15+ Country money laundering risk ratings info

Home » about money loundering Info » 15+ Country money laundering risk ratings infoYour Country money laundering risk ratings images are available in this site. Country money laundering risk ratings are a topic that is being searched for and liked by netizens today. You can Get the Country money laundering risk ratings files here. Download all free images.

If you’re searching for country money laundering risk ratings images information connected with to the country money laundering risk ratings keyword, you have visit the right site. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Country Money Laundering Risk Ratings. The last follow up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Guernsey was undertaken in 2016. A EU or EEA countries. The criteria included the availability and access to beneficial ownership information existence of effective proportionate and dissuasive sanctions in case of breaches of anti-money laundering and counter terrorist financing obligations as well as third countries practice in cooperation and exchange of. ABN AMRO Bank NVs ratings are unaffected by the EUR480 million settlement following the conclusion of an anti-money laundering AML investigation Fitch Ratings says.

Keeping Up With Money Laundering Risks Updates To This Year S Basel Aml Index Methodology Basel Institute On Governance From baselgovernance.org

Keeping Up With Money Laundering Risks Updates To This Year S Basel Aml Index Methodology Basel Institute On Governance From baselgovernance.org

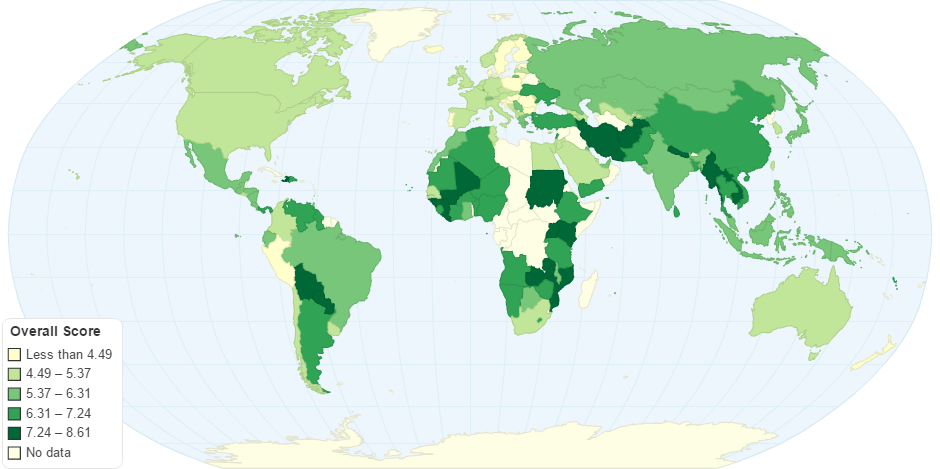

Geographical risk factors characterise situations which potentially pose a limited risk Appendix 2. US Department of State Money Laundering assessment INCSR Cayman Islands is categorised by the US State Department as a CountryJurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes. It was deemed Highly effective for 0 and Substantially Effective for 0 of the Effectiveness Technical Compliance ratings. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. The domicile has strong anti-money laundering regulations. The overall risk score of the country has jumped up from 394 to 538 out of 10 where 10 is the highest possible risk.

Medium country money laundering risk rating.

Medium country money laundering risk rating. It can also be used by regulators to design low or lower MLTF risk financial products. A EU or EEA countries. According to that Evaluation Guernsey was deemed Compliant for 28 and Largely Compliant for 20 of the FATF 40 9 Recommendations. The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Nigeria was undertaken by the Financial Action Task Force FATF in 2007. The authors of the report note that the Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF worldwide.

Source: baselgovernance.org

Source: baselgovernance.org

This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. Based upon data collected from many international and government agencies we have subjectively weighted the findings to provide a free rating tool that is predominantly focused on money laundering. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. Approach RBA to Managing Money Laundering Risks which set out a number of commonly used risk criteria to measure money laundering risks including a country risk factor.

Source: ojk.go.id

Source: ojk.go.id

A EU or EEA countries. The domicile has some weaknesses in its anti-money laundering laws. The penalty announced on April 19 has a moderate one-off financial impact on. The domicile has low or non-existent anti-money laundering. KnowYourCountry Limited has achieved ISO 90012015 Certification for the provision of on-line information of money laundering and sanction information on a country by country basis.

Source: researchgate.net

Source: researchgate.net

According to that Evaluation Nigeria was deemed Compliant for 2 and Largely Compliant for 7 of the FATF 40 9 Recommendations. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. This module aims to assist authorities in evaluating money laundering and terrorist financing risks arising from both existing and emergingnew financial inclusion products and can be used as a basis for designing a risk-based approach in the preventive measures. Normal country money laundering risk rating. Russias legal framework appropriately addresses these risks and the country has formal policies in place supported by strong domestic co-ordination and co-operation to combat money laundering.

Source: dpnsee.org

Source: dpnsee.org

Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships. Since the publication of that guidance the industry has evolved its understanding of money laundering risks and how to implement appropriate controls to manage those risks. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. Based upon data collected from many international and government agencies we have subjectively weighted the findings to provide a free rating tool that is predominantly focused on money laundering. The overall risk score of the country has jumped up from 394 to 538 out of 10 where 10 is the highest possible risk.

Source: bi.go.id

Source: bi.go.id

This is particularly true of country risk and its means of. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Nigeria was undertaken by the Financial Action Task Force FATF in 2007. The last follow up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Guernsey was undertaken in 2016. Based upon data collected from many international and government agencies we have subjectively weighted the findings to provide a free rating tool that is predominantly focused on money laundering.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

The domicile has strong anti-money laundering regulations. Medium country money laundering risk rating. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with.

Source: coe.int

Source: coe.int

US Department of State Money Laundering assessment INCSR Cayman Islands is categorised by the US State Department as a CountryJurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. The domicile has some weaknesses in its anti-money laundering laws. Fitch Ratings-WarsawLondon-20 April 2021. The domicile has low or non-existent anti-money laundering.

Source: globale2c.com.sg

Source: globale2c.com.sg

Fitch Ratings-WarsawLondon-20 April 2021. A EU or EEA countries. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. Geographical risk factors characterise situations which potentially pose a limited risk Appendix 2. A domicile may have one of three country money laundering risks.

A national risk assessment complemented by in-depth knowledge of relevant law enforcement agencies has allowed the country to identify and understand its risks including terrorist financing risks. Geographical risk factors characterise situations which potentially pose a limited risk Appendix 2. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. Fitch Ratings-WarsawLondon-20 April 2021. These requirements have been strengthened by the Fifth Anti-Money Laundering Directive.

Geographical risk factors characterise situations which potentially involve an increased risk Appendix 3. The last follow up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Guernsey was undertaken in 2016. This is particularly true of country risk and its means of. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. Russias legal framework appropriately addresses these risks and the country has formal policies in place supported by strong domestic co-ordination and co-operation to combat money laundering.

Source: bi.go.id

Source: bi.go.id

The domicile has strong anti-money laundering regulations. The domicile has low or non-existent anti-money laundering. The new FATF assessment is the main cause for such dramatic changes. It was deemed Highly effective for 0 and Substantially Effective for 0 of the Effectiveness Technical Compliance ratings. MLTF country risk-rating tool for compliance and risk assessment purposes.

Source: bi.go.id

Source: bi.go.id

High country money laundering risk rating. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. Fitch Ratings-WarsawLondon-20 April 2021. According to that Evaluation Nigeria was deemed Compliant for 2 and Largely Compliant for 7 of the FATF 40 9 Recommendations. A domicile may have one of three country money laundering risks.

Source: ec.europa.eu

Source: ec.europa.eu

A EU or EEA countries. Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. It was deemed Highly effective for 0 and Substantially Effective for 0 of the Effectiveness Technical Compliance ratings. In a 2019 report published by think tank Basel Institute on Governance Estonia has been ranked among the 125 countries examined as the country with the lowest risk of money laundering worldwide.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title country money laundering risk ratings by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas