20++ Client risk rating factors ideas

Home » about money loundering idea » 20++ Client risk rating factors ideasYour Client risk rating factors images are available. Client risk rating factors are a topic that is being searched for and liked by netizens today. You can Download the Client risk rating factors files here. Download all royalty-free vectors.

If you’re looking for client risk rating factors pictures information connected with to the client risk rating factors keyword, you have pay a visit to the ideal site. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

Client Risk Rating Factors. Absence of behaviour is scored a 0. Name Email Website. Ratings should reflect the risks posed by both the borrowers expected performance and the transactions structure. As of May 17 2012 this guidance applies to federal savings associations in addition to national banks.

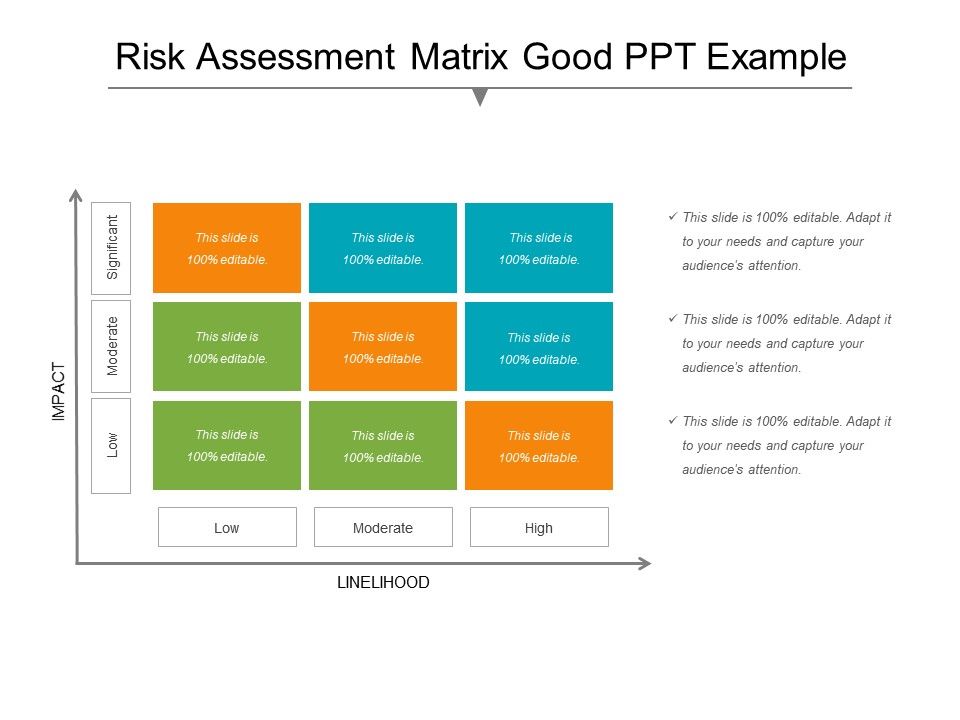

Risk Assessment Matrix Good Ppt Example Presentation Powerpoint Templates Ppt Slide Templates Presentation Slides Design Idea From slideteam.net

Risk Assessment Matrix Good Ppt Example Presentation Powerpoint Templates Ppt Slide Templates Presentation Slides Design Idea From slideteam.net

When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. How much risk a client is willing to take in pursuit of better returns. How much risk a client can afford to take without risking their objectives. Each of these three risk aspects has an impact on the selection of an appropriate investment strategy. Using factors such as length of relationship and age of business.

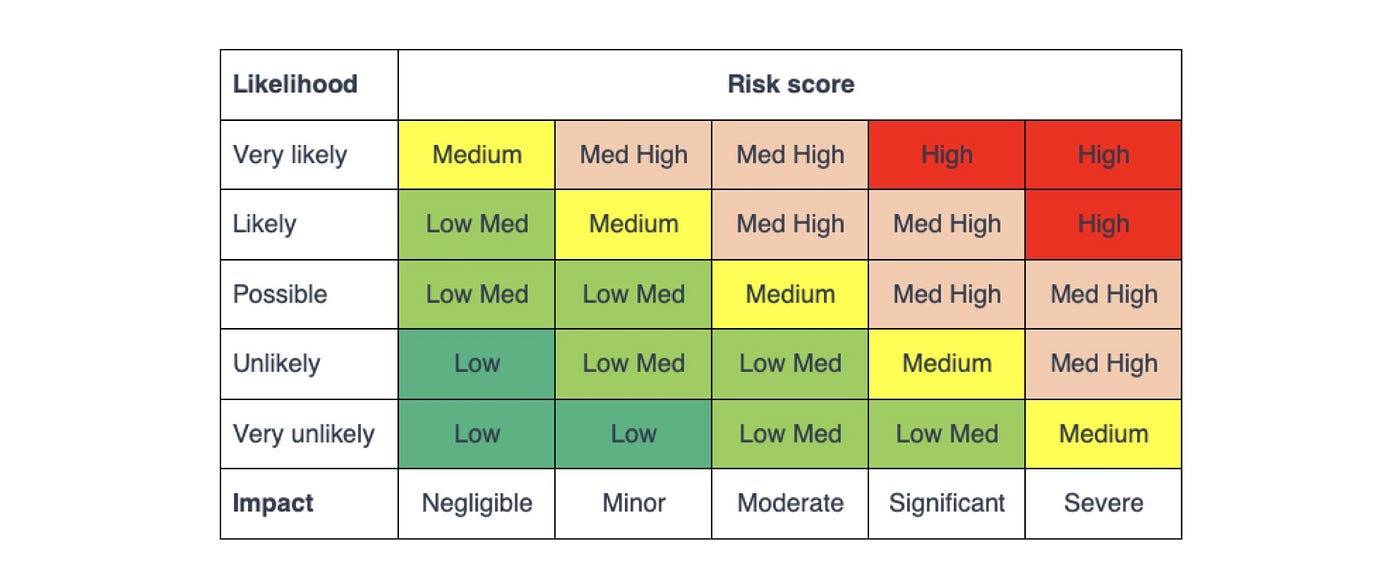

Risk Rating is assessing the risks involved in the daily activities of a business and classifying them low medium high risk on the basis of the impact on the business.

Behavioural risks are monitored via the output of the Banks surveillance. If the risk rating is high that client will be consistently and closely monitored. Add a comment Cancel reply. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. Robert Glazer reveals the metrics he uses to find the best prospects early on.

Source: service.betterregulation.com

Source: service.betterregulation.com

How is client risk determined. Name Email Website. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. 4 Unresponsive Clients. If the risk rating is high that client will be consistently and closely monitored.

Source: researchgate.net

Source: researchgate.net

It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. 4 Unresponsive Clients. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. Presence of a behaviour is scored a 1.

Source: researchgate.net

Source: researchgate.net

Add a comment Cancel reply. If the risk rating is high that client will be consistently and closely monitored. Generating a Customer Risk Rating. Risk Tolerance is the level of risk the client is comfortable with. Robert Glazer reveals the metrics he uses to find the best prospects early on.

Source: slideteam.net

Source: slideteam.net

Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. On every shift or prior to home visit etc. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. The models deployed by most institutions today are based on an assessment of risk factors such as the customers occupation salary and the banking products used. 4 Unresponsive Clients.

Source: pinterest.com

Source: pinterest.com

Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. 140 mmHg or greater. Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. Risk Capacity is the level of financial risk the client can afford to take and. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk.

Source: pinterest.com

Source: pinterest.com

On every shift or prior to home visit etc. Rating Credit Risk Comptrollers Handbook April 2001. Generating a Customer Risk Rating. Age being confined to a bed requiring help to get around requiring aid getting around being widowed never married welfare as a payment source insurance as a payment source and perceived health status. How is client risk determined.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Age being confined to a bed requiring help to get around requiring aid getting around being widowed never married welfare as a payment source insurance as a payment source and perceived health status. However they usually look at four factors to determine client risk. The client must decide how much hes willing to pay for protection. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. Risk Rating is assessing the risks involved in the daily activities of a business and classifying them low medium high risk on the basis of the impact on the business.

Source: pinterest.com

Source: pinterest.com

If the risk rating is high that client will be consistently and closely monitored. As a result the holding goes unsold. Industry and occupation ratings are applied to clients to assess Activity Risk. Some are more open to risk than others. The capacity for risk also provides the advisor with an understanding of how the clients portfolio will function and the rate of change financially if a specific investment results in either a.

Source: advisoryhq.com

Source: advisoryhq.com

Each of these three risk aspects has an impact on the selection of an appropriate investment strategy. Risk Required and Risk Capacity are financial characteristics calculated using a financial planning tool. Score the client at agreed times as outlined in the Organizations Procedures eg. Using factors such as length of relationship and age of business. If the risk rating is low the client will still be monitored but not as diligently.

Source: medium.com

Source: medium.com

The models deployed by most institutions today are based on an assessment of risk factors such as the customers occupation salary and the banking products used. Presence of a behaviour is scored a 1. Risk Rating is assessing the risks involved in the daily activities of a business and classifying them low medium high risk on the basis of the impact on the business. Absence of behaviour is scored a 0. Nine variables emerged as statistically significant predictors.

Source: pinterest.com

Source: pinterest.com

The models deployed by most institutions today are based on an assessment of risk factors such as the customers occupation salary and the banking products used. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate. Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. As a successful financial advisor or financial consultant assessing a clients risk profile is a not-so-simple process of engaging the client in cost-benefit analysis. For service-based businesses few things are more important than finding clients that are a good fit for the long haul.

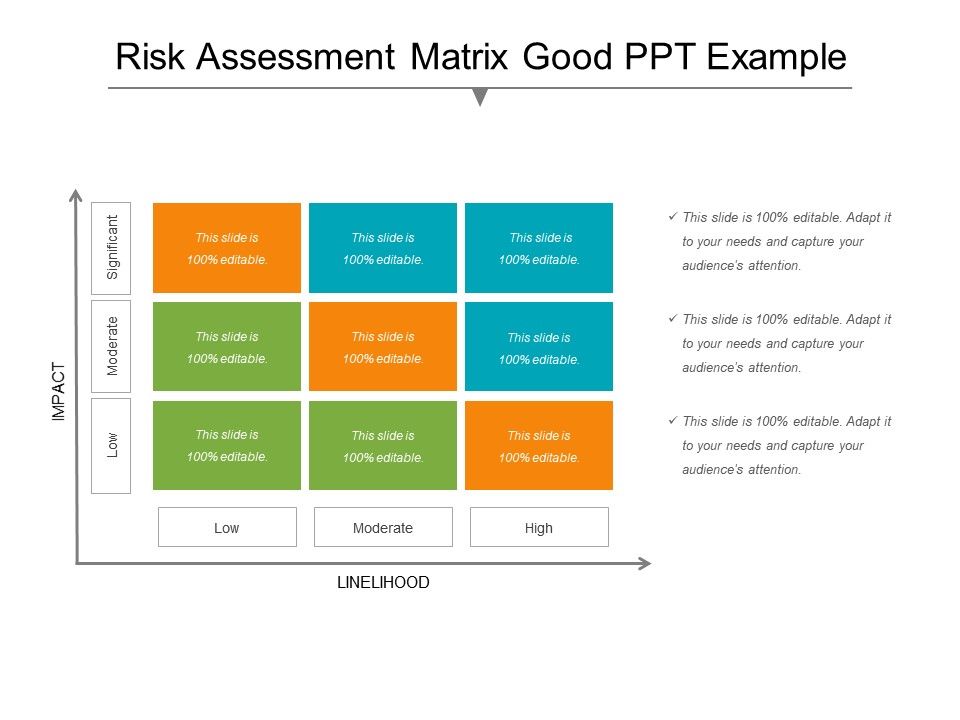

Source: slideteam.net

Source: slideteam.net

The client must decide how much hes willing to pay for protection. Using factors such as length of relationship and age of business. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. Name Email Website. On every shift or prior to home visit etc.

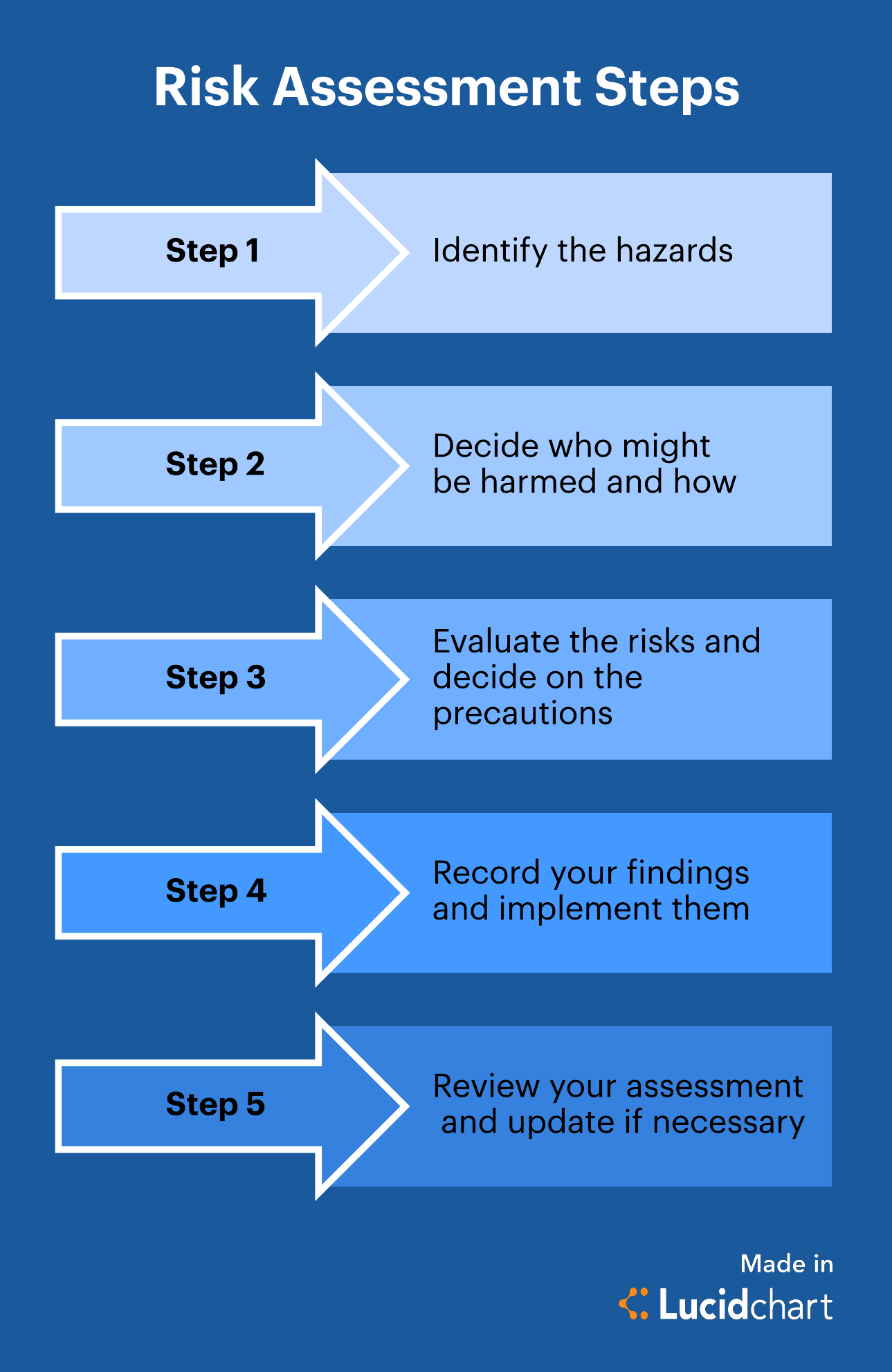

Source: lucidchart.com

Source: lucidchart.com

As a result the holding goes unsold. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. Nine variables emerged as statistically significant predictors. Age being confined to a bed requiring help to get around requiring aid getting around being widowed never married welfare as a payment source insurance as a payment source and perceived health status. Factoring companies consider your industry when determining how to structure a proposal.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title client risk rating factors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information