17+ Crr customer risk rating ideas in 2021

Home » about money loundering Info » 17+ Crr customer risk rating ideas in 2021Your Crr customer risk rating images are ready. Crr customer risk rating are a topic that is being searched for and liked by netizens today. You can Get the Crr customer risk rating files here. Find and Download all royalty-free images.

If you’re searching for crr customer risk rating pictures information related to the crr customer risk rating keyword, you have visit the right blog. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Crr Customer Risk Rating. Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality. Commonly referred to as the customer risk rating. Used at the time of issuing a credit card sanctioning loans and advances opening a new account for an existing customer or increasing limits. National bank where the customers are rated from Low to High over 13 time periods.

Curentis Frankfurt From curentis.com

Curentis Frankfurt From curentis.com

The approach identifies high-risk customers far more effectively than the method used by most financial institutions today in some cases reducing the number of incorrectly labeled. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. As these are sensitive data we are not able to fully disclose all characteristics of the dataset. Commonly referred to as the customer risk rating. Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between.

Dynamic risk rating based on transaction indicators.

As these are sensitive data we are not able to fully disclose all characteristics of the dataset. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. LEVEL OF APPLICATION OF REQUIREMENTS. SUBJECT MATTER SCOPE AND DEFINITIONS. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. How to institute and manage a single consistent customer risk rating CRR methodology across its entire organization.

Source: alamy.com

Source: alamy.com

Create a form that asks for all of the types and amounts of activities they will have on the account. As these are sensitive data we are not able to fully disclose all characteristics of the dataset. Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time. Reporting into the Director AML Program Office this new position has been created for the primary purpose of managing the Banks Customer Risk Rating CRR Methodologies in the US in addition to supporting technology based Anti-Money Laundering AML and Know Your Customer KYC programs and projects. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism.

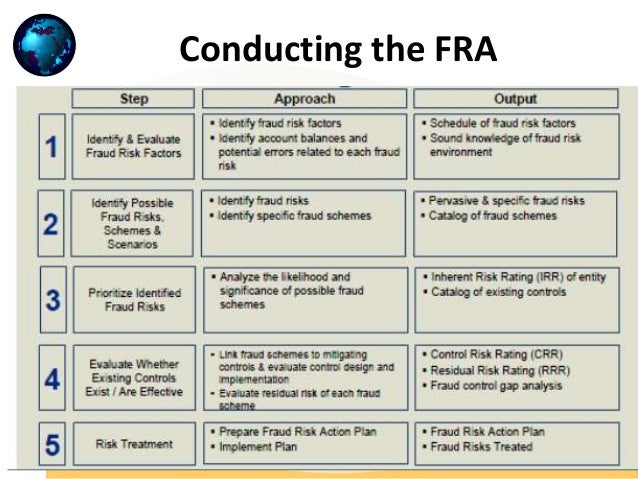

Source: slidetodoc.com

Source: slidetodoc.com

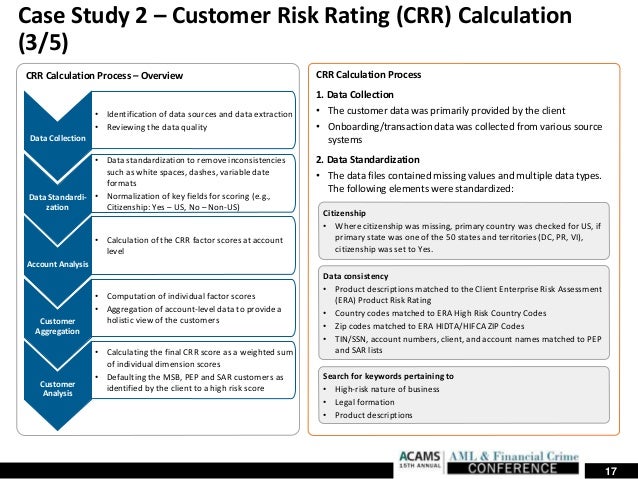

Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile. Transaction monitoring and customer screening. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. Further a spectrum of risks may be identifiable even within the same category of customers. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings.

Source: researchgate.net

Source: researchgate.net

A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time. You can rate them based upon that information.

Source: slidetodoc.com

Source: slidetodoc.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. SUBJECT MATTER SCOPE AND DEFINITIONS. National bank where the customers are rated from Low to High over 13 time periods. Configuring your CRR environment. Further a spectrum of risks may be identifiable even within the same category of customers.

Source: eba.europa.eu

Source: eba.europa.eu

The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. A statistical framework is presented to assess customer risk ratings used in anti-money laundering AML surveillance. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between.

Source: pt.slideshare.net

Source: pt.slideshare.net

A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts on an ongoing basis. Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Jason Chorlins.

Source:

Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time. It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Jason Chorlins. You can rate them based upon that information. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward.

Source: eba.europa.eu

Source: eba.europa.eu

Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile. Any customer account may be used for illicit purposes including money laundering or terrorist financing. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. Used in transaction risk scoring and fraud modelling. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Source: slidetodoc.com

Source: slidetodoc.com

Application of stricter requirements by institutions. How to institute and manage a single consistent customer risk rating CRR methodology across its entire organization. Reporting into the Director AML Program Office this new position has been created for the primary purpose of managing the Banks Customer Risk Rating CRR Methodologies in the US in addition to supporting technology based Anti-Money Laundering AML and Know Your Customer KYC programs and projects. You can rate them based upon that information. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business.

Source: eba.europa.eu

Source: eba.europa.eu

Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts on an ongoing basis. SUBJECT MATTER SCOPE AND DEFINITIONS. Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. Dynamic risk rating based on transaction indicators. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward.

Source: slideshare.net

Source: slideshare.net

Since this would require major changes to its. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Used at the time of issuing a credit card sanctioning loans and advances opening a new account for an existing customer or increasing limits. LEVEL OF APPLICATION OF REQUIREMENTS. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism.

Source:

Used at the time of issuing a credit card sanctioning loans and advances opening a new account for an existing customer or increasing limits. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Application of stricter requirements by institutions. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Jason Chorlins.

Source: curentis.com

Source: curentis.com

It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. A statistical framework is presented to assess customer risk ratings used in anti-money laundering AML surveillance. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title crr customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas