18+ Countries with higher risk of money laundering ideas

Home » about money loundering idea » 18+ Countries with higher risk of money laundering ideasYour Countries with higher risk of money laundering images are available. Countries with higher risk of money laundering are a topic that is being searched for and liked by netizens now. You can Get the Countries with higher risk of money laundering files here. Get all royalty-free photos.

If you’re searching for countries with higher risk of money laundering images information related to the countries with higher risk of money laundering topic, you have pay a visit to the right site. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Countries With Higher Risk Of Money Laundering. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring.

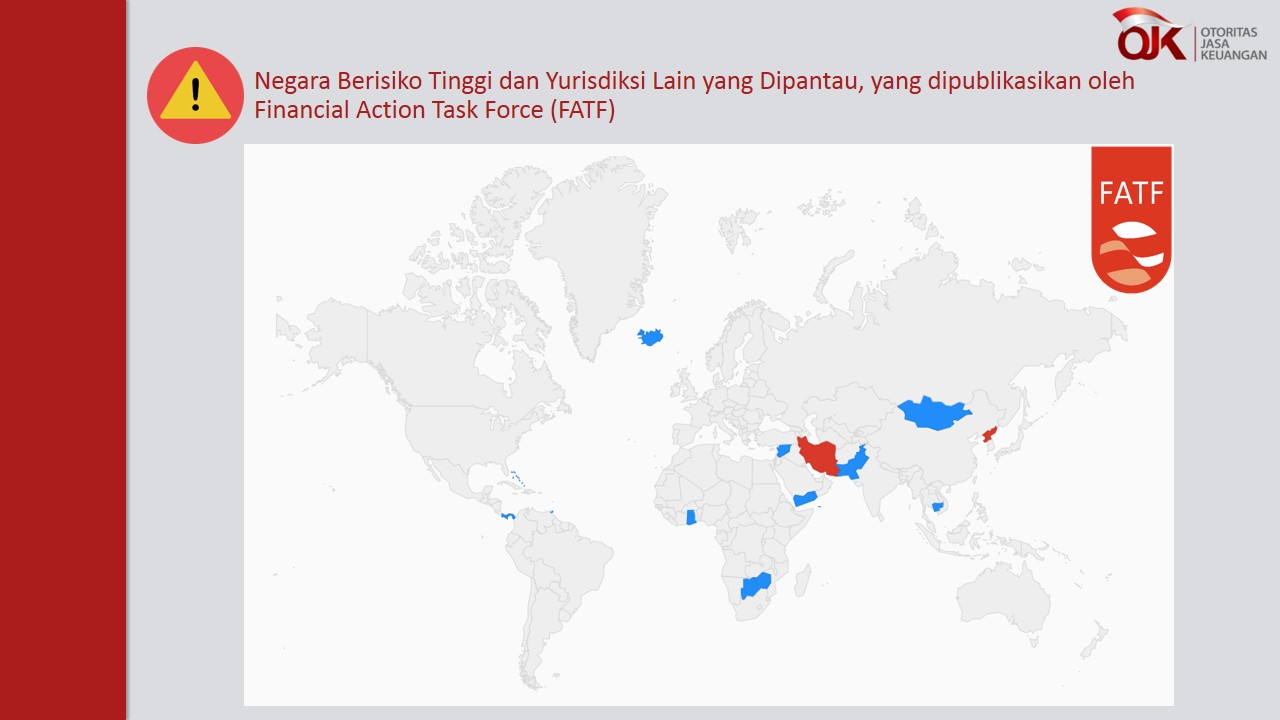

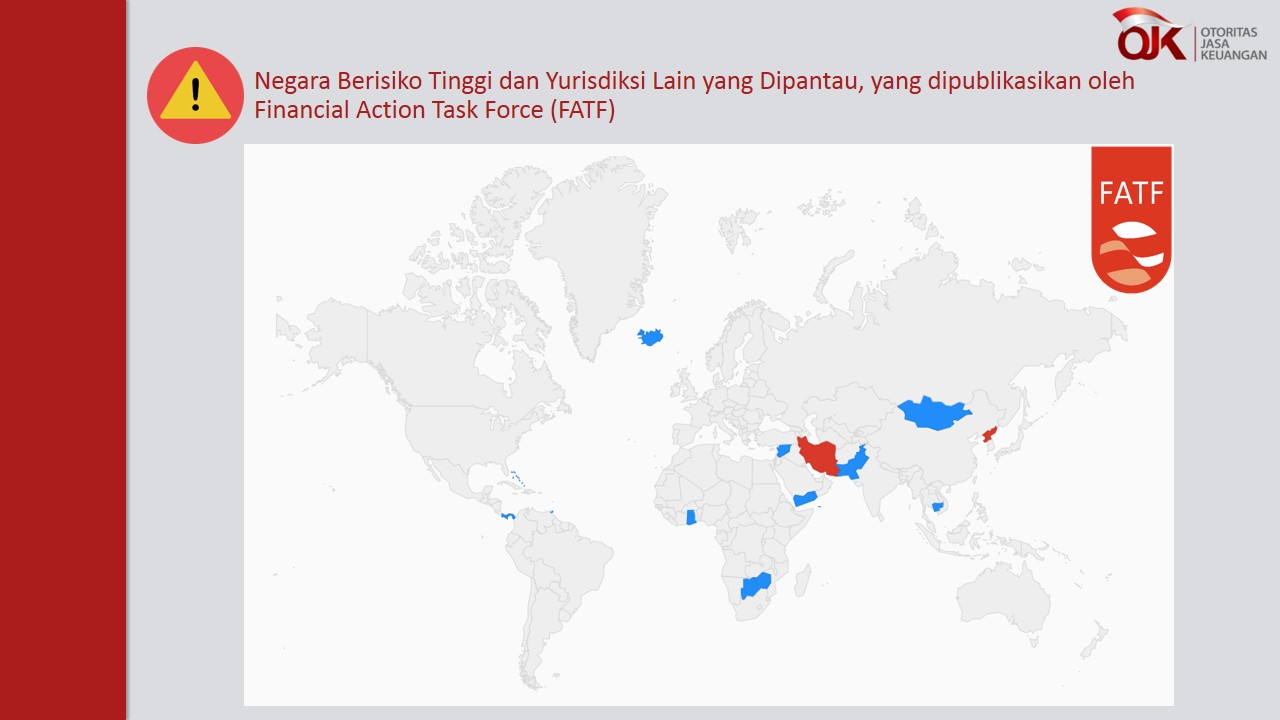

Informasi Terkait Daftar Negara Berisiko Tinggi Dan Yurisdiksi Lain Yang Dipantau Yang Dipublikasikan Oleh Financial Action Task Force Fatf From ojk.go.id

Informasi Terkait Daftar Negara Berisiko Tinggi Dan Yurisdiksi Lain Yang Dipantau Yang Dipublikasikan Oleh Financial Action Task Force Fatf From ojk.go.id

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. EU list of high-risk third countries 13 February 2019 by eub2– last modified 13 February 2019 The EU Commission adopted on 13 February its new list of 23 third countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. We list nearly half of all countries as major money-laundering destinations - China Hong Kong Indonesia Laos Macao Malaysia Myanmar Philippines Thailand and Vietnam.

Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore.

These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk third country. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD.

Source: ctmfile.com

Source: ctmfile.com

High-Risk Products or Services. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. Under 4MLD the European Commission must from time to time draw up. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing.

Source: ft.lk

Source: ft.lk

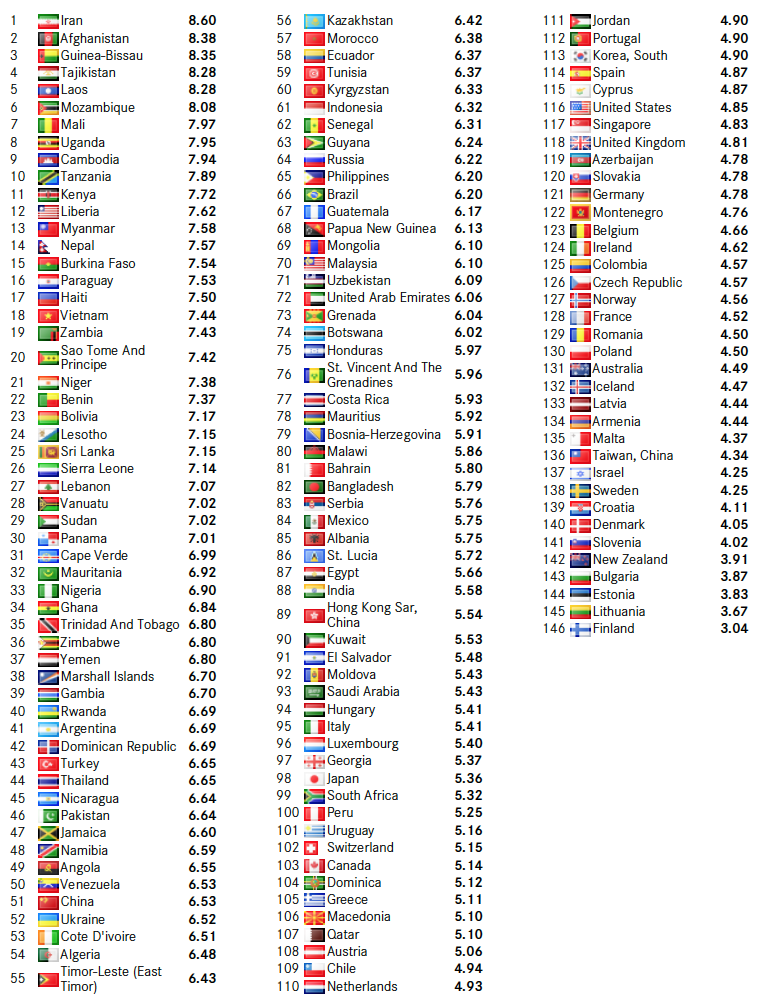

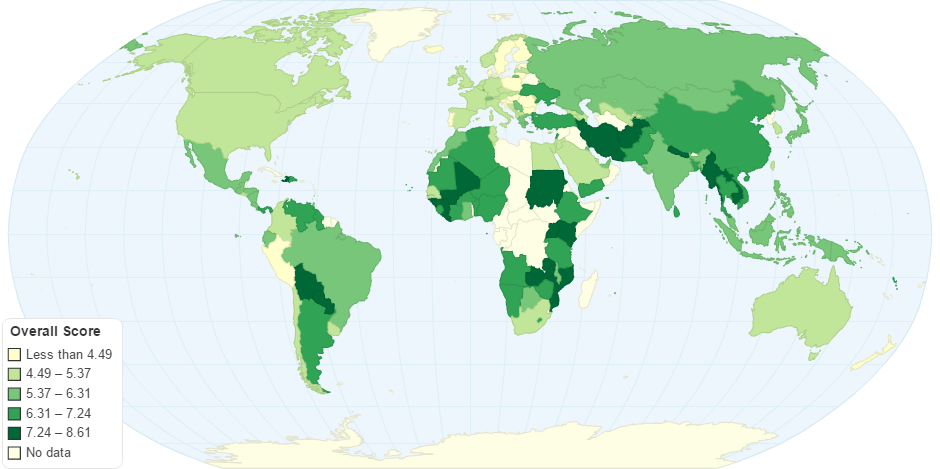

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. We list nearly half of all countries as major money-laundering destinations - China Hong Kong Indonesia Laos Macao Malaysia Myanmar Philippines Thailand and Vietnam. Geographies where money laundering or terrorist financing risk is high. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing.

Source: bi.go.id

Source: bi.go.id

As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. We list nearly half of all countries as major money-laundering destinations - China Hong Kong Indonesia Laos Macao Malaysia Myanmar Philippines Thailand and Vietnam. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing.

Source: pinterest.com

Source: pinterest.com

The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk. Industries that involve certain products or services can also be a factor contributing to a higher risk of terrorist financing or money laundering. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore.

A large volume of electronic payments like ACH wire transfers remittances. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money.

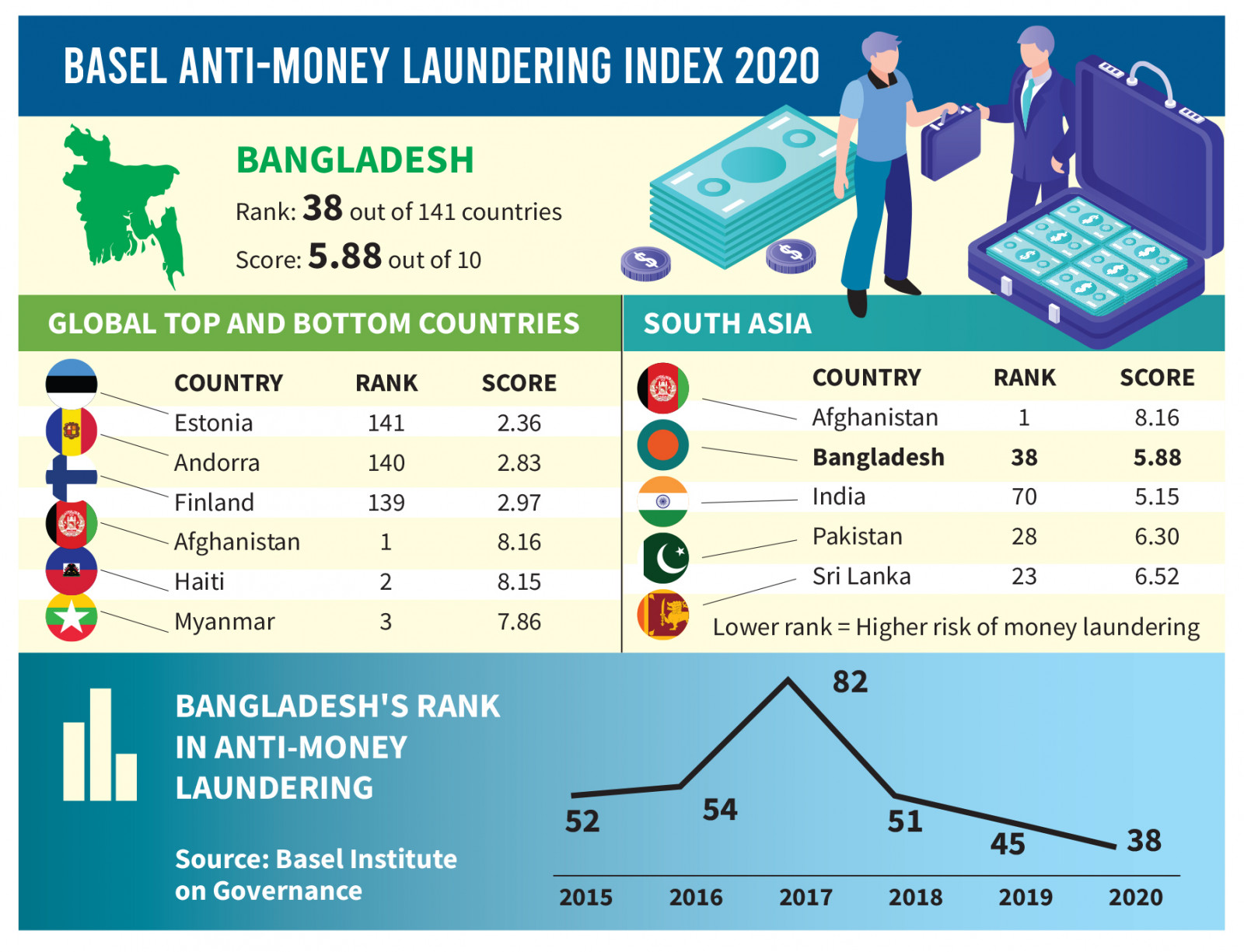

Source: tbsnews.net

Source: tbsnews.net

The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. Hong Kong Japan Singapore and Taiwan face the most massive issues with financial secrecy. The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering.

Source: pinterest.com

Source: pinterest.com

Money Laundering Regulations. Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. High Risk Third Countries Statement UK national risk assessment of money laundering and terrorist financing Money laundering. Hong Kong Japan Singapore and Taiwan face the most massive issues with financial secrecy.

Source: ojk.go.id

Source: ojk.go.id

Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money.

Source: baselgovernance.org

Source: baselgovernance.org

The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk third country. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Although these countries committed to develop and improve their AMLCFT regimes and national compliance efforts they are currently considered high-risk countries for AMLCFT purposes. What are considered higher risk customer types for money laundering. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing.

Source: ec.europa.eu

Source: ec.europa.eu

These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. New delegated act on high-risk third countries.

Source: tbsnews.net

Source: tbsnews.net

What are considered higher risk customer types for money laundering. Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. As of October 2018 the FATF has reviewed over 80 countries and. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. What are considered higher risk customer types for money laundering.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

You should have risk-based systems and controls in place for. The Democratic Peoples Republic of Korea and Iran remain high-risk jurisdictions. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring.

Source: bi.go.id

Source: bi.go.id

A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore. EU list of high-risk third countries 13 February 2019 by eub2– last modified 13 February 2019 The EU Commission adopted on 13 February its new list of 23 third countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks. The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title countries with higher risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information