19++ Countries with high risk of money laundering ideas in 2021

Home » about money loundering Info » 19++ Countries with high risk of money laundering ideas in 2021Your Countries with high risk of money laundering images are available. Countries with high risk of money laundering are a topic that is being searched for and liked by netizens today. You can Download the Countries with high risk of money laundering files here. Get all royalty-free photos and vectors.

If you’re looking for countries with high risk of money laundering pictures information linked to the countries with high risk of money laundering keyword, you have pay a visit to the ideal blog. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

Countries With High Risk Of Money Laundering. The EU Commission adopted on 13 February its new list of 23 third countries with strategic deficiencies in their anti-money laundering and. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333aAny references to high-risk third countries. Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries.

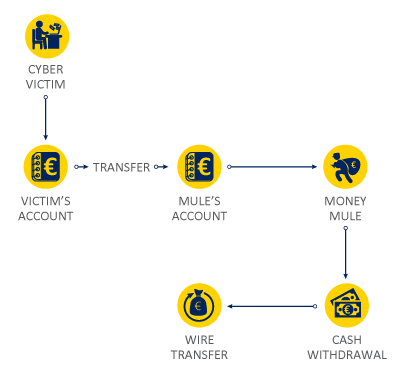

Money Laundering Crime Areas Europol From europol.europa.eu

Money Laundering Crime Areas Europol From europol.europa.eu

High Risk Third Countries Statement. The objective of the listing is to protect the. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. UK national risk assessment of money laundering and terrorist financing. The Anti-Money Laundering Directive was revised in order to provide a broader set of criteria in view of an autonomous assessment by the Commission of third countries. Geographies where money laundering or terrorist financing risk is high.

As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie.

Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. The objective of the listing is to protect the. High Risk Third Countries Statement. High-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes. Geographies where money laundering or terrorist financing risk is high. Money Laundering Regulations.

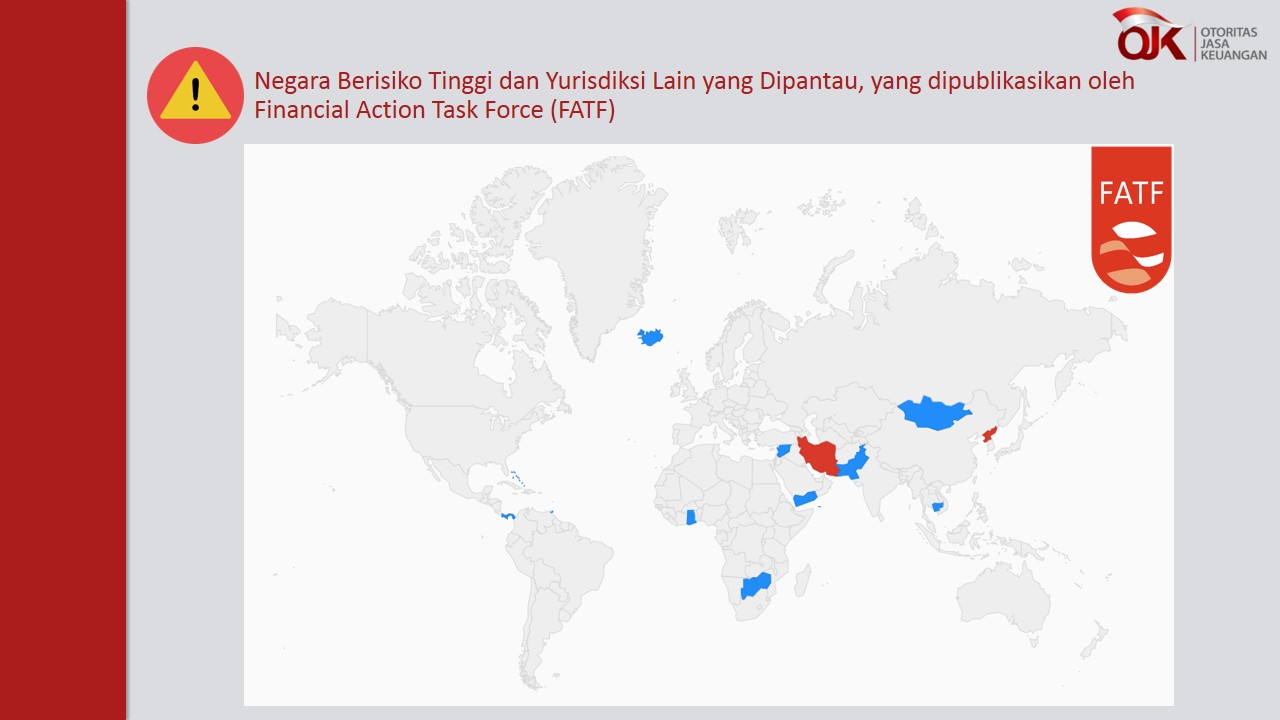

Source: ojk.go.id

Source: ojk.go.id

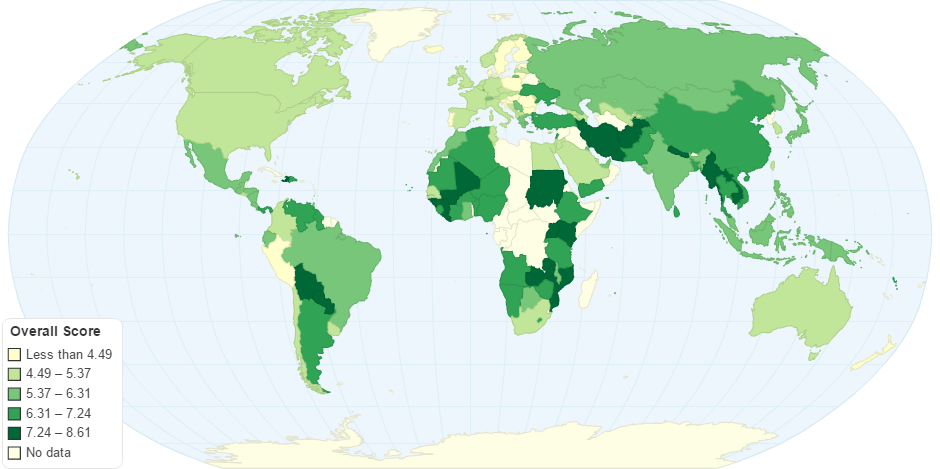

Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. High-Risk Countries for Money Laundering. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333aAny references to high-risk third countries. According to the 2019 Basel Anti-Money Laundering Index Cambodia was rated as having the 16th worst risk for money laundering in the world out of 125 countries measured improving from seventh most risky of 129 nations in 2018.

Source: amlcompliance.ie

Source: amlcompliance.ie

This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. High-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD.

Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. High Risk Third Countries Statement. Geographies where money laundering or terrorist financing risk is high. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes.

Source: ec.europa.eu

Source: ec.europa.eu

Translated and edited from the original article on VOD Khmer. Which Countries Are High Risk For Money Laundering pada tanggal Agustus 05 2021. A new UK list of high risk third countries for the purposes of enhanced customer due diligence requirements has been published. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. Money Laundering Regulations.

Source: bi.go.id

Source: bi.go.id

The Anti-Money Laundering Directive was revised in order to provide a broader set of criteria in view of an autonomous assessment by the Commission of third countries. These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie. The Anti-Money Laundering Directive was revised in order to provide a broader set of criteria in view of an autonomous assessment by the Commission of third countries.

Source: bitquery.io

Source: bitquery.io

High-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes. The Anti-Money Laundering Directive was revised in order to provide a broader set of criteria in view of an autonomous assessment by the Commission of third countries. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. The 24 high-risk third countries are. As at end of June 2018 the FATF identified 8 jurisdictions with deficiencies in their anti-money laundering andor combating the financing of terrorism regime AMLCFT ie.

Source: pinterest.com

Source: pinterest.com

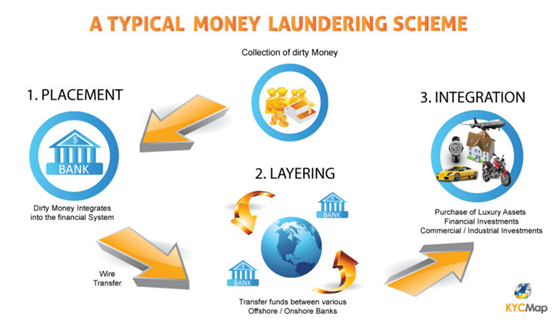

Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. A risk-based approach means that countries competent authorities and banks identify assess and understand the money laundering and terrorist financing risk to which they are exposed and take the appropriate mitigation measures in accordance with the level of risk. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 introduces this list in Schedule 3ZA which replaces the previous definition in Regulation 333aAny references to high-risk third countries. The Anti-Money Laundering Directive was revised in order to provide a broader set of criteria in view of an autonomous assessment by the Commission of third countries. The 24 high-risk third countries are.

Source: acfcs.org

Source: acfcs.org

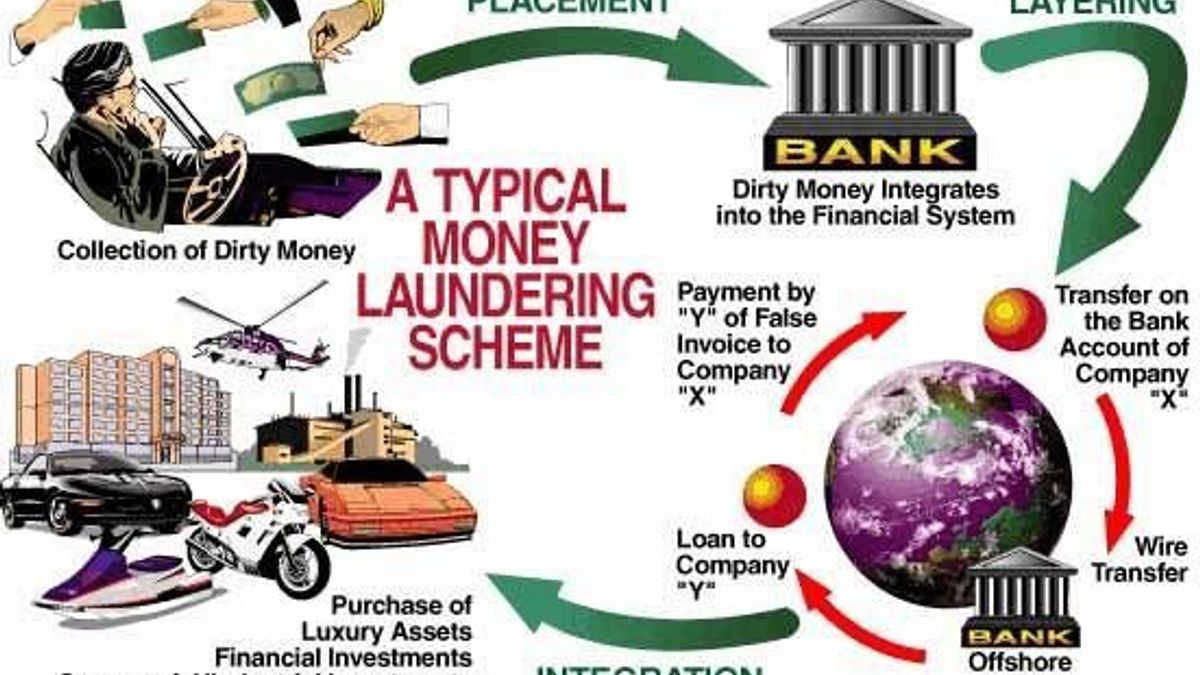

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. The objective of the listing is to protect the. A new UK list of high risk third countries for the purposes of enhanced customer due diligence requirements has been published. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021.

Source: ft.lk

Source: ft.lk

Ethiopia Pakistan Republic of Serbia Sri Lanka Syria Trinidad and Tobago Tunisia and Yemen. Geographies where money laundering or terrorist financing risk is high. EU list of high-risk third countries. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. The objective of the listing is to protect the.

Source: jagranjosh.com

Source: jagranjosh.com

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. A risk-based approach means that countries competent authorities and banks identify assess and understand the money laundering and terrorist financing risk to which they are exposed and take the appropriate mitigation measures in accordance with the level of risk. As of October 2018 the FATF has reviewed over 80 countries and. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. High-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes.

Source: redalyc.org

Source: redalyc.org

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. The objective of the listing is to protect the. A new UK list of high risk third countries for the purposes of enhanced customer due diligence requirements has been published. By eub2 – last modified 13 February 2019.

High-Risk Countries for Money Laundering. High-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes. The objective of the listing is to protect the. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. As of October 2018 the FATF has reviewed over 80 countries and.

Source: europol.europa.eu

Source: europol.europa.eu

High-Risk Countries for Money Laundering. These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. EU list of high-risk third countries. Translated and edited from the original article on VOD Khmer. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title countries with high risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas