17+ Bsaaml overview final assessment ideas

Home » about money loundering Info » 17+ Bsaaml overview final assessment ideasYour Bsaaml overview final assessment images are available. Bsaaml overview final assessment are a topic that is being searched for and liked by netizens today. You can Get the Bsaaml overview final assessment files here. Download all free photos.

If you’re searching for bsaaml overview final assessment pictures information connected with to the bsaaml overview final assessment interest, you have visit the ideal blog. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

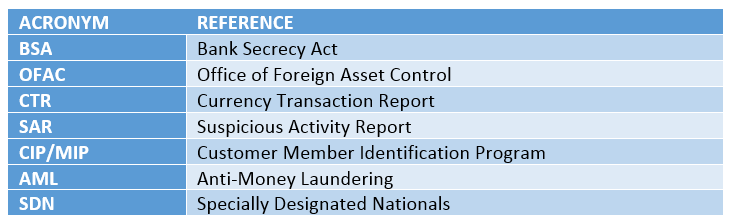

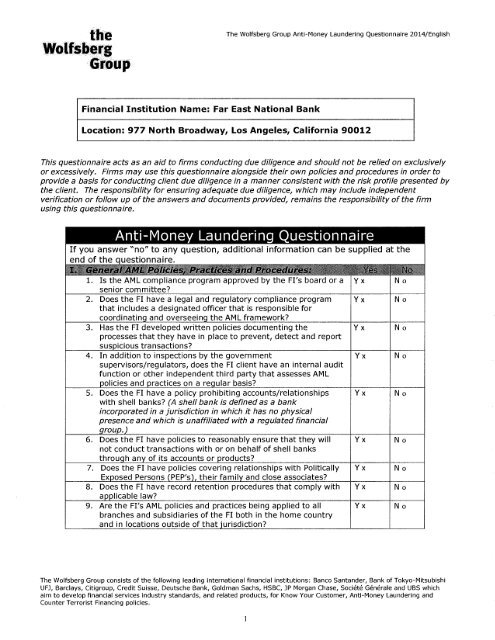

Bsaaml Overview Final Assessment. Does the BSAAML examination manual offer new guidance for Suspicious Activity Reports. Create a paper trail to help investigators. CIP Basics Final Assessment. Assess the banks compliance with the regulatory requirements for customer due diligence CDD.

Bsa Examination Manual Updated Nafcu From nafcu.org

Domestic higher-risk geographic locations include HIDTA areas. The final result is a risk-based BSAAML compliance program. We have BSA training during staff meeting and then hand out the test the next week. BSA was designed to. Documenting the BSAAML risk assessment in writing is a sound practice to effectively communicate MLTF and other illicit financial activity risks to appropriate bank personnel. BSA Test with Answer Sheet.

The banking organizations risk assessment.

The Bank Secrecy Act and related federal and state law requirements SAAML are a crucial component of bank operations. The cornerstone of a strong BSAAML compliance program is the adoption and implementation of risk-based CDD policies. Create a paper trail to help investigators. The bank may demonstrate its understanding of the customer. Customer Information Risk-Based Procedures As described above the bank is required to form an understanding of the nature and purpose of the customer relationship. Assess the banks compliance with the regulatory requirements for customer due diligence CDD.

Source: nafcu.org

Which option lists two required activities that must be included in a financial institutions Bank Secrecy Act BSA compliance program. As the first line of defense for financial crimes banks play an important role in minimizing fraud money. Persons including banks who transport currency or monetary instruments in excess of 10000 into or out of the United States must file one. An essential component of a banks BSAAML risk management is steps to identify geographic locations that may pose a higher risk for money laundering and other illegal activity. Developing Conclusions and Finalizing the Examination.

Source: pinterest.com

Source: pinterest.com

An effective risk-based independent testing program will cover all of a banks BSAAML-. The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of. Anti-Money Laundering Specialists ACAMS Methodology. Documenting the BSAAML risk assessment in writing is a sound practice to effectively communicate MLTF and other illicit financial activity risks to appropriate bank personnel. As the first line of defense for financial crimes banks play an important role in minimizing fraud money.

Source: slideserve.com

Source: slideserve.com

The BSAAML risk assessment should be provided to all business lines across the bank the board of directors management and appropriate staff. Customer Due Diligence Overview. Domestic higher-risk geographic locations include HIDTA areas. The BSAAML risk assessment should be provided to all business lines across the bank the board of directors management and appropriate staff. The bank may demonstrate its understanding of the customer.

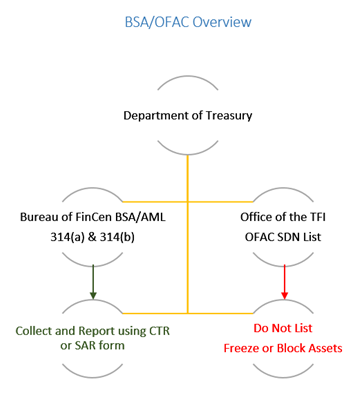

While OFAC regulations are not part of the BSA the core sections include overview and examination procedures for examining a banks policies procedures and processes for ensuring compliance with OFAC sanctions. Assessing the BSAAML Compliance Program and address areas such as scoping and planning and the BSAAML risk assessment and compliance program. Customer Due Diligence Overview. Developing Conclusions and Finalizing the Examination. If the organization has not developed a risk assessment or if it is considered inadequate then the examiner must complete a risk assessment.

Source: complianceonline.com

Source: complianceonline.com

From those findings examiners should develop and document conclusions about the adequacy of the banks BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. The Bank Secrecy Act and related federal and state law requirements SAAML are a crucial component of bank operations. The banking organizations risk assessment. Learn vocabulary terms and more with flashcards games and other study tools. The bank may demonstrate its understanding of the customer.

Source: abrigo.com

BSA Test with Answer Sheet. From February 25 - March 12 2013 LexisNexis and ACAMS conducted a joint research study to examine how the Anti-Money Laundering community is managing their Customer Enhanced Due Diligence and AML Risk Assessment processes. Linked and is a product of a BSAAML risk assessment. Learn vocabulary terms and more with flashcards games and other study tools. Person at a Company USA This is a 20 question test regarding BSA.

Which option lists two required activities that must be included in a financial institutions Bank Secrecy Act BSA compliance program. Create a paper trail to help investigators. The cornerstone of a strong BSAAML compliance program is the adoption and implementation of risk-based CDD policies. The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of. BSA was designed to.

Source: present5.com

Source: present5.com

The BSAAML risk assessment should be provided to all business lines across the bank the board of directors management and appropriate staff. An essential component of a banks BSAAML risk management is steps to identify geographic locations that may pose a higher risk for money laundering and other illegal activity. Start studying BSAAML Assessment. CIP Basics Final Assessment. Domestic higher-risk geographic locations include HIDTA areas.

Source: infosightinc.com

Source: infosightinc.com

Regulatory Requirements and Related Topics which include the customer Identification program customer due diligence suspicious activity reporting funds transfers recordkeeping foreign correspondent accounts OFAC and other topics. The results of a risk assessment should have a direct impact on the level of policies and procedures required to maintain compliance. Create a paper trail to help investigators. In the final phase of the BSAAML examination examiners should assemble all findings from the examination and testing procedures completed. Linked and is a product of a BSAAML risk assessment.

Source: capitalcomplianceexperts.com

Source: capitalcomplianceexperts.com

Regulatory Requirements and Related Topics which include the customer Identification program customer due diligence suspicious activity reporting funds transfers recordkeeping foreign correspondent accounts OFAC and other topics. Assessing Compliance with BSA Regulatory Requirements. Persons including banks who transport currency or monetary instruments in excess of 10000 into or out of the United States must file one. Which fundamental component is required of a banks Bank Secrecy Act BSA program to help prevent financial crime. Create a paper trail to help investigators.

Source: yumpu.com

Source: yumpu.com

The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of. Persons including banks who transport currency or monetary instruments in excess of 10000 into or out of the United States must file one. USA PATRIOT Act Final Assessment. The final result is a risk-based BSAAML compliance program. Customer Due Diligence Overview.

Source: yumpu.com

Source: yumpu.com

If the organization has not developed a risk assessment or if it is considered inadequate then the examiner must complete a risk assessment. The cornerstone of a strong BSAAML compliance program is the adoption and implementation of risk-based CDD policies. CIP Basics Final Assessment. The online survey was emailed to the entire ACAMS database. USA PATRIOT Act Final Assessment.

Source: slideshare.net

Source: slideshare.net

High Intensity Drug Trafficking Areas. The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of. Customer Information Risk-Based Procedures As described above the bank is required to form an understanding of the nature and purpose of the customer relationship. Start studying BSAAML Assessment. Person at a Company USA This is a 20 question test regarding BSA.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsaaml overview final assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas