11++ Customer declaration for zero rated vat ideas

Home » about money loundering Info » 11++ Customer declaration for zero rated vat ideasYour Customer declaration for zero rated vat images are ready in this website. Customer declaration for zero rated vat are a topic that is being searched for and liked by netizens now. You can Download the Customer declaration for zero rated vat files here. Find and Download all free vectors.

If you’re looking for customer declaration for zero rated vat pictures information linked to the customer declaration for zero rated vat topic, you have come to the ideal blog. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

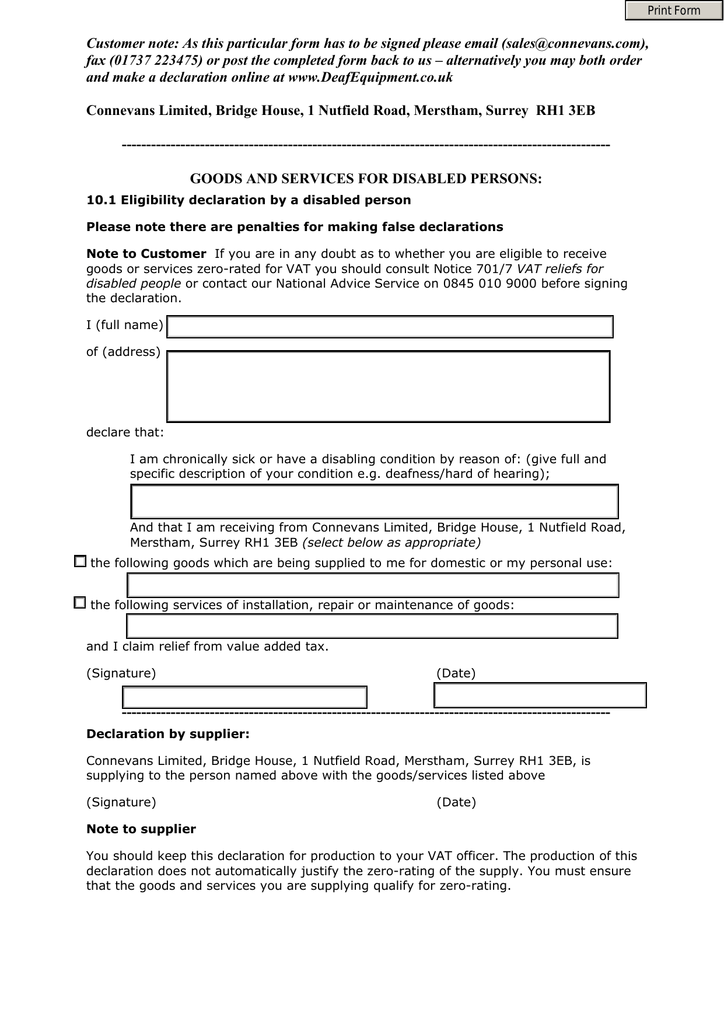

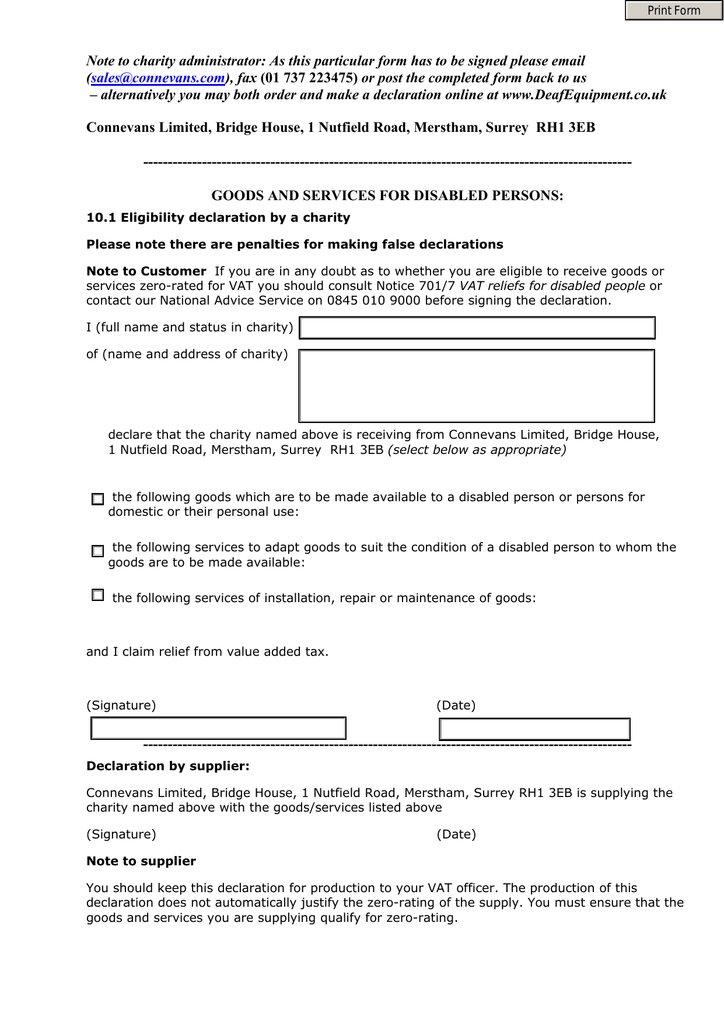

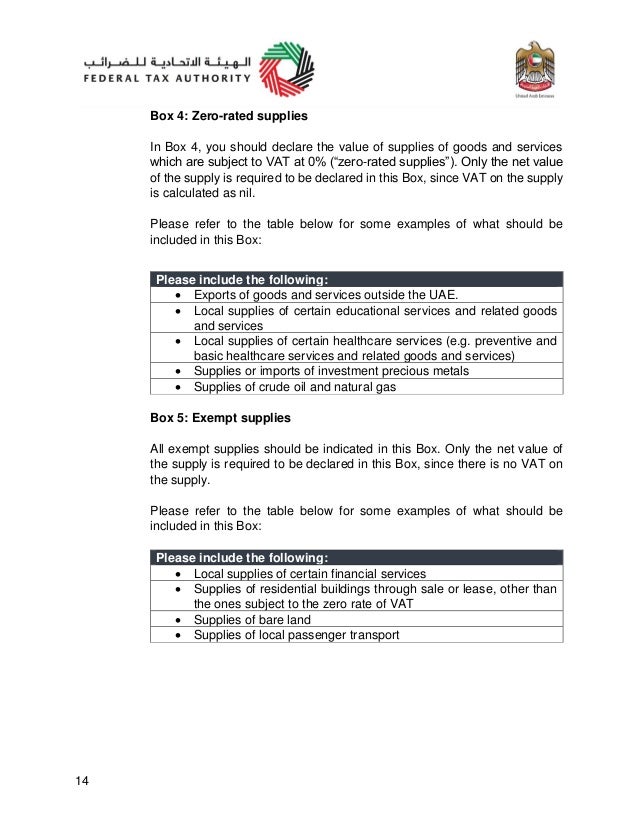

Customer Declaration For Zero Rated Vat. Use this customer declaration form VAT1615A to claim VAT relief on adapted motor vehicles for disabled wheelchair or stretcher users charities and eligible bodies. Any VAT -registered person whose sales are zero-rated or effectively zero-rated may within two 2 years after the close of the taxable quarter when the sales were made apply for the issuance of a tax credit certificate or refund of creditable input tax due or paid attributable to such sales except transitional input tax to the extent that such input tax has not been applied against output tax Emphasis supplied. The requirements for electing the zero-rating of an indirect export are contained in the Export Regulation gazetted on 2 May 2014 GG 37580. You should also keep proof of goods leaving the UK.

We Are Ready to Help. If you need further guidance phone the VAT Disabled. Tick a box saying they are eligible for zero rated VAT relief on the product which removes the 20 VAT from the price 2. Goods exported to a customer outside the EU can also be zero-rated for VAT even if they initially travel through other EU countries. In the case of the VAT 215 record the recipient where the recipient is not a registered vendor of. 2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT.

The payment of the VAT liability declared in the VAT 215 and VAT 216 records must be made on eFiling by the following persons.

Entrust Your VAT Compliance to The Highly Qualified Specialists. A tax invoice need not be issued for zero-rated exempt and deemed supplies or to non-GST registered customer. Almost all countries apply preferential rates to some goods and services making them either zero rated or exempt For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. Separate rules apply to goods that are moved through EU countries to other EU countries. Filing of the Monthly Value-added Tax Declaration on or before the 20th day following the end of the taxable month for manual filerson or before the prescribed due dates enunciated in RR No. We Are Ready to Help.

Source: tax-handbook.rra.gov.rw

Source: tax-handbook.rra.gov.rw

Almost all countries apply preferential rates to some goods and services making them either zero rated or exempt For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. We Are Ready to Help. The place of an intra-Community supply ICS of goods is the place where the transport begins. The requirements for electing the zero-rating of an indirect export are contained in the Export Regulation gazetted on 2 May 2014 GG 37580. 2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT.

Source: cdn-customsclearance.co.uk

Source: cdn-customsclearance.co.uk

We Are Ready to Help. Ad Global VAT Declaration Services on One and Totally Free Platform - Register Now. Almost all countries apply preferential rates to some goods and services making them either zero rated or exempt For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. Entrust Your VAT Compliance to The Highly Qualified Specialists. Entrust Your VAT Compliance to The Highly Qualified Specialists.

Source: dhl.com

Source: dhl.com

In the case of the VAT 215 record the recipient where the recipient is not a registered vendor of. The gross sales figure is included in the FRS calculations. If you need further guidance phone the VAT Disabled. Then complete the standard checkout process purchasing the product with zero rated VAT. 2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT.

Source: docs.microsoft.com

Source: docs.microsoft.com

Filing of the Monthly Value-added Tax Declaration on or before the 20th day following the end of the taxable month for manual filerson or before the prescribed due dates enunciated in RR No. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records. The place of an intra-Community supply ICS of goods is the place where the transport begins. Governments commonly lower the tax burden on low-income households by zero rating essential goods such as food and utilities or. The payment of the VAT liability declared in the VAT 215 and VAT 216 records must be made on eFiling by the following persons.

Source: manualzz.com

Source: manualzz.com

2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT. The zero rate of Value-Added Tax VAT can apply to the ICS if the following conditions are met. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records. The place of an intra-Community supply ICS of goods is the place where the transport begins. Ad Global VAT Declaration Services on One and Totally Free Platform - Register Now.

Separate rules apply to goods that are moved through EU countries to other EU countries. Ad Global VAT Declaration Services on One and Totally Free Platform - Register Now. We Are Ready to Help. Zero-rated for Value Added Tax VAT refer to the guidance provided in Notice 1002. Goods exported to a customer outside the EU can also be zero-rated for VAT even if they initially travel through other EU countries.

Source: bizindo.com

Source: bizindo.com

16-2005 for e-filers using BIR Form No. Almost all countries apply preferential rates to some goods and services making them either zero rated or exempt For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. Filing of the Monthly Value-added Tax Declaration on or before the 20th day following the end of the taxable month for manual filerson or before the prescribed due dates enunciated in RR No. 2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT. When payment has been made to you you must issue a serially printed receipt to the payer if a tax invoice or simplified tax invoice has not been issued by you.

The requirements for electing the zero-rating of an indirect export are contained in the Export Regulation gazetted on 2 May 2014 GG 37580. If you need further guidance phone the VAT Disabled. We Are Ready to Help. Zero rate of VAT on ICS of goods. See the updated Guide for completing the Value Added Tax VAT201 Declaration.

Source: manualzz.com

Source: manualzz.com

Find out more about importing goods and services and VAT. Zero rate of VAT on ICS of goods. You must obtain and retain the customers VAT registration number including country prefix you must quote your VAT. The Customs Intermediarys immediate customer in this case is the UK based Freight Forwarder so their services are within the scope of UK VAT. Use this customer declaration form VAT1615A to claim VAT relief on adapted motor vehicles for disabled wheelchair or stretcher users charities and eligible bodies.

Declare sales on your VAT return and complete an. Zero-rated for Value Added Tax VAT refer to the guidance provided in Notice 1002. The payment of the VAT liability declared in the VAT 215 and VAT 216 records must be made on eFiling by the following persons. We Are Ready to Help. The requirements for electing the zero-rating of an indirect export are contained in the Export Regulation gazetted on 2 May 2014 GG 37580.

Source: docplayer.net

Source: docplayer.net

The payment of the VAT liability declared in the VAT 215 and VAT 216 records must be made on eFiling by the following persons. Filing of the Monthly Value-added Tax Declaration on or before the 20th day following the end of the taxable month for manual filerson or before the prescribed due dates enunciated in RR No. Adapted motor vehicles for disabled people and charities. 2550Q reflecting therein gross receipts for seller of service gross sales for seller of goods and output tax VAT. From 1 January 2021 these sales will be zero-rated for UK VAT purposes export of goods and subject to VAT and import duty when they arrive in the destination country.

Source: slideshare.net

Source: slideshare.net

Then complete a standard declaration form with their details which is then sent to me for record tax purposes 3. 16-2005 for e-filers using BIR Form No. When payment has been made to you you must issue a serially printed receipt to the payer if a tax invoice or simplified tax invoice has not been issued by you. Ad Global VAT Declaration Services on One and Totally Free Platform - Register Now. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records.

Source: accountsco.it

Source: accountsco.it

A tax invoice need not be issued for zero-rated exempt and deemed supplies or to non-GST registered customer. 1 June 2020 Payment of VAT liability declared in VAT 215 and VAT 216 records. The Customs Intermediarys immediate customer in this case is the UK based Freight Forwarder so their services are within the scope of UK VAT. The rules for zero-rating contained in these publications cover designated commercial exit ports documentation time periods for removing the movable goods from South Africa and time periods within which the supporting documentation must be obtained. Entrust Your VAT Compliance to The Highly Qualified Specialists.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer declaration for zero rated vat by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas