17++ Bsaaml know your customer information

Home » about money loundering Info » 17++ Bsaaml know your customer informationYour Bsaaml know your customer images are ready. Bsaaml know your customer are a topic that is being searched for and liked by netizens today. You can Get the Bsaaml know your customer files here. Find and Download all royalty-free photos.

If you’re looking for bsaaml know your customer images information connected with to the bsaaml know your customer topic, you have come to the ideal site. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that match your interests.

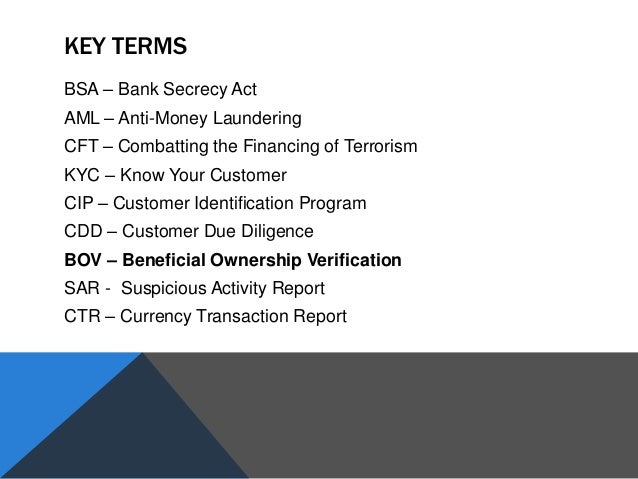

Bsaaml Know Your Customer. Leadership must actively support and understand compliance efforts 2. In addition existing laws and regulations may impose and supervisory guidance may explain expectations for specific customer due diligence and in some cases enhanced due diligence requirements for certain accounts or customers. Law requiring financial institutions in the United States to assist US. Efforts to manage and mitigate BSAAML deficiencies and risks must not be compromised by revenue interests 3.

Transforming Bsa Aml And Kyc With Process Intelligence Technologies Fortressiq From fortressiq.com

Transforming Bsa Aml And Kyc With Process Intelligence Technologies Fortressiq From fortressiq.com

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Effectively managing BSAAML risk for casino customers requires. Such a profile should include execution of enhanced due diligence EDD including review of a casino customers BSAAML program. Based on its BSAAML risk assessment a bank may require identifying information in addition to the required information for certain customers or product lines. Bankers are familiar with the notion of Know Your Customer KYC as it pertains to the world of customer due diligence. KYC is a crucial component of managing financial risk and it means that bankers must understand the companies and individuals with whom they are doing business.

Bankers are familiar with the notion of Know Your Customer KYC as it pertains to the world of customer due diligence.

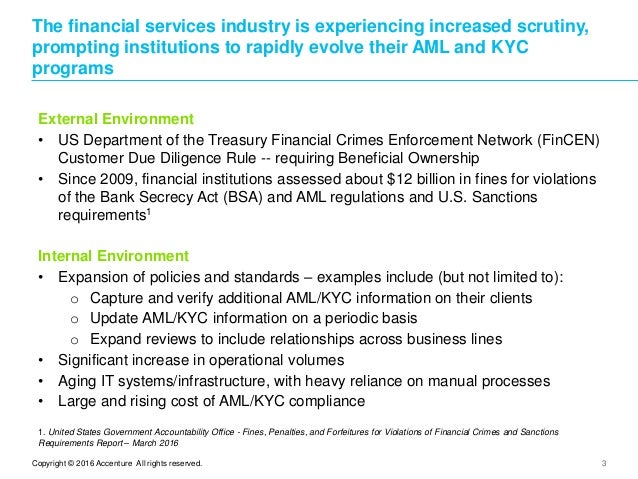

In addition existing laws and regulations may impose and supervisory guidance may explain expectations for specific customer due diligence and in some cases enhanced due diligence requirements for certain accounts or customers. Integral to this process is a strong know your customer program in which customer information is collected on an ongoing basis to maintain up-to-date information on activity and product utilization and the associated risks. This material will provide an overview of BSAAMLKnow Your Customer KYC components including the Customer Identification Program CIP and beneficial owner Customer Due Diligence CDD Rule. Know Your Customers Customer Identification Program CIP BSAAML Follow. A financial institution can strengthen its BSAAML compliance culture by following these six FinCEN critical aspects of a culture of compliance. The know your customer or know your client KYC guidelines in financial services require that professionals make an effort to verify the identity suitability and risks involved with maintaining a business relationship.

Source: docplayer.net

Source: docplayer.net

A financial institution can strengthen its BSAAML compliance culture by following these six FinCEN critical aspects of a culture of compliance. Know Your Customers Customer Identification Program CIP BSAAML Follow. A financial institution can strengthen its BSAAML compliance culture by following these six FinCEN critical aspects of a culture of compliance. In addition existing laws and regulations may impose and supervisory guidance may explain expectations for specific customer due diligence and in some cases enhanced due diligence requirements for certain accounts or customers. We will cover key definitions and procedural issues for compliance and highlight areas of risk for enhanced due diligence.

Source: fineksus.com

Source: fineksus.com

This material will provide an overview of BSAAMLKnow Your Customer KYC components including the Customer Identification Program CIP and beneficial owner Customer Due Diligence CDD Rule. While not inclusive certain customer types such as those found in the Persons and Entities section of the FFIEC BSAAML Examination Manual may pose heightened risk. In addition existing laws and regulations may impose and supervisory guidance may explain expectations for specific customer due diligence and in some cases enhanced due diligence requirements for certain accounts or customers. Leadership must actively support and understand compliance efforts 2. Law requiring financial institutions in the United States to assist US.

Source: slideserve.com

Source: slideserve.com

Know Your Customers Customer Identification Program CIP BSAAML Follow. Customer Identification Program CIP Phase. Leadership must actively support and understand compliance efforts 2. While not inclusive certain customer types such as those found in the Persons and Entities section of the FFIEC BSAAML Examination Manual may pose heightened risk. KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements.

Source: kyc-chain.com

Source: kyc-chain.com

This is part of what is known as the customer onboarding process. Know your risks It is imperative to understand the nature and purpose of the customer relationship in order to develop an accurate customer risk profile. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Efforts to manage and mitigate BSAAML deficiencies and risks must not be compromised by revenue interests 3. This material will provide an overview of BSAAMLKnow Your Customer KYC components including the Customer Identification Program CIP and beneficial owner Customer Due Diligence CDD Rule.

Source: acamstoday.org

Source: acamstoday.org

The know your customer or know your client KYC guidelines in financial services require that professionals make an effort to verify the identity suitability and risks involved with maintaining a business relationship. Determine whether the bank has defined in its policies procedures and processes how customer information including beneficial ownership information for legal entity customers is used to meet other relevant regulatory requirements including but not limited to identifying suspicious activity identifying nominal and beneficial owners of private banking accounts and determining OFAC sanctioned parties. In addition existing laws and regulations may impose and supervisory guidance may explain expectations for specific customer due diligence and in some cases enhanced due diligence requirements for certain accounts or customers. Many countries having strict Know Your Customer KYC laws that dont extend to shell corporations or similar entities. 18 FinCEN Federal Reserve FDIC NCUA OCC OTS Treasury April 28 2005 Interagency Interpretive Guidance on Customer Identification Program Requirements under Section 326 of the USA PATRIOT Act Definition of customer FAQs.

Source: acamstoday.org

Source: acamstoday.org

Such a profile should include execution of enhanced due diligence EDD including review of a casino customers BSAAML program. We will cover key definitions and procedural issues for compliance and highlight areas of risk for enhanced due diligence. AML Know Your Customer Rule The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Know Your Customers Customer Identification Program CIP BSAAML Follow.

Source: slideshare.net

Source: slideshare.net

However that is changing as the demand to close loopholes increases and countries start to regulate laws that fall under the heading Know Your Customers Customer KYCC. This material will provide an overview of BSAAMLKnow Your Customer KYC components including the Customer Identification Program CIP and beneficial owner Customer Due Diligence CDD Rule. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. There are fewer restrictions on shells. Bankers are familiar with the notion of Know Your Customer KYC as it pertains to the world of customer due diligence.

Source: slideshare.net

Source: slideshare.net

Efforts to manage and mitigate BSAAML deficiencies and risks must not be compromised by revenue interests 3. Knowing Your Customer KYC is the cornerstone of a strong BSAAML compliance program1 The purpose of KYC is to identify customers counterparties beneficial owners and others doing business with a financial institution who pose greater money laundering financial crime or terrorist financing risk. We will cover key definitions and procedural issues for compliance and highlight areas of risk for enhanced due diligence. KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements. It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client.

Source: shuftipro.com

Source: shuftipro.com

It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client. Effectively managing BSAAML risk for casino customers requires. 18 FinCEN Federal Reserve FDIC NCUA OCC OTS Treasury April 28 2005 Interagency Interpretive Guidance on Customer Identification Program Requirements under Section 326 of the USA PATRIOT Act Definition of customer FAQs. There are fewer restrictions on shells. Customer Identification Program CIP Phase.

Source: fortressiq.com

Source: fortressiq.com

Leadership must actively support and understand compliance efforts 2. For instance a schoolteacher would have a very different transaction record than say Mark Zuckerberg. Applying BSA Principles to Everyday Life Know Your Customer. The difficulty in BSA reporting comes not in the well-known parameters of the law but in the subjective gray areas like the Know Your Customer KYC expectations foisted upon compliance professionals. Such a profile should include execution of enhanced due diligence EDD including review of a casino customers BSAAML program.

Source: tookitaki.ai

Source: tookitaki.ai

Leadership must actively support and understand compliance efforts 2. KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements. However that is changing as the demand to close loopholes increases and countries start to regulate laws that fall under the heading Know Your Customers Customer KYCC. While not inclusive certain customer types such as those found in the Persons and Entities section of the FFIEC BSAAML Examination Manual may pose heightened risk. Bankers are familiar with the notion of Know Your Customer KYC as it pertains to the world of customer due diligence.

Source: fortressiq.com

Source: fortressiq.com

Integral to this process is a strong know your customer program in which customer information is collected on an ongoing basis to maintain up-to-date information on activity and product utilization and the associated risks. For instance a schoolteacher would have a very different transaction record than say Mark Zuckerberg. AML Know Your Customer Rule The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. Not only is this practice good for BSAAML compliance purposes it is. Know your risks It is imperative to understand the nature and purpose of the customer relationship in order to develop an accurate customer risk profile.

Source: issuu.com

Source: issuu.com

This is part of what is known as the customer onboarding process. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. KYC is a crucial component of managing financial risk and it means that bankers must understand the companies and individuals with whom they are doing business. AML Know Your Customer Rule The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. Know Your Customers Customer Identification Program CIP BSAAML Follow.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsaaml know your customer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas