20++ Customer risk rating crr info

Home » about money loundering idea » 20++ Customer risk rating crr infoYour Customer risk rating crr images are available. Customer risk rating crr are a topic that is being searched for and liked by netizens now. You can Download the Customer risk rating crr files here. Find and Download all royalty-free photos and vectors.

If you’re looking for customer risk rating crr pictures information linked to the customer risk rating crr keyword, you have come to the right site. Our website always gives you hints for downloading the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

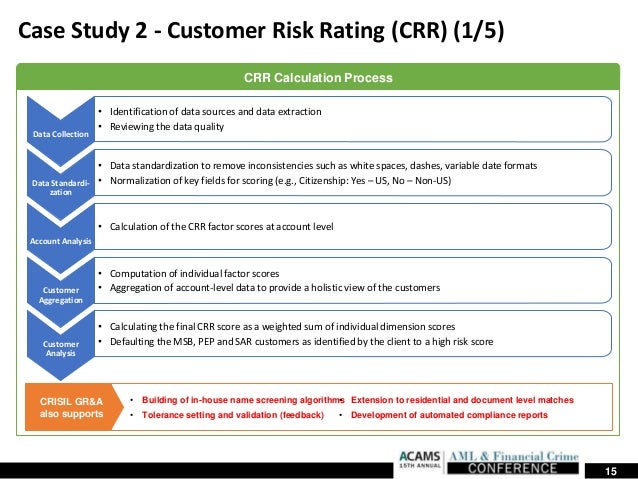

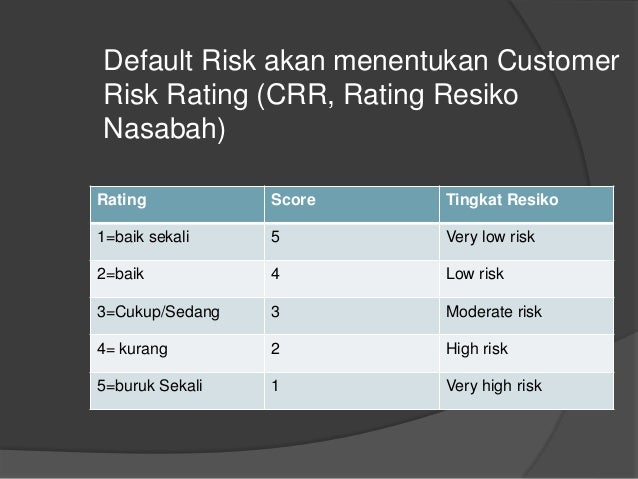

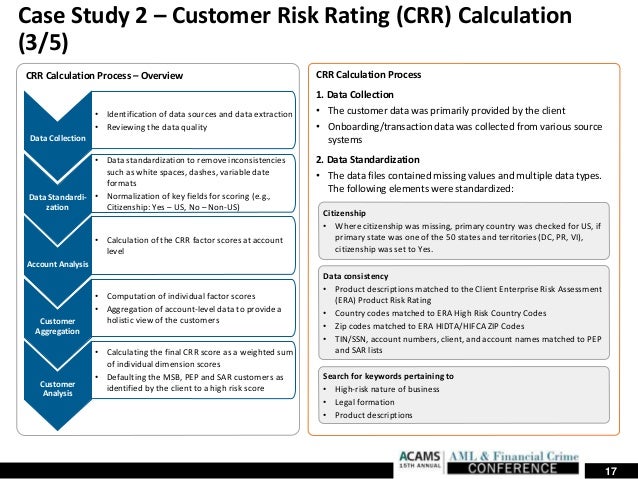

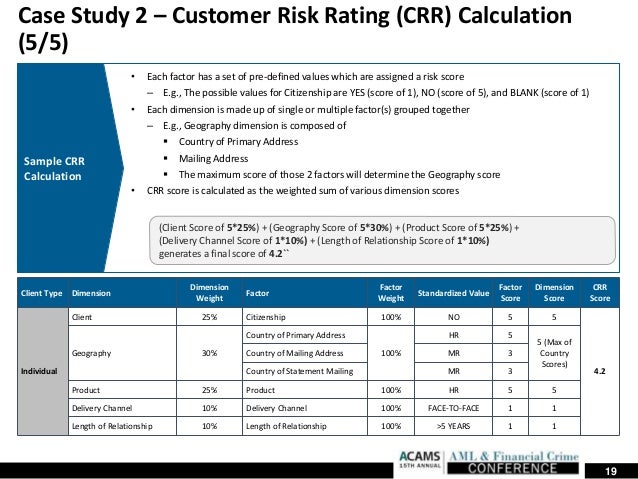

Customer Risk Rating Crr. Used at the time of issuing a credit card sanctioning loans and advances opening a new. Best practice in customer risk rating To adopt the new generation of customer risk-rating. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. Dynamic risk rating based on transaction indicators.

Crisil Acams Las Vegas 2016 Alan Paris From slideshare.net

Crisil Acams Las Vegas 2016 Alan Paris From slideshare.net

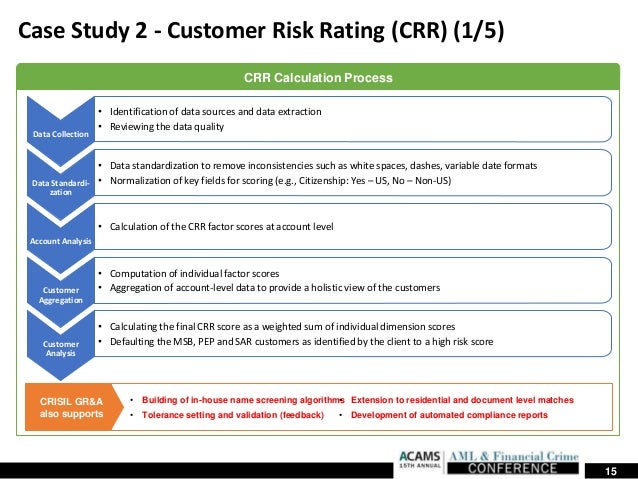

Typically a range of risk ratings with categorical labels such as Low Medium or High is used to classify customers. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers. Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time. Any customer account may be used for illicit purposes including money laundering or terrorist financing. National bank where the customers are rated from Low to High over 13 time periods. Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators.

Used in transaction risk scoring and fraud modelling.

Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. Ratings can be assigned manually andor. Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality. You can rate them based upon that information. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. Further a spectrum of risks may be identifiable even within the same category of customers.

Source: pinterest.com

Source: pinterest.com

Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts on an ongoing basis. Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. You can rate them based upon that information. Used at the time of issuing a credit card sanctioning loans and advances opening a new.

Source: slideshare.net

Source: slideshare.net

Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Kaufman Rossins Jason Chorlins risk advisory services principal. Reporting into the Director AML Program Office this new position has been created for the primary purpose of managing the Banks Customer Risk Rating CRR Methodologies in the US in addition to supporting technology based Anti-Money Laundering AML and Know Your Customer KYC programs and projects. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time.

Source: slideshare.net

Source: slideshare.net

The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers. Further a spectrum of risks may be identifiable even within the same category of customers. Configuring your CRR environment. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings.

Source: eba.europa.eu

Source: eba.europa.eu

Any customer account may be used for illicit purposes including money laundering or terrorist financing. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. You can rate them based upon that information. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. Typically a range of risk ratings with categorical labels such as Low Medium or High is used to classify customers.

Source: slideshare.net

Source: slideshare.net

Risk customers far more effectively than the method used by most financial institutions today in some cases reducing the number of incorrectly labeled high-risk customers by between 25 and 50 percent. Maintaining your CRR environment. Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators. Used at the time of issuing a credit card sanctioning loans and advances opening a new. Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update.

Source: slidetodoc.com

Source: slidetodoc.com

Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. Maintaining your CRR environment. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time. Used in transaction risk scoring and fraud modelling.

Source: curentis.com

Source: curentis.com

A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. Commonly referred to as the customer risk rating. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Kaufman Rossins Jason Chorlins risk advisory services principal. Any customer account may be used for illicit purposes including money laundering or terrorist financing. You can rate them based upon that information.

Source: eba.europa.eu

Source: eba.europa.eu

Any customer account may be used for illicit purposes including money laundering or terrorist financing. Learn more about anti-money laundering AML best practices customer risk ratings and customer due diligence CDD from Kaufman Rossins Jason Chorlins risk advisory services principal. Reporting into the Director AML Program Office this new position has been created for the primary purpose of managing the Banks Customer Risk Rating CRR Methodologies in the US in addition to supporting technology based Anti-Money Laundering AML and Know Your Customer KYC programs and projects. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers. Commonly referred to as the customer risk rating.

Source: researchgate.net

Source: researchgate.net

It also uses AML resources far more efficiently. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk. Used at the time of issuing a credit card sanctioning loans and advances opening a new. Ratings can be assigned manually andor.

Source:

This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk. Used in transaction risk scoring and fraud modelling. Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts on an ongoing basis. A statistical framework is presented to assess customer risk ratings used in anti-money laundering AML surveillance. Best practice in customer risk rating To adopt the new generation of customer risk-rating.

Source:

Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. Used in transaction risk scoring and fraud modelling. Reporting into the Director AML Program Office this new position has been created for the primary purpose of managing the Banks Customer Risk Rating CRR Methodologies in the US in addition to supporting technology based Anti-Money Laundering AML and Know Your Customer KYC programs and projects. Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Source: eba.europa.eu

Source: eba.europa.eu

Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started. Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business.

Source: slideshare.net

Source: slideshare.net

Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators. Configuring your CRR environment. Commonly referred to as the customer risk rating. Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile. Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer risk rating crr by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information