15+ Bsaaml board reporting ideas

Home » about money loundering idea » 15+ Bsaaml board reporting ideasYour Bsaaml board reporting images are available. Bsaaml board reporting are a topic that is being searched for and liked by netizens now. You can Find and Download the Bsaaml board reporting files here. Find and Download all royalty-free images.

If you’re looking for bsaaml board reporting images information connected with to the bsaaml board reporting interest, you have pay a visit to the ideal blog. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

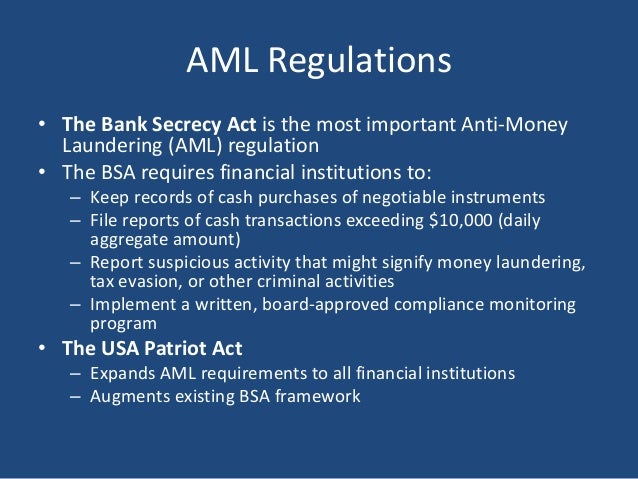

Bsaaml Board Reporting. BSAAML exam manual updated council reports. Aml rightsource board of directors. On an annual basis the board or a designated board committee must approve the BSAAML compliance program. The Act is designed to aid federal government in detecting illegal activity through tracking certain cash-based transactions.

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering From pinterest.com

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering From pinterest.com

The BSAAML Analyst is responsible for review and analysis of alerts transactions trends and reports and supports the day-to-day operations of the BSAAML function of the bank. Aml training board directors. Regardless of who performs the independent testing the party conducting the BSAAML independent testing should report directly to the board of directors or to a designated board committee comprised primarily or completely of outside directors. June 21 2021 FDIC NCUA OCC Other The Fed 0. The BSA compliance officer is responsible for carrying out the direction of the board and ensuring that employees adhere to the banks BSAAML. Adding a section for the culture of compliance in your written BSA Policy will show that your institution is on board assuming policy is adhered to and those not following are held accountable.

O Importance of BSAAML regulatory requirements o Ramifications of noncompliance o Risks posed to the Bank.

June 21 2021 FDIC NCUA OCC Other The Fed 0. We are already reporting this on a quarterly basis and present the current years quarterly totals and the prior three years quarterly totals but their comment was while the quarterly amounts are good they also want the amounts annually because it is a better comparison for the Board. Updates to four sections of the Bank Secrecy Actanti-money laundering BSAAML examination manual for financial institution examiners were announced Monday by the federal financial institution regulators umbrella examination council. Regardless of who performs the independent testing the party conducting the BSAAML independent testing should report directly to the board of directors or to a designated board committee comprised primarily or completely of outside directors. The BSA compliance officer should regularly report the status of ongoing compliance with the BSA to the board of directors and senior management so that they can make informed decisions about existing risk exposure and the overall BSAAML compliance program. Lenders are required to file reports of daily transactions conducted in currency in.

Source: pinterest.com

Source: pinterest.com

Aml foods board of directors. Updates to four sections of the Bank Secrecy Actanti-money laundering BSAAML examination manual for financial institution examiners were announced Monday by the federal financial institution regulators umbrella examination council. Lenders are required to file reports of daily transactions conducted in currency in. Regardless of who performs the independent testing the party conducting the BSAAML independent testing should report directly to the board of directors or to a designated board committee comprised primarily or completely of outside directors. Bsa aml board of directors training.

Source: acamstoday.org

Source: acamstoday.org

Our trustworthy BSAAML resources assist in the day-to-day BSAAMLOFAC requirements the management of this function and ending with the Board reporting requirements. Pertinent BSA-related information including the reporting of SARs filed with FinCEN should be reported to the board of directors or an appropriate board committee so that these individuals can make informed decisions about overall BSAAML compliance. Reporting to the board of directors or a designated board committee about the status of ongoing compliance should include pertinent BSA-related information including the required notification of suspicious activity report. The BSAAML Analyst is responsible for review and analysis of alerts transactions trends and reports and supports the day-to-day operations of the BSAAML function of the bank. We are already reporting this on a quarterly basis and present the current years quarterly totals and the prior three years quarterly totals but their comment was while the quarterly amounts are good they also want the amounts annually because it is a better comparison for the Board.

Source: fineksus.com

Source: fineksus.com

The reports should be tailored to support its oversight activities and should include. On an annual basis the board or a designated board committee must approve the BSAAML compliance program. VP at a bank 176MUSA Our internal auditors would like us to provide an annual report to the Board of Directors on the effectiveness of our BSAAML compliance program and any significant BSAAML matters. O Importance of BSAAML regulatory requirements o Ramifications of noncompliance o Risks posed to the Bank. Aml training board directors.

Source: probank.com

Source: probank.com

We help you establish BSAAML programs policies and procedures to ensure accuracy of recordkeeping. Aml training for board of directors. We help you establish BSAAML programs policies and procedures to ensure accuracy of recordkeeping. Annual BSAAML Report to Board. Aml training board directors.

Source: pinterest.com

Source: pinterest.com

The BSA compliance officer is responsible for carrying out the direction of the board and ensuring that employees adhere to the banks BSAAML. Annual BSAAML Report to Board. Bsa aml board of directors training. Finally they want us reporting to the Board the cash activity by large customer so that the Board sees the total. The reports should be tailored to support its oversight activities and should include.

Source: pinterest.com

Source: pinterest.com

Aml foods board of directors. BSAAML exam manual updated council reports. More and more we hear about regulatory enforcement actions for lack of a robust BSAAML Program. Our BSAAML tools include policies procedures checklists risk assessments monitoring and auditing worksheets training tools and much more. O Importance of BSAAML regulatory requirements o Ramifications of noncompliance o Risks posed to the Bank.

Source: researchandmarkets.com

Source: researchandmarkets.com

The board should receive periodic reports about the operation of the program. The BSA compliance officer should regularly report the status of ongoing compliance with the BSA to the board of directors and senior management so that they can make informed decisions about existing risk exposure and the overall BSAAML compliance program. The board should receive periodic reports about the operation of the program. Lenders are required to file reports of daily transactions conducted in currency in. Regardless of who performs the independent testing the party conducting the BSAAML independent testing should report directly to the board of directors or to a designated board committee comprised primarily or completely of outside directors.

Source: chaussureslouboutin-soldes.fr

Source: chaussureslouboutin-soldes.fr

Aml foods board of directors. More and more we hear about regulatory enforcement actions for lack of a robust BSAAML Program. The Act is designed to aid federal government in detecting illegal activity through tracking certain cash-based transactions. The reports should be tailored to support its oversight activities and should include. Anti-money laundering AML law.

Source: pinterest.com

Source: pinterest.com

Included in the information provided would be the number of SARs and CTRs filed for the year CTR exemptions. Effective board reporting on BSA AML risks focuses on the overall health of the program by highlighting trends and summaries Reynolds said. On an annual basis the board or a designated board committee must approve the BSAAML compliance program. The BSA compliance officer should regularly report the status of ongoing compliance with the BSA to the board of directors and senior management so that they can make informed decisions about existing risk exposure and the overall BSAAML compliance program. Updates to four sections of the Bank Secrecy Actanti-money laundering BSAAML examination manual for financial institution examiners were announced Monday by the federal financial institution regulators umbrella examination council.

Source: fineksus.com

Source: fineksus.com

We are already reporting this on a quarterly basis and present the current years quarterly totals and the prior three years quarterly totals but their comment was while the quarterly amounts are good they also want the amounts annually because it is a better comparison for the Board. VP at a bank 176MUSA Our internal auditors would like us to provide an annual report to the Board of Directors on the effectiveness of our BSAAML compliance program and any significant BSAAML matters. Our trustworthy BSAAML resources assist in the day-to-day BSAAMLOFAC requirements the management of this function and ending with the Board reporting requirements. The board should receive periodic reports about the operation of the program. Aml training board directors.

Oversight of the BSA program requires good information to be reported up the line to Senior Management and the Board. BSAAML exam manual updated council reports. The Act is designed to aid federal government in detecting illegal activity through tracking certain cash-based transactions. On an annual basis the board or a designated board committee must approve the BSAAML compliance program. O Dont expect your BSA Officer to know what information you need.

Source: pinterest.com

Source: pinterest.com

Finally they want us reporting to the Board the cash activity by large customer so that the Board sees the total. Bsa aml board of directors training. O Dont expect your BSA Officer to know what information you need. On an annual basis the board or a designated board committee must approve the BSAAML compliance program. BSA AML Compliance Forms.

Source: slideshare.net

Source: slideshare.net

Pertinent BSA-related information including the reporting of SARs filed with FinCEN should be reported to the board of directors or an appropriate board committee so that these individuals can make informed decisions about overall BSAAML compliance. BSAAML exam manual updated council reports. Oversight of the BSA program requires good information to be reported up the line to Senior Management and the Board. O Importance of BSAAML regulatory requirements o Ramifications of noncompliance o Risks posed to the Bank. Aml board of directors.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsaaml board reporting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information