12++ Bsa structuring money laundering ideas in 2021

Home » about money loundering idea » 12++ Bsa structuring money laundering ideas in 2021Your Bsa structuring money laundering images are ready in this website. Bsa structuring money laundering are a topic that is being searched for and liked by netizens now. You can Download the Bsa structuring money laundering files here. Download all free photos and vectors.

If you’re looking for bsa structuring money laundering images information connected with to the bsa structuring money laundering keyword, you have come to the ideal blog. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

Bsa Structuring Money Laundering. In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The consumer has a large balance with the Bank. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities.

Red Flags Of Money Laundering From slideshare.net

Red Flags Of Money Laundering From slideshare.net

These records opened up avenues of prosecution for money laundering charges as the SARs detailed a series of transactions designed to evade the BSA reporting requirements. Civil asset forfeiture allows law enforcement agents to take property they suspect of being tied to crime even if no criminal charges are filed. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. Money laundering is the movement of illicit funds for the purpose of concealing the true source ownership or use of the funds. Structuring transactions to evade Bank Secrecy Act reporting and certain record-keeping requirements can result in civil and criminal penalties.

Through money laundering the monetary proceeds derived from criminal activity are transformed into funds with an apparently legal source.

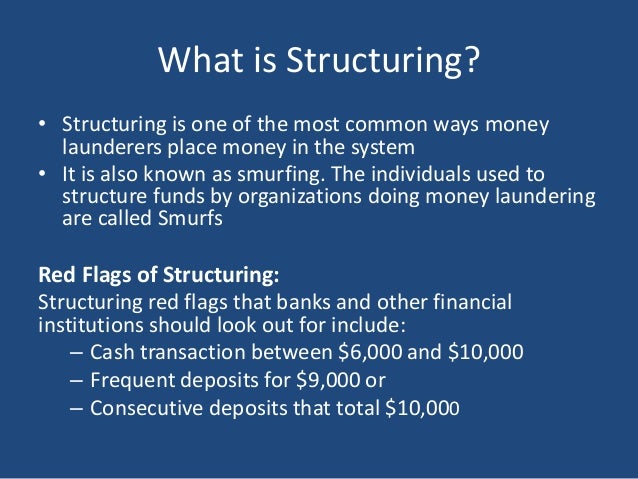

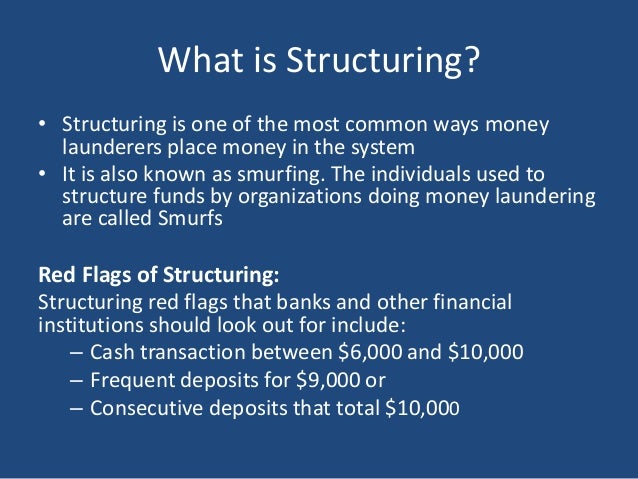

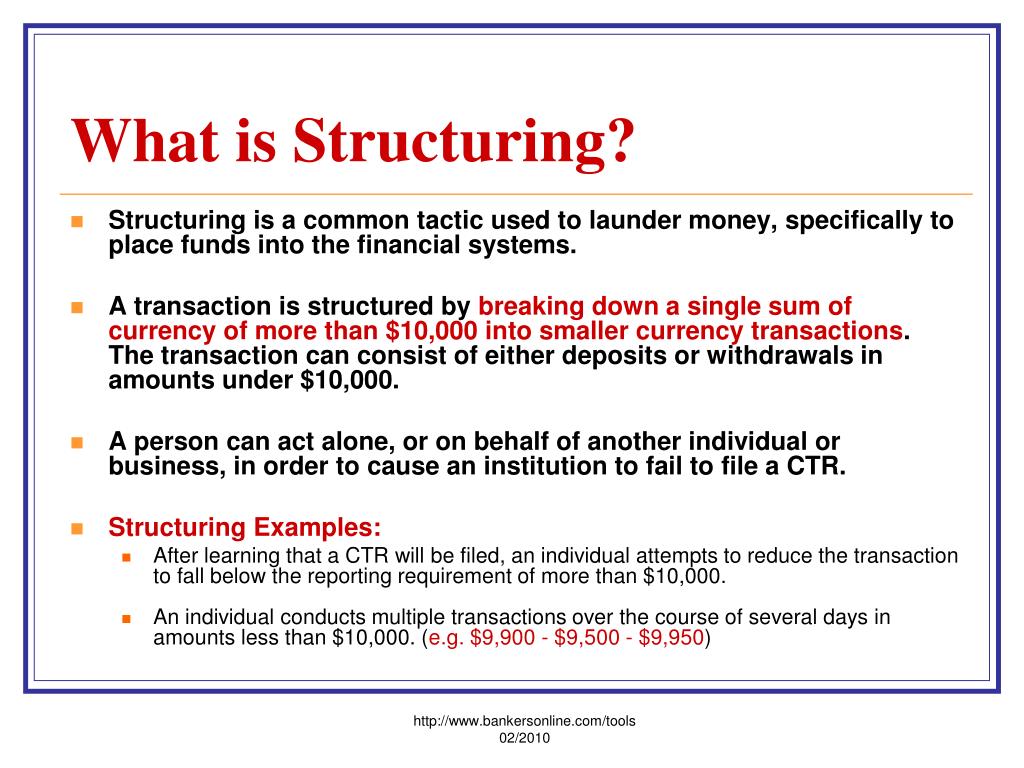

Under the BSA no person shall for the purpose of evading the CTR Currency Transaction Reporting. 2 The extent and specific parameters under which a financial institution must monitor accounts. On the financial institutions SAR form the check box used for perceived structuring instances is titled Bank Secrecy Act Structuring Money Laundering So as you can see it is not a clean delineation. Smurfs - A popular method used to launder cash in the placement stage. The mission of the BSA Program is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing the financial community top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. Civil asset forfeiture allows law enforcement agents to take property they suspect of being tied to crime even if no criminal charges are filed.

Source: slideshare.net

Source: slideshare.net

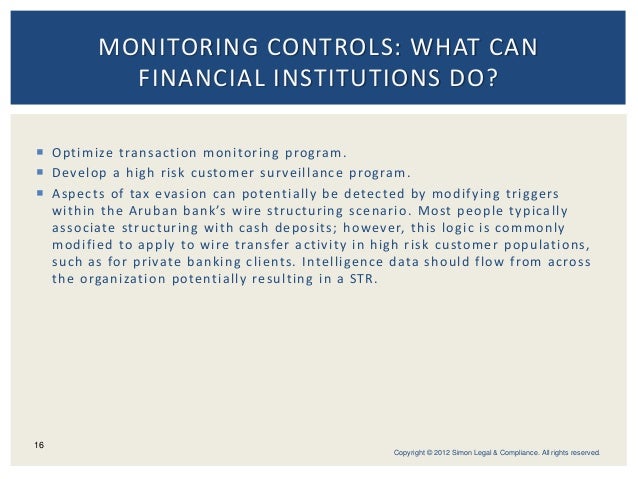

A financial institutions anti-money laundering program should be designed to detect and report both categories of structuring to guard against use of the institution for money laundering and ensure the institution is compliant with the suspicious activity reporting requirements of the Bank Secrecy Act. The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency. The consumer has a large balance with the Bank. Review of BSAStructuringMoney Laundering Violation on SAR Forms. Through money laundering the monetary proceeds derived from criminal activity are transformed into funds with an apparently legal source.

Source: slideshare.net

Source: slideshare.net

Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. Civil asset forfeiture allows law enforcement agents to take property they suspect of being tied to crime even if no criminal charges are filed. 2 The extent and specific parameters under which a financial institution must monitor accounts. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits.

Source: present5.com

Source: present5.com

Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. 2 The extent and specific parameters under which a financial institution must monitor accounts. Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges. Under the BSA 31 USC 5324 no person shall for the purpose of evading the Currency Transaction Report CTR or a geographic targeting order reporting requirement or certain BSA record-keeping requirements such as the monetary. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA.

Source: taxcontroversy.com

Source: taxcontroversy.com

Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that they make in the legitimate economy. On the financial institutions SAR form the check box used for perceived structuring instances is titled Bank Secrecy Act Structuring Money Laundering So as you can see it is not a clean delineation. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all.

Source: slideserve.com

Source: slideserve.com

In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative. Structuring transactions to evade Bank Secrecy Act reporting and certain record-keeping requirements can result in civil and criminal penalties. On the financial institutions SAR form the check box used for perceived structuring instances is titled Bank Secrecy Act Structuring Money Laundering So as you can see it is not a clean delineation. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits. Under the BSA no person shall for the purpose of evading the CTR Currency Transaction Reporting.

Source: goldinglawyers.com

Source: goldinglawyers.com

These laws are part of the Bank Secrecy Act discussed below. Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges. Structuring transactions to evade Bank Secrecy Act reporting and certain record-keeping requirements can result in civil and criminal penalties. These records opened up avenues of prosecution for money laundering charges as the SARs detailed a series of transactions designed to evade the BSA reporting requirements. The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency.

Source: slideshare.net

Source: slideshare.net

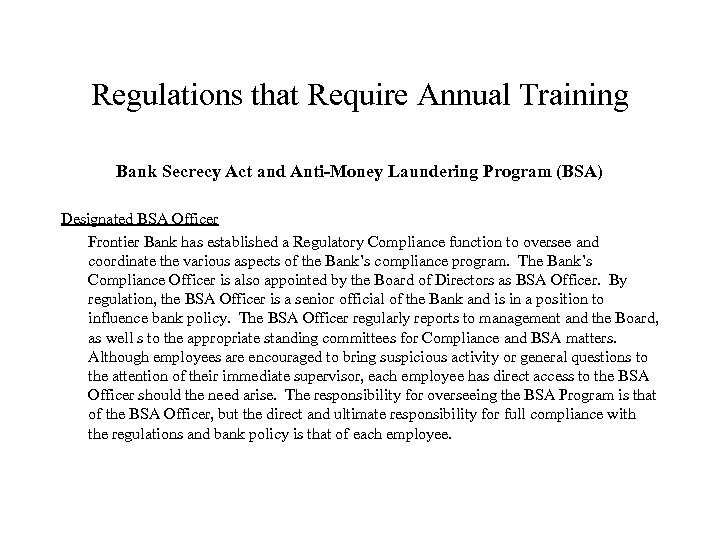

The Money Laundering Control Act of 1986 prohibited structuring made money laundering a federal crime and required banks to do a better job of establishing and monitoring their compliance programs. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. These laws are part of the Bank Secrecy Act discussed below. 2 The extent and specific parameters under which a financial institution must monitor accounts. Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that they make in the legitimate economy.

Source: slideplayer.com

Source: slideplayer.com

The mission of the BSA Program is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing the financial community top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative. Money laundering is the movement of illicit funds for the purpose of concealing the true source ownership or use of the funds. Structuring transactions to evade Bank Secrecy Act reporting and certain record-keeping requirements can result in civil and criminal penalties. Smurfs - A popular method used to launder cash in the placement stage.

Source: slideplayer.com

Source: slideplayer.com

The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. The Money Laundering Control Act of 1986 prohibited structuring made money laundering a federal crime and required banks to do a better job of establishing and monitoring their compliance programs. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy.

Source: slideplayer.com

Source: slideplayer.com

The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency. The consumer has a large balance with the Bank. The Money Laundering Control Act of 1986 prohibited structuring made money laundering a federal crime and required banks to do a better job of establishing and monitoring their compliance programs. Review of BSAStructuringMoney Laundering Violation on SAR Forms. These laws are part of the Bank Secrecy Act discussed below.

Source: pinterest.com

Source: pinterest.com

The mission of the BSA Program is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing the financial community top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. 2 The extent and specific parameters under which a financial institution must monitor accounts. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities. Money laundering is the movement of illicit funds for the purpose of concealing the true source ownership or use of the funds. Review of BSAStructuringMoney Laundering Violation on SAR Forms.

Source: aml-assassin.com

Source: aml-assassin.com

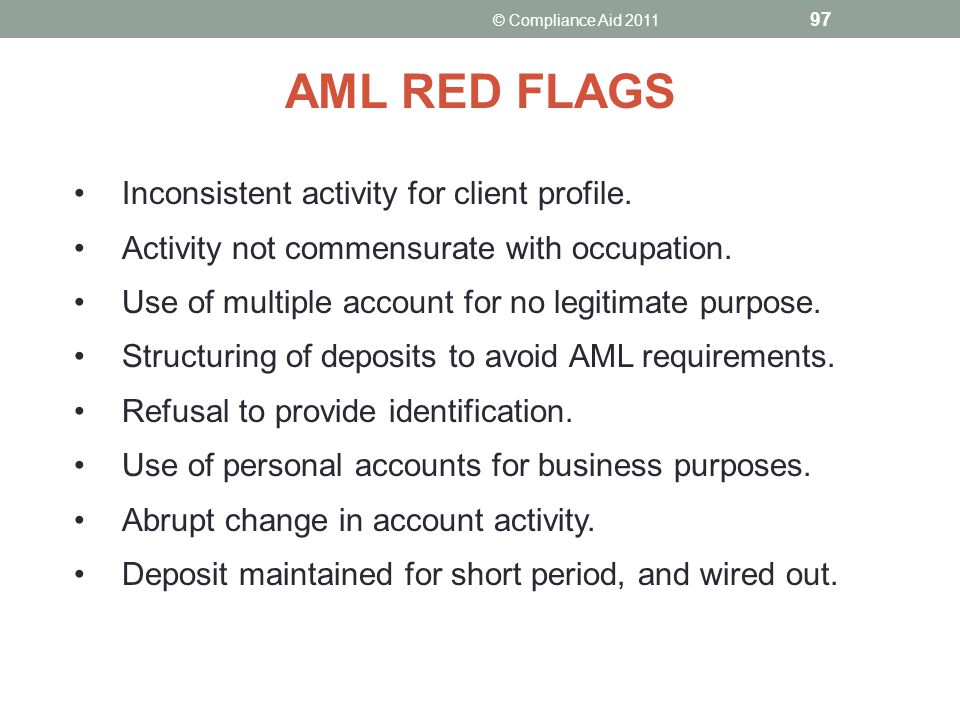

The consumer has a large balance with the Bank. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. A financial institutions anti-money laundering program should be designed to detect and report both categories of structuring to guard against use of the institution for money laundering and ensure the institution is compliant with the suspicious activity reporting requirements of the Bank Secrecy Act. Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges.

Source: slideplayer.com

Source: slideplayer.com

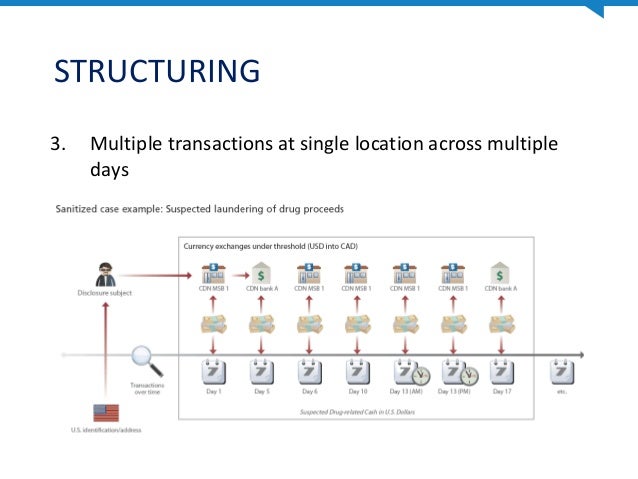

On the financial institutions SAR form the check box used for perceived structuring instances is titled Bank Secrecy Act Structuring Money Laundering So as you can see it is not a clean delineation. Frequent sometimes more than one a day cash deposits were made to an account followed by online transfers from the receiving account to another account ie moving funds electronically from a checking account to a money market account or from a savings account to a. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The consumer has a large balance with the Bank. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa structuring money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information