11+ Customer risk rating best practices info

Home » about money loundering idea » 11+ Customer risk rating best practices infoYour Customer risk rating best practices images are available in this site. Customer risk rating best practices are a topic that is being searched for and liked by netizens today. You can Get the Customer risk rating best practices files here. Download all royalty-free vectors.

If you’re looking for customer risk rating best practices pictures information linked to the customer risk rating best practices keyword, you have pay a visit to the right site. Our website always provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Customer Risk Rating Best Practices. 62 - 81 Low 3. Inherent risk is the risk of violations if there were absolutely no controls in place. Vest Risk Rating Responsibility Appropriately. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating.

Fmea Template Failure Mode Effects Analysis Excel Template Excel Templates Lean Six Sigma Excel From pinterest.com

Fmea Template Failure Mode Effects Analysis Excel Template Excel Templates Lean Six Sigma Excel From pinterest.com

The customer or beneficial owner is a Politically Exposed Person PEP must apply enhanced due diligence measures. Further a spectrum of risks may be identifiable even within the same category of customers. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Customers may lose faith in your product. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Inherent risk is the risk of violations if there were absolutely no controls in place.

Your CX strategy and efforts to lower your customer attrition rate go hand in hand. Your CX strategy and efforts to lower your customer attrition rate go hand in hand. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Some institutions may also use a committee structure to discuss risk ratings. Vest Risk Rating Responsibility Appropriately. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk.

Source: pinterest.com

Source: pinterest.com

Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. Customer Risk Rating and CDD Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts on an ongoing basis. Customers may lose faith in your product. Customers may adopt bad habits in using your product. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Source: pinterest.com

Source: pinterest.com

Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts. Purpose of Training Influence Design Controls has on Customer Complaints How Customer Complaints impact your CAPA system Best practices for Design Controls Best practices for Risk Management Risk-based approaches to Customer Complaint and CAPA management 3 4. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. 62 - 81 Low 3. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating.

Source: pinterest.com

Source: pinterest.com

The customer or beneficial owner is a Politically Exposed Person PEP must apply enhanced due diligence measures. Customers may lose faith in your product. How well do you know your customer. How to score Customer Health is a subject near and dear to my heart and also critical to the long-term success of any Customer Success team. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating.

Source: pinterest.com

Source: pinterest.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. In fact its really just an extrapolation of what youve all been doing for years by coding customers as red yellow or green. Your CX strategy and efforts to lower your customer attrition rate go hand in hand. Inherent risk is the risk of violations if there were absolutely no controls in place. This implies first of all that appropriate risk management systems must be in place to determine whether the customer or the final beneficiary beneficial owner is a.

Source: pinterest.com

Source: pinterest.com

Risk rating assignment should be separate from loan origination in order to limit bias - both real and perceived. For instance how you manage and leverage customer data across channels ads emails social media impacts both the way your target audience perceive your business especially compared to competitors and their purchasing decisions. The customer or beneficial owner is a Politically Exposed Person PEP must apply enhanced due diligence measures. Vest Risk Rating Responsibility Appropriately. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Kaufman Rossins Jason Chorlins risk advisory services principal.

Source: pinterest.com

Source: pinterest.com

43 - 61 M oderate 4. Customers may lose faith in your product. The credit analyst may discuss the risk rating with the lender since the lender is likely to have additional perspective on the borrowers state. Your CX strategy and efforts to lower your customer attrition rate go hand in hand. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined.

Source: pinterest.com

Source: pinterest.com

In fact its really just an extrapolation of what youve all been doing for years by coding customers as red yellow or green. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. Customers may encounter technical issues and spend significant time working with your Support team. In fact its really just an extrapolation of what youve all been doing for years by coding customers as red yellow or green. Customers may adopt bad habits in using your product.

Source: pinterest.com

Source: pinterest.com

In fact its really just an extrapolation of what youve all been doing for years by coding customers as red yellow or green. Some firms only have. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. How to score Customer Health is a subject near and dear to my heart and also critical to the long-term success of any Customer Success team. Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts.

Source: pinterest.com

Source: pinterest.com

Vest Risk Rating Responsibility Appropriately. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Kaufman Rossins Jason Chorlins risk advisory services principal. How well do you know your customer. This implies first of all that appropriate risk management systems must be in place to determine whether the customer or the final beneficiary beneficial owner is a. 43 - 61 M oderate 4.

Source: pinterest.com

Source: pinterest.com

How to score Customer Health is a subject near and dear to my heart and also critical to the long-term success of any Customer Success team. Purpose of Training Influence Design Controls has on Customer Complaints How Customer Complaints impact your CAPA system Best practices for Design Controls Best practices for Risk Management Risk-based approaches to Customer Complaint and CAPA management 3 4. 62 - 81 Low 3. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. They may exhibit this pessimism by canceling meetings not responding to your emails or.

Source: pinterest.com

Source: pinterest.com

Purpose of Training Influence Design Controls has on Customer Complaints How Customer Complaints impact your CAPA system Best practices for Design Controls Best practices for Risk Management Risk-based approaches to Customer Complaint and CAPA management 3 4. Customers may encounter technical issues and spend significant time working with your Support team. 43 - 61 M oderate 4. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Kaufman Rossins Jason Chorlins risk advisory services principal. 82 - 100 U ndoubted 2.

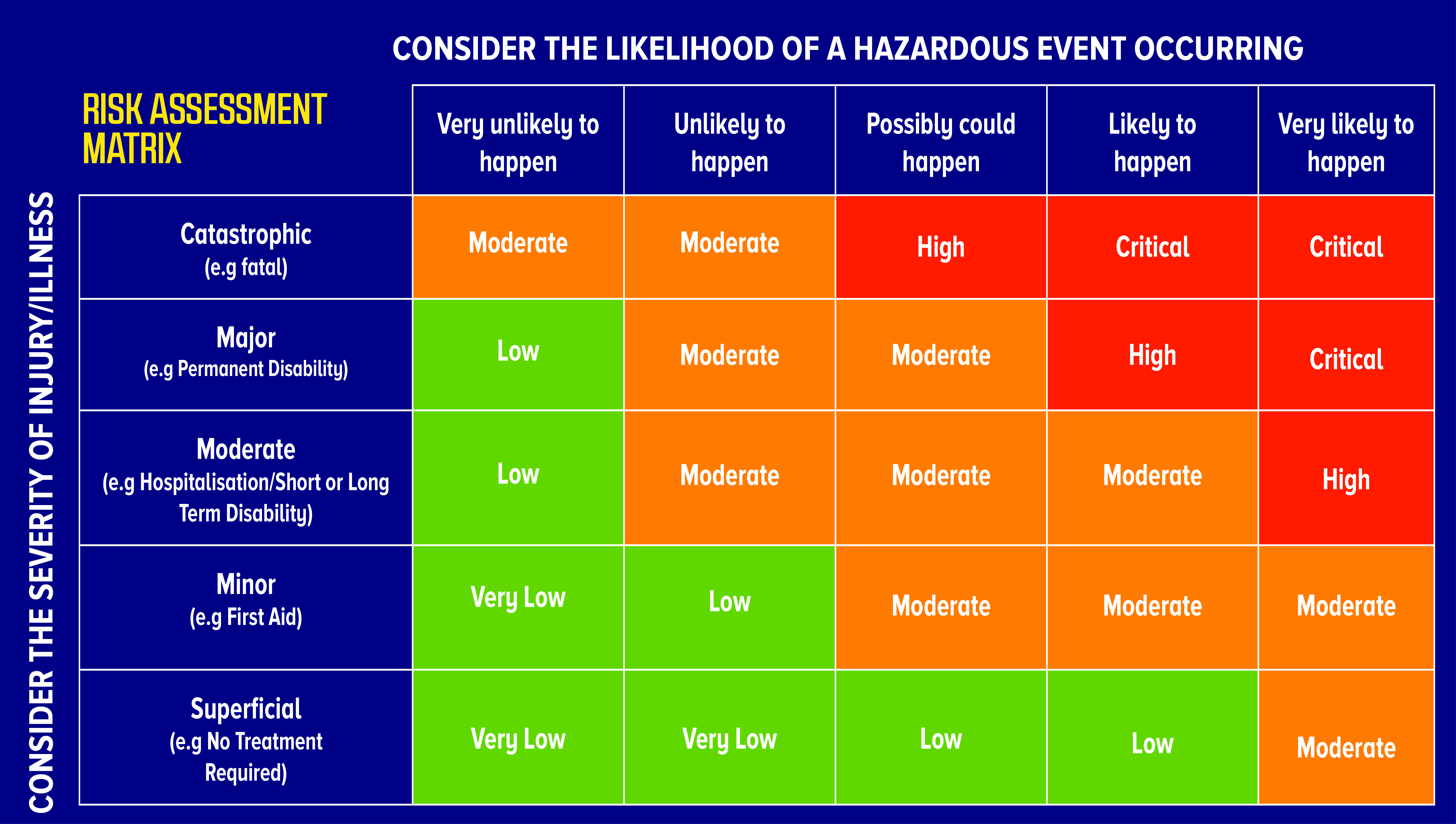

Source: sitesafe.org.nz

Source: sitesafe.org.nz

Some institutions may also use a committee structure to discuss risk ratings. Some firms only have. The customer or beneficial owner is a Politically Exposed Person PEP must apply enhanced due diligence measures. How to score Customer Health is a subject near and dear to my heart and also critical to the long-term success of any Customer Success team. Inherent risk is the risk of violations if there were absolutely no controls in place.

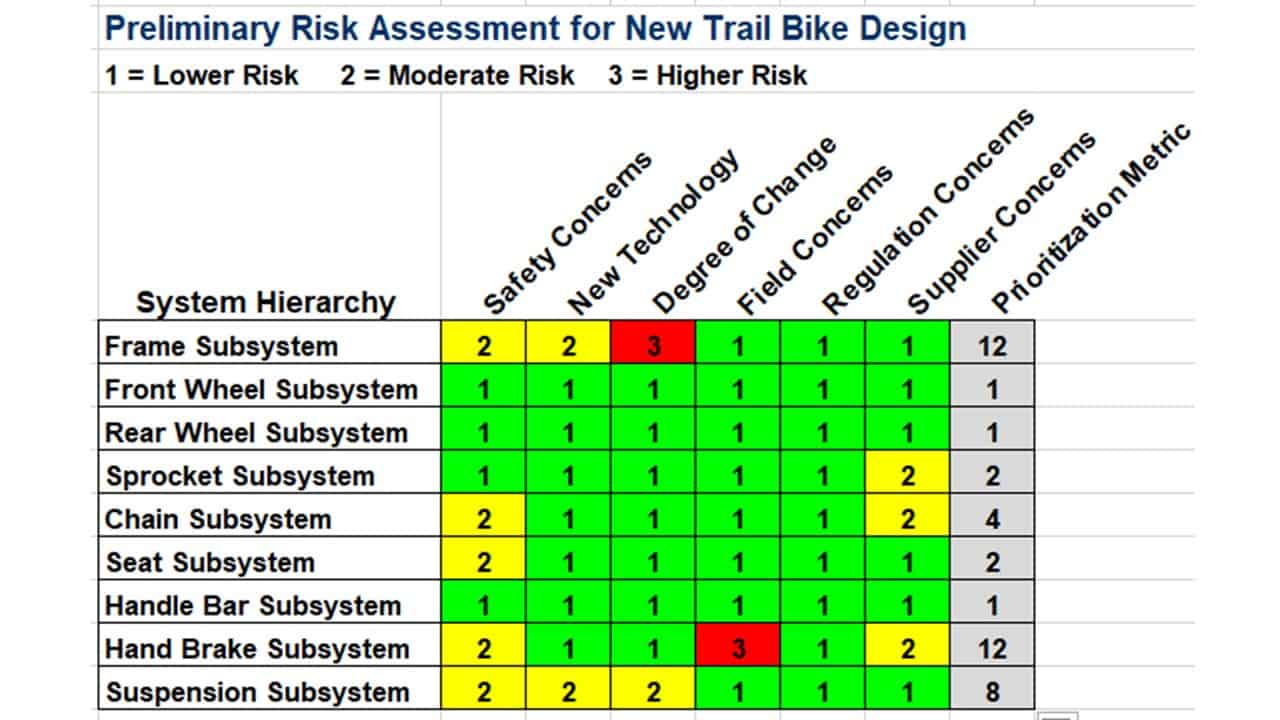

Source: accendoreliability.com

Source: accendoreliability.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. Further a spectrum of risks may be identifiable even within the same category of customers. Commonly referred to as the customer risk rating. In fact its really just an extrapolation of what youve all been doing for years by coding customers as red yellow or green.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer risk rating best practices by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information