18++ Customer declaration on turnover for fy 2020 21 info

Home » about money loundering idea » 18++ Customer declaration on turnover for fy 2020 21 infoYour Customer declaration on turnover for fy 2020 21 images are available in this site. Customer declaration on turnover for fy 2020 21 are a topic that is being searched for and liked by netizens now. You can Get the Customer declaration on turnover for fy 2020 21 files here. Get all royalty-free photos and vectors.

If you’re looking for customer declaration on turnover for fy 2020 21 images information linked to the customer declaration on turnover for fy 2020 21 interest, you have visit the ideal site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

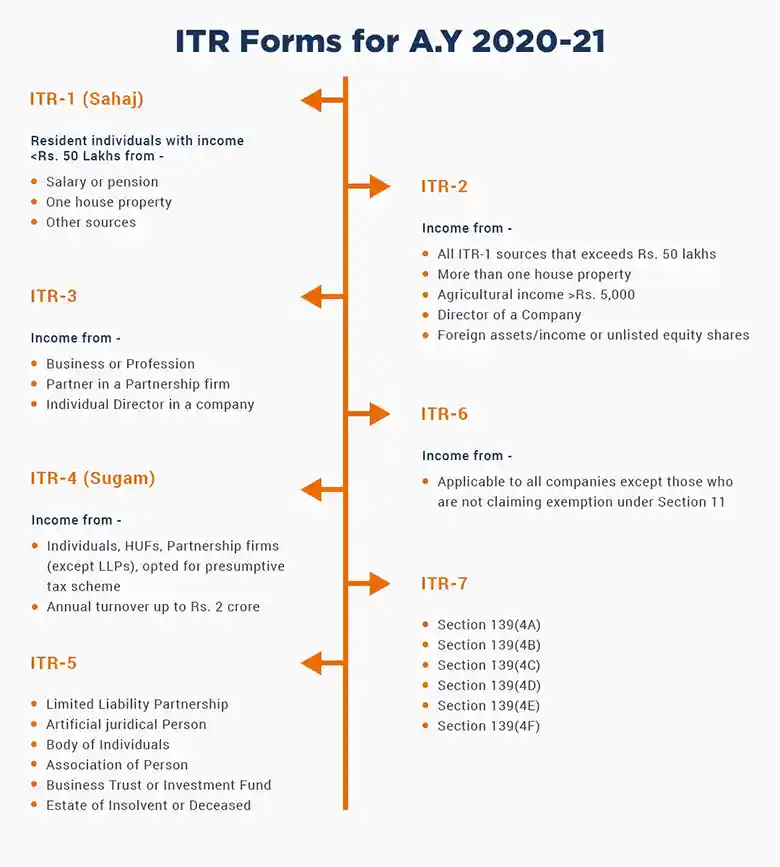

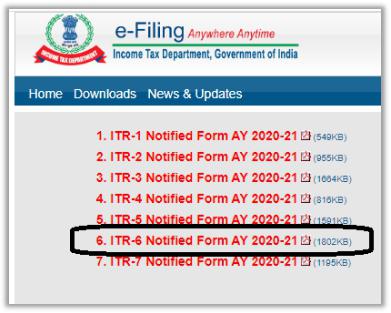

Customer Declaration On Turnover For Fy 2020 21. The year 2020-21 has been challenging for each one of us. 5 Compliance calendar for FY 2020-21 Key COVID-19 relief announcements SNo. In the below chart applicable from 14th May 2020. Below is the TDS rate for FY 2020-21.

Tax Compliances in January 2021 Important due. This is a provisional statement that has details about your proposed investments and expenses that are Income Tax. These amendments shall take effect from 1 st April 2020. Hence we shall be deducting tax at source at per. You will not be required to do TDS in the FY 2020-21 as your turnover in the FY 2019-20 was below Rs. A declaration of 0 turnover was made for the entry between 1 July and 22 July.

If you are an employee of a company at the beginning of every financial year or while joining the company you have to submit Income Tax Declaration to your employer.

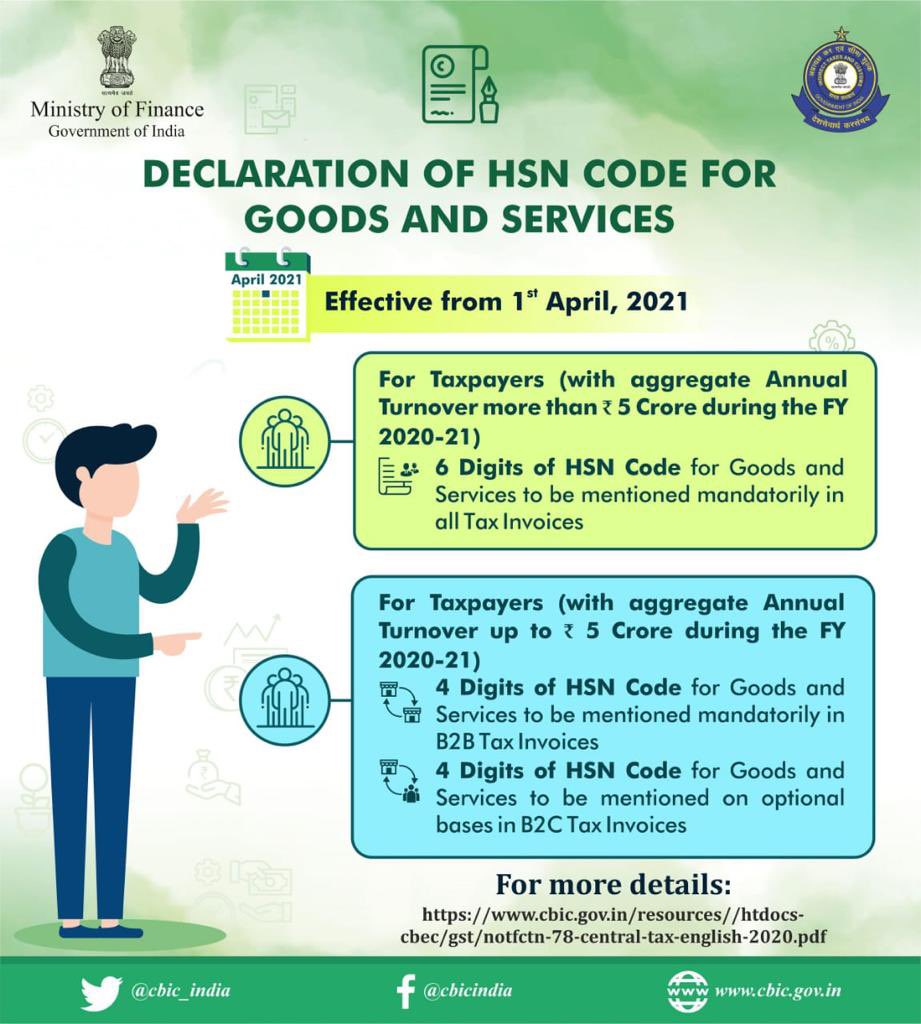

OMLs Global Creator Network clocks 100cr turnover in FY 2020-21. Deducting the applicable 01 under Section 1940 While remitting to the Of NTPC Limited. If AGM is held on 31122020 if AGM is held before 31122020 then AGM 15 days. The Finance Act 2020 says All individuals HUF will be liable to deduct TDS if the turnover had cross Rs. We name of buyer having PAN PAN of buyer hereby inform you that our total salesgross receiptsturnover from Business during FY 2020-21 has been more than Rs10 Crore. If your turnover for FY 2020-21 exceeds Rs.

Source: myloancare.in

Source: myloancare.in

The sponsor must still make a final declaration of 0 turnover for the entry during the declaration period between 1 July and 22 July 2021. AND did. For the 2020-21 fiscal. PF payment due dates for FY 2019-20 for tax audit reporting While preparing Tax Audit Report in Form 3CD it is important to fill due date of payment to various Employees contribution fund and actual payment of the contribution. We name of buyer having PAN PAN of buyer hereby inform you that our total salesgross receiptsturnover from Business during FY 2020-21 has been more than Rs10 Crore.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Your turnover for April 2020 to April 2021 is down by 20 compared to 2019 to 2020. The sales gross receipts turnover of the FY 2020-21 would be relevant in determining the applicability in the FY 2021-22. Below is the TDS rate for FY 2020-21. The sponsor must still make a final declaration of 0 turnover for the entry during the declaration period between 1 July and 22 July 2021. You will not be required to do TDS in the FY 2020-21 as your turnover in the FY 2019-20 was below Rs.

OMLs Global Creator Network clocks 100cr turnover in FY 2020-21. Ltd the artist-first content creator and talent management firm has announced that its youngest vertical the four-year-old Global Creator Network GCN has clocked a turnover of over INR 100 cr. OMLs Global Creator Network clocks 100cr turnover in FY 2020-21. You may send to us your declaration in the enclosed draft on or before 20062021 to enable us to take note of the same and modify our accounting software accordingly. The sponsor must still make a final declaration of 0 turnover for the entry during the declaration period between 1 July and 22 July 2021.

You may send to us your declaration in the enclosed draft on or before 20062021 to enable us to take note of the same and modify our accounting software accordingly. You may send to us your declaration in the enclosed draft on or before 20062021 to enable us to take note of the same and modify our accounting software accordingly. Therefore provisions of Section 194Q inserted in the Income Tax Act vide Finance Act 2021 with effect from 01072021 are applicable to our company. This will ensure the entry does not attract a 2020-21 annual charge which will become due and payable if no declaration is received. If AGM is held on 31122020 if AGM is held before 31122020 then AGM 30 days.

Source: alstom.com

Source: alstom.com

These amendments shall take effect from 1 st April 2020. If AGM is held on 31122020 if AGM is held before 31122020 then AGM 30 days. An existing entry was qualified to be exempt under the ACE scheme in 2020-21 if the entry was eligible for ACE in 2019-20. We Confirm that provisions of Section is on our from NTPC exceeding RS50 during FY 2021-22. This will ensure the entry does not attract a 2020-21 annual charge which will become due and payable if no declaration is received.

Ie Details of contributions received from employees for various funds as referred to in section 361va Most commonly reported funds under the clause are EPF and ESIC. In case your declaration is not received by us by the above date we will modify our software to deduct tax at the rate of 5 percent and it would be difficult for us to take corrective action to reduce the rate during the. Our aggregate turnover exceeds INR 10 Crore for FY 2020-21 hence we are covered within the ambit of Section 194Q of the Income Tax Act 1961 effective from July 1 2021. WE quality purpose of Section Of the Act. Whether the above legal entitys total sales gross receipts or turnover from the business exceeded Rs10 crore during FY 2020-21.

Therefore provisions of Section 194Q inserted in the Income Tax Act vide Finance Act 2021 with effect from 01072021 are applicable to our company. In the below chart applicable from 14th May 2020. Our focus continues to be on our peoples health safety ensuring uninterrupted supplies of COVID relevant portfolio meeting the demand arising out of evolving consumer needs caring for the communities in which we operate and finally protecting our business model. WE quality purpose of Section Of the Act. TDS applicability would be required to be examined every year on the basis of turnover of preceding previous year.

Source: twitter.com

Source: twitter.com

Youll get the lower grant amount which is worth 30 of 3 months average trading profits because your. Tax Compliances in January 2021 Important due. If your turnover for FY 2020-21 exceeds Rs. Particulars Current due date Extended due date Remarks Income tax 1 Filing of Income Tax Return for FY 2018-19 31 March 2020 30 June 2020 Both original and revised return 2 Declaration and payment under Vivad se. Your employer may soon ask you to submit the investment proofs for the Financial Year 2020-21.

Source: a2ztaxcorp.com

Source: a2ztaxcorp.com

Deducting the applicable 01 under Section 1940 While remitting to the Of NTPC Limited. Our aggregate turnover exceeds INR 10 Crore for FY 2020-21 hence we are covered within the ambit of Section 194Q of the Income Tax Act 1961 effective from July 1 2021. PF payment due dates for FY 2019-20 for tax audit reporting While preparing Tax Audit Report in Form 3CD it is important to fill due date of payment to various Employees contribution fund and actual payment of the contribution. Here is to confirm that Annual Audited Turnover of Ms. These amendments shall take effect from 1 st April 2020.

Relying on our declaration. 5 Compliance calendar for FY 2020-21 Key COVID-19 relief announcements SNo. A declaration of 0 turnover was made for the entry between 1 July and 22 July. Particulars Current due date Extended due date Remarks Income tax 1 Filing of Income Tax Return for FY 2018-19 31 March 2020 30 June 2020 Both original and revised return 2 Declaration and payment under Vivad se. Deducting the applicable 01 under Section 1940 While remitting to the Of NTPC Limited.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

PF payment due dates for FY 2019-20 for tax audit reporting While preparing Tax Audit Report in Form 3CD it is important to fill due date of payment to various Employees contribution fund and actual payment of the contribution. Seller should obtain declaration information from their customer whether the customers turnover exceeds Rs 10 crore in the immediately preceding year check Turnover of FY 20-21 for applicability in FY 2021-22 a If the turnover of Customer does not exceed the said threshold limit of 10 crore the seller will be under obligation to collect tax at source on receipts in excess of Rs 50 Lakh. 10 crore during Financial Year 2020-21 and liableto deduct TDS us 194Q of Income Tax Act 1961 applicable from 01072021. We Confirm that provisions of Section is on our from NTPC exceeding RS50 during FY 2021-22. The year 2020-21 has been challenging for each one of us.

Query If the turnover in FY 2019-20 was more than Rs. AND did. Our aggregate turnover exceeds INR 10 Crore for FY 2020-21 hence we are covered within the ambit of Section 194Q of the Income Tax Act 1961 effective from July 1 2021. You will not be required to do TDS in the FY 2020-21 as your turnover in the FY 2019-20 was below Rs. Here is to confirm that Annual Audited Turnover of Ms.

You will not be required to do TDS in the FY 2020-21 as your turnover in the FY 2019-20 was below Rs. 10 crore during Financial Year 2020-21 and liableto deduct TDS us 194Q of Income Tax Act 1961 applicable from 01072021. Here is the Sample format of the Customer Declaration for Section 194Q. Our aggregate turnover exceeds INR 10 Crore for FY 2020-21 hence we are covered within the ambit of Section 194Q of the Income Tax Act 1961 effective from July 1 2021. Your turnover for April 2020 to April 2021 is down by 20 compared to 2019 to 2020.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer declaration on turnover for fy 2020 21 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information