18+ Common methods of money laundering in insurance industry info

Home » about money loundering Info » 18+ Common methods of money laundering in insurance industry infoYour Common methods of money laundering in insurance industry images are ready. Common methods of money laundering in insurance industry are a topic that is being searched for and liked by netizens today. You can Find and Download the Common methods of money laundering in insurance industry files here. Get all royalty-free photos.

If you’re looking for common methods of money laundering in insurance industry pictures information linked to the common methods of money laundering in insurance industry interest, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

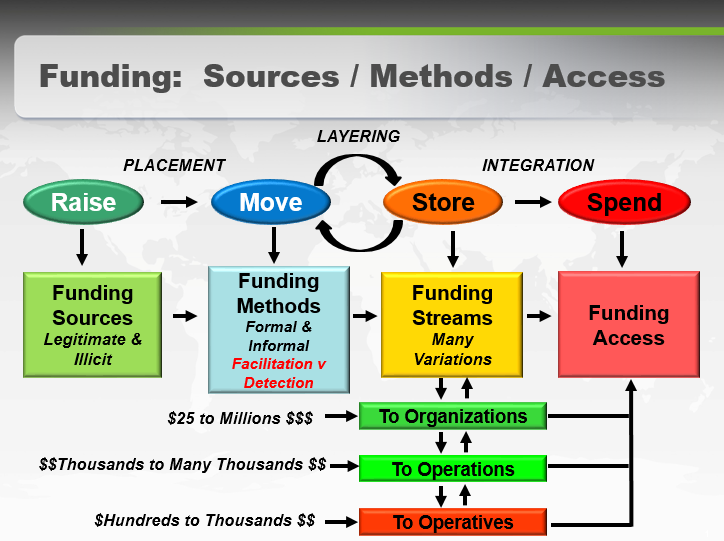

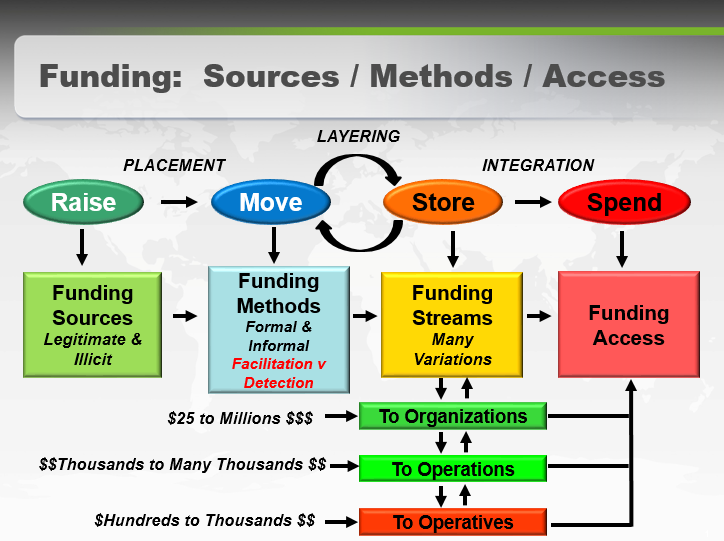

Common Methods Of Money Laundering In Insurance Industry. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Life insurance products and mechanisms that are vulnerable to money laundering include. Ad Unlimited access to Insurance market reports on 180 countries. The following section provides a framework to understand the stages of money laundering activities.

Dennis M Lormel S Statement Before The U S Senate Banking Subcommittee On National Security International Trade And Finance Hearing Acams Today From acamstoday.org

Dennis M Lormel S Statement Before The U S Senate Banking Subcommittee On National Security International Trade And Finance Hearing Acams Today From acamstoday.org

According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Insurance Anti Money Laundering. Policies that allow money launderers to. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Money launders will then try to get the money back through a fraudulent claim.

However insurance products particularly life insurance do provide opportunities to launder money given the significant flow of funds.

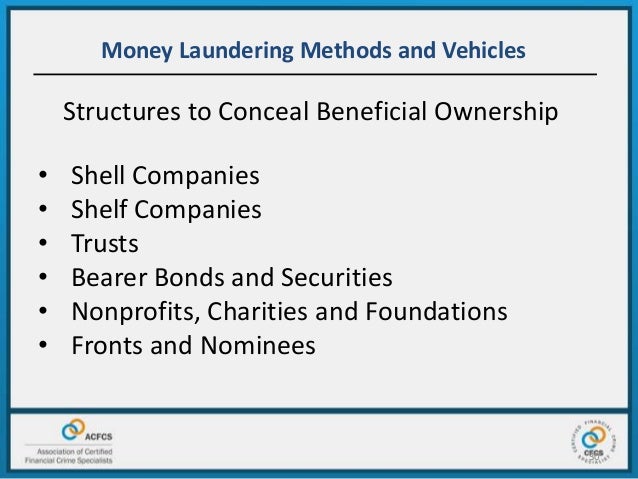

Instant industry overview Market sizing forecast key players trends. To relate the analysis to the insurance industry the report sets out the insurance industry structure the money laundering regulation to which. As a result AML regulations are evolving. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Proof Of Concept Samples And Techniques Ppt Download. Money launders use insurance companies for money laundering by purchasing insurance and then making claims to get insurance funds.

Source: onestopbrokers.com

Source: onestopbrokers.com

Insurance firms operating in the US that issue or underwrite covered products which may pose a higher risk of money laundering for example must comply with Bank Secrecy Actanti-money laundering BSAAML programme. Some common methods of laundering are. Money launders use insurance companies for money laundering by purchasing insurance and then making claims to get insurance funds. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Money launders will then try to get the money back through a fraudulent claim.

Source: piranirisk.com

Source: piranirisk.com

Insurance Anti Money Laundering. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. Some common methods of laundering are. In the first section the report explains money laundering as an offence and an issue worthy of concern.

Source: slideshare.net

Source: slideshare.net

According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. Insurance firms operating in the US that issue or underwrite covered products which may pose a higher risk of money laundering for example must comply with Bank Secrecy Actanti-money laundering BSAAML programme. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. It is a process by which soiled cas. Http Blog Cubeiq Gr Files Iais Core Curriculum 8 2 1 Aml Cft Pdf.

Source: researchgate.net

Source: researchgate.net

Some of the red flags which may indicate money laundering include. However insurance products particularly life insurance do provide opportunities to launder money given the significant flow of funds. It is a process by which soiled cas. Insurance Anti Money. Insurance Anti Money Laundering.

Source: acamstoday.org

Source: acamstoday.org

Aml Fraud Flags Best Practices For Insurers Thomson Reuters. Insurance Anti Money. Launderers generally pay for the insurance with cash and then request early redemption of the policy or make a claim against their property insurance thus obtaining payment in bank money. Money launders use insurance companies for money laundering by purchasing insurance and then making claims to get insurance funds. Http Blog Cubeiq Gr Files Iais Core Curriculum 8 2 1 Aml Cft Pdf.

Source: jagranjosh.com

Source: jagranjosh.com

Money launders use insurance companies for money laundering by purchasing insurance and then making claims to get insurance funds. Policies that allow money launderers to. To relate the analysis to the insurance industry the report sets out the insurance industry structure the money laundering regulation to which. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Insurance Anti Money Laundering.

Source: acamstoday.org

Source: acamstoday.org

Process of Money Laundering. Ad Unlimited access to Insurance market reports on 180 countries. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Some common methods of laundering are. Paying a large top-up into an existing life insurance policy Purchasing a general insurance policy then making a claim soon after A customer who usually.

Source: jagranjosh.com

Source: jagranjosh.com

For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Http Blog Cubeiq Gr Files Iais Core Curriculum 8 2 1 Aml Cft Pdf. Insurance Anti Money Laundering. The idea of money laundering is essential to be understood for these working in the financial sector. The Placement Stage Filtering.

Source: slideshare.net

Source: slideshare.net

Money Laundering in the Insurance Industry How Does It Happen. The Warning Signs There are a number of ways that launderers can use insur-ance products. Life insurance products and mechanisms that are vulnerable to money laundering include. The idea of money laundering is essential to be understood for these working in the financial sector. Overview Of The Insurance Industry S Aml Compliance Sanction Scanner.

Insurance Anti Money. The Warning Signs There are a number of ways that launderers can use insur-ance products. In the first section the report explains money laundering as an offence and an issue worthy of concern. Insurance firms operating in the US that issue or underwrite covered products which may pose a higher risk of money laundering for example must comply with Bank Secrecy Actanti-money laundering BSAAML programme. Instant industry overview Market sizing forecast key players trends.

Insurance Anti Money Laundering. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Ad Unlimited access to Insurance market reports on 180 countries. Instant industry overview Market sizing forecast key players trends. To relate the analysis to the insurance industry the report sets out the insurance industry structure the money laundering regulation to which.

Source: wikiwand.com

Source: wikiwand.com

Money launders will then try to get the money back through a fraudulent claim. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. The money laundering process is divided into 3 segments. Insurance Anti Money. The Placement Stage Filtering.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. The Warning Signs There are a number of ways that launderers can use insur-ance products. It is a process by which soiled cas. Money Laundering in the Insurance Industry How Does It Happen. According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title common methods of money laundering in insurance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas