20+ Customer risk rating aml risk assessment matrix info

Home » about money loundering idea » 20+ Customer risk rating aml risk assessment matrix infoYour Customer risk rating aml risk assessment matrix images are available. Customer risk rating aml risk assessment matrix are a topic that is being searched for and liked by netizens now. You can Get the Customer risk rating aml risk assessment matrix files here. Get all royalty-free photos and vectors.

If you’re searching for customer risk rating aml risk assessment matrix pictures information linked to the customer risk rating aml risk assessment matrix keyword, you have visit the right site. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Customer Risk Rating Aml Risk Assessment Matrix. Nearly two-thirds 62 use manual spreadsheets or. Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters. When assessing Recommendation 1 assessors should concentrate their analysis on the following elements. The workflow of KYC enables financial institutions to perform Due Diligence Enhanced Due Diligence and continuous monitoring of customers.

Free Know Your Risk Assessment Tool Omni Risk From omnirisk.me

Free Know Your Risk Assessment Tool Omni Risk From omnirisk.me

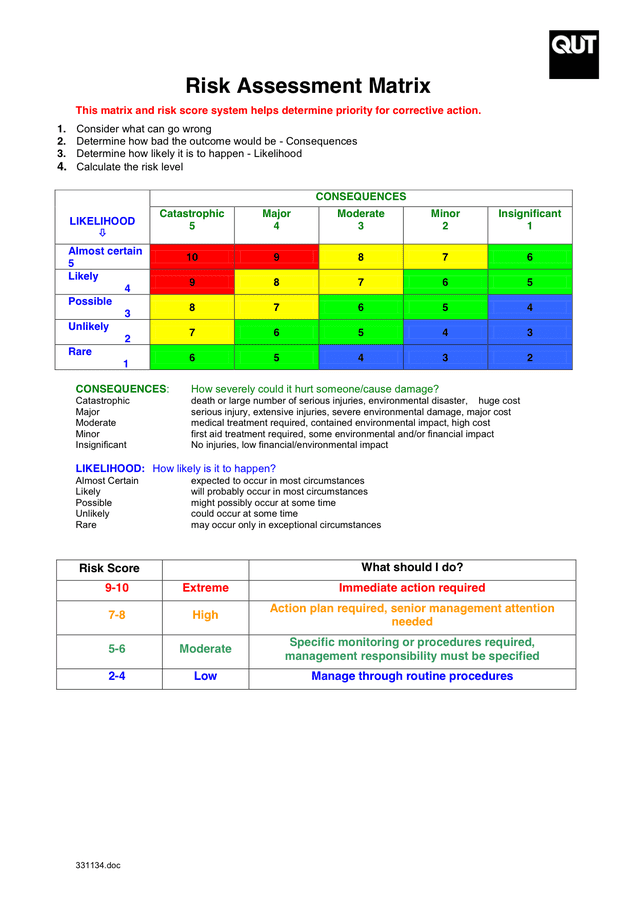

It is a mathematical model that rates countries by risk based on various. Assess the Risk by using. Low Minor or negligible MLTF risk. Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer. This is scored from 0 5. The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate.

This is scored from 0 5.

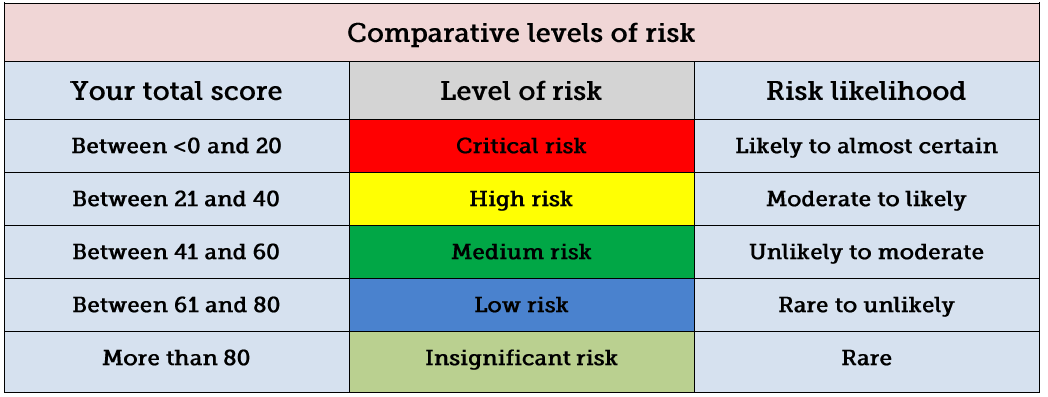

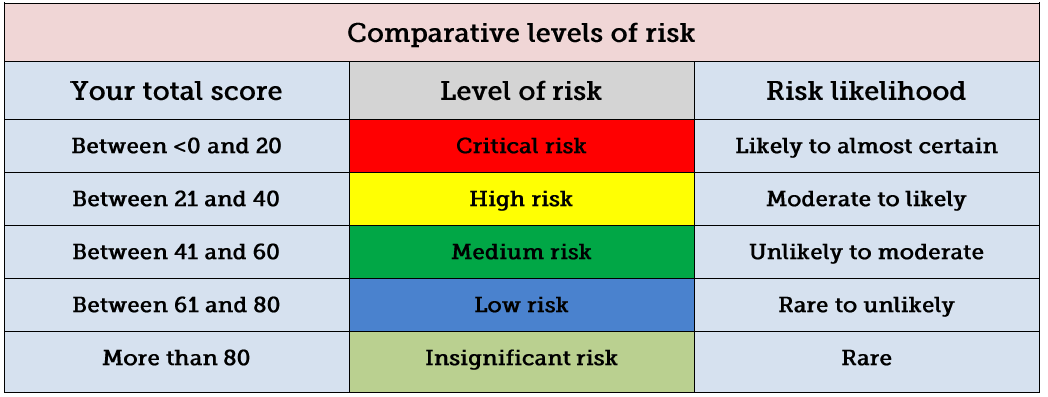

8 rows Examiners should use the following matrix as appropriate when assessing a banks risk of. When assessing Recommendation 1 assessors should concentrate their analysis on the following elements. The attributes differ based on the customer type. 1 processes and mechanisms in place to produce and coordinate the risk assessments. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. Cover 100 of flood risk in Asia Pacific with RMS models and maps.

Source: pinterest.com

Source: pinterest.com

When assessing Recommendation 1 assessors should concentrate their analysis on the following elements. 0 - no likelihood of the risk factor impacting the business. High Serious MLTF risk. Sometimes risk ratingsassessments conducted as part of the AML compliance programme are often confused with institutional risk assessment. 2 the reasonableness of the risk assessments.

Source: pinterest.com

Source: pinterest.com

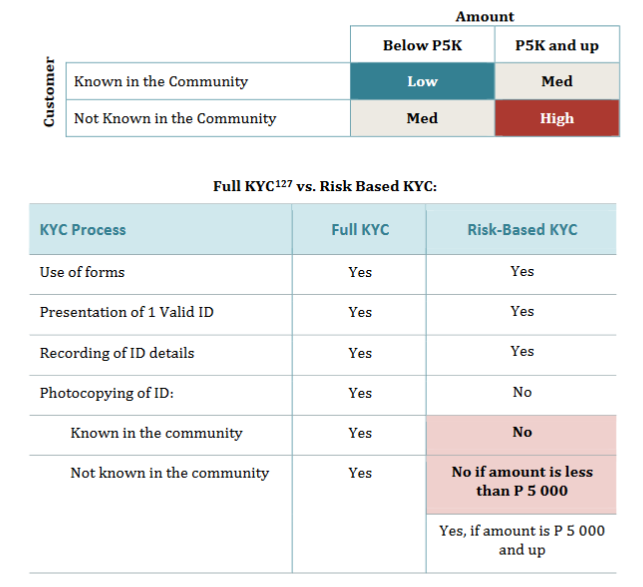

A Customer Risk Rating Matrix ensures that customers posing elevated levels of AMLBSAOFACCFT risk are properly identified and monitored. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. High Serious MLTF risk. In a bank a customer is a salaried private employee earning less than 5000 a year is rated as a High-Risk Customer who only uses that account for his salary deposit and withdrawal.

Source: siorik.com

Source: siorik.com

Low Minor or negligible MLTF risk. The World Bank Risk Assessment Methodology 1. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. The AML Accelerate risk assessment methodology defines the criteria for rating both the inherent and residual risk as well as consistent criteria for assessing the effectiveness of controls as.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

In a bank a customer is a salaried private employee earning less than 5000 a year is rated as a High-Risk Customer who only uses that account for his salary deposit and withdrawal. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Only 5 of financial institutions have fully automated AML Risk Assessment or Customer Due Diligence systems 2. And time-consuming manual operation. The World Bank Risk Assessment Methodology 1.

Source: service.betterregulation.com

Source: service.betterregulation.com

Here are some examples to drive the point home. Cover 100 of flood risk in Asia Pacific with RMS models and maps. When assessing Recommendation 1 assessors should concentrate their analysis on the following elements. ComplianceAid will assist regulated entities with formulating criteria for risk evaluation in areas including PEPs Sanctions Customer Types Locations Products and Services as well as Other Factors. 1 rare may occur at some time but this would be by exception.

Source: pdfprof.com

Source: pdfprof.com

The World Bank Risk Assessment Methodology 1. Approval may be evidenced in writing or electronically. In a bank a customer is a salaried private employee earning less than 5000 a year is rated as a High-Risk Customer who only uses that account for his salary deposit and withdrawal. Cover 100 of flood risk in Asia Pacific with RMS models and maps. And 3 the alignment of risk-based measures with the risks identified.

Source: osr.2160pusiulize.pw

Source: osr.2160pusiulize.pw

It is a mathematical model that rates countries by risk based on various. Sometimes risk ratingsassessments conducted as part of the AML compliance programme are often confused with institutional risk assessment. The attributes differ based on the customer type. Approval may be evidenced in writing or electronically. A Customer Risk Rating Matrix ensures that customers posing elevated levels of AMLBSAOFACCFT risk are properly identified and monitored.

Source: kumpulanalamatsurabaya.blogspot.com

Source: kumpulanalamatsurabaya.blogspot.com

Country risk rating matrix. These risk ratings include the following. High Serious MLTF risk. Country risk rating matrix. Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer.

Source: pinterest.com

Source: pinterest.com

Cover 100 of flood risk in Asia Pacific with RMS models and maps. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Approval may be evidenced in writing or electronically. 255 rows AML Risk Assessment Template and Sample Rating Matrix Downloadable Template Raw Data When on-boarding new customers and throughout the relationship with each customer financial institutions are required by regulators to perform anti-money laundering AML and know-your-customer KYC risk assessments to determine a customers overall money laundering risk.

Source: youtube.com

Source: youtube.com

The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. This is scored from 0 5. 1 processes and mechanisms in place to produce and coordinate the risk assessments. And time-consuming manual operation. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program.

Source: pinterest.com

Source: pinterest.com

Only 5 of financial institutions have fully automated AML Risk Assessment or Customer Due Diligence systems 2. Medium Moderate MLTF risk. Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. And 3 the alignment of risk-based measures with the risks identified.

Source: omnirisk.me

Source: omnirisk.me

1 rare may occur at some time but this would be by exception. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Approval may be evidenced in writing or electronically. Therefore how to do proper Risk Assessment is a million-dollar question. Country risk rating matrix.

Source: advisoryhq.com

Source: advisoryhq.com

This is scored from 0 5. High Serious MLTF risk. Only 5 of financial institutions have fully automated AML Risk Assessment or Customer Due Diligence systems 2. The workflow of KYC enables financial institutions to perform Due Diligence Enhanced Due Diligence and continuous monitoring of customers. Therefore how to do proper Risk Assessment is a million-dollar question.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer risk rating aml risk assessment matrix by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information