12+ Credit union bank secrecy act policy ideas in 2021

Home » about money loundering Info » 12+ Credit union bank secrecy act policy ideas in 2021Your Credit union bank secrecy act policy images are available in this site. Credit union bank secrecy act policy are a topic that is being searched for and liked by netizens now. You can Get the Credit union bank secrecy act policy files here. Find and Download all free photos and vectors.

If you’re searching for credit union bank secrecy act policy images information connected with to the credit union bank secrecy act policy topic, you have pay a visit to the ideal site. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

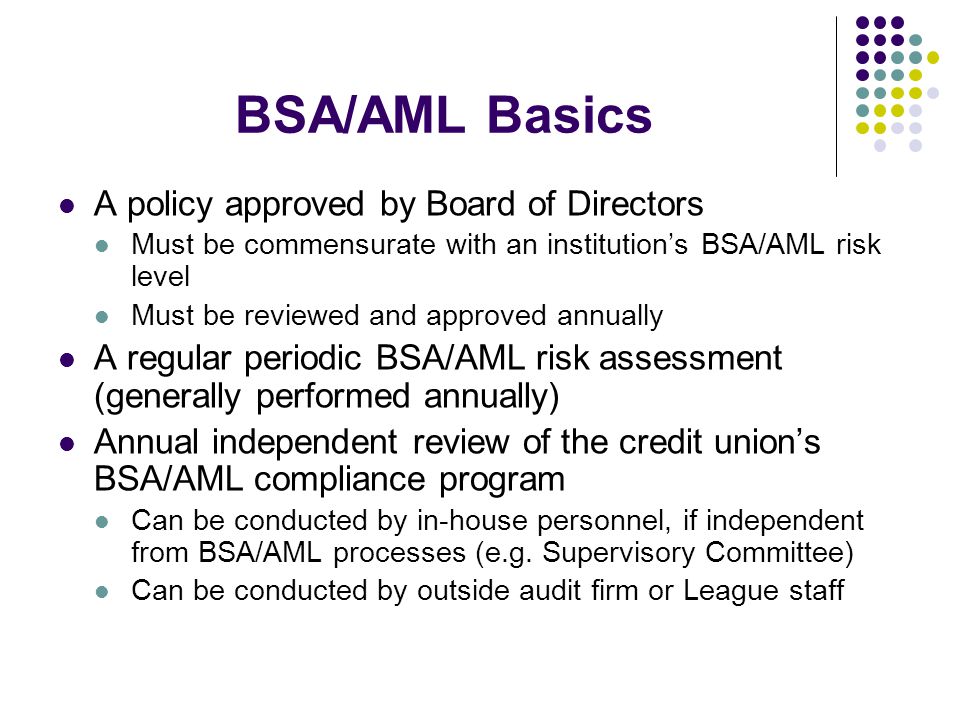

Credit Union Bank Secrecy Act Policy. This is key to being in compliance with the require-ments of the Bank Secrecy Act. CF-LA Credit Union Policy Manual - 9 - The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race color religion national origin sex age provided that the applicant has the capacity to enter into a binding contract because all or part of the applicants income derives from any public assistance program or because the applicant has in good. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. Additionally all employees who handle member transactions as well as all Board members are required to attend BSA training annually.

Ncua Board Of Directors Policies Required Policies And Risk Assessm From slideshare.net

Ncua Board Of Directors Policies Required Policies And Risk Assessm From slideshare.net

You get specific sample credit union policies and procedures for every appropriate area like fair lending AL management and personnel to satisfy the examiners and help. Government agencies in detecting and preventing money laundering such as. Organized to serve democratically controlled credit unions provide their members with a safe place to save and borrow at reasonable rates. As such some of the Bank Secrecy Act requirements are not applicable. Quarterly BSA Enewsletter NAFCUs BSA Blast is a NAFCU member-only quarterly enewsletter offering coverage and analysis of credit union compliance issues and industry activity concerning the Bank Secrecy Act BSA and Treasurys Office of Foreign Assets Control OFAC regulations. Of course you also need to be sure that you know the BSA policy and procedures at your credit union.

Additionally all employees who handle member transactions as well as all Board members are required to attend BSA training annually.

As such some of the Bank Secrecy Act requirements are not applicable. The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures. Quarterly BSA Enewsletter NAFCUs BSA Blast is a NAFCU member-only quarterly enewsletter offering coverage and analysis of credit union compliance issues and industry activity concerning the Bank Secrecy Act BSA and Treasurys Office of Foreign Assets Control OFAC regulations. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. As part of the credit unions overall compliance with the Bank Secrecy Act it is the policy of the credit union to have a clear and concise understanding of all credit union member practices in order to avoid criminal exposure to the credit union by any member who would use the credit unions.

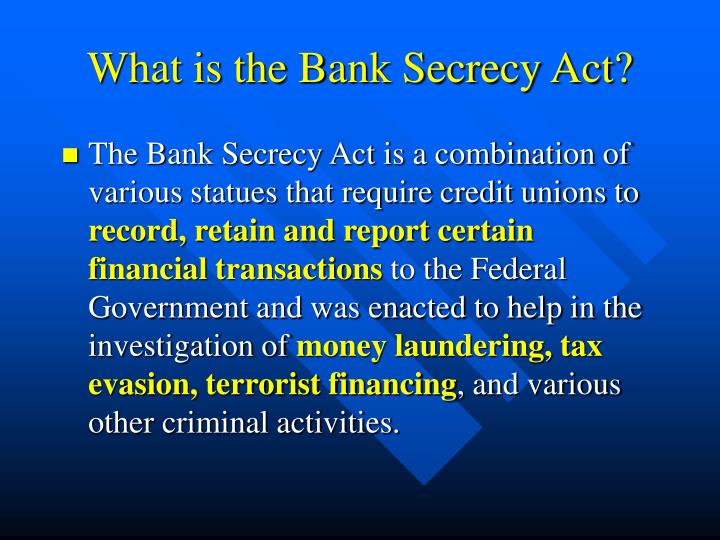

The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Bank Secrecy Act BSA Training Certificate for Board of Directors. Bank Secrecy Act Resources National Credit Union Administration Bank Secrecy Act Resources In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act BSA establishing recordkeeping and reporting requirements by private individuals banks and other financial institutions. Government agencies in detecting and preventing money laundering such as. The Second Quarter issue is available now.

Source: slideserve.com

Source: slideserve.com

Bank Secrecy Act Resources National Credit Union Administration Bank Secrecy Act Resources In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act BSA establishing recordkeeping and reporting requirements by private individuals banks and other financial institutions. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. The Division 819 Transit Employees Credit Union is a nonprofit cooperative financial institution owned and run by its members. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Bank Secrecy Act Resources National Credit Union Administration Bank Secrecy Act Resources In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act BSA establishing recordkeeping and reporting requirements by private individuals banks and other financial institutions. Bulletin B-05-07 is now cancelled and this Bulletin will replace it. Members pool their funds to make loans to one-another. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. The Division 819 Transit Employees Credit Union is a nonprofit cooperative financial institution owned and run by its members.

Source: slideshare.net

Source: slideshare.net

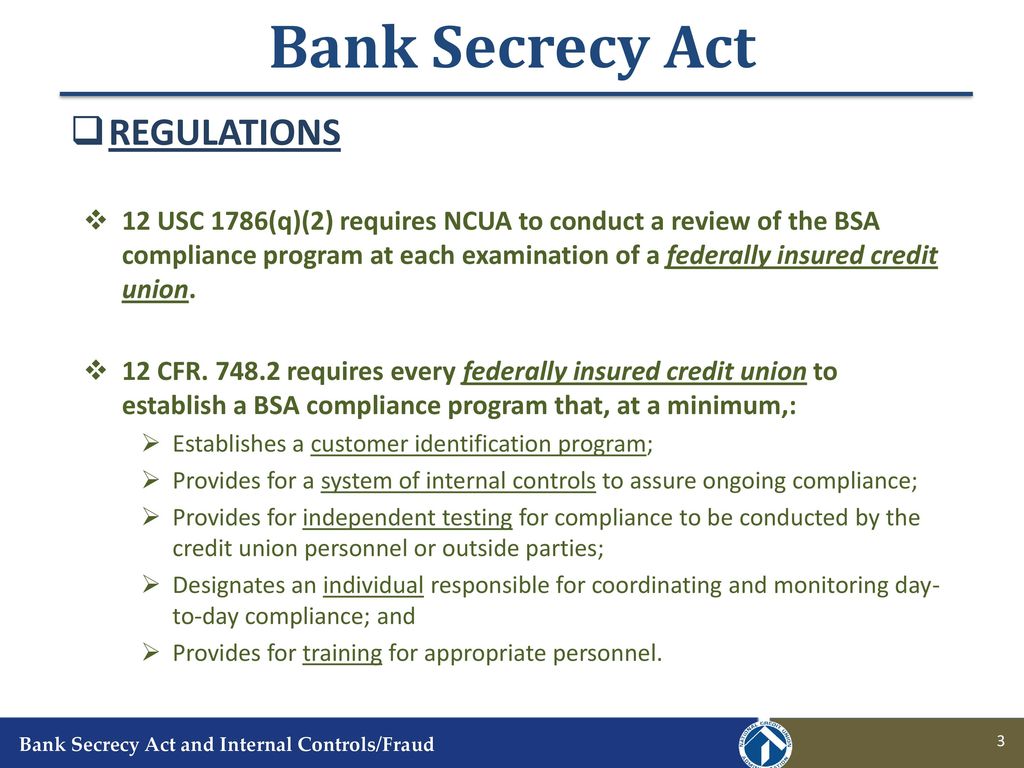

Bank Secrecy Act Resources National Credit Union Administration Bank Secrecy Act Resources In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act BSA establishing recordkeeping and reporting requirements by private individuals banks and other financial institutions. DIVISION 819 TRANSIT EMPLOYEES CREDIT UNION BANK SECRECY ACT POLICY Compliance Program Credit unions must establish and maintain a written compliance program for fulfilling the requirements of the BSA that includes at least. The Second Quarter issue is available now. Government agencies in detecting and preventing money laundering such as. Part 3268b1 of the FDIC Rules and Regulations.

Source: slideplayer.com

Source: slideplayer.com

The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures. You get specific sample credit union policies and procedures for every appropriate area like fair lending AL management and personnel to satisfy the examiners and help. Bank Secrecy Act Guidance and Exam Procedures While preparing the Division of Credit Unions Compliance Manual to be published in 2014 we noticed that Bulletin B-05-07 had out-of-date information. Bulletin B-05-07 is now cancelled and this Bulletin will replace it. Quarterly BSA Enewsletter NAFCUs BSA Blast is a NAFCU member-only quarterly enewsletter offering coverage and analysis of credit union compliance issues and industry activity concerning the Bank Secrecy Act BSA and Treasurys Office of Foreign Assets Control OFAC regulations.

Under the Bank Secrecy Act BSA financial institutions are required to assist US. You get specific sample credit union policies and procedures for every appropriate area like fair lending AL management and personnel to satisfy the examiners and help. CF-LA Credit Union Policy Manual - 9 - The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race color religion national origin sex age provided that the applicant has the capacity to enter into a binding contract because all or part of the applicants income derives from any public assistance program or because the applicant has in good. Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA YEAR LAW PURPOSE 1970 Bank Secrecy Act. Government agencies in detecting and preventing money laundering such as.

Source: slideplayer.com

Source: slideplayer.com

As such some of the Bank Secrecy Act requirements are not applicable. Additionally all employees who handle member transactions as well as all Board members are required to attend BSA training annually. Quarterly BSA Enewsletter NAFCUs BSA Blast is a NAFCU member-only quarterly enewsletter offering coverage and analysis of credit union compliance issues and industry activity concerning the Bank Secrecy Act BSA and Treasurys Office of Foreign Assets Control OFAC regulations. RPI EMPLOYEES FEDERAL CREDIT UNION BANK SECRECY ACT Compliance Program February 13 2012 The Rensselaer Polytechnic Institute Employees Federal Credit Union RPIEFCU is a non-cash operation. Policies and Procedures for Credit Unions is a comprehensive credit union policies and procedures manual that covers all the functional areas of credit unionsoperations lending financetreasury and administration.

Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. Organized to serve democratically controlled credit unions provide their members with a safe place to save and borrow at reasonable rates. Bank Secrecy Act including specific actions that you as a member of your credit unions operations staff must take to be BSA compliant. Additionally all employees who handle member transactions as well as all Board members are required to attend BSA training annually. Under the Bank Secrecy Act BSA financial institutions are required to assist US.

Source: slideplayer.com

Source: slideplayer.com

Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. Government agencies in detecting and preventing money laundering such as. DIVISION 819 TRANSIT EMPLOYEES CREDIT UNION BANK SECRECY ACT POLICY Compliance Program Credit unions must establish and maintain a written compliance program for fulfilling the requirements of the BSA that includes at least. The Second Quarter issue is available now. Under the Bank Secrecy Act BSA financial institutions are required to assist US.

Source: bankpolicies.com

Source: bankpolicies.com

CF-LA Credit Union Policy Manual - 9 - The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race color religion national origin sex age provided that the applicant has the capacity to enter into a binding contract because all or part of the applicants income derives from any public assistance program or because the applicant has in good. Organized to serve democratically controlled credit unions provide their members with a safe place to save and borrow at reasonable rates. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures. Bank Secrecy Act BSA Training Certificate for Board of Directors. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

CF-LA Credit Union Policy Manual - 9 - The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race color religion national origin sex age provided that the applicant has the capacity to enter into a binding contract because all or part of the applicants income derives from any public assistance program or because the applicant has in good. The individual enrolling new members must complete sign and date the CIP checklist. Government agencies in detecting and preventing money laundering such as. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures. Policies and Procedures for Credit Unions is a comprehensive credit union policies and procedures manual that covers all the functional areas of credit unionsoperations lending financetreasury and administration.

Source: slideplayer.com

Source: slideplayer.com

The individual enrolling new members must complete sign and date the CIP checklist. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. Bulletin B-05-07 is now cancelled and this Bulletin will replace it. The individual enrolling new members must complete sign and date the CIP checklist. Government agencies in detecting and preventing money laundering such as.

Source: slideplayer.com

Source: slideplayer.com

Government agencies in detecting and preventing money laundering such as. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Under the Bank Secrecy Act BSA financial institutions are required to assist US. RPI EMPLOYEES FEDERAL CREDIT UNION BANK SECRECY ACT Compliance Program February 13 2012 The Rensselaer Polytechnic Institute Employees Federal Credit Union RPIEFCU is a non-cash operation. DIVISION 819 TRANSIT EMPLOYEES CREDIT UNION BANK SECRECY ACT POLICY Compliance Program Credit unions must establish and maintain a written compliance program for fulfilling the requirements of the BSA that includes at least.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit union bank secrecy act policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 18+ How serious is money laundering ideas

- 10+ Fca appointed representative termination form information