16++ Customer risk rating factors ideas

Home » about money loundering Info » 16++ Customer risk rating factors ideasYour Customer risk rating factors images are ready in this website. Customer risk rating factors are a topic that is being searched for and liked by netizens now. You can Get the Customer risk rating factors files here. Download all royalty-free photos.

If you’re searching for customer risk rating factors pictures information related to the customer risk rating factors keyword, you have come to the ideal blog. Our website always gives you hints for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

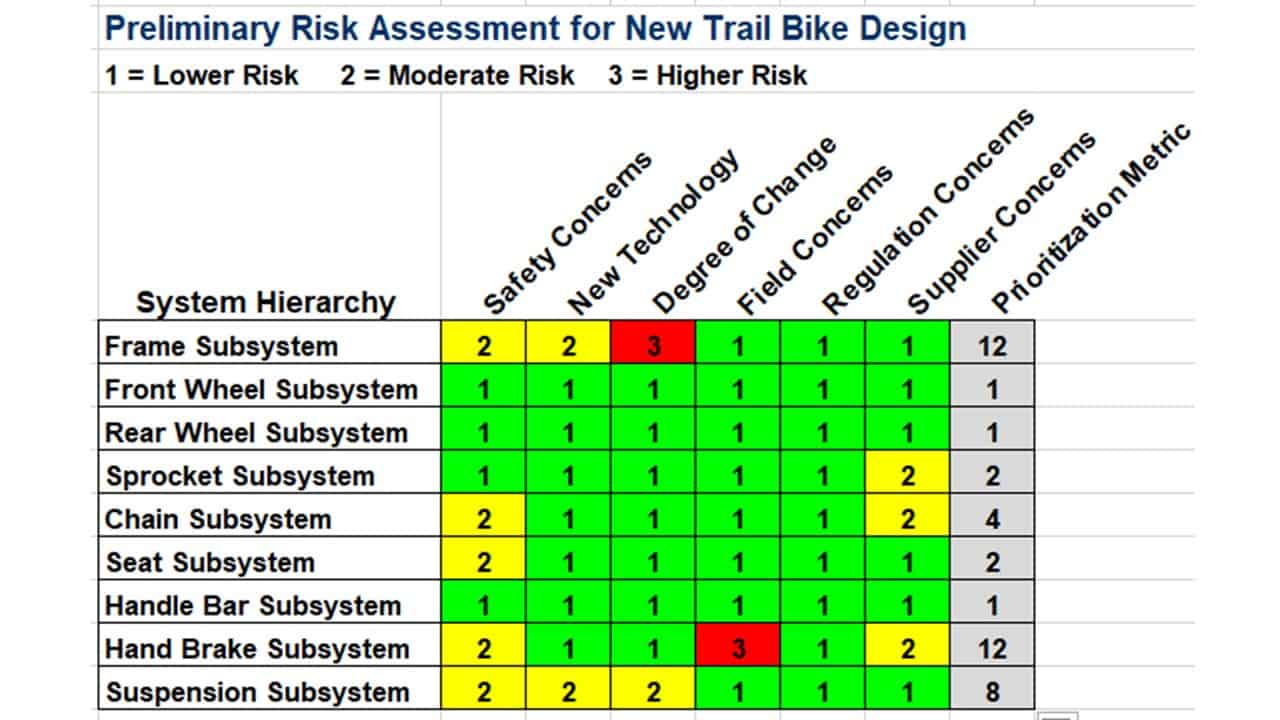

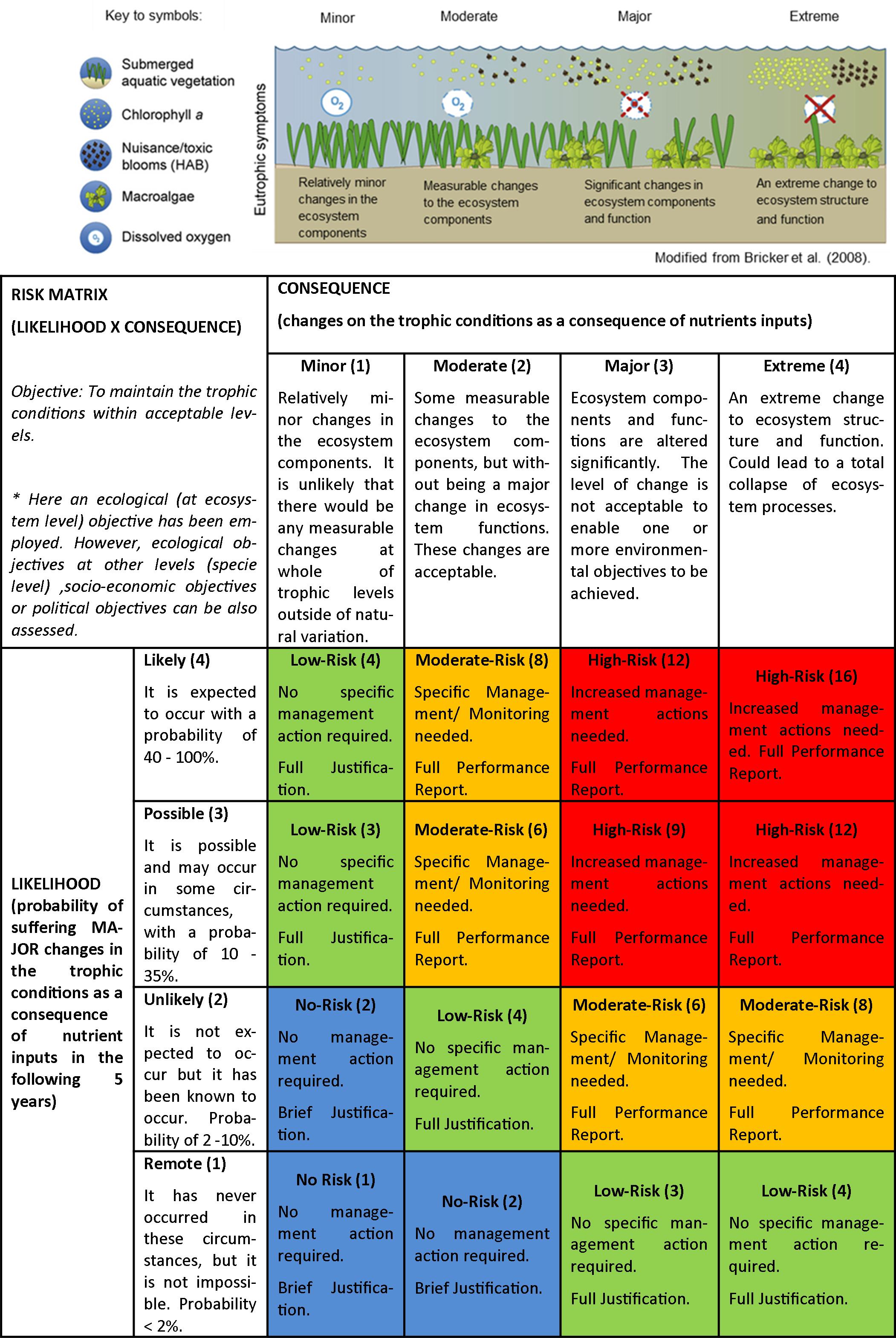

Customer Risk Rating Factors. In this video we explore the Ins and Outs of what is customer risk rating as well as the risk factors to consider at the time of performing the customer risk. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. The customers activity is associated with a higher risk of MLFT.

Risk Assessment Criteria Download Table From researchgate.net

Risk Assessment Criteria Download Table From researchgate.net

255 rows For example a customers country of domicile or business registration might be rated low if. Further a spectrum of risks may be identifiable even within the same category of customers. High Risk - Rating. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. The customer pursues activity commonly associated with a higher risk of corruption. The factors the bank should consider when assessing a customer risk profile are substantially similar to the risk categories considered when determining the banks overall risk profile.

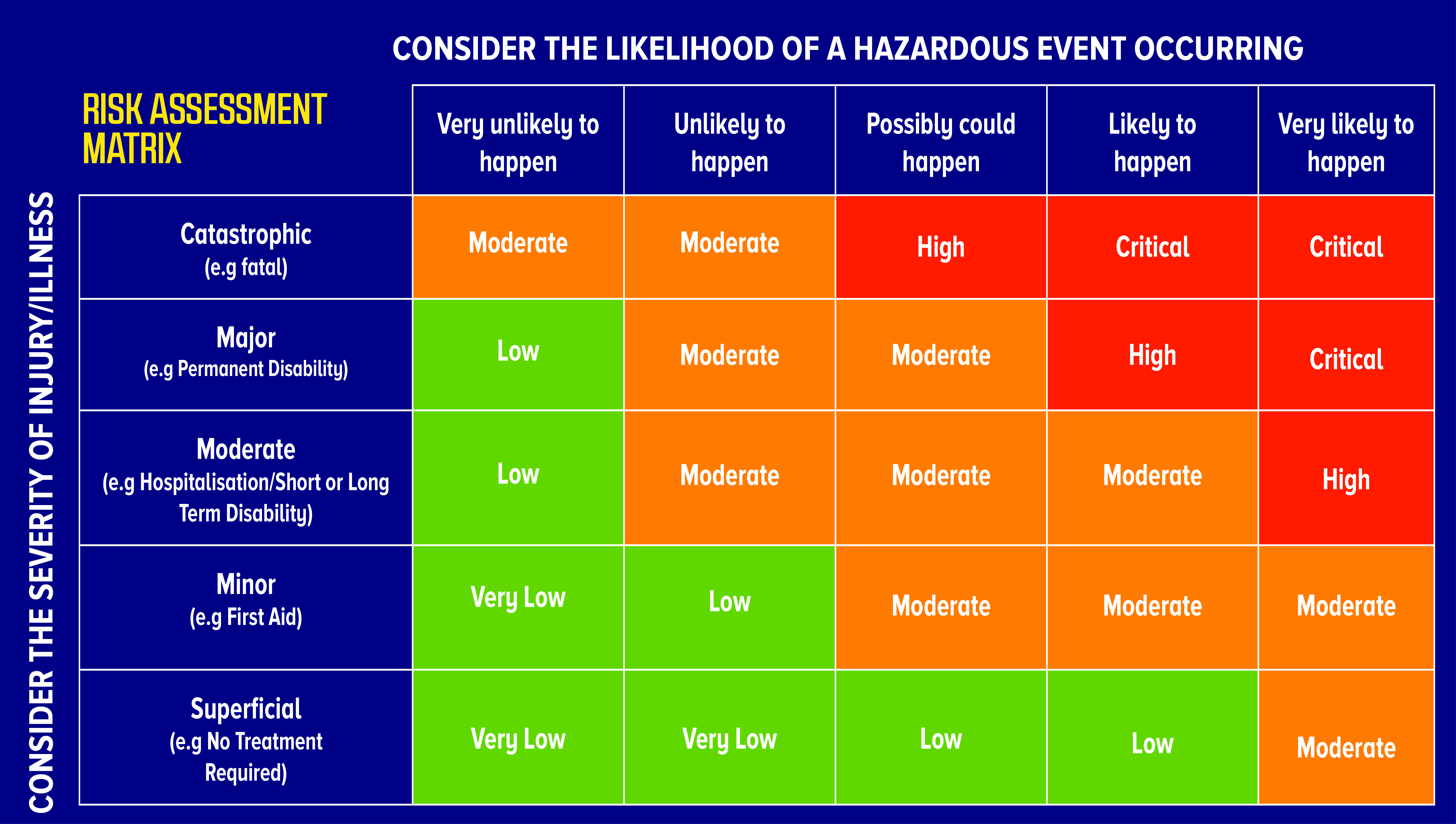

If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor.

Master value pricing and transform your business profits and client satisfaction Get the Master Class 5. Significant unexplained geographic distance between the financial institution and the customer. Let us look at the major factors that govern the risk rating. Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. Based on the customers risk score the KYC system determines the next review date. The customer is a voluntary organisationwhose primary activity is to raise or.

Source: pinterest.com

Source: pinterest.com

Medium Risk - Rating of 6 or 8. High Risk - Rating. The customer is a voluntary organisationwhose primary activity is to raise or. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers.

Source: researchgate.net

Source: researchgate.net

The bank should identify the specific risks of the customer or category of customers and then conduct an analysis of all pertinent information in order to develop the customers risk profile. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Your task is to lower mitigate or eliminate those risks. If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Source: pinterest.com

Source: pinterest.com

Master value pricing and transform your business profits and client satisfaction Get the Master Class 5. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Both of these can provide you with good opportunities to mitigate risk.

Source: pinterest.com

Source: pinterest.com

High Risk - Rating. High Risk - Rating. Significant unexplained geographic distance between the financial institution and the customer. Look hard at your contracts and your length of engagement. Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised.

Source: accendoreliability.com

Source: accendoreliability.com

Companies determine the risk level of customers in the process of customer onboarding. Your task is to lower mitigate or eliminate those risks. High-risk customers must be checked regularly due to the threat of crime and AML policy. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. The customer is a voluntary organisationwhose primary activity is to raise or.

Source: pinterest.com

Source: pinterest.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Significant unexplained geographic distance between the financial institution and the customer. Any customer account may be used for illicit purposes including money laundering or terrorist financing. The customer pursues activity commonly associated with a higher risk of corruption. If a customer has contracted with you over a longer time period.

Source: sitesafe.org.nz

Source: sitesafe.org.nz

Let us look at the major factors that govern the risk rating. Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. Medium Risk - Rating of 6 or 8. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. The business relationship is conducted in unusual circumstances eg.

Source: in.pinterest.com

Source: in.pinterest.com

Risk Factor Rating Score Customers transaction profile for dollar amount is greater than H 3 Customers transaction profile for dollar amount is greater than but less than M 2 Customers transaction profile for dollar amount is less than L 0. Commonly referred to as the customer risk rating. Ongoing monitoring is the AML control process applied to check high-risk customers. Companies determine the risk level of customers in the process of customer onboarding. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

Source: perseus-net.eu

Source: perseus-net.eu

Different Types of Customer Risk This presentation explores different types of risk your customers or clients consider when they are purchasing your solution. If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Medium Risk - Rating of 6 or 8. The business relationship is conducted in unusual circumstances eg.

Source: pinterest.com

Source: pinterest.com

Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. High Risk - Rating. Look hard at your contracts and your length of engagement. Risk Factor Rating Score Customers transaction profile for dollar amount is greater than H 3 Customers transaction profile for dollar amount is greater than but less than M 2 Customers transaction profile for dollar amount is less than L 0. High-risk customers must be checked regularly due to the threat of crime and AML policy.

Source: researchgate.net

Source: researchgate.net

High Risk - Rating. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. The business relationship is conducted in unusual circumstances eg. Medium Risk - Rating of 6 or 8. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Source: pinterest.com

Source: pinterest.com

Risk Factor Rating Score Customers transaction profile for dollar amount is greater than H 3 Customers transaction profile for dollar amount is greater than but less than M 2 Customers transaction profile for dollar amount is less than L 0. The customer is a voluntary organisationwhose primary activity is to raise or. If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering.

Source: researchgate.net

Source: researchgate.net

Customer Risk Examples of MLFT high risk indicators vis-à-vis customer cont. Your task is to lower mitigate or eliminate those risks. The business relationship is conducted in unusual circumstances eg. High-risk customers must be checked regularly due to the threat of crime and AML policy. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title customer risk rating factors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas