAAML system validation engagements are competitively priced and include a review of both the effectiveness of your parameters and the quality of your data. Our BSAAML-related validation and advisory services include. Governance System and Data. A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports generated by the banks MIS or vendor systems in order to identify unusual activity.

Source: acamstoday.org

Source: acamstoday.org

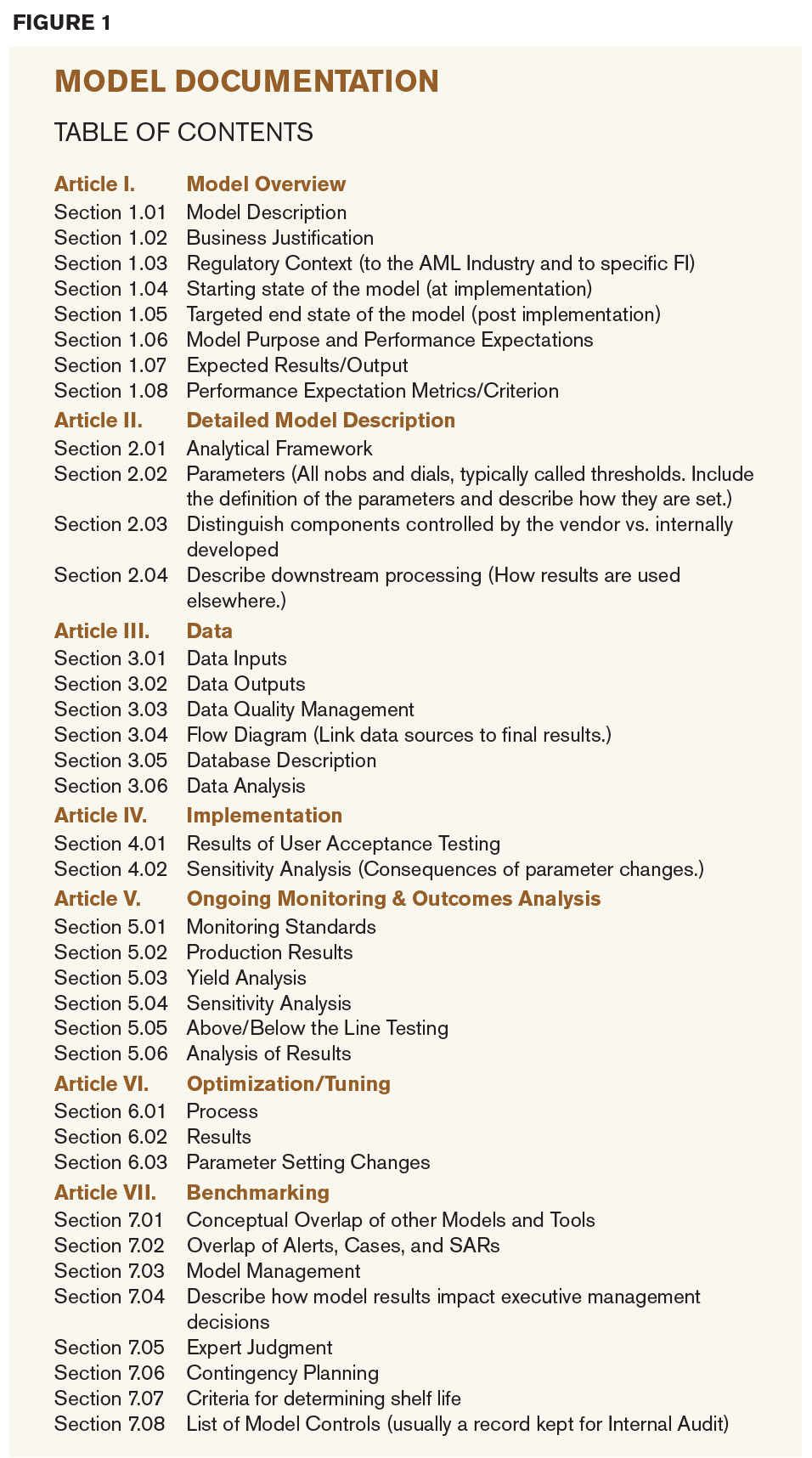

Our BSAAML-related validation and advisory services include. The banks information technology sources systems and processes used to support the BSAAML compliance program are complete and accurate. In order to meet the required depth of an AML Model Validation you must look at all three parts. BSA-Verafin system validation. Our BSAAML-related validation and advisory services include.

Source: rmajournal.org

Source: rmajournal.org

The Bank Secrecy Act BSA Anti-Money Laundering programs are becoming increasingly reliant on automated models in detecting suspicious activity measuring risk and supporting key business. Prior to founding Secura Terri served as co-founder of Payments Information Circle PIC a service. When validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. Identify large currency transactions aggregate daily currency transactions record monetary instrument sales and funds transfer transactions and provide analytical and trend reports. Bank Secrecy Act BSAAnti-Money Laundering AML System Validation ProBank Austin professionals will validate the programming of the automated transaction monitoring system used for suspicious activity monitoring and reporting purposes.

Source: stout.com

Source: stout.com

BSA-Verafin system validation. The Bank Secrecy Act BSA Anti-Money Laundering programs are becoming increasingly reliant on automated models in detecting suspicious activity measuring risk and supporting key business. These may include reports or automated programs used to. Prior to founding Secura Terri served as co-founder of Payments Information Circle PIC a service. Completion of a merger or acquisition.

Source: complianceonline.com

Source: complianceonline.com

Advisory around effective know your customer KYC procedures including an evaluation of systems controls policies individual responsibility and. Bank Secrecy Act BSAAnti-Money Laundering AML System Validation ProBank Austin professionals will validate the programming of the automated transaction monitoring system used for suspicious activity monitoring and reporting purposes. An AML model validation includes a thorough review of three parts. Advisory around effective know your customer KYC procedures including an evaluation of systems controls policies individual responsibility and. When validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity.

Source:

Our BSAAML-related validation and advisory services include. VP at a bank 38BUSA We validate data imports weekly and we have an outside firm perform a model validation annually. During Bank Secrecy ActAnti Money Laundering BSAAML exams examiners are testing to see whether financial institutions had their transaction monitoring system independently validated. Some financial institutions have pushed back on this requirement and argued that they do not need to have their system independently validated since it is not required in the Bank Secrecy Act or. However many institutions dont know what a model is let alone when an independent third-party validation is required.

Source: advisx.com

Source: advisx.com

Change in the BSA or AML risk profile. Changes to the customer base. Can anyone recommend a vendor for this and share their experiences in dealing with that provider. As dependency on automated anti-money laundering AML monitoring systems is ever increasing the need for strong AML system validation and calibration has never been more important. Each part on their own is not effective in demonstrating that the model is working.

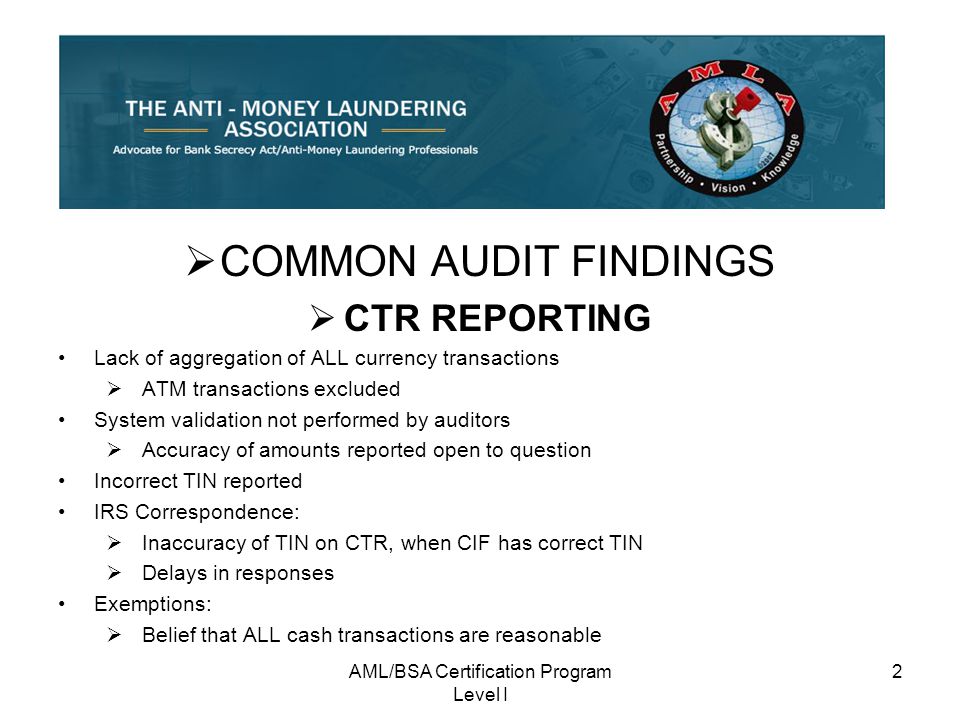

Model validations are a vital component of monitoring a financial institutions Bank Secrecy Actanti-money laundering BSAAML risk. Challenges and Opportunities Validation of AML monitoring software presents several. In order to meet the required depth of an AML Model Validation you must look at all three parts. Examples of critical changes that may prompt an AML-system validation include the following. During Bank Secrecy ActAnti Money Laundering BSAAML exams examiners are testing to see whether financial institutions had their transaction monitoring system independently validated.

Source: infosightinc.com

Source: infosightinc.com

In order to meet the required depth of an AML Model Validation you must look at all three parts. During Bank Secrecy ActAnti Money Laundering BSAAML exams examiners are testing to see whether financial institutions had their transaction monitoring system independently validated. Some financial institutions have pushed back on this requirement and argued that they do not need to have their system independently validated since it is not required in the Bank Secrecy Act or. Completion of a merger or acquisition. Our BSAAML-related validation and advisory services include.

Source: affirmx.com

Source: affirmx.com

Some financial institutions have pushed back on this requirement and argued that they do not need to have their system independently validated since it is not required in the Bank Secrecy Act or. These may include reports or automated programs used to. Each part on their own is not effective in demonstrating that the model is working. A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports generated by the banks MIS or vendor systems in order to identify unusual activity. The regulatory expectation outlined in the FFIEC BSAAML Examination Manual that a monitoring systems program-ming methodology and algorithms should be validated independently to ensure the models are detecting potentially suspicious activity.

Source: probank.com

Source: probank.com

In order to meet the required depth of an AML Model Validation you must look at all three parts. Employee at a credit_union 186MUSA Our credit union has begun to utilize Verafin and we are needing a system validation done. Challenges and Opportunities Validation of AML monitoring software presents several. Guidance from a primary regulator. Our BSAAML-related validation and advisory services include.

Source: pwc.com

Source: pwc.com

Advisory around effective know your customer KYC procedures including an evaluation of systems controls policies individual responsibility and. When validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. Governance System and Data. Guidance from a primary regulator. DCGs BSAAML model validations are designed to help banks tackle these challenges head-on and mitigate their BSAAML-related risks.

Source: slideplayer.com

Source: slideplayer.com

Terri is an Advanced Certified Anti-Money Laundering Specialist an At-Risk Adult Crime Specialist and an Accredited ACH Professional. The Bank Secrecy Act BSA Anti-Money Laundering programs are becoming increasingly reliant on automated models in detecting suspicious activity measuring risk and supporting key business. Governance System and Data. Major changes to the AML system. Employee at a credit_union 186MUSA Our credit union has begun to utilize Verafin and we are needing a system validation done.

Source: blogs.claconnect.com

Source: blogs.claconnect.com

It is always best to complete the model validation in a test environment. Identify large currency transactions aggregate daily currency transactions record monetary instrument sales and funds transfer transactions and provide analytical and trend reports. In order to meet the required depth of an AML Model Validation you must look at all three parts. Prior to founding Secura Terri served as co-founder of Payments Information Circle PIC a service. Each part on their own is not effective in demonstrating that the model is working.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml system validation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas