20++ Bsaaml transaction monitoring process ideas in 2021

Home » about money loundering Info » 20++ Bsaaml transaction monitoring process ideas in 2021Your Bsaaml transaction monitoring process images are available. Bsaaml transaction monitoring process are a topic that is being searched for and liked by netizens today. You can Download the Bsaaml transaction monitoring process files here. Find and Download all royalty-free photos and vectors.

If you’re searching for bsaaml transaction monitoring process images information linked to the bsaaml transaction monitoring process interest, you have pay a visit to the right blog. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Bsaaml Transaction Monitoring Process. Smaller financial institutions often think they can manually handle the daily transaction monitoring required by the Bank Secrecy Act BSA but the truth is those institutions are bigger targets for financial crime. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Sensors and analyzers that reduce maintenance efforts and improve process control. The investigation process has significant operational implications from a risk and cost perspective.

Anti Money Laundering Transaction Monitoring System Implementation Considerations Acams Today From acamstoday.org

Anti Money Laundering Transaction Monitoring System Implementation Considerations Acams Today From acamstoday.org

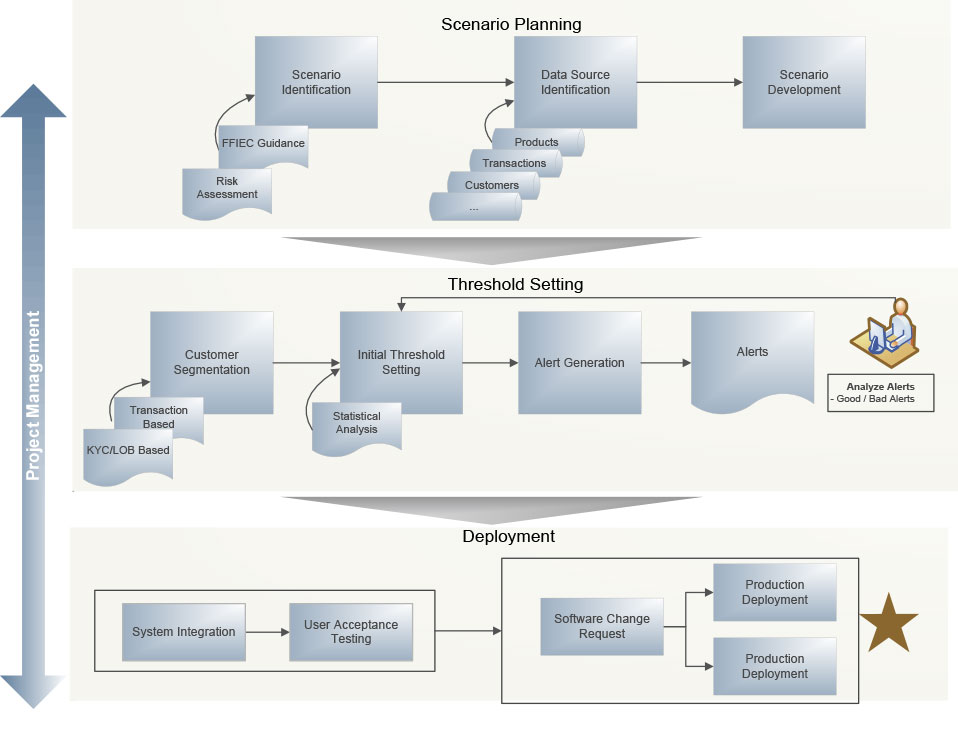

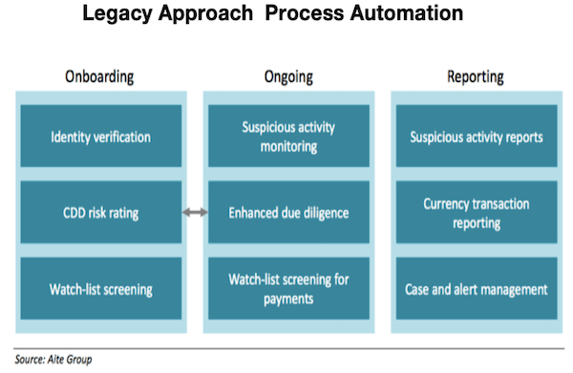

Innovation has the potential to augment aspects of banks BSAAML compliance programs such as risk identification transaction monitoring and suspicious activity reporting. Recent mergers acquisitions or other significant organizational changes. For example resubmitting a transaction under a different name or for slightly modified dollar amounts can be an attempt to circumvent these limitations and are violations of. Monitoring transactions for anti-money laundering purposes has been a mainstay of financial services organisations for a long time. The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Typically implemented through a TMS identification of cases is automated for further investigation.

Stay BSA and AML compliant without extra burden.

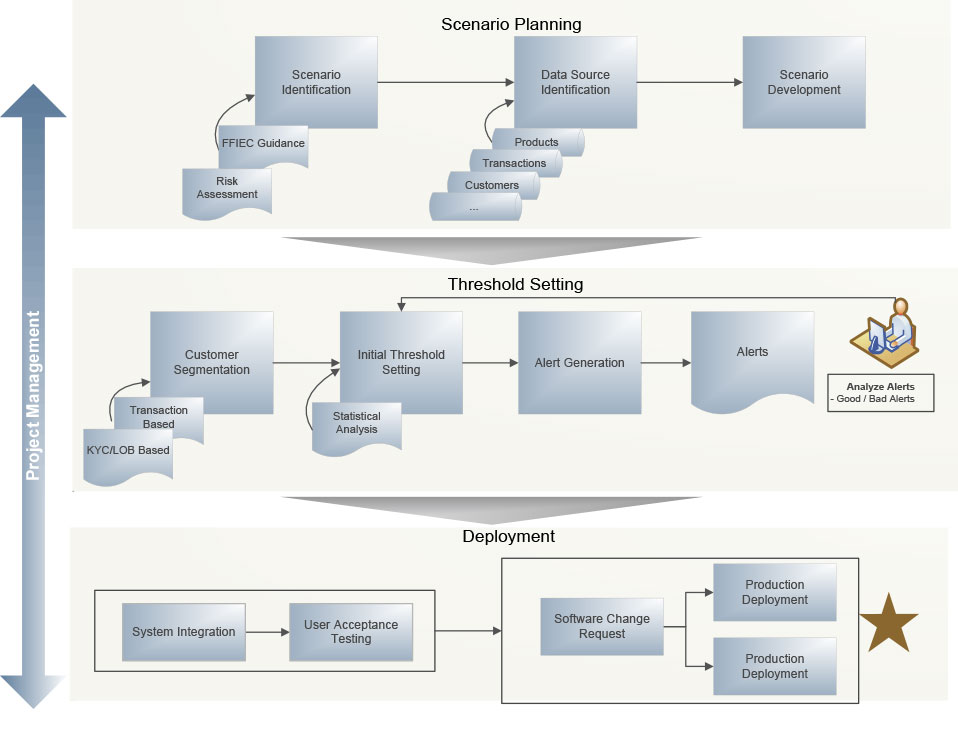

Transaction monitoring processes involve analyzing transactional data and identifying suspicious activities that are potential indicators of money laundering or terrorist financing activity. Ad Automated tools to reduce chargeback rates and boost business profits in record time. The investigation process has significant operational implications from a risk and cost perspective. Recent mergers acquisitions or other significant organizational changes. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Alacer analyzed manual detection sources and mapped them to known AML risk typologies and historical Case and SAR rates in order to build the case with data for scenario retirement and revisions.

Source: acamstoday.org

Source: acamstoday.org

Banks should establish policies procedures and processes for identifying subjects of law enforcement requests monitoring the transaction activity of those subjects when appropriate identifying unusual or potentially suspicious activity related to those subjects and filing as. Transaction monitoring processes involve analyzing transactional data and identifying suspicious activities that are potential indicators of money laundering or terrorist financing activity. Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports. The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Innovation has the potential to augment aspects of banks BSAAML compliance programs such as risk identification transaction monitoring and suspicious activity reporting.

![]() Source: adiconsulting.com

Source: adiconsulting.com

In fact it states. Typically implemented through a TMS identification of cases is automated for further investigation. Alacer analyzed manual detection sources and mapped them to known AML risk typologies and historical Case and SAR rates in order to build the case with data for scenario retirement and revisions. A tool on the other hand provides outputs which do not qualify as quantitative estimates. Monitoring transactions for anti-money laundering purposes has been a mainstay of financial services organisations for a long time.

Source: acamstoday.org

Source: acamstoday.org

Typically implemented through a TMS identification of cases is automated for further investigation. Transactions should be monitored for patterns that may be indicative of attempts to evade NACHA limitations on returned entries. Stay BSA and AML compliant without extra burden. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Ad Sensors for DO pHORP conductivity turbidity CO2 TOC microbial detection and more.

![]() Source: adiconsulting.com

Source: adiconsulting.com

Innovation has the potential to augment aspects of banks BSAAML compliance programs such as risk identification transaction monitoring and suspicious activity reporting. Relying on a manual BSAAML solution and missing suspicious activity. In fact it states. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering. Some banks are becoming increasingly sophisticated in their approaches to identifying suspicious activity.

Source: calameo.com

Source: calameo.com

The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Quality and extent of review by audit or independent parties. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Sensors and analyzers that reduce maintenance efforts and improve process control.

Source: acamstoday.org

Source: acamstoday.org

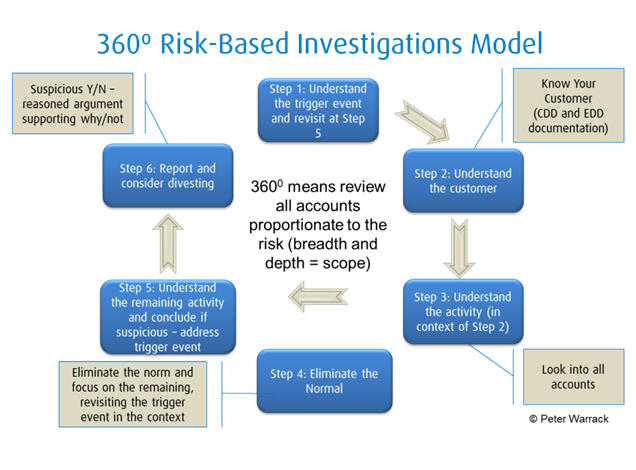

Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports. Sensors and analyzers that reduce maintenance efforts and improve process control. TRANSACTION MONITORING PROGRAM 5043a BSAAML RISK ASSESSMENTS 5043a 1-3 The Federal Financial Institutions Examination Council FFIEC BSAAML Examination Manual does not state that an institution is required to have a BSAAML risk assessment. Innovation has the potential to augment aspects of banks BSAAML compliance programs such as risk identification transaction monitoring and suspicious activity reporting. Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports.

Source: finextra.com

Source: finextra.com

Automatically boost transaction rates without increasing chargebacks or friendly fraud. Some banks are becoming increasingly sophisticated in their approaches to identifying suspicious activity. TRANSACTION MONITORING PROGRAM 5043a BSAAML RISK ASSESSMENTS 5043a 1-3 The Federal Financial Institutions Examination Council FFIEC BSAAML Examination Manual does not state that an institution is required to have a BSAAML risk assessment. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Relying on a manual BSAAML solution and missing suspicious activity.

Source: e-elgar.com

Source: e-elgar.com

Automatically boost transaction rates without increasing chargebacks or friendly fraud. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Typically implemented through a TMS identification of cases is automated for further investigation. The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by.

Source: youtube.com

Source: youtube.com

To simplify this applies to a BSA departments transaction monitoring system customer risk rating system sanctions and watchlist scanning currency transaction reporting systems and the institutions CECL automation because they use quantitative data to produce outcomes. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Innovation has the potential to augment aspects of banks BSAAML compliance programs such as risk identification transaction monitoring and suspicious activity reporting. Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports. The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies.

Automatically boost transaction rates without increasing chargebacks or friendly fraud. Relying on a manual BSAAML solution and missing suspicious activity. After a customer is approved Transaction Monitoring takes over to continuously review their financial activity flagging risky behaviors for review. Recent mergers acquisitions or other significant organizational changes. Stay BSA and AML compliant without extra burden.

Source: abrigo.com

After a customer is approved Transaction Monitoring takes over to continuously review their financial activity flagging risky behaviors for review. Stay BSA and AML compliant without extra burden. Ad Sensors for DO pHORP conductivity turbidity CO2 TOC microbial detection and more. Alacer analyzed manual detection sources and mapped them to known AML risk typologies and historical Case and SAR rates in order to build the case with data for scenario retirement and revisions. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by.

Source: pinterest.com

Source: pinterest.com

The investigation process has significant operational implications from a risk and cost perspective. Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Stay BSA and AML compliant without extra burden.

Source: qa.nonprod.trulioo.com

Source: qa.nonprod.trulioo.com

Ad Automated tools to reduce chargeback rates and boost business profits in record time. Smaller financial institutions often think they can manually handle the daily transaction monitoring required by the Bank Secrecy Act BSA but the truth is those institutions are bigger targets for financial crime. According to ACAMS the following reports from core banking systems or transaction monitoring systems are potential sources to identify suspicious transactions. The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Some banks are becoming increasingly sophisticated in their approaches to identifying suspicious activity.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsaaml transaction monitoring process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas