16++ Charity commission money laundering info

Home » about money loundering idea » 16++ Charity commission money laundering infoYour Charity commission money laundering images are available. Charity commission money laundering are a topic that is being searched for and liked by netizens today. You can Get the Charity commission money laundering files here. Get all free images.

If you’re looking for charity commission money laundering pictures information related to the charity commission money laundering topic, you have visit the right site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Charity Commission Money Laundering. The EUs Fifth Anti-Money Laundering Directive 5MLD is the next stage of the EUs campaign against terrorist financing and money laundering. Similarly charity staff are not allowed to be trustees without permission from the Charity Commission. The National Crime Agency estimates that individuals the private sector and the charity sector lose billions of pounds each year to fraud. Reporting financial abuse to the Charity Commission - If it is known or suspected that a charity is a victim of financial crime then this should always be reported to the police and to the Charity.

Regulator Warns Charities Against The Use Of Cash Couriers Gov Uk From gov.uk

Regulator Warns Charities Against The Use Of Cash Couriers Gov Uk From gov.uk

In this case the Charity Tribunal upheld the Charity Commissions original order which had been based on allegation of fraud even though the fraud allegation was not made out before the Charity Tribunal. The term laundering is used because criminals turn dirty money into clean funds which can then be integrated into the legitimate economy as though they have been acquired lawfully. It also resulted in the UK establishing the Trust. The Commission assessed information and found a pattern of regulatory concerns across the charities which included signs. The Commission will be producing specific guidance in 2018 to help charity trustees identify risk and introduce controls to prevent these matters. Reporting financial abuse to the Charity Commission - If it is known or suspected that a charity is a victim of financial crime then this should always be reported to the police and to the Charity.

The National Crime Agency estimates that individuals the private sector and the charity sector lose billions of pounds each year to fraud.

The Commission will be producing specific guidance in 2018 to help charity trustees identify risk and introduce controls to prevent these matters. The EUs Fifth Anti-Money Laundering Directive 5MLD is the next stage of the EUs campaign against terrorist financing and money laundering. To find out more about our work see our annual report. Written by Matthew Smith barrister at Maitland Chambers. Charity Commission warning on money laundering. The objectives of the FATF are to set standards and promote effective implementation of legal regulatory and operational measures for combating money laundering terrorist financing MLTF and other related threats to the integrity of the international financial system.

Source: emilford.com.au

Source: emilford.com.au

The EUs Fifth Anti-Money Laundering Directive 5MLD is the next stage of the EUs campaign against terrorist financing and money laundering. Crimes and Money Laundering TCML agreed to examine the tax evasion and money laundering vulnerabilities associated with the abuse of charities. Chapter 2 of the Charity Commissions Compliance toolkit this guidance. The Charity Commission has revealed it is undertaking a class statutory inquiry into London-based charities alleged to be involved in a scheme to launder 10m from the sale of counterfeit erectile dysfunction and slimming pills The charities had a number of trustees in common. The Charity Commission is the independent regulator of charities in England and Wales.

Source: thirdsector.co.uk

Source: thirdsector.co.uk

The Charity Commission has revealed it is undertaking a class statutory inquiry into London-based charities alleged to be involved in a scheme to launder 10m from the sale of counterfeit erectile dysfunction and slimming pills The charities had a number of trustees in common. The regulator has been investigating the eight charities all based in North London since June 2014 when it was notified of a Metropolitan Police investigation into concerns that they were being used for money laundering. Similarly charity staff are not allowed to be trustees without permission from the Charity Commission. 5MLD comes hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which enhanced transparency in financial systems across Europe. To find out more about our work see our annual report.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

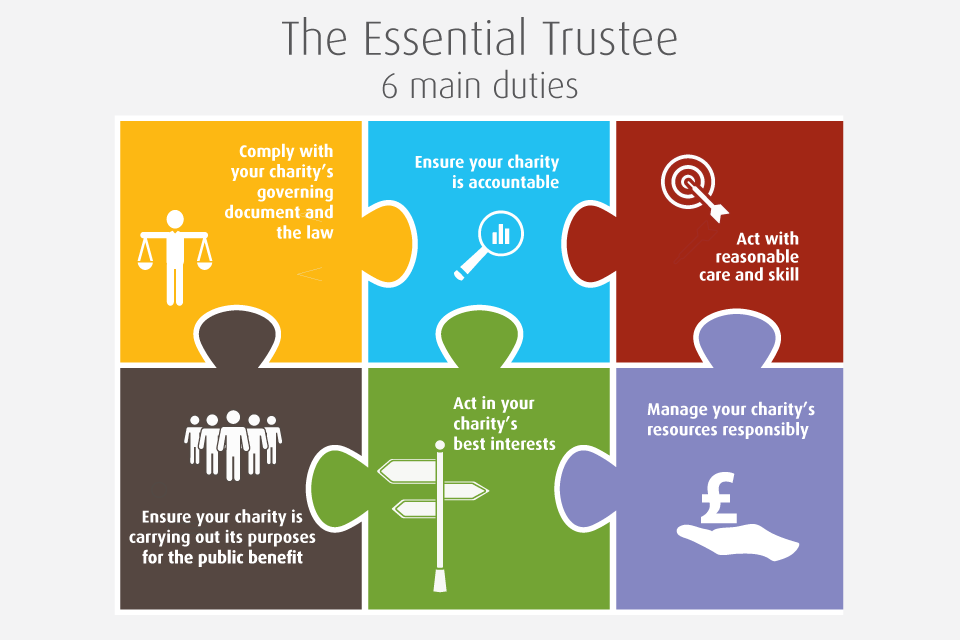

Thousands of charities could face increased administrative bureaucracy as part of the governments new anti-money laundering regulations a lawyer has warned. Crimes and Money Laundering TCML agreed to examine the tax evasion and money laundering vulnerabilities associated with the abuse of charities. Makes all trustees aware of their legal duties and responsibilities in. The regulator has been investigating the eight charities all based in North London since June 2014 when it was notified of a Metropolitan Police investigation into concerns that they were being used for money laundering. The Commission assessed information and found a pattern of regulatory concerns across the charities which included signs.

Source: farrer.co.uk

Source: farrer.co.uk

The EUs Fifth Anti-Money Laundering Directive 5MLD is the next stage of the EUs campaign against terrorist financing and money laundering. Money laundering - donors can make loans to charities as a means of laundering money or they can make donations with specific restrictions as to which partner or project is to be funded as a means. Reporting financial abuse to the Charity Commission - If it is known or suspected that a charity is a victim of financial crime then this should always be reported to the police and to the Charity. Search for charities on our check charity tool. Writing for Charity Finance magazine Lucy Rhodes associate at Bates Wells said the Fifth Money Laundering Directive 5MLD could force all charitable trusts irrespective of size to register with the governments new trust.

Source:

5MLD comes hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which enhanced transparency in financial systems across Europe. Writing for Charity Finance magazine Lucy Rhodes associate at Bates Wells said the Fifth Money Laundering Directive 5MLD could force all charitable trusts irrespective of size to register with the governments new trust. The objectives of the FATF are to set standards and promote effective implementation of legal regulatory and operational measures for combating money laundering terrorist financing MLTF and other related threats to the integrity of the international financial system. Similarly charity staff are not allowed to be trustees without permission from the Charity Commission. Thousands of charities could face increased administrative bureaucracy as part of the governments new anti-money laundering regulations a lawyer has warned.

Source: civilsociety.co.uk

Source: civilsociety.co.uk

The Commission assessed information and found a pattern of regulatory concerns across the charities which included signs. The Commission assessed information and found a pattern of regulatory concerns across the charities which included signs. These controls should be designed to prevent fraud and error. The Charity Commission has revealed it is undertaking a class statutory inquiry into London-based charities alleged to be involved in a scheme to launder 10m from the sale of counterfeit erectile dysfunction and slimming pills The charities had a number of trustees in common. To find out more about our work see our annual report.

Source: slideplayer.com

Source: slideplayer.com

Several charities have unwittingly been involved in a scam says Michelle Russell the commissions head of investigations and enforcement. The term laundering is used because criminals turn dirty money into clean funds which can then be integrated into the legitimate economy as though they have been acquired lawfully. Written by Matthew Smith barrister at Maitland Chambers. Money laundering - donors can make loans to charities as a means of laundering money or they can make donations with specific restrictions as to which partner or project is to be funded as a means. 5MLD comes hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which enhanced transparency in financial systems across Europe.

Source: gov.uk

Source: gov.uk

Chapter 2 of the Charity Commissions Compliance toolkit this guidance. However charity trustees should also consider where relevant the potential for loss through terrorist financing or money laundering. The Commission assessed information and found a pattern of regulatory concerns across the charities which included signs. The Charity Commission is the independent regulator of charities in England and Wales. Similarly charity staff are not allowed to be trustees without permission from the Charity Commission.

Source: theguardian.com

Source: theguardian.com

The regulator has been investigating the eight charities all based in North London since June 2014 when it was notified of a Metropolitan Police investigation into concerns that they were being used for money laundering. The delegate for Canada took the lead on surveying practice developing the analysis and collating case studies for the report. In this case the Charity Tribunal upheld the Charity Commissions original order which had been based on allegation of fraud even though the fraud allegation was not made out before the Charity Tribunal. Specific exemption from the Charity Commission a charity will not be able to pay its trustees. The Commission will be producing specific guidance in 2018 to help charity trustees identify risk and introduce controls to prevent these matters.

Source: gov.uk

Source: gov.uk

Trustees have a duty to manage their charitys. Charities and money laundering offences. However charity trustees should also consider where relevant the potential for loss through terrorist financing or money laundering. Reporting financial abuse to the Charity Commission - If it is known or suspected that a charity is a victim of financial crime then this should always be reported to the police and to the Charity. Written by Matthew Smith barrister at Maitland Chambers.

Source: gov.uk

Source: gov.uk

Charities and money laundering offences. Chapter 2 of the Charity Commissions Compliance toolkit this guidance. Thousands of charities could face increased administrative bureaucracy as part of the governments new anti-money laundering regulations a lawyer has warned. The regulator has been investigating the eight charities all based in North London since June 2014 when it was notified of a Metropolitan Police investigation into concerns that they were being used for money laundering. Crimes and Money Laundering TCML agreed to examine the tax evasion and money laundering vulnerabilities associated with the abuse of charities.

Source: timesofisrael.com

Source: timesofisrael.com

Money laundering The process of turning the proceeds of crime into property or money that can be accessed legitimately without arousing suspicion. The delegate for Canada took the lead on surveying practice developing the analysis and collating case studies for the report. The Charity Commission has revealed it is undertaking a class statutory inquiry into London-based charities alleged to be involved in a scheme to launder 10m from the sale of counterfeit erectile dysfunction and slimming pills The charities had a number of trustees in common. The absence of a unitary board is another barrier to money laundering or terrorist financing. The regulator has been investigating the eight charities all based in North London since June 2014 when it was notified of a Metropolitan Police investigation into concerns that they were being used for money laundering.

Source: kyc360.riskscreen.com

Source: kyc360.riskscreen.com

These controls should be designed to prevent fraud and error. The term laundering is used because criminals turn dirty money into clean funds which can then be integrated into the legitimate economy as though they have been acquired lawfully. The Charity Commission has revealed it is undertaking a class statutory inquiry into London-based charities alleged to be involved in a scheme to launder 10m from the sale of counterfeit erectile dysfunction and slimming pills The charities had a number of trustees in common. Charities and money laundering offences. The EUs Fifth Anti-Money Laundering Directive 5MLD is the next stage of the EUs campaign against terrorist financing and money laundering.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title charity commission money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information