16++ Central bank of ireland 4th aml directive information

Home » about money loundering idea » 16++ Central bank of ireland 4th aml directive informationYour Central bank of ireland 4th aml directive images are available in this site. Central bank of ireland 4th aml directive are a topic that is being searched for and liked by netizens now. You can Find and Download the Central bank of ireland 4th aml directive files here. Get all free photos and vectors.

If you’re searching for central bank of ireland 4th aml directive images information linked to the central bank of ireland 4th aml directive keyword, you have visit the right site. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

Central Bank Of Ireland 4th Aml Directive. Regulations amending the primary anti-money laundering and countering the financing of terrorism AMLCFT legislation in Ireland were published on 25 November 2019The European Union Money Laundering and Terrorist Financing Regulations 2019 the Regulations have been introduced to give further effect in Ireland to the 4th EU Money Laundering Directive. This follows the initial publication of these guidelines which issued in September 2019. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. Anti-Money Laundering and Countering the Financing of Terrorism.

Brokers Ireland Anti Money Laundering Presentation Ppt Download From slideplayer.com

Brokers Ireland Anti Money Laundering Presentation Ppt Download From slideplayer.com

Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. Application of certain Acts. Central Bank of Ireland Eurosystem revised FATF recommendations published in February 2012 European Commissions review of the implementation of the Third Anti-Money Laundering Directive 200560EC and preparation for a fourth Directive Heads of a Criminal Justice Money Laundering and Terrorist Financing Amendment Bill published in June 2012. In June this year the Central Bank of Ireland CBI issued an updated revision of their guidelines on Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT for the financial sector. Subsequently in December 2018 the Central Bank issued Consultation Paper 128 CP 128 setting out its draft AMLCFT Guidelines for financial institutions the Draft Guidelines. It is important that a country is seen as having robust AML regulatory framework with financial firms effectively implementing AML systems and controls as it dissuades criminals from targeting that financial system.

Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018.

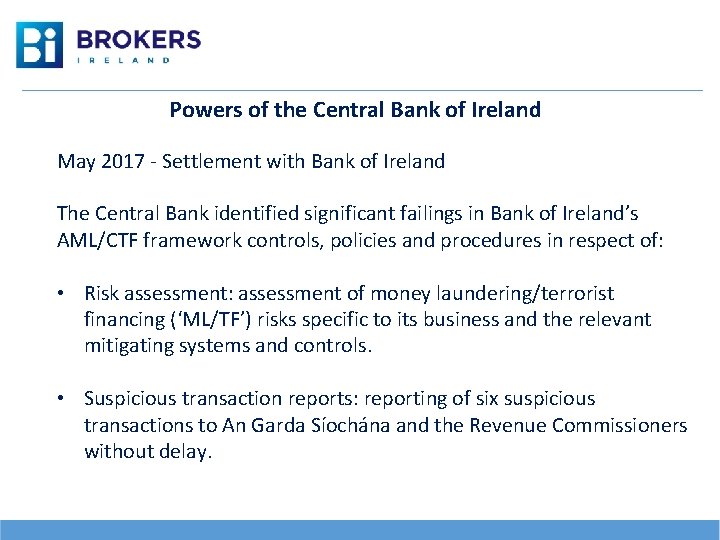

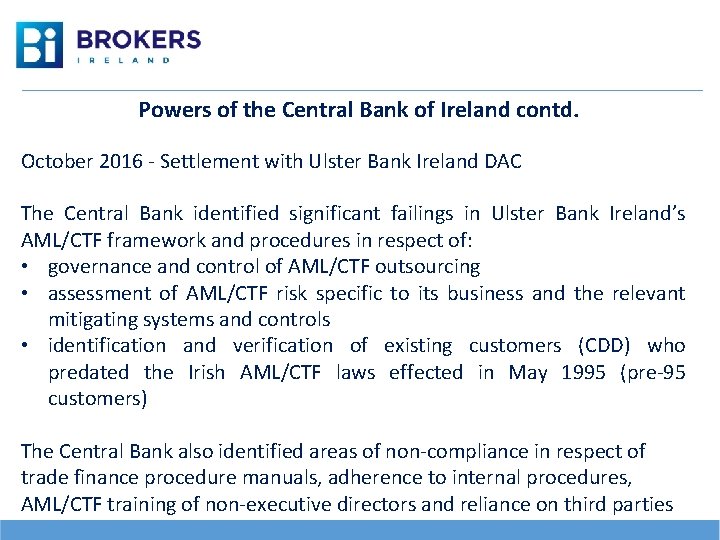

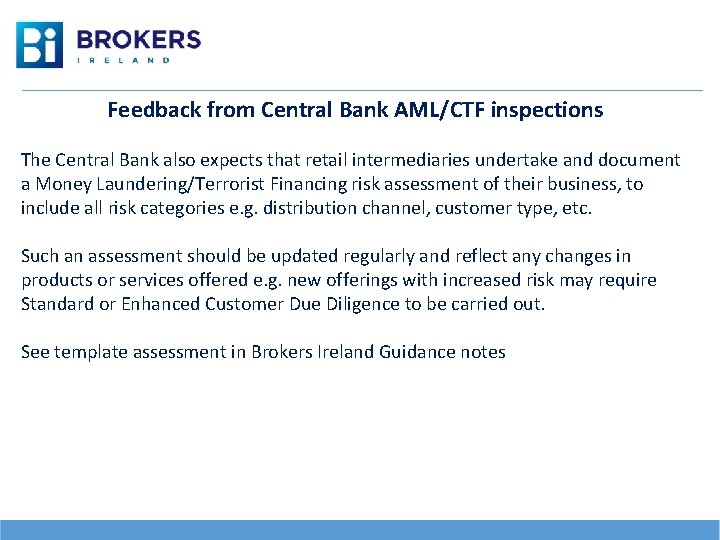

Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. This follows the initial publication of these guidelines which issued in September 2019. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. Regulations amending the primary anti-money laundering and countering the financing of terrorism AMLCFT legislation in Ireland were published on 25 November 2019The European Union Money Laundering and Terrorist Financing Regulations 2019 the Regulations have been introduced to give further effect in Ireland to the 4th EU Money Laundering Directive. The Central Bank is empowered to perform certain of its powers under Central Bank legislation for the purposes of ensuring compliance with the Fourth Money Laundering Directive 5AMLD and the FATF Recommendations.

Source:

Source:

Central Bank of Ireland Eurosystem revised FATF recommendations published in February 2012 European Commissions review of the implementation of the Third Anti-Money Laundering Directive 200560EC and preparation for a fourth Directive Heads of a Criminal Justice Money Laundering and Terrorist Financing Amendment Bill published in June 2012. The purpose of these guidelines is to provide assistance to all Credit and Financial. The purpose of the guidelines we are launching this morning is to help firms to understand their obligations under the Criminal Justice Money Laundering and Terrorist Financing Act 2010 which was updated last year when the Fourth EU Anti-Money Laundering Directive. Regulations amending the primary anti-money laundering and countering the financing of terrorism AMLCFT legislation in Ireland were published on 25 November 2019The European Union Money Laundering and Terrorist Financing Regulations 2019 the Regulations have been introduced to give further effect in Ireland to the 4th EU Money Laundering Directive. Anti-Money Laundering and Countering the Financing of Terrorism.

Source: slidetodoc.com

Source: slidetodoc.com

Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. Application of certain Acts. It is important that a country is seen as having robust AML regulatory framework with financial firms effectively implementing AML systems and controls as it dissuades criminals from targeting that financial system.

Source: slidetodoc.com

Source: slidetodoc.com

Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. The Central Bank is empowered to perform certain of its powers under Central Bank legislation for the purposes of ensuring compliance with the Fourth Money Laundering Directive 5AMLD and the FATF Recommendations. In June this year the Central Bank of Ireland CBI issued an updated revision of their guidelines on Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT for the financial sector. Application of certain Acts. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland.

Source: slidetodoc.com

Source: slidetodoc.com

In June this year the Central Bank of Ireland CBI issued an updated revision of their guidelines on Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT for the financial sector. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. Regulations amending the primary anti-money laundering and countering the financing of terrorism AMLCFT legislation in Ireland were published on 25 November 2019The European Union Money Laundering and Terrorist Financing Regulations 2019 the Regulations have been introduced to give further effect in Ireland to the 4th EU Money Laundering Directive. Application of certain Acts.

Source: slideplayer.com

Source: slideplayer.com

Regulations amending the primary anti-money laundering and countering the financing of terrorism AMLCFT legislation in Ireland were published on 25 November 2019The European Union Money Laundering and Terrorist Financing Regulations 2019 the Regulations have been introduced to give further effect in Ireland to the 4th EU Money Laundering Directive. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. In June this year the Central Bank of Ireland CBI issued an updated revision of their guidelines on Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT for the financial sector. Application of certain Acts.

Source:

Central Bank of Ireland Eurosystem revised FATF recommendations published in February 2012 European Commissions review of the implementation of the Third Anti-Money Laundering Directive 200560EC and preparation for a fourth Directive Heads of a Criminal Justice Money Laundering and Terrorist Financing Amendment Bill published in June 2012. Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland.

Source: kbassociates.ie

Source: kbassociates.ie

The purpose of these guidelines is to provide assistance to all Credit and Financial. Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. It is important that a country is seen as having robust AML regulatory framework with financial firms effectively implementing AML systems and controls as it dissuades criminals from targeting that financial system. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland.

Source: slideshare.net

Source: slideshare.net

Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland. It is important that a country is seen as having robust AML regulatory framework with financial firms effectively implementing AML systems and controls as it dissuades criminals from targeting that financial system. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. Subsequently in December 2018 the Central Bank issued Consultation Paper 128 CP 128 setting out its draft AMLCFT Guidelines for financial institutions the Draft Guidelines.

Source: slideplayer.com

Source: slideplayer.com

Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. The purpose of the guidelines we are launching this morning is to help firms to understand their obligations under the Criminal Justice Money Laundering and Terrorist Financing Act 2010 which was updated last year when the Fourth EU Anti-Money Laundering Directive. Anti-Money Laundering and Countering the Financing of Terrorism. Application of certain Acts. 4th Anti-Money Laundering Directive 4AMLD Directive 2015849 The 4AMLD and the associated Funds Transfer Regulation FTR were agreed in 2015 at EU level.

Source: slideplayer.com

Source: slideplayer.com

Anti-Money Laundering and Countering the Financing of Terrorism. 4th Anti-Money Laundering Directive 4AMLD Directive 2015849 The 4AMLD and the associated Funds Transfer Regulation FTR were agreed in 2015 at EU level. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland. This follows the initial publication of these guidelines which issued in September 2019. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018.

Source: slidetodoc.com

Source: slidetodoc.com

Central Bank of Ireland Eurosystem revised FATF recommendations published in February 2012 European Commissions review of the implementation of the Third Anti-Money Laundering Directive 200560EC and preparation for a fourth Directive Heads of a Criminal Justice Money Laundering and Terrorist Financing Amendment Bill published in June 2012. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland. The Central Bank is empowered to perform certain of its powers under Central Bank legislation for the purposes of ensuring compliance with the Fourth Money Laundering Directive 5AMLD and the FATF Recommendations. Application of certain Acts. Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system.

Source:

Subsequently in December 2018 the Central Bank issued Consultation Paper 128 CP 128 setting out its draft AMLCFT Guidelines for financial institutions the Draft Guidelines. Subsequently in December 2018 the Central Bank issued Consultation Paper 128 CP 128 setting out its draft AMLCFT Guidelines for financial institutions the Draft Guidelines. It is important that a country is seen as having robust AML regulatory framework with financial firms effectively implementing AML systems and controls as it dissuades criminals from targeting that financial system. Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. The purpose of the guidelines we are launching this morning is to help firms to understand their obligations under the Criminal Justice Money Laundering and Terrorist Financing Act 2010 which was updated last year when the Fourth EU Anti-Money Laundering Directive.

Source: archive.comsuregroup.com

Source: archive.comsuregroup.com

Subsequently in December 2018 the Central Bank issued Consultation Paper 128 CP 128 setting out its draft AMLCFT Guidelines for financial institutions the Draft Guidelines. Weak Anti Money Laundering AML and Countering the Financial of Terrorism CFT controls will also have reputational consequences for a countrys financial system. The negotiations were led by the Department of Finance in consultation with other relevant departments agencies and. Ireland amended the Act to transpose the EUs Fourth Money Laundering Directive 2015849 MLD4 into Irish law in November 2018. Regulations amending the primary anti-money laundering and countering the financing of terrorism AMLCFT legislation in Ireland were published on 25 November 2019The European Union Money Laundering and Terrorist Financing Regulations 2019 the Regulations have been introduced to give further effect in Ireland to the 4th EU Money Laundering Directive.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title central bank of ireland 4th aml directive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information