13++ Consumer risk rating form info

Home » about money loundering idea » 13++ Consumer risk rating form infoYour Consumer risk rating form images are available in this site. Consumer risk rating form are a topic that is being searched for and liked by netizens today. You can Find and Download the Consumer risk rating form files here. Download all royalty-free photos.

If you’re looking for consumer risk rating form images information related to the consumer risk rating form interest, you have visit the ideal blog. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

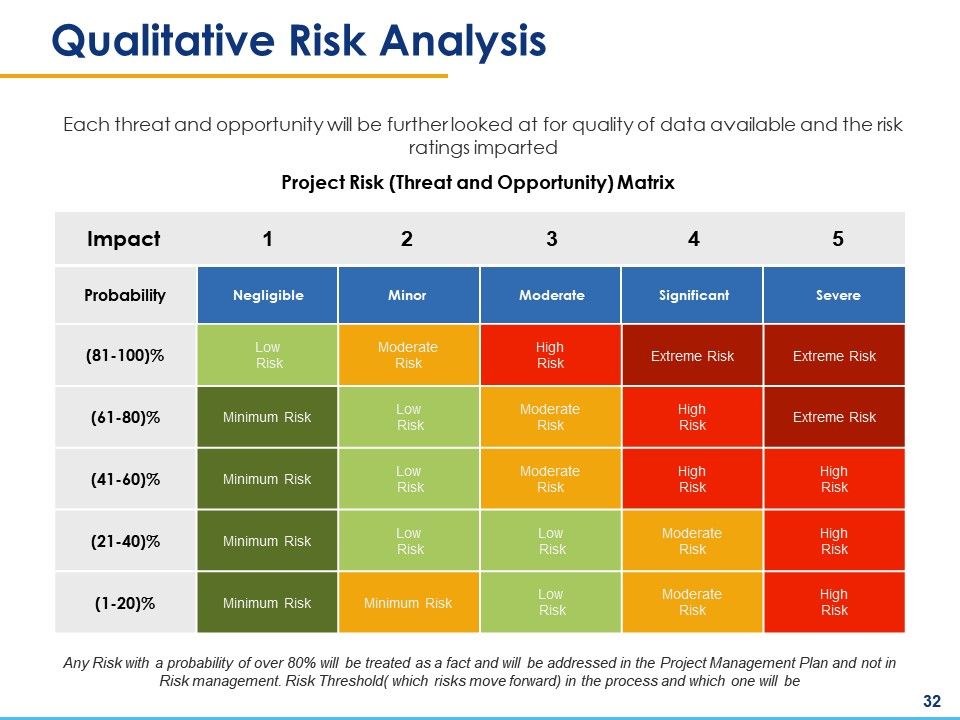

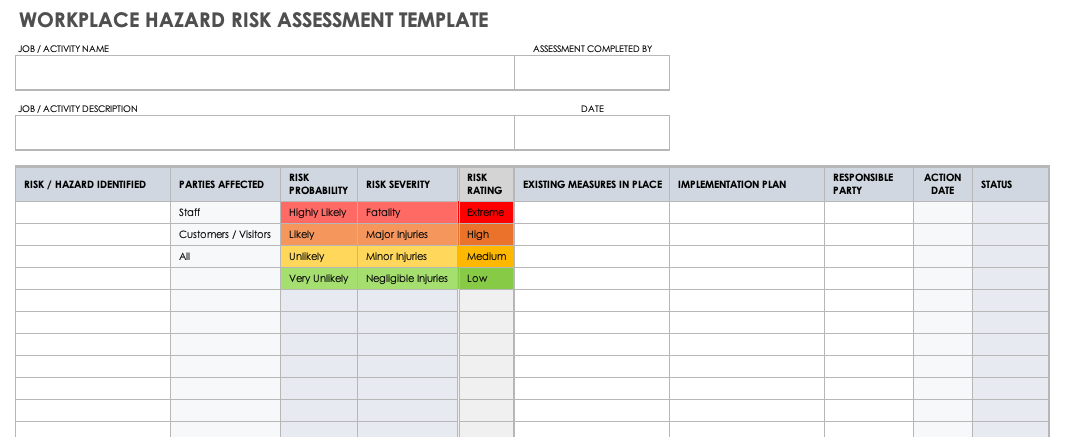

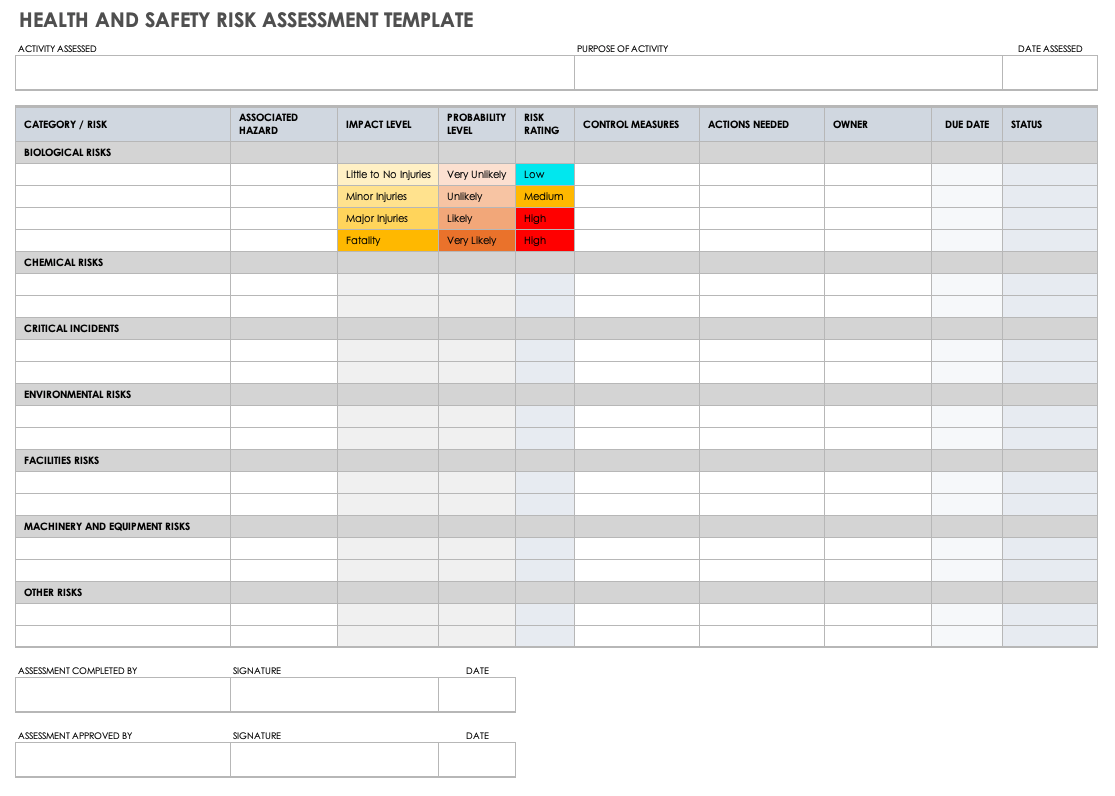

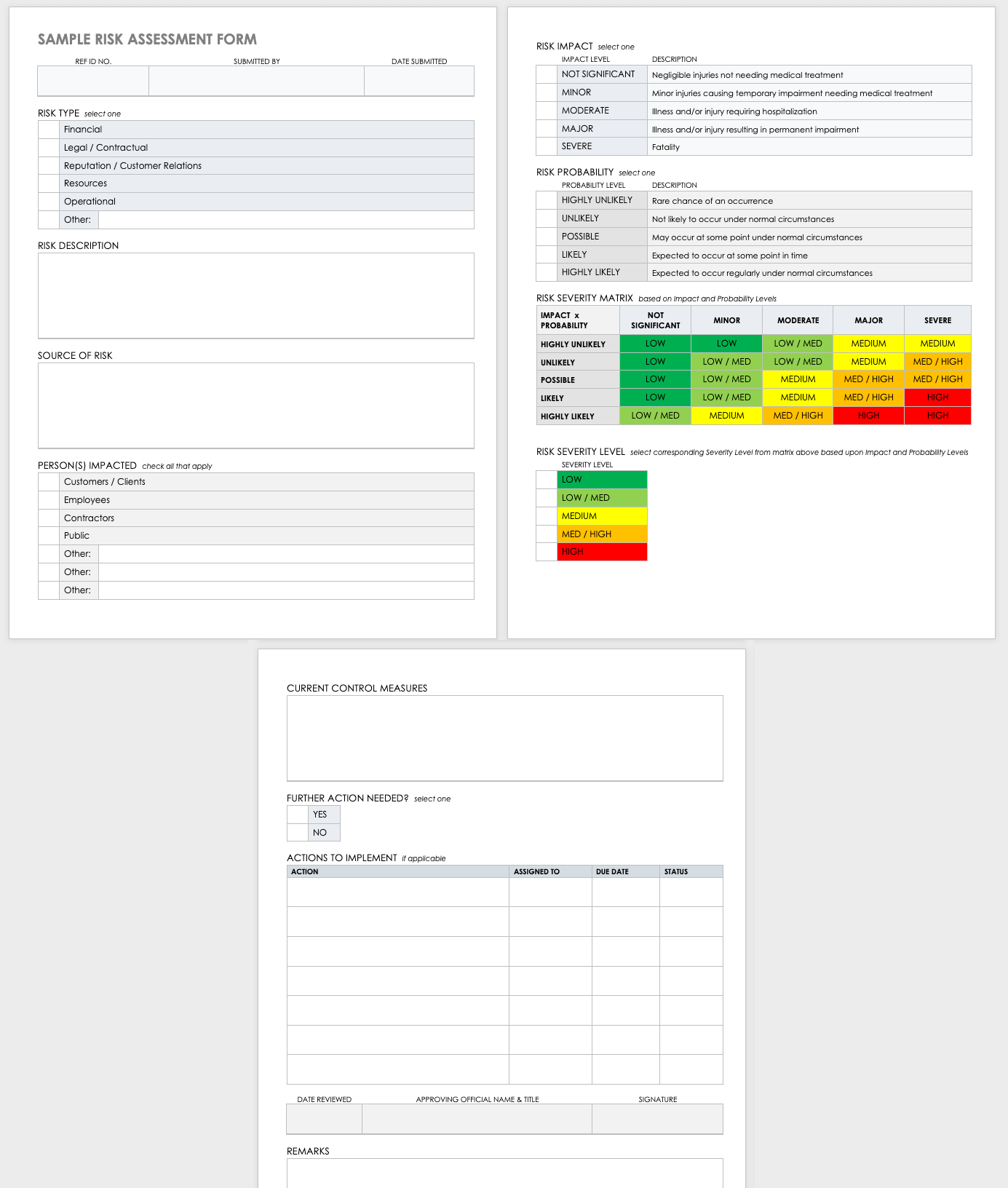

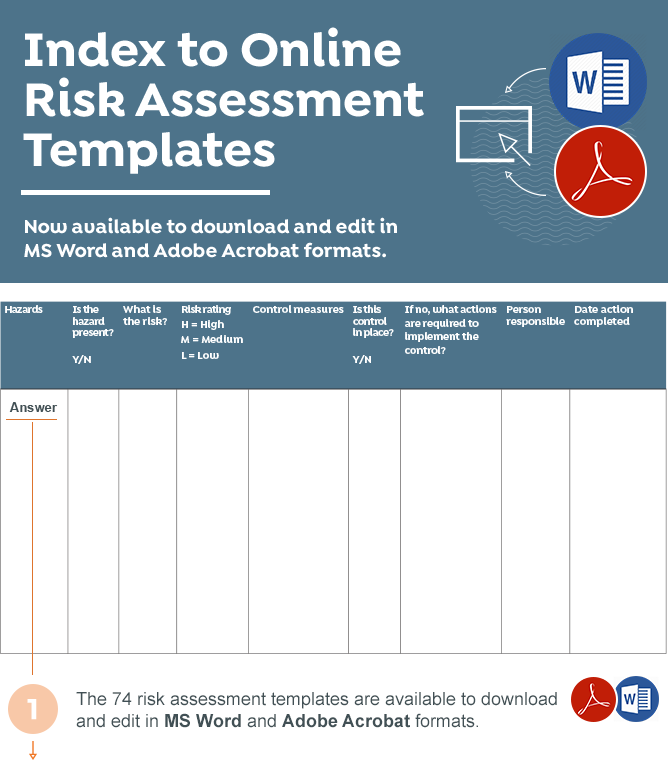

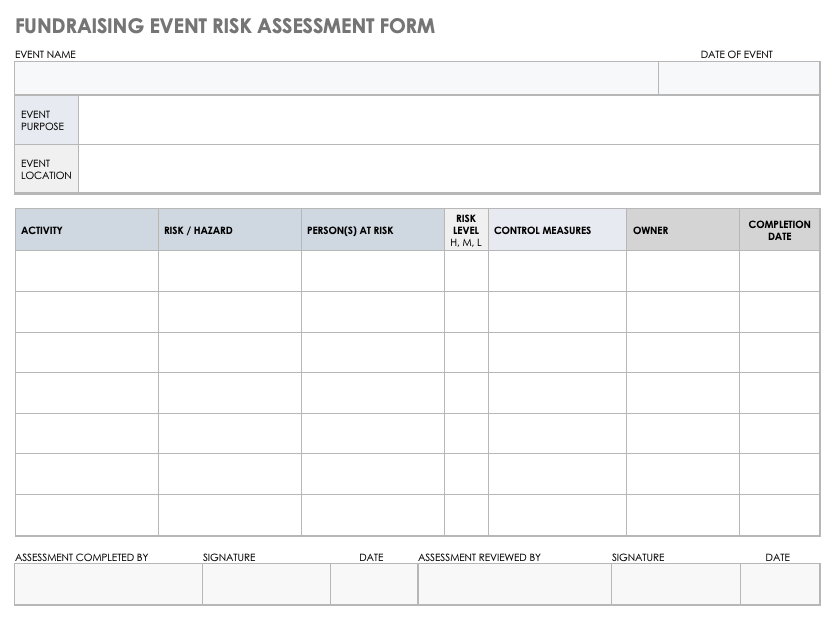

Consumer Risk Rating Form. Every risk assessment matrix has two axes. To calculate a Quantative Risk Rating begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive. Chief Compliance Officer at a bank 178MUSA We use this form at account opening or account review to help determine a possible account risk rating. A Risk Assessment Form is used to assess the risk involved in a particular event or circumstance.

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation From service.betterregulation.com

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation From service.betterregulation.com

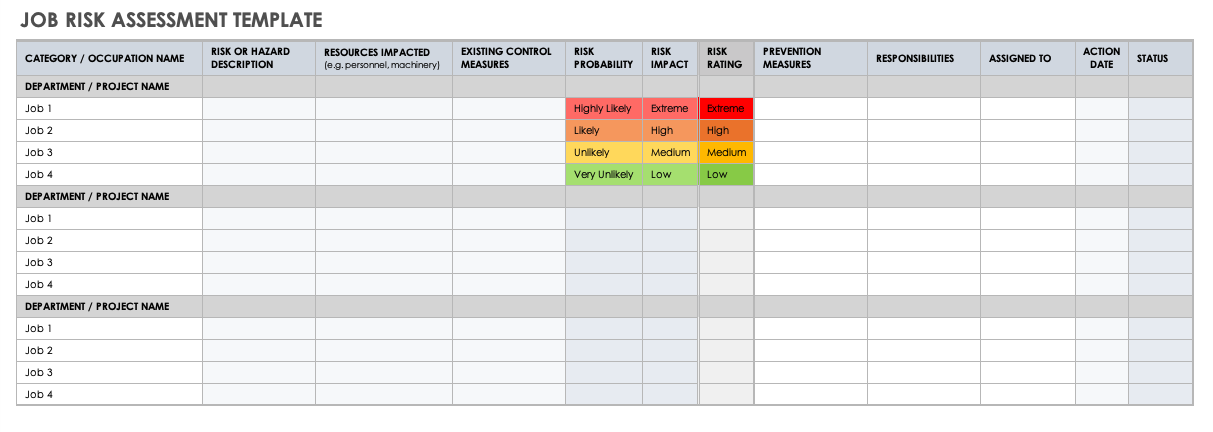

Each loan is evaluated under four risk components. Yellow is medium risk. Market research has its place in your business but this isnt it. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. This form prints with all new business deposit account forms at his bankThe CSRs use this tool to risk rate business deposit accounts for BSA purposes and it contains away to gather info for. One approach to guarantee that all dangers are assessed similarly is to utilize a risk assessment form.

Any institution may find this form helpful.

This spreadsheet contains the form that after you assign a numerical score to each question asked it calculates a score then give a low med or high risk. Form A201 MLCO Questionnaire. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in some cases negating the risk. Risks ought to be deliberately recognized and explored to guarantee those things exercises circumstances forms and so forth that reason damage to individuals or property are controlled.

Source: slideteam.net

Source: slideteam.net

Remisier Dealer required to ensure to obtain Data Correction Request Form A. This form prints with all new business deposit account forms at his bankThe CSRs use this tool to risk rate business deposit accounts for BSA purposes and it contains away to gather info for. Quarterly Transaction Report Free zone. This spreadsheet contains the form that after you assign a numerical score to each question asked it calculates a score then give a low med or high risk suggestion it also contains a sheet we use on newly established accounts to review their actual routine cash transactions against what. It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in some cases negating the risk.

Source: smartsheet.com

Source: smartsheet.com

Each loan is evaluated under four risk components. To calculate a Quantative Risk Rating begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive. It comprises of a number of subheads which the person assessing the situation needs to fill in based on his findings. The maximum individual component score and overall score are outlined below. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component.

Source: smartsheet.com

Source: smartsheet.com

Quarterly Transaction Report Jeweler Vehicle Dealers Real Estate Agents. Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. To be completed by Dealer Remisier Authorised Officer Business Owner Treasury Markets TM Equity Markets EM Debt Markets DM Client Coverage CC Yes No a. This form prints with all new business deposit account forms at his bankThe CSRs use this tool to risk rate business deposit accounts for BSA purposes and it contains away to gather info for. Origin of the client - High Risk Country.

Source: slideteam.net

Source: slideteam.net

Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Risk Assessment Form Template 40 Examples. 255 rows AML Risk Assessment Template and Sample Rating Matrix Downloadable Template. Market research has its place in your business but this isnt it. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose.

Source: smartsheet.com

Source: smartsheet.com

It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in some cases negating the risk. Market research has its place in your business but this isnt it. A Risk Assessment Form is used to assess the risk involved in a particular event or circumstance. BOL user Oursisnottoreasonwhy and his bank created this worksheet to make the job easier and more consistent. It comprises of a number of subheads which the person assessing the situation needs to fill in based on his findings.

Source: pinterest.com

Source: pinterest.com

Chief Compliance Officer at a bank 178MUSA We use this form at account opening or account review to help determine a possible account risk rating. It comprises of a number of subheads which the person assessing the situation needs to fill in based on his findings. Quarterly Transaction Report Jeweler Vehicle Dealers Real Estate Agents. BOL user Oursisnottoreasonwhy and his bank created this worksheet to make the job easier and more consistent. One approach to guarantee that all dangers are assessed similarly is to utilize a risk assessment form.

Source: hsa.ie

Source: hsa.ie

Risks ought to be deliberately recognized and explored to guarantee those things exercises circumstances forms and so forth that reason damage to individuals or property are controlled. This allows bank management and examiners to monitor changes and trends. Form A201 MLCO Questionnaire. Remisier Dealer required to ensure to obtain Data Correction Request Form A. Risks ought to be deliberately recognized and explored to guarantee those things exercises circumstances forms and so forth that reason damage to individuals or property are controlled.

Source: service.betterregulation.com

Source: service.betterregulation.com

A Risk Assessment Form is used to assess the risk involved in a particular event or circumstance. Consumer Risk Assessment CFPBs Risk Assessment process is designed to evaluate on a consistent basis the extent of risk to consumers arising from the activities of a particular supervised entity and to identify the sources of that risk. It doesnt matter if theyre Dissatisfied Big sad face two-out-of-five stars or a 310 on the NPS scale. Green is low risk. If you want them to keep being your customer and if you want to grow your business through their referrals you need to fix the problem.

Source: smartsheet.com

Source: smartsheet.com

To calculate a Quantative Risk Rating begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive. If you want them to keep being your customer and if you want to grow your business through their referrals you need to fix the problem. To calculate a Quantative Risk Rating begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive. Chief Compliance Officer at a bank 178MUSA We use this form at account opening or account review to help determine a possible account risk rating. If you want to improve your upcoming event you can get suggestions from participants by using this event satisfaction survey template.

Source: smartsheet.com

Source: smartsheet.com

Chief Compliance Officer at a bank 178MUSA We use this form at account opening or account review to help determine a possible account risk rating. Market research has its place in your business but this isnt it. Casino Monthly Transaction Report. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. The maximum individual component score and overall score are outlined below.

Source: smartsheet.com

Source: smartsheet.com

Scores used for risk ratings are based on an evaluation of the relative strength or weakness of each consideration within the risk component. This allows bank management and examiners to monitor changes and trends. Remisier Dealer required to ensure to obtain Data Correction Request Form A. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. Event Satisfaction Survey Form.

Source: safety.unimelb.edu.au

Source: safety.unimelb.edu.au

Form A201 MLCO Questionnaire. To calculate a Quantative Risk Rating begin by allocating a number to the Likelihood of the risk arising and Severity of Injury and then multiply the Likelihood by the Severity to arrive. Orange is high risk. Generally this short hand form of risk rating is used to determine which hazard should take priority over another in terms of deciding what to do and when. This operational risk management template is ideal for creating a list of risks the rate and cost of annual incidents probability of risk occurrence and associated mitigation and control costs.

Source: xenongroup.co.uk

Source: xenongroup.co.uk

Risk Assessment Form Template 40 Examples. It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in some cases negating the risk. To use a risk matrix extract the data from the risk assessment form and plug it into the matrix accordingly. The risk rating model uses an Excel spreadsheet. This allows bank management and examiners to monitor changes and trends.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title consumer risk rating form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information