13+ Consequences of money laundering in south africa info

Home » about money loundering Info » 13+ Consequences of money laundering in south africa infoYour Consequences of money laundering in south africa images are ready. Consequences of money laundering in south africa are a topic that is being searched for and liked by netizens now. You can Find and Download the Consequences of money laundering in south africa files here. Get all royalty-free images.

If you’re searching for consequences of money laundering in south africa pictures information linked to the consequences of money laundering in south africa topic, you have visit the right site. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Consequences Of Money Laundering In South Africa. Money laundering risks associated with attorneys were brought to the fore through the Panama Papers leak in 2016. This is addressed in more detail in 313 Money Laundering below. Money Laundering and KYC regulations in South Africa May 16 2018 Samantha S Learning 5 minutes Where there is money. To this end nine issues in relation t o mo ney launder ing c ontrol and banks a re inve stiga ted.

Pdf Money Laundering From researchgate.net

Pdf Money Laundering From researchgate.net

The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie. Violation of this act carries a fine of up to rand 100 million or imprisonment for up to 30 years. The aim of this research study was to identify whether the South African anti-money laundering regulatory framework adequately addresses managing the risks of politically exposed persons. The South African government aims to prevent money laundering by strengthening anti-money laundering regimes. South Africa is the only African country that is a member of the FATF which means they adhere to strict regulations to prevent money laundering and other criminal activity such as tax evasion. Money laundering and terrorist financingcontrolinSouthAfrica Money laundering trends in South Africa Practical examples Money laundering in different industries and sectors The Prevention of Organised Crime Act No.

In particular a bank that receives the benefits of crimes such as fraud or theft faces prosecution if it fails to heed FICAs money laundering control duties for example the filing of a suspicious transaction report.

The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie. For instance the higher profile accorded to banks in preventing money laundering is premised on the assumption that they occupy a front-line role in detecting transactions involving the proceeds of crime. The aim of this research study was to identify whether the South African anti-money laundering regulatory framework adequately addresses managing the risks of politically exposed persons. Financial institutions aim to ensure AML compliance by making controls according to regulations. Money laundering by terror organisations and organised crime syndicates is one of the biggest challenges facing governments world wide. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks.

Source: researchgate.net

Source: researchgate.net

The study considers South Africas efforts to fulfil its international anti-money laundering obligations whilst upholding the criminal procedural rights guaranteed in the Constitution. Money laundering and terrorist financingcontrolinSouthAfrica Money laundering trends in South Africa Practical examples Money laundering in different industries and sectors The Prevention of Organised Crime Act No. This is addressed in more detail in 313 Money Laundering below. To this end nine issues in relation t o mo ney launder ing c ontrol and banks a re inve stiga ted. For instance the higher profile accorded to banks in preventing money laundering is premised on the assumption that they occupy a front-line role in detecting transactions involving the proceeds of crime.

Source: intosaijournal.org

Source: intosaijournal.org

The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. The Financial Intelligence Centre Act 38 of 2001 FIC Act aims to make this. South Africa is the only African country that is a member of the FATF which means they adhere to strict regulations to prevent money laundering and other criminal activity such as tax evasion. Money laundering and terrorist financingcontrolinSouthAfrica Money laundering trends in South Africa Practical examples Money laundering in different industries and sectors The Prevention of Organised Crime Act No. 121 of 1998 POCA The Financial Intelligence Centre Act No.

Source: researchgate.net

Source: researchgate.net

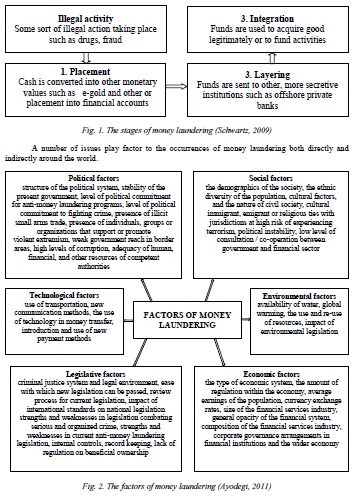

More than 500 banks including several major financial institutions their subsidiaries and branches hired a Panamanian law firm to manage the finances of their wealthy clients. By Bhanu Wijayaratne Money laundering which is commonly known as washing black money can be defined as the process of hiding the true origin of illegally made money and giving such proceeds a legitimate outlook. Under South Africas primary anti-money laundering AML legislation POCA it is an offence to enter into a transaction so as conceal or disguise the nature or source of property including money which is deemed to be the proceeds of unlawful activity. Money laundering is considered a major crime in South Africa. The money laundering risk for financial institutions can be defined as the risk of non-detection of laundering of money through bank accounts or by using any p.

Source: infotaste.com

Source: infotaste.com

121 of 1998 POCA The Financial Intelligence Centre Act No. One of the lingering issues in anti-money laundering in South Africa is the degree of market penetration by financial institutions. The Financial Intelligence Centre FIC was established in 2001 to act as the primary authority over Anti-Money Laundering AML efforts in South Africa. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. 38 of 2001 FICA as amended.

Source: researchgate.net

Source: researchgate.net

To this end nine issues in relation t o mo ney launder ing c ontrol and banks a re inve stiga ted. The leaked documents revealed information about 214. Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing. To this end nine issues in relation t o mo ney launder ing c ontrol and banks a re inve stiga ted. The study considers South Africas efforts to fulfil its international anti-money laundering obligations whilst upholding the criminal procedural rights guaranteed in the Constitution.

Source: slideplayer.com

Source: slideplayer.com

The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie. The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie. South Africa is the only African country that is a member of the FATF which means they adhere to strict regulations to prevent money laundering and other criminal activity such as tax evasion. More than 500 banks including several major financial institutions their subsidiaries and branches hired a Panamanian law firm to manage the finances of their wealthy clients. This is addressed in more detail in 313 Money Laundering below.

Source: slideshare.net

Source: slideshare.net

The Financial Intelligence Centre FIC defines money laundering as the process used by criminals to hide conceal or disguise the nature source location disposition or movement of the proceeds of unlawful activities or any interest which anyone has in such proceeds. In particular a bank that receives the benefits of crimes such as fraud or theft faces prosecution if it fails to heed FICAs money laundering control duties for example the filing of a suspicious transaction report. 312 Aiding and Abetting. The advances in technology and particularly electronic funds transfers brought a dramatic increase in organised crime. It is suggested that certain sections of FICA and POCA fail to find the required balance between protecting citizens from the harms of money laundering and protecting the fundamental rights of attorneys and their clients.

Source: researchgate.net

Source: researchgate.net

For instance the higher profile accorded to banks in preventing money laundering is premised on the assumption that they occupy a front-line role in detecting transactions involving the proceeds of crime. Money Laundering and KYC regulations in South Africa May 16 2018 Samantha S Learning 5 minutes Where there is money. The Financial Intelligence Centre FIC was established in 2001 to act as the primary authority over Anti-Money Laundering AML efforts in South Africa. Violation of this act carries a fine of up to rand 100 million or imprisonment for up to 30 years. The South African government aims to prevent money laundering by strengthening anti-money laundering regimes.

Source:

More than 500 banks including several major financial institutions their subsidiaries and branches hired a Panamanian law firm to manage the finances of their wealthy clients. Money laundering risks associated with attorneys were brought to the fore through the Panama Papers leak in 2016. In addition if money laundering. The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie. Financial institutions that do not comply with AML compliance are fined.

Source: researchgate.net

Source: researchgate.net

The money laundering risk for financial institutions can be defined as the risk of non-detection of laundering of money through bank accounts or by using any p. Ii criminalises money laundering in general and also creates a number of serious offences in respect of laundering and racketeering. There will always be fraud and corruption. The advances in technology and particularly electronic funds transfers brought a dramatic increase in organised crime. The Financial Intelligence Centre FIC defines money laundering as the process used by criminals to hide conceal or disguise the nature source location disposition or movement of the proceeds of unlawful activities or any interest which anyone has in such proceeds.

Source: researchgate.net

Source: researchgate.net

Financial institutions that do not comply with AML compliance are fined. Money laundering and terrorist financingcontrolinSouthAfrica Money laundering trends in South Africa Practical examples Money laundering in different industries and sectors The Prevention of Organised Crime Act No. South Africa prevents financial crimes with the AML regulations they publish. Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing. Iii contains a general reporting obligation for businesses coming into.

Source: slideplayer.com

Source: slideplayer.com

Money laundering is considered a major crime in South Africa. Iii contains a general reporting obligation for businesses coming into. Another important money laundering issue currently faced by South Africa is where domestic attempts to comply with international anti-money laundering requirements result in negative economic consequences. Money laundering by terror organisations and organised crime syndicates is one of the biggest challenges facing governments world wide. The Financial Intelligence Centre FIC was established in 2001 to act as the primary authority over Anti-Money Laundering AML efforts in South Africa.

Source: elibrary.imf.org

Source: elibrary.imf.org

To this end nine issues in relation t o mo ney launder ing c ontrol and banks a re inve stiga ted. Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing. 38 of 2001 FICA as amended. For instance the higher profile accorded to banks in preventing money laundering is premised on the assumption that they occupy a front-line role in detecting transactions involving the proceeds of crime. It is suggested that certain sections of FICA and POCA fail to find the required balance between protecting citizens from the harms of money laundering and protecting the fundamental rights of attorneys and their clients.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title consequences of money laundering in south africa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas