15++ Bsaaml for non banking institutions ideas

Home » about money loundering Info » 15++ Bsaaml for non banking institutions ideasYour Bsaaml for non banking institutions images are available in this site. Bsaaml for non banking institutions are a topic that is being searched for and liked by netizens today. You can Get the Bsaaml for non banking institutions files here. Find and Download all royalty-free photos.

If you’re searching for bsaaml for non banking institutions images information connected with to the bsaaml for non banking institutions topic, you have come to the ideal blog. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

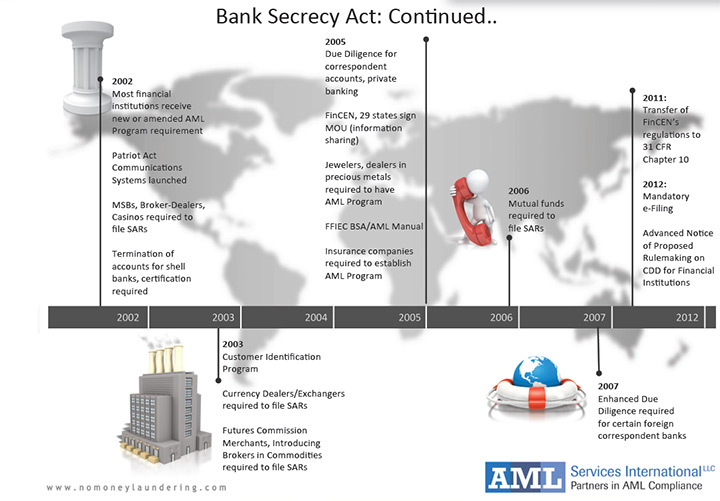

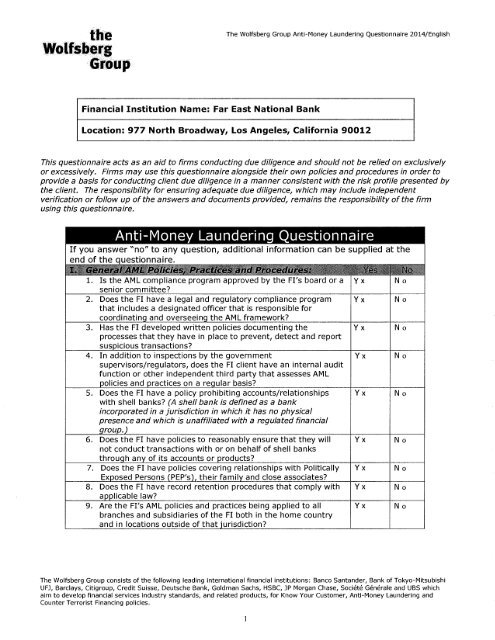

Bsaaml For Non Banking Institutions. Nonbank Financial Institutions Overview FFIEC BSAAML Examination Manual 299 2272015V2 Nonbank Financial Institutions Overview Objective. The OCC uses informal and formal enforcement actions to. To be compliant with BSA requirements banks should also monitor transactions for Non- Bank Financial Institution NBFI and Money Services Business MSB customers. The joint statement sets forth the agencies policy on the circumstances in which an agency will issue a mandatory cease and desist order to address non-compliance with the BSA.

Keeps Your Financial Institution S Bsa Aml Compliance Program Effective Up To Date With Our Bsa Aml Complian Smart Goals Risk Management Debt Management Plan From pinterest.com

Keeps Your Financial Institution S Bsa Aml Compliance Program Effective Up To Date With Our Bsa Aml Complian Smart Goals Risk Management Debt Management Plan From pinterest.com

The OCC uses informal and formal enforcement actions to. Identify areas where improvements are needed. While nonbanking companies are generally not regulated for BSAAML and sanctions compliance to the same degree that banks are they are widely perceived as vulnerable to illicit activity and therefore subject to significant. BSAAnti-Money Laundering AML Examinations. Assess the adequacy of the banks systems to manage the risks associated with accounts of nonbank financial institutions NBFI and managements ability to implement. BSA Office of Foreign Assets Control OFAC Enforcement.

On July 15 2009 the Financial Crimes Enforcement Network FinCEN issued an advance notice of proposed rulemaking ANPRM to solicit public comment pertaining to the possible application of anti-money laundering AML program and suspicious activity report SAR regulations to a specific sub-set of loan and finance companies.

It is also known as money-laundering act or jointly referred to as BSAAML. The financial institutions are also required to report any suspicious activity that may show any signs of money laundering tax evasion etc. Each identified high risk entity that is a NBFI should be reviewed quarterly for activity that would. New Events in Non-Banking Financial Institution BSAAML Audit and Periphery will blow your MIND. BSA Office of Foreign Assets Control OFAC Enforcement. Examination of adherence to BSAAML laws and regulations applicable to regulated financial institutions or non-bank financial institutions.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. Risks Associated with Money Laundering and Terrorist Financing. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. Each identified high risk entity that is a NBFI should be reviewed quarterly for activity that would. The joint statement sets forth the agencies policy on the circumstances in which an agency will issue a mandatory cease and desist order to address non-compliance with the BSA.

Source: businesslawtoday.org

Source: businesslawtoday.org

It is also known as money-laundering act or jointly referred to as BSAAML. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. These apply broadly and can potentially result in. It is also known as money-laundering act or jointly referred to as BSAAML. An effective BSA-AML compliance program should suit the unique needs of the financial institution it serves including the risk profile it faces.

Source: pinterest.com

Source: pinterest.com

These apply broadly and can potentially result in. Services include transaction monitoring alert backlog. To determine compliance with the BSA. Non-bank residential mortgage lenders and originators Non-Bank. Each identified high risk entity that is a NBFI should be reviewed quarterly for activity that would.

Source: pinterest.com

Source: pinterest.com

BSA Office of Foreign Assets Control OFAC Enforcement. Non-bank residential mortgage lenders and originators Non-Bank. The Bank Secrecy Act authorizes the Secretary of the Treasury to require financial institutions to keep records and file reports that have a high degree of usefulness in criminaltax or regulatory investigations or in the conduct of intelligence or counterintelligence activities relating to international terrorismThis has excluded non-bank RMLOs until recently. The joint statement sets forth the agencies policy on the circumstances in which an agency will issue a mandatory cease and desist order to address non-compliance with the BSA. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk.

Source: acamstoday.org

Source: acamstoday.org

Identify areas where improvements are needed. Examination of adherence to BSAAML laws and regulations applicable to regulated financial institutions or non-bank financial institutions. Non-bank residential mortgage lenders and originators Non-Bank. Each identified high risk entity that is a NBFI should be reviewed quarterly for activity that would. To determine compliance with the BSA.

Source: pinterest.com

Source: pinterest.com

While nonbanking companies are generally not regulated for BSAAML and sanctions compliance to the same degree that banks are they are widely perceived as vulnerable to illicit activity and therefore subject to significant. The Bank Secrecy Act authorizes the Secretary of the Treasury to require financial institutions to keep records and file reports that have a high degree of usefulness in criminaltax or regulatory investigations or in the conduct of intelligence or counterintelligence activities relating to international terrorismThis has excluded non-bank RMLOs until recently. Published on June 17 2016 June 17 2016 4 Likes 0 Comments. New Events in Non-Banking Financial Institution BSAAML Audit and Periphery will blow your MIND. Services include transaction monitoring alert backlog.

Source: pinterest.com

Source: pinterest.com

The joint statement sets forth the agencies policy on the circumstances in which an agency will issue a mandatory cease and desist order to address non-compliance with the BSA. The Bank Secrecy Act BSA was originally enacted in 1970 and subsequently amended many times. To be compliant with BSA requirements banks should also monitor transactions for Non- Bank Financial Institution NBFI and Money Services Business MSB customers. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. It is also known as money-laundering act or jointly referred to as BSAAML.

Source: yumpu.com

Source: yumpu.com

Identify areas where improvements are needed. Assess the adequacy of the banks systems to manage the risks associated with accounts of. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. To determine compliance with the BSA. Services include transaction monitoring alert backlog.

Source: pinterest.com

Source: pinterest.com

To be compliant with BSA requirements banks should also monitor transactions for Non- Bank Financial Institution NBFI and Money Services Business MSB customers. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. Assess the adequacy of the banks systems to manage the risks associated with accounts of nonbank financial institutions NBFI and managements ability to implement. We provide highly trained AMLBSA professionals to assist banks and non-bank financial institutions to meet day-to-day compliance tasks. The principal elements of an AML compliance program are as follows.

Source: pinterest.com

Source: pinterest.com

Although the AML requirements in the BSA do not apply to companies other than financial institutions all companies operating in the US. The OCC uses informal and formal enforcement actions to. The BSA requires financial institutions to each develop an Anti Money Laundering AML program. Risks Associated with Money Laundering and Terrorist Financing. Although the AML requirements in the BSA do not apply to companies other than financial institutions all companies operating in the US.

Source: pinterest.com

Source: pinterest.com

The Bank Secrecy Act authorizes the Secretary of the Treasury to require financial institutions to keep records and file reports that have a high degree of usefulness in criminaltax or regulatory investigations or in the conduct of intelligence or counterintelligence activities relating to international terrorismThis has excluded non-bank RMLOs until recently. We provide highly trained AMLBSA professionals to assist banks and non-bank financial institutions to meet day-to-day compliance tasks. Review of agencys detailed written reports of deficiencies. The financial institutions are also required to report any suspicious activity that may show any signs of money laundering tax evasion etc. Assess the adequacy of the banks systems to manage the risks associated with accounts of.

Source: abrigo.com

The OCC conducts regular examinations of national banks federal savings associations federal branches and agencies of foreign banks in the US. The OCC uses informal and formal enforcement actions to. Identify areas where improvements are needed. The principal elements of an AML compliance program are as follows. Review BSAAML compliance programs relative to an institutions risk profile.

Source: pinterest.com

Source: pinterest.com

The joint statement sets forth the agencies policy on the circumstances in which an agency will issue a mandatory cease and desist order to address non-compliance with the BSA. We provide highly trained AMLBSA professionals to assist banks and non-bank financial institutions to meet day-to-day compliance tasks. An effective BSA-AML compliance program should suit the unique needs of the financial institution it serves including the risk profile it faces. BSA Office of Foreign Assets Control OFAC Enforcement. Assess the adequacy of the banks systems to manage the risks associated with accounts of nonbank financial institutions NBFI and managements ability to implement.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsaaml for non banking institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas