14+ Currency and foreign transactions reporting act ideas

Home » about money loundering Info » 14+ Currency and foreign transactions reporting act ideasYour Currency and foreign transactions reporting act images are ready. Currency and foreign transactions reporting act are a topic that is being searched for and liked by netizens now. You can Find and Download the Currency and foreign transactions reporting act files here. Find and Download all free images.

If you’re looking for currency and foreign transactions reporting act images information connected with to the currency and foreign transactions reporting act interest, you have pay a visit to the ideal blog. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

Currency And Foreign Transactions Reporting Act. Where chapter X of title 31 of the Code of Federal Regulations and 24017a-4 of this chapter require the same records or reports. Exemption handbook represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. These currency transactions need not be reported if they. Also known as the Currency and Foreign Transactions Reporting Act the Bank Secrecy Act BSA is US.

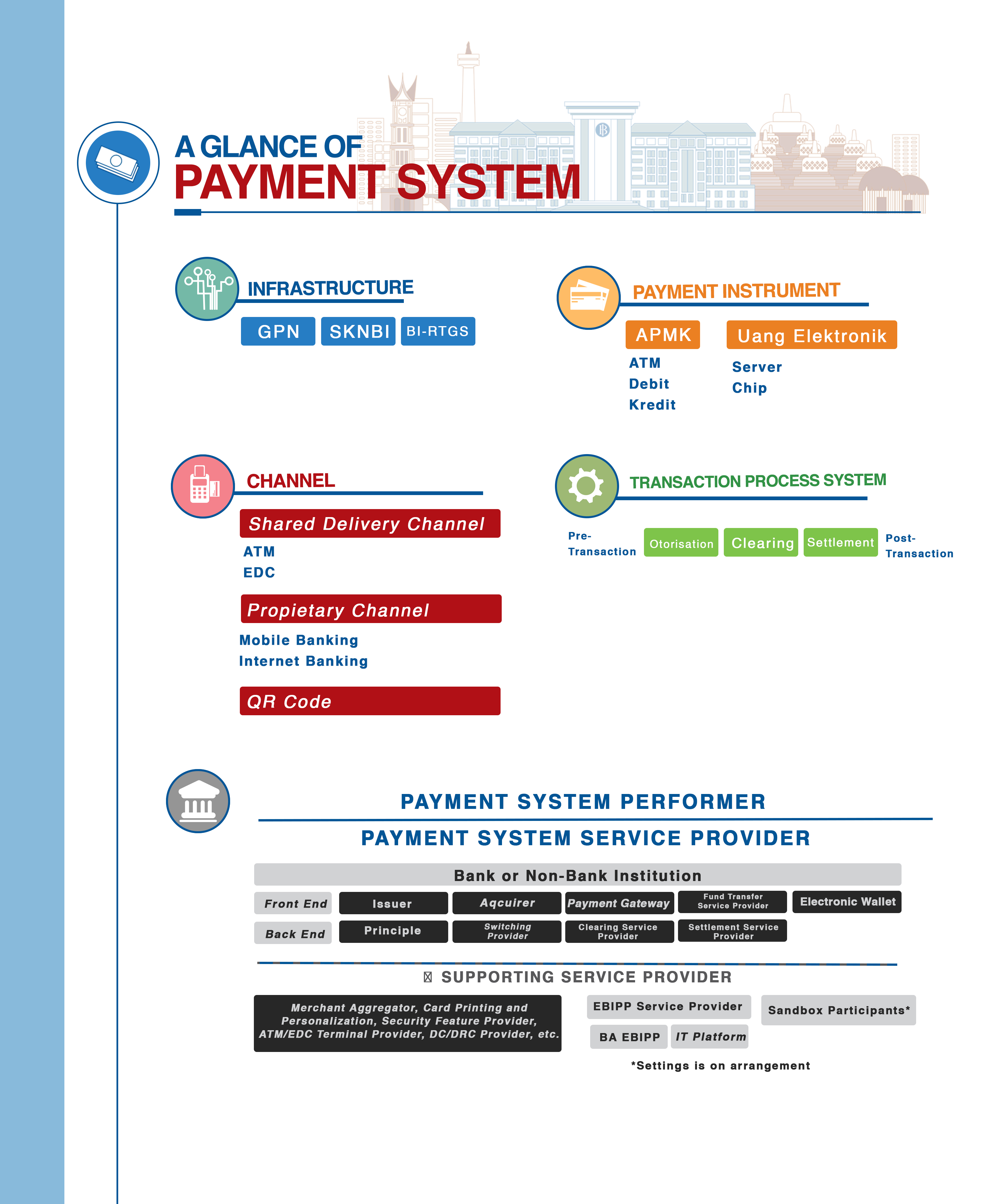

Payment System And Rupiah Currency Management From bi.go.id

Payment System And Rupiah Currency Management From bi.go.id

A bank must electronically file a Currency Transaction Report CTR for each transaction in currency 1 deposit withdrawal exchange of currency or other payment or transfer of more than 10000 by through or to the bank. Currency and Foreign Transactions Reporting Act 5010 Bank Secrecy Act Manual September 1997 Page 5. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Currency and Foreign Transactions Reporting Act. Currency and Foreign Transactions Reporting Act. 95-561 title III Sec.

Currency and Foreign Transactions Reporting Act.

1051 et seq is often referred to as The Bank Secrecy Act BSA. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Currency and foreign transactions reporting act - a new law enforcement tool. 95-561 title III Sec. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax. The Currency and Foreign Transactions Reporting Act of 1970 the Currency Act was enacted as a means of requiring certain financial institutions including broker-dealers to create records of currency transactions that may be useful in criminal tax or other regulatory investigations.

Source: dailyfx.com

Source: dailyfx.com

Currency and foreign transactions reporting act - a new law enforcement tool. Title III part J Sec. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Treasury Department Office of Foreign Asset Control and ii applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transaction Reporting Act of 1970 as amended including the Money Laundering Control Act of 1986 as amended the rules and regulations thereunder and any related or similar money laundering statutes rules regulations or guidelines issued administered or enforced by any Federal governmental agency collectively the Money.

Source: pinterest.com

Source: pinterest.com

Currency and Foreign Transactions Reporting Act. 91-508 title II Oct. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Where chapter X of title 31 of the Code of Federal Regulations and 24017a-4 of this chapter require the same records or reports. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax.

Source: ipohub.org

Source: ipohub.org

Currency and foreign transactions reporting act - a new law enforcement tool. 1051 et seq is often referred to as The Bank Secrecy Act BSA. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Currency and Foreign Transaction Reporting Act Federal law requires that credit unions as well as other financial institutions file reports to the United States Treasury for certain currency transactions made and that they keep and retain records of certain financial transactions. Law requiring financial institutions in the United States to assist US.

Source: bi.go.id

Source: bi.go.id

91-508 title II Oct. Government agencies in detecting and preventing money laundering. Legislation created in 1970 to prevent financial institutions from being used as tools by. Government agencies to detect and prevent money laundering. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a.

Source: co.pinterest.com

Source: co.pinterest.com

Government agencies to detect and prevent money laundering. The Currency and Foreign Transactions Reporting Act of 1970 the Currency Act was enacted as a means of requiring certain financial institutions including broker-dealers to create records of currency transactions that may be useful in criminal tax or other regulatory investigations. 91-508 title II Oct. Currency and Foreign Transactions Reporting Act. Where chapter X of title 31 of the Code of Federal Regulations and 24017a-4 of this chapter require the same records or reports.

Source: setupmyhotel.com

Source: setupmyhotel.com

Currency and Foreign Transactions Reporting Act 5010 Bank Secrecy Act Manual September 1997 Page 5. 91-508 title II Oct. The item Currency and Foreign Transactions Reporting Act. 26 1970 84 Stat. Legislation created in 1970 to prevent financial institutions from being used as tools by.

Source: pinterest.com

Source: pinterest.com

Legislation created in 1970 to prevent financial institutions from being used as tools by. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Currency and Foreign Transactions Reporting Act 5010 Bank Secrecy Act Manual September 1997 Page 5. These currency transactions need not be reported if they. Understanding Currency Transaction Reports CTRs The Bank Secrecy Act initiated the currency transaction report in 1970.

Source: pinterest.com

Source: pinterest.com

Where chapter X of title 31 of the Code of Federal Regulations and 24017a-4 of this chapter require the same records or reports. Currency and Foreign Transactions Reporting Act 5010 Bank Secrecy Act Manual September 1997 Page 5. 301 a this act refers to only a portion of the Public Law. Currency and foreign transactions reporting act - a new law enforcement tool. The tables below are for the entire Public Law.

Source: bi.go.id

Source: bi.go.id

Also known as the Currency and Foreign Transactions Reporting Act the Bank Secrecy Act BSA is US. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Understanding Currency Transaction Reports CTRs The Bank Secrecy Act initiated the currency transaction report in 1970. Currency and Foreign Transactions Reporting Act. 371 et seq as added Pub.

Source: bi.go.id

Currency and Foreign Transactions Reporting Act. Currency and Foreign Transactions Reporting Act. The Currency and Foreign Transactions Reporting Act of 1970 as amended hereinafter the Bank Secrecy Act or BSA provides inter alia authority for the Secretary of the Treasury to require financial institutions to maintain effective anti-money laundering AML programs2 These AML. 5311 et seq is referred to as the Bank Secrecy Act BSA. 91-508 title II Oct.

Source: id.pinterest.com

Source: id.pinterest.com

The item Currency and Foreign Transactions Reporting Act. Every registered broker or dealer who is subject to the requirements of the Currency and Foreign Transactions Reporting Act of 1970 shall comply with the reporting recordkeeping and record retention requirements of chapter X of title 31 of the Code of Federal Regulations. These currency transactions need not be reported if they. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax. The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US.

Source: pinterest.com

Source: pinterest.com

However not all transactions greater than 10000 need to be reported. The item Currency and Foreign Transactions Reporting Act. Understanding Currency Transaction Reports CTRs The Bank Secrecy Act initiated the currency transaction report in 1970. Currency and foreign transactions reporting act - a new law enforcement tool. Currency and Foreign Transactions Reporting Act.

Source: dailyfx.com

Source: dailyfx.com

The tables below are for the entire Public Law. Currency and Foreign Transactions Reporting Act 5010 Bank Secrecy Act Manual September 1997 Page 5. Treasury Department Office of Foreign Asset Control and ii applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transaction Reporting Act of 1970 as amended including the Money Laundering Control Act of 1986 as amended the rules and regulations thereunder and any related or similar money laundering statutes rules regulations or guidelines issued administered or enforced by any Federal governmental agency collectively the Money. Title III part J Sec. Its purpose is to require financial institutions to maintain appropriate records and file certain reports which have a high degree of usefulness in criminal tax.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title currency and foreign transactions reporting act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas