12+ Bsaaml self assessment tool information

Home » about money loundering idea » 12+ Bsaaml self assessment tool informationYour Bsaaml self assessment tool images are ready. Bsaaml self assessment tool are a topic that is being searched for and liked by netizens today. You can Find and Download the Bsaaml self assessment tool files here. Find and Download all royalty-free photos and vectors.

If you’re looking for bsaaml self assessment tool images information related to the bsaaml self assessment tool keyword, you have visit the right site. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

Bsaaml Self Assessment Tool. The BSAAML Self-Assessment Tool is a spreadsheet intended to reduce uncertainty surrounding BSAAML compliance and support more transparency within the financial sector. The tool considers five 5 main categories to arrive at an aggregate risk score for your business. First the Tool identifies risk in three categories. 1 Products.

Keeps Your Financial Institution S Bsa Aml Compliance Program Effective Up To Date With Our Bsa Aml Complian Smart Goals Risk Management Debt Management Plan From pinterest.com

Keeps Your Financial Institution S Bsa Aml Compliance Program Effective Up To Date With Our Bsa Aml Complian Smart Goals Risk Management Debt Management Plan From pinterest.com

The Conference of State Bank Supervisors CSBS recently announced a new voluntary tool to help depository and non-depository financial institutions better manage Bank Secrecy ActAnti-Money Laundering BSAAML risk. The Conference of State Bank Supervisors CSBS has continued its efforts to promote improvements in Bank Secrecy ActAnti-Money Laundering compliance with the release in January 2017 of a new BSAAML Self-Assessment Tool for banks. In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. The CSBS and a group of state BSAAML subject-matter experts developed the BSAAML Self-Assessment Tool to be used at the discretion of a financial institution to help in the BSAAML risk assessment process. According to the CSBS the tool known as the BSAAML Self-Assessment Tool is intended to improve the ability of institutions to identify monitor and communicate BSAAML risk. In the development of the Assessment Tool state regulators worked to balance standardization and flexibility.

This tool was developed by the CSBS and included the.

The tool is designed to help financial institutions self-evaluate for BSAAML risk and reduce the regulatory burden of BSAAML requirements. The BSAAML Self-Assessment Tool is a spreadsheet intended to reduce uncertainty surrounding BSAAML compliance and support more transparency within the financial sector. TDOB BSAAML Self Assessment Tool. Our BSAAML tools include policies procedures checklists risk assessments monitoring and auditing worksheets training tools and much more. BSAAML Self-Assessment Tool Assessment Tool for the banking industry. The tool is not intended to replace any other aspect of a financial institutions BSAAML program.

Source:

In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. AVP at a bank 302M USA Has anyone attempted to complete this assessment. Select this function to access a comprehensive BSAAML program beginning with CIP the filing of CTRs and SARs through to the monitoring and auditing of the program. BSAAML Self-Assessment Tool Assessment Tool for the banking industry. Accordingly the BSAAML Self-Assessment Tool is designed to be flexible.

Source:

BSAAML requirements are the first line of defense against financial crimes and financial institutions play a major role in minimizing these risks said Texas Banking Commissioner and CSBS Chairman Charles Cooper. The BSAAML Self-Assessment Tool is a spreadsheet intended to reduce uncertainty surrounding BSAAML compliance and support more transparency within the financial sector. The CSBS and a group of state BSAAML subject-matter experts developed the BSAAML Self-Assessment Tool to be used at the discretion of a financial institution to help in the BSAAML risk assessment process. First the Tool identifies risk in three categories. According to the CSBS the tool known as the BSAAML Self-Assessment Tool is intended to improve the ability of institutions to identify monitor and communicate BSAAML risk.

Source: m.bankingexchange.com

Source: m.bankingexchange.com

The tool is not intended to replace any other aspect of a financial institutions BSAAML program. 2 Customers. Select this function to access a comprehensive BSAAML program beginning with CIP the filing of CTRs and SARs through to the monitoring and auditing of the program. AVP at a bank 302M USA Has anyone attempted to complete this assessment. On February 1 the Conference of State Bank Supervisors CSBS announced the release of its BSAAML Self-Assessment Toola new voluntary tool to help banks and non-depository financial institutions better manage Bank Secrecy ActAnti-Money Laundering BSAAML risk.

Source: abrigo.com

We have most of it completed but I would be interested in seeing what others are putting on there for what constitutes the Low Moderate High risks. Risk Assessment Free secure risk analysis tool for banks and credit unions. TDOB BSAAML Self Assessment Tool. The tool comes with. In the development of the Assessment Tool state regulators worked to balance standardization and flexibility.

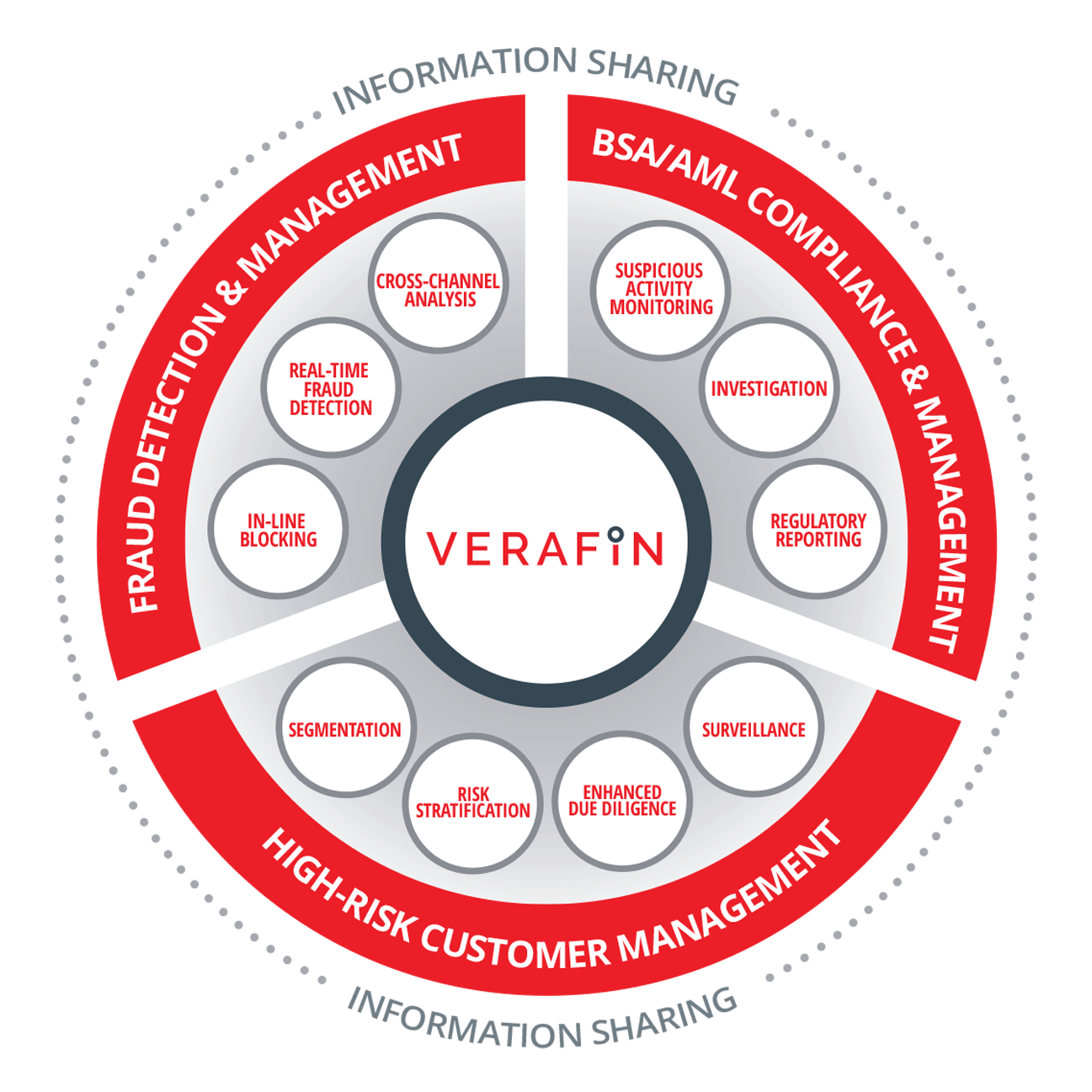

Source: verafin.com

Source: verafin.com

The BSAAML Self-Assessment Tool is a spreadsheet intended to reduce uncertainty surrounding BSAAML compliance and support more transparency within the financial sector. One of the goals in releasing the tool is to promote a more consistent framework for assessing and communicating BSAAML risk. Institutions are free to adjust the formulas rating values and other variables to more appropriately reflect risks and the assessments thereof. State regulators and the Conference of State Bank Supervisors CSBS have released a new voluntary self-assessment tool to help banks better manage Bank Secrecy Act and anti-money laundering risk. Banking State Issues Bank Secrecy Act CSBS Anti-Money Laundering.

Source:

This BSAAML Self-Assessment Tool Assessment Tool is voluntary and may be used at your institutions discretion. In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. BSAAML requirements are the first line of defense against financial crimes and financial institutions play a major role in minimizing these risks said Texas Banking Commissioner and CSBS Chairman Charles Cooper. 2 Customers. The following instructions explain how the Tool was designed for use but institutions should not hesitate to customize the Tool.

Source:

The tool is not intended to replace any other aspect of a financial institutions BSAAML program. Our BSAAML tools include policies procedures checklists risk assessments monitoring and auditing worksheets training tools and much more. BSAAML Self-Assessment Tool Assessment Tool for the banking industry. Mortgage Settlement Services Integrated mortgage settlement services software and provider marketplace. The tool is not intended to replace any other aspect of a financial institutions BSAAML program.

Source: slidetodoc.com

Source: slidetodoc.com

According to the CSBS the tool known as the BSAAML Self-Assessment Tool is intended to improve the ability of institutions to identify monitor and communicate BSAAML risk. Accordingly this Assessment Tool is intended to help each institution have a consistent framework for assessing and communicating internally about their. BSAAML Self-Assessment Tool Assessment Tool for the banking industry. This tool was developed by the CSBS and included the. The tool is meant to help institutions better identify monitor and communicate BSAAML risk reduce uncertainty surrounding BSAAML compliance and foster greater transparency within the.

Source: slideserve.com

Source: slideserve.com

In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. And 3 Geographic Locations. AVP at a bank 302M USA Has anyone attempted to complete this assessment. TDOB BSAAML Self Assessment Tool. According to the CSBS the tool known as the BSAAML Self-Assessment Tool is intended to improve the ability of institutions to identify monitor and communicate BSAAML risk.

Source: yumpu.com

Source: yumpu.com

The Conference of State Bank Supervisors CSBS has continued its efforts to promote improvements in Bank Secrecy ActAnti-Money Laundering compliance with the release in January 2017 of a new BSAAML Self-Assessment Tool for banks. According to the CSBS the tool known as the BSAAML Self-Assessment Tool is intended to improve the ability of institutions to identify monitor and communicate BSAAML risk. The tool considers five 5 main categories to arrive at an aggregate risk score for your business. In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. One of the goals in releasing the tool is to promote a more consistent framework for assessing and communicating BSAAML risk.

Source: pinterest.com

Source: pinterest.com

Select this function to access a comprehensive BSAAML program beginning with CIP the filing of CTRs and SARs through to the monitoring and auditing of the program. The tool comes with. Select this function to access a comprehensive BSAAML program beginning with CIP the filing of CTRs and SARs through to the monitoring and auditing of the program. The Self-Assessment Tool is a spreadsheet in Microsoft Excel format which has pre-populated categories that mirror those used in the FFIEC BSA-AML Examination Manual. KYC2020 AML Risk Assessment Tool benefits heavily from the Federal Financial Institutions Examination Councils FFIEC Risk Assessment guidelines as well as the Conference of State Bank Supervisors CSBS BSAAML Self Assessment tool.

Source: pinterest.com

Source: pinterest.com

The optional tool is intended to help state-chartered banks enhance their risk assessment process. Banking State Issues Bank Secrecy Act CSBS Anti-Money Laundering. BSAAML Self-Assessment Tool Assessment Tool for the banking industry. Our BSAAML tools include policies procedures checklists risk assessments monitoring and auditing worksheets training tools and much more. TDOB BSAAML Self Assessment Tool.

Source: pinterest.com

Source: pinterest.com

In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. In the development of the Assessment Tool state regulators worked to balance standardization and flexibility. The tool considers five 5 main categories to arrive at an aggregate risk score for your business. The Conference of State Bank Supervisors CSBS recently announced a new voluntary tool to help depository and non-depository financial institutions better manage Bank Secrecy ActAnti-Money Laundering BSAAML risk. The tool is not intended to replace any other aspect of a financial institutions BSAAML program.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsaaml self assessment tool by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information