15+ Characteristics of an insurance companys anti money laundering program ideas in 2021

Home » about money loundering idea » 15+ Characteristics of an insurance companys anti money laundering program ideas in 2021Your Characteristics of an insurance companys anti money laundering program images are available in this site. Characteristics of an insurance companys anti money laundering program are a topic that is being searched for and liked by netizens now. You can Download the Characteristics of an insurance companys anti money laundering program files here. Download all royalty-free vectors.

If you’re looking for characteristics of an insurance companys anti money laundering program pictures information connected with to the characteristics of an insurance companys anti money laundering program interest, you have come to the right site. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

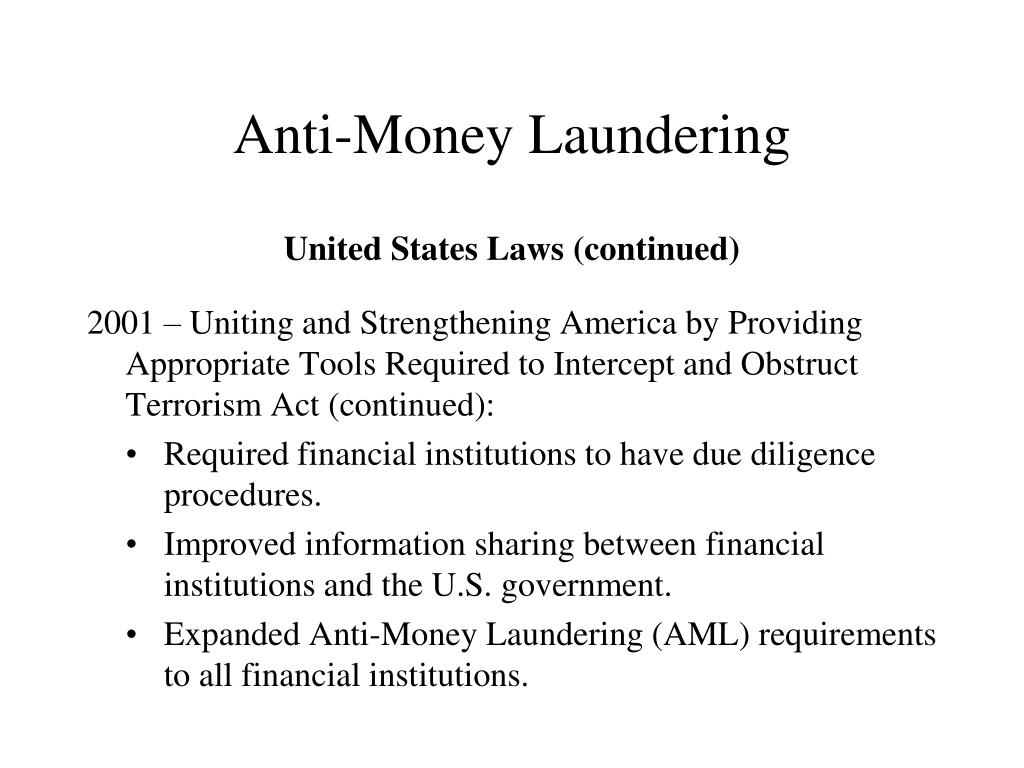

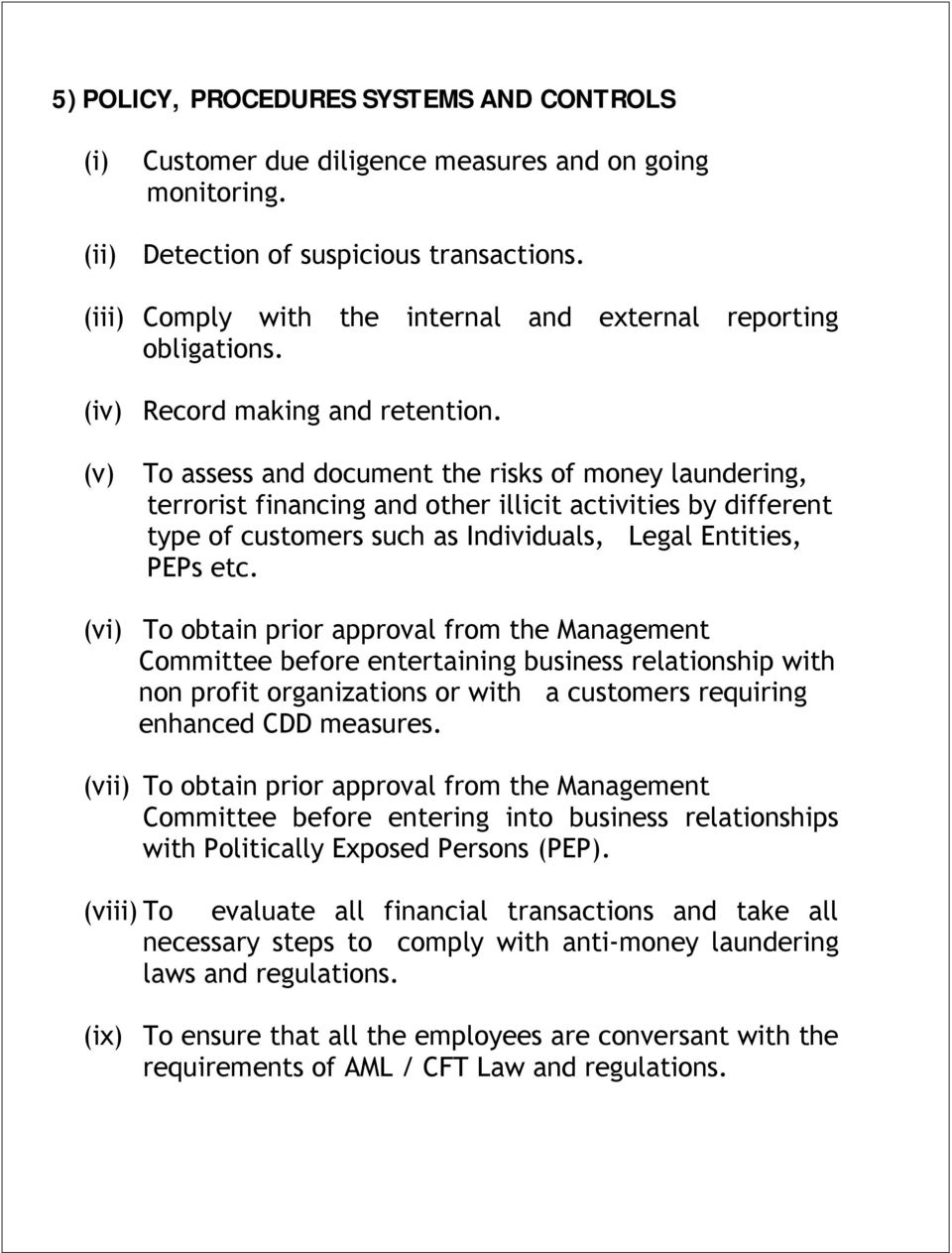

Characteristics Of An Insurance Companys Anti Money Laundering Program. Broker-dealers in securities currently are subject to an independent anti-money laundering program obligation under our regulations 31 CFR 103120. Money Laundering Money laundering is the illegal practice of placing money gained from criminal activity dirty money through a series of apparently legitimate transactions in order to. 1 However the company. Als job requires him to create an AML compliance program for an insurance company under the USA Patriot Act.

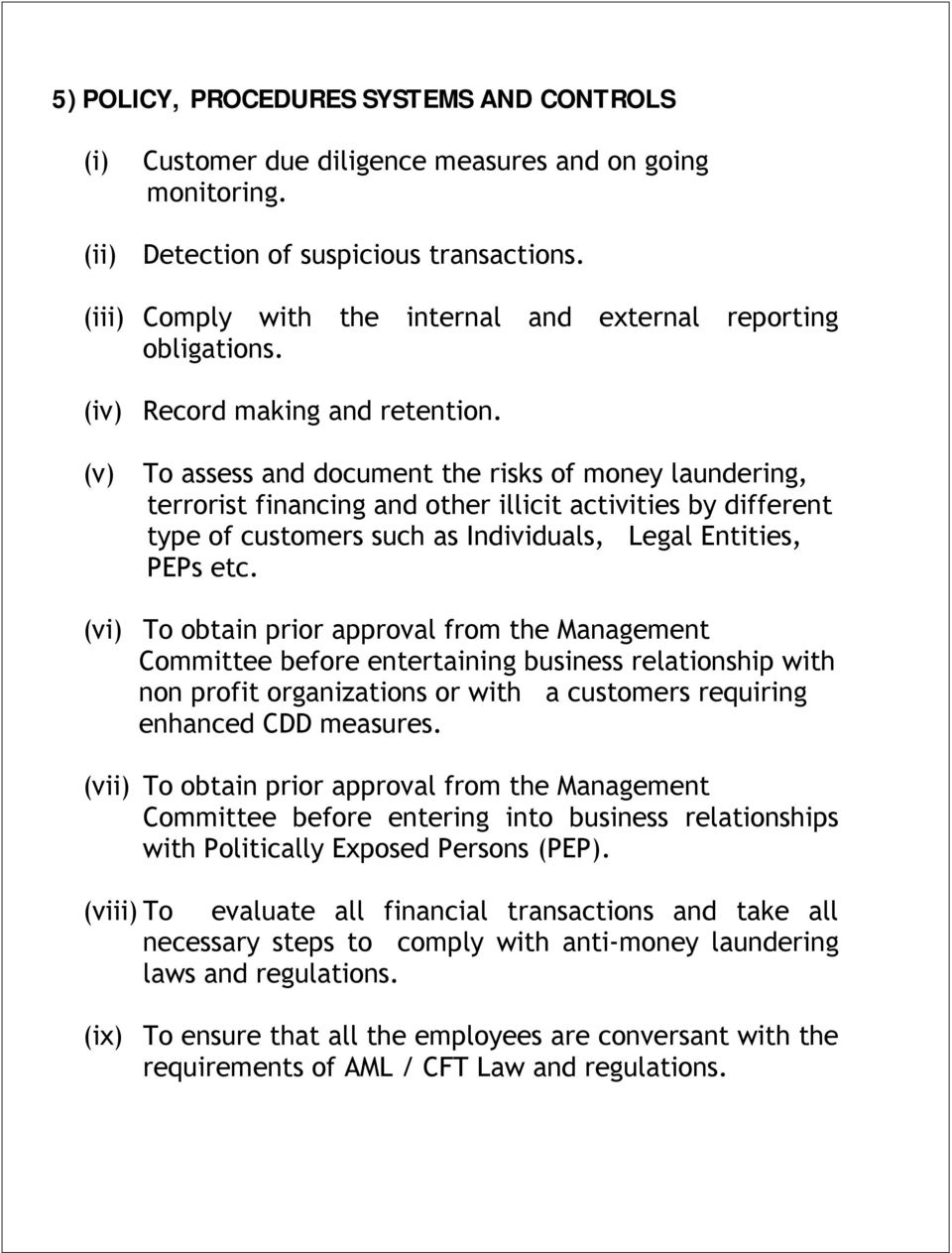

Anti Money Laundering And Combating Financing Of Terrorism Aml Cft Policy Pdf Free Download From docplayer.net

Anti Money Laundering And Combating Financing Of Terrorism Aml Cft Policy Pdf Free Download From docplayer.net

Resources to strengthening their anti-money laundering regime. Company employees must comply with the companys AML program to prevent deter and report any money laundering activity or suspicious transaction. Company employees are obliged to report any suspicious transactions to the financial intelligence units. The AML program of a covered insurance company however must encompass the activities of its agents or brokers that sell its covered products. Access the money laundering risks associated with the insurance particular product clients distribution channels and locations. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses.

At minimum insurance companies subject to the rule requiring an anti-money laundering program must establish a program that comprises four basic elements.

Als job requires him to create an AML compliance program for an insurance company under the USA Patriot Act. The Patriot Act created new anti-money laundering responsibilities for insurance companies. Internal policies procedures and controls Each insurance company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering program as detailed below. Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. The agents and brokers are often unaware of the need to screen clients or to question payment methods. However insurance companies are held responsible for compliance with their program which includes the activities of any agents and brokers.

Source: researchgate.net

Source: researchgate.net

The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. Investigative Forensic Accountants possess certain professional skills and. The AML program of a covered insurance company however must encompass the activities of its agents or brokers that sell its covered products. Securian Financials Anti-money Laundering AML Program is designed to ensure compliance with all applicable BSA regulations and other related SEC Self-Regulatory Organization and Treasury regulations and where applicable relevant rules of the bank regulatory agencies. Insurance companies should therefore integrate their agents and brokers into their AML program.

Source: researchgate.net

Source: researchgate.net

Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. Internal policies procedures and controls Each insurance company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering program as detailed below. Department of the Treasurys Financial Crimes Enforcement Network FinCEN in March 2008 offered insurance companies guidance concerning their anti-money-laundering. Securian Financials Anti-money Laundering AML Program is designed to ensure compliance with all applicable BSA regulations and other related SEC Self-Regulatory Organization and Treasury regulations and where applicable relevant rules of the bank regulatory agencies. 103137 c 2005 sets forth minimum requirements for an insurance companys written anti-money laundering program but that regulation does not specifically preclude the use of money orders and certified bank checks for premium payment of a life insurance companys covered products.

Source: slideserve.com

Source: slideserve.com

Securian Financials Anti-money Laundering AML Program is designed to ensure compliance with all applicable BSA regulations and other related SEC Self-Regulatory Organization and Treasury regulations and where applicable relevant rules of the bank regulatory agencies. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value. The other 60 attributed the low STR reporting levels to lack of automated systems for AML detection non-acceptance of cash as a method of premium payment by the industry and lack of senior management support. The AML program of a covered insurance company however must encompass the activities of its agents or brokers that sell its covered products. Company employees are obliged to report any suspicious transactions to the financial intelligence units.

Source: researchgate.net

Source: researchgate.net

Access the money laundering risks associated with the insurance particular product clients distribution channels and locations. 103137 c 2005 sets forth minimum requirements for an insurance companys written anti-money laundering program but that regulation does not specifically preclude the use of money orders and certified bank checks for premium payment of a life insurance companys covered products. Company employees must comply with the companys AML program to prevent deter and report any money laundering activity or suspicious transaction. The program will be reviewed and updated on a regular basis to ensure appropriate policies procedures and. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value.

Source: researchgate.net

Source: researchgate.net

1 However the company. Money Laundering Money laundering is the illegal practice of placing money gained from criminal activity dirty money through a series of apparently legitimate transactions in order to. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Company employees are obliged to report any suspicious transactions to the financial intelligence units. When should KYC be done.

Source: docplayer.net

Source: docplayer.net

Company employees are obliged to report any suspicious transactions to the financial intelligence units. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value. Als job requires him to create an AML compliance program for an insurance company under the USA Patriot Act. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Because insurance agents and brokers are an integral part of the insurance industry due to their direct contact with customers the final rule requires each insurance company to establish and implement policies procedures and internal controls that are reasonably designed to integrate its agents and brokers into its anti-money laundering program and to monitor their performance with its.

Source: docplayer.net

Source: docplayer.net

1 However the company. Resources to strengthening their anti-money laundering regime. Internal policies procedures and controls Each insurance company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering program as detailed below. KYC and Risk Profile of the Customer 4. Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements.

Source: fsblockchain.medium.com

Source: fsblockchain.medium.com

Department of the Treasurys Financial Crimes Enforcement Network FinCEN in March 2008 offered insurance companies guidance concerning their anti-money-laundering. 103137 c 2005 sets forth minimum requirements for an insurance companys written anti-money laundering program but that regulation does not specifically preclude the use of money orders and certified bank checks for premium payment of a life insurance companys covered products. Therefore the insurance company would not be required to establish a separate anti-money laundering program in order to comply with the final rule as long as it has established an anti-money laundering program pursuant to that requirement and complies with the program. Als job requires him to create an AML compliance program for an insurance company under the USA Patriot Act. An insurance company is responsible for integrating its agents and brokers into its anti-money laundering program for obtaining relevant customer-related information from them and for using that information to assess the money-laundering risks presented by its business and to identify any red flags emphasis added.

Source: academia.edu

Source: academia.edu

The other 60 attributed the low STR reporting levels to lack of automated systems for AML detection non-acceptance of cash as a method of premium payment by the industry and lack of senior management support. Department of the Treasurys Financial Crimes Enforcement Network FinCEN in March 2008 offered insurance companies guidance concerning their anti-money-laundering. Access the money laundering risks associated with the insurance particular product clients distribution channels and locations. Resources to strengthening their anti-money laundering regime. 1 However the company.

Source: docplayer.net

Source: docplayer.net

Therefore the insurance company would not be required to establish a separate anti-money laundering program in order to comply with the final rule as long as it has established an anti-money laundering program pursuant to that requirement and complies with the program. When should KYC be done. At minimum insurance companies subject to the rule requiring an anti-money laundering program must establish a program that comprises four basic elements. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. 103137 c 2005 sets forth minimum requirements for an insurance companys written anti-money laundering program but that regulation does not specifically preclude the use of money orders and certified bank checks for premium payment of a life insurance companys covered products.

Source: yumpu.com

Source: yumpu.com

Internal policies procedures and controls Each insurance company has to establish and implement policies procedures and internal controls which would also integrate its agents in its anti-money laundering program as detailed below. When should KYC be done. Resources to strengthening their anti-money laundering regime. 1 However the company. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value.

Source: docplayer.net

Source: docplayer.net

Therefore the insurance company would not be required to establish a separate anti-money laundering program in order to comply with the final rule as long as it has established an anti-money laundering program pursuant to that requirement and complies with the program. Department of the Treasurys Financial Crimes Enforcement Network FinCEN in March 2008 offered insurance companies guidance concerning their anti-money-laundering. Broker-dealers in securities currently are subject to an independent anti-money laundering program obligation under our regulations 31 CFR 103120. Because insurance agents and brokers are an integral part of the insurance industry due to their direct contact with customers the final rule requires each insurance company to establish and implement policies procedures and internal controls that are reasonably designed to integrate its agents and brokers into its anti-money laundering program. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies.

Source: researchgate.net

Source: researchgate.net

Therefore the insurance company would not be required to establish a separate anti-money laundering program in order to comply with the final rule as long as it has established an anti-money laundering program pursuant to that requirement and complies with the program. 103137 c 2005 sets forth minimum requirements for an insurance companys written anti-money laundering program but that regulation does not specifically preclude the use of money orders and certified bank checks for premium payment of a life insurance companys covered products. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. The agents and brokers are often unaware of the need to screen clients or to question payment methods. At minimum insurance companies subject to the rule requiring an anti-money laundering program must establish a program that comprises four basic elements.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title characteristics of an insurance companys anti money laundering program by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information