20++ Civil penalties for money laundering info

Home » about money loundering idea » 20++ Civil penalties for money laundering infoYour Civil penalties for money laundering images are ready in this website. Civil penalties for money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Civil penalties for money laundering files here. Download all royalty-free photos and vectors.

If you’re looking for civil penalties for money laundering pictures information related to the civil penalties for money laundering topic, you have visit the ideal site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Civil Penalties For Money Laundering. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. FinCEN assessed two significant AML-related civil money penalties in 2016 against a bank and credit union. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not.

Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. General Accounting Office GAO conducted a study focusing on the Department of the Treasurys Office of Financial Enforcement OFE which processes civil penalty referrals for violations of the Bank Secrecy Act which prohibits money laundering. Section 1957 carries a maximum penalty of ten years in prison and maximum fine of 250000 or twice the value of the transaction. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not.

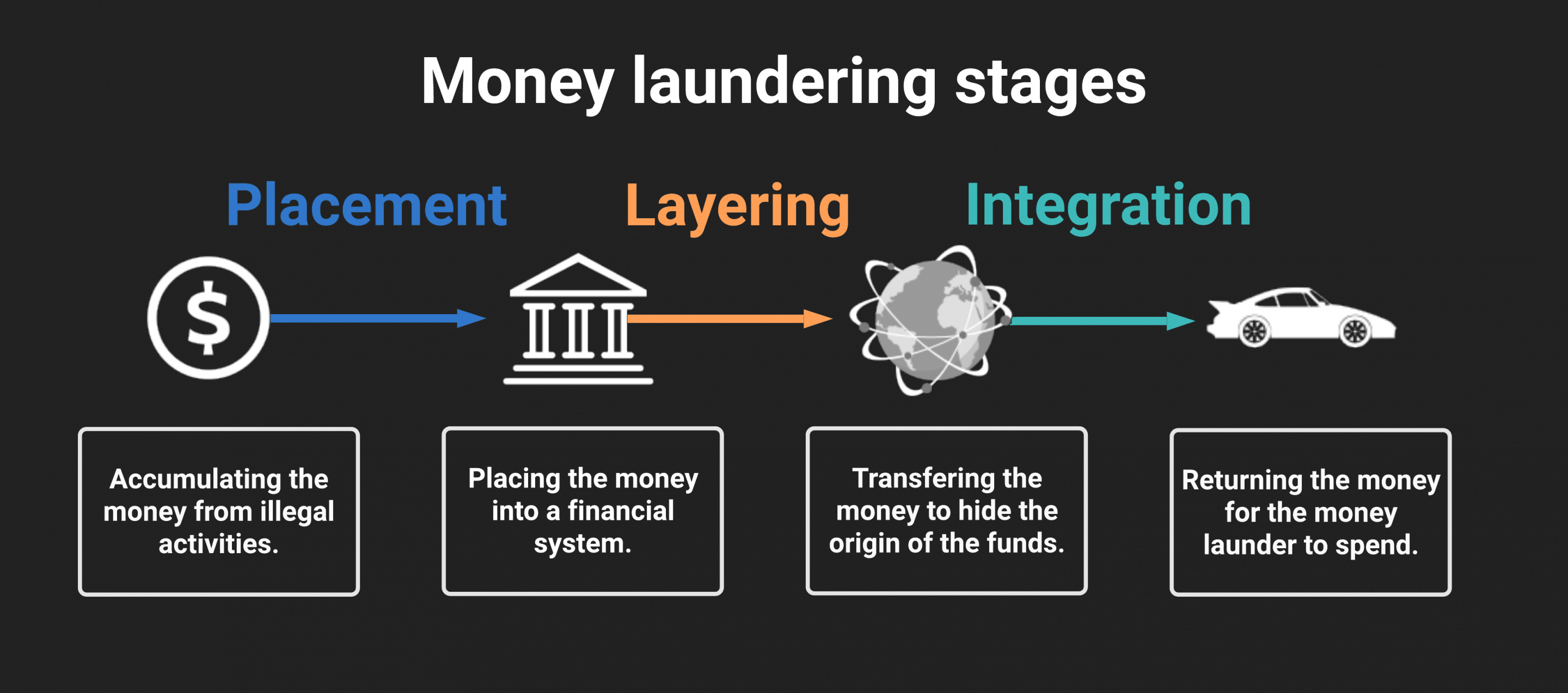

Some of the most common forms of money laundering include.

Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. Some of the most common forms of money laundering include. FinCEN assessed two significant AML-related civil money penalties in 2016 against a bank and credit union. Under Chapter 9A83 RCW MONEY LAUNDERING Complete Chapter 9A83020 Money laundering money laundering is a class B felony leading to up to 10 years imprisonment. A Penalties for the Crime of Money Laundering.

Source: brittontime.com

Source: brittontime.com

A conviction for money laundering under Proceeds of Crime Act section 327 to 329 can result in a prison sentence of up to 14 years a fine or both. Rather the point of this post is that the case law now being made in the FBAR and offshore account context will have direct application to more traditional Anti-Money Laundering AMLBSA enforcement actions because the civil penalty statute being interpreted in the FBAR cases is the same provision which applies to claimed failures to maintain an adequate AML program and other violations of the BSA. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. From a civil standpoint the potential penalty is usually 10000 or the value of financial transaction in question whichever is greater. General Accounting Office GAO conducted a study focusing on the Department of the Treasurys Office of Financial Enforcement OFE which processes civil penalty referrals for violations of the Bank Secrecy Act which prohibits money laundering.

Source: brill.com

Source: brill.com

Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. Money laundering regulations penalty for failure to report. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention.

Source: pinterest.com

Source: pinterest.com

A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. Rather the point of this post is that the case law now being made in the FBAR and offshore account context will have direct application to more traditional Anti-Money Laundering AMLBSA enforcement actions because the civil penalty statute being interpreted in the FBAR cases is the same provision which applies to claimed failures to maintain an adequate AML program and other violations of the BSA.

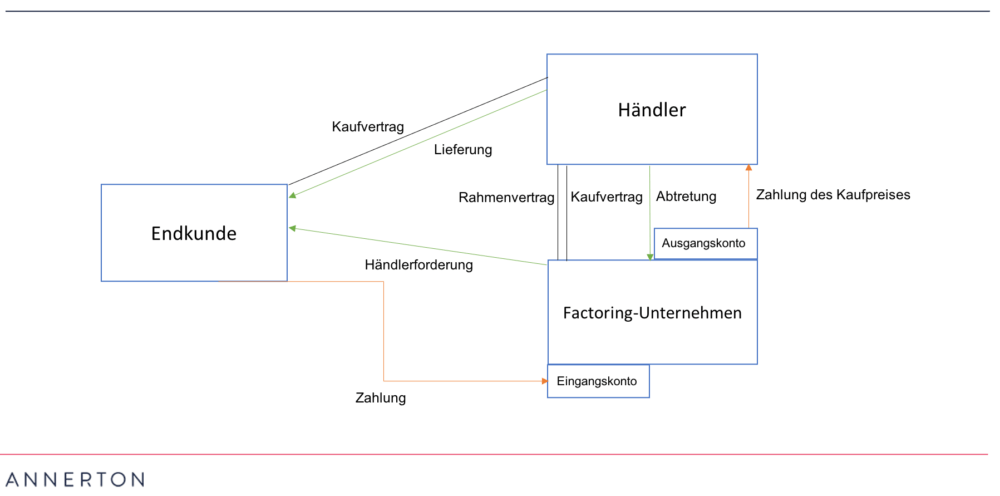

Source: paytechlaw.com

Source: paytechlaw.com

Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. FinCEN assessed two significant AML-related civil money penalties in 2016 against a bank and credit union.

Source: researchgate.net

Source: researchgate.net

A conviction for money laundering under Proceeds of Crime Act section 327 to 329 can result in a prison sentence of up to 14 years a fine or both. Civil Money Penalties 2-00 141-2 DSC Risk Management Manual of Examination Policies Federal Deposit Insurance Corporation. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not.

Source: yumpu.com

Source: yumpu.com

General Accounting Office GAO conducted a study focusing on the Department of the Treasurys Office of Financial Enforcement OFE which processes civil penalty referrals for violations of the Bank Secrecy Act which prohibits money laundering. From a civil standpoint the potential penalty is usually 10000 or the value of financial transaction in question whichever is greater. The most significant difference from 1956 prosecutions is the intent requirement. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. Civil penalties for money laundering.

A Penalties for the Crime of Money Laundering. Under Chapter 9A83 RCW MONEY LAUNDERING Complete Chapter 9A83020 Money laundering money laundering is a class B felony leading to up to 10 years imprisonment. General Accounting Office GAO conducted a study focusing on the Department of the Treasurys Office of Financial Enforcement OFE which processes civil penalty referrals for violations of the Bank Secrecy Act which prohibits money laundering. FinCEN assessed two significant AML-related civil money penalties in 2016 against a bank and credit union. There is no civil penalty provision.

Rather the point of this post is that the case law now being made in the FBAR and offshore account context will have direct application to more traditional Anti-Money Laundering AMLBSA enforcement actions because the civil penalty statute being interpreted in the FBAR cases is the same provision which applies to claimed failures to maintain an adequate AML program and other violations of the BSA. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention.

Source: socialistsanddemocrats.eu

Source: socialistsanddemocrats.eu

Section 1957 carries a maximum penalty of ten years in prison and maximum fine of 250000 or twice the value of the transaction. General Accounting Office GAO conducted a study focusing on the Department of the Treasurys Office of Financial Enforcement OFE which processes civil penalty referrals for violations of the Bank Secrecy Act which prohibits money laundering. Rather the point of this post is that the case law now being made in the FBAR and offshore account context will have direct application to more traditional Anti-Money Laundering AMLBSA enforcement actions because the civil penalty statute being interpreted in the FBAR cases is the same provision which applies to claimed failures to maintain an adequate AML program and other violations of the BSA. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. There is no civil penalty provision.

Source: pinterest.com

Source: pinterest.com

This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations. A civil money penalty in an amount equal to not less than 2 times the amount of the transaction but not. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention.

Source: pinterest.com

Source: pinterest.com

This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. A conviction for money laundering under Proceeds of Crime Act section 327 to 329 can result in a prison sentence of up to 14 years a fine or both. This note explains the civil penalties that can be imposed under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511. There is no civil penalty provision. The most significant difference from 1956 prosecutions is the intent requirement.

Source: wikiwand.com

Source: wikiwand.com

CIVIL MONEY PENALTIES Section 141 Examiners should recommend a specific money penalty and as stated in the policy statement the financial or. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. Some of the most common forms of money laundering include. Civil Money Penalties 2-00 141-2 DSC Risk Management Manual of Examination Policies Federal Deposit Insurance Corporation. A Penalties for the Crime of Money Laundering.

Source: researchgate.net

Source: researchgate.net

There is no civil penalty provision. Money laundering offenses can also give rise to a civil action under Section 1956. Anti-Money Laundering and Countering the Financing of Terrorism Civil Penalties Regulations 2019 4 The Authority may reduce a penalty by up to 30 of the calculated amount but only if the relevant person has a co-operated with the Authority in respect of any proceedings or investigation into the contravention. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. Both sections 31 USC 5318 Compliance exemptions and summons authority and 31 USC 5318A are viewed as complementary international counter money laundering provisions and share the same penalty 31 USC 5321a7 Penalties for International Counter Money Laundering Violations.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title civil penalties for money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information