17+ Customer risk rating fatf info

Home » about money loundering Info » 17+ Customer risk rating fatf infoYour Customer risk rating fatf images are ready in this website. Customer risk rating fatf are a topic that is being searched for and liked by netizens now. You can Download the Customer risk rating fatf files here. Download all free vectors.

If you’re searching for customer risk rating fatf pictures information related to the customer risk rating fatf keyword, you have visit the ideal site. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

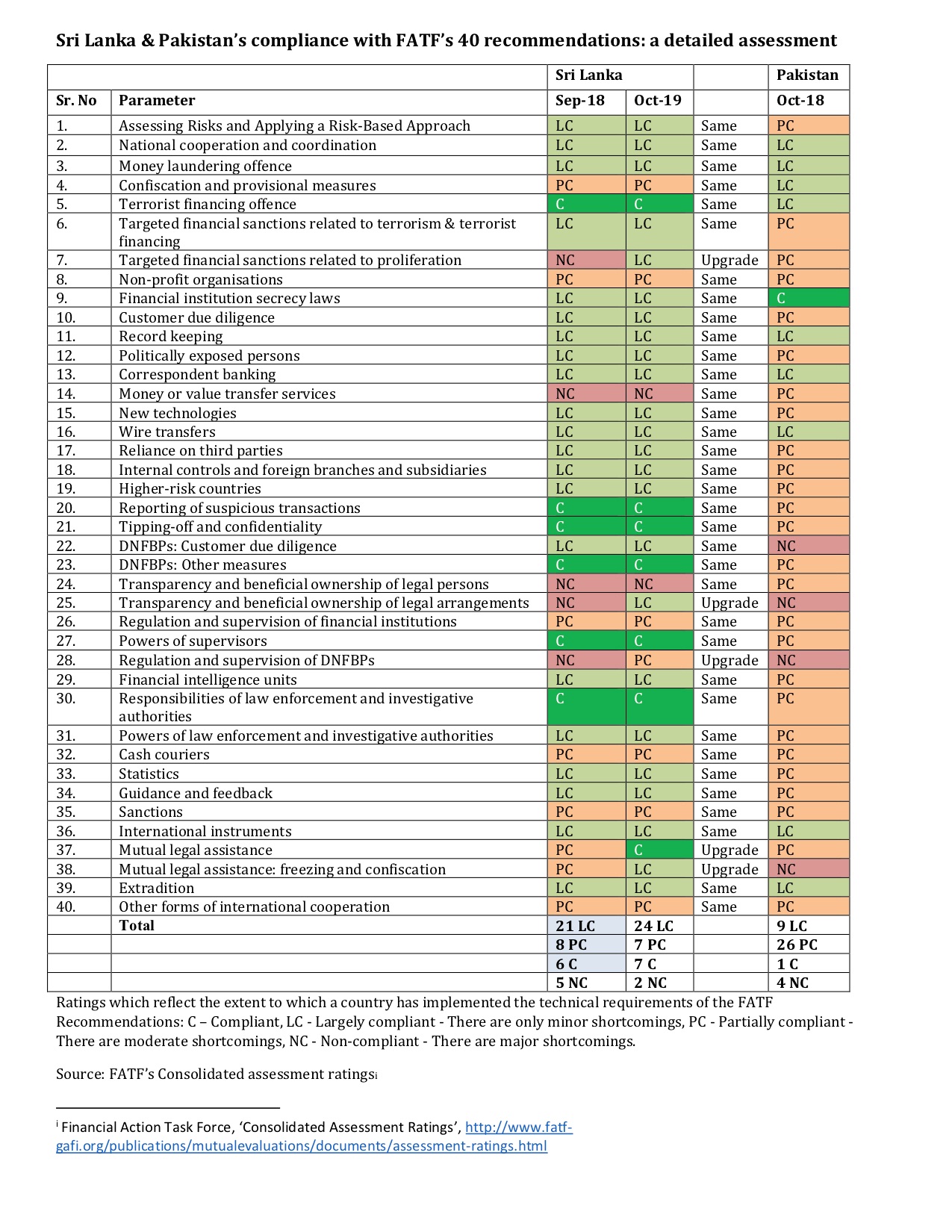

Customer Risk Rating Fatf. These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more. Money laundering risk from customer need not be reviewed. Being estimated at between US800 billion to US2 trillion every year money laundering is a serious problem for the global economy. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Documents Financial Action Task Force Fatf From fatf-gafi.org

Documents Financial Action Task Force Fatf From fatf-gafi.org

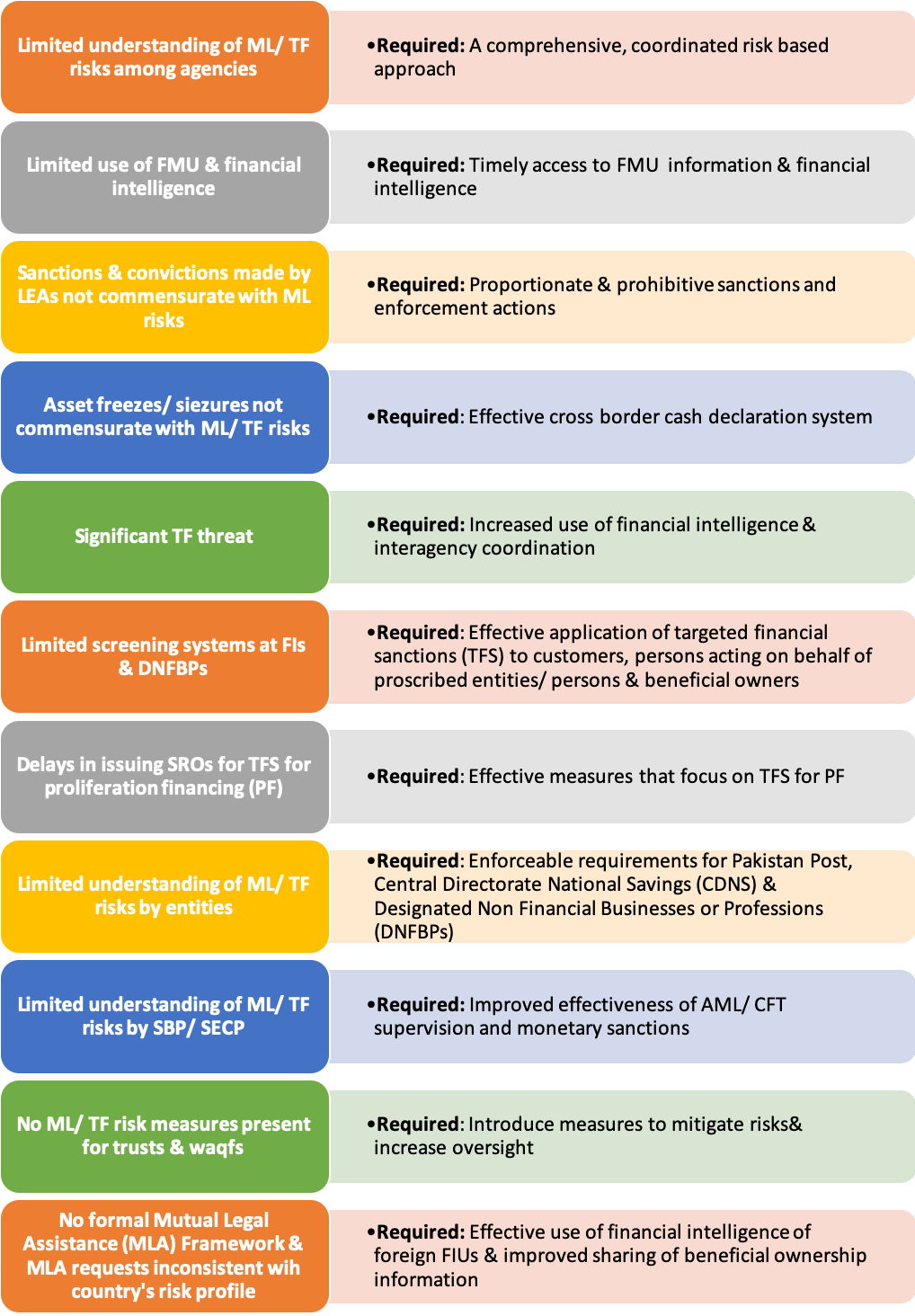

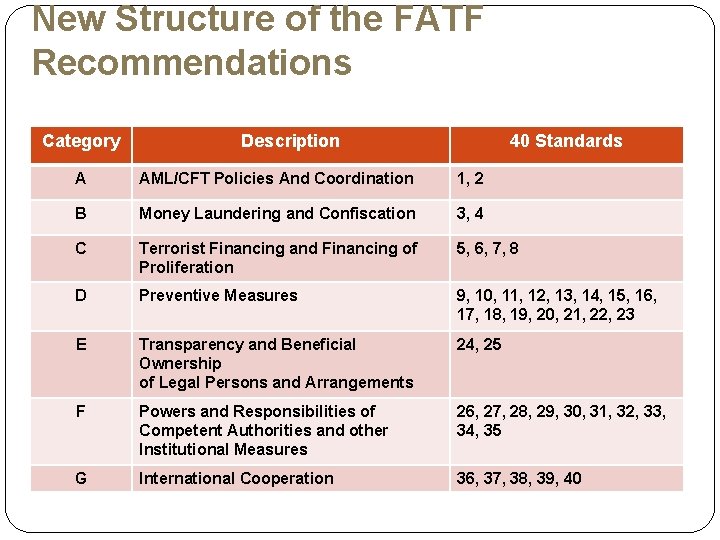

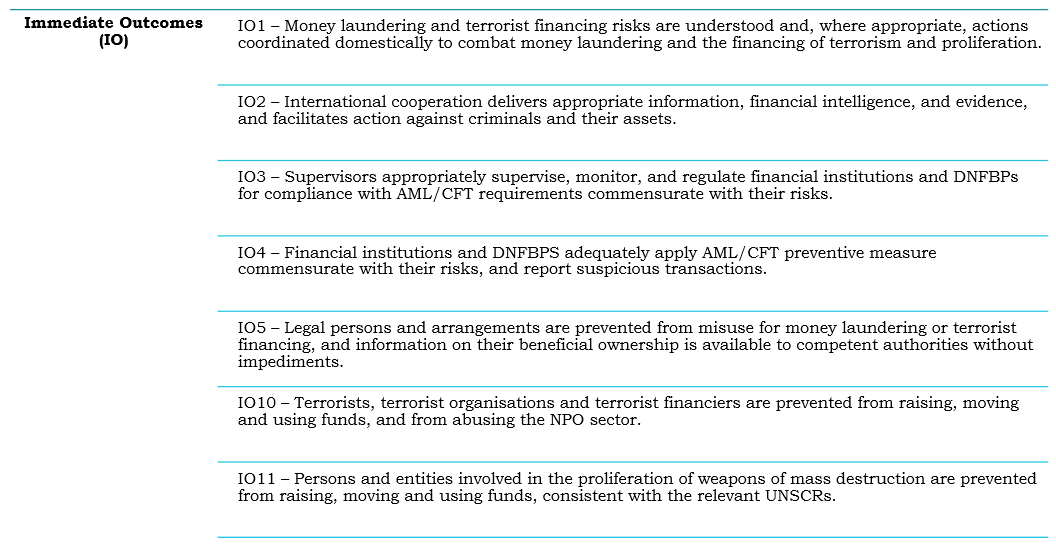

This involves prioritising and sequencing the implementation of MER recommendations on the basis of identified risksvulnerabilities and the 16 coreKey FATF Recommendations This will be updated as the FATF discussions evolve on this point and factoring in resourcing and capacity constraint issues. Some examples of what the customer risk. Not All Customers Are Created Equal. The customers awareness of a possible STR or investigation could compromise future efforts to investigate the suspected money laundering or terrorist financing operation. RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. The theory supporting risk assessment tools and templates is.

Some examples of what the customer risk.

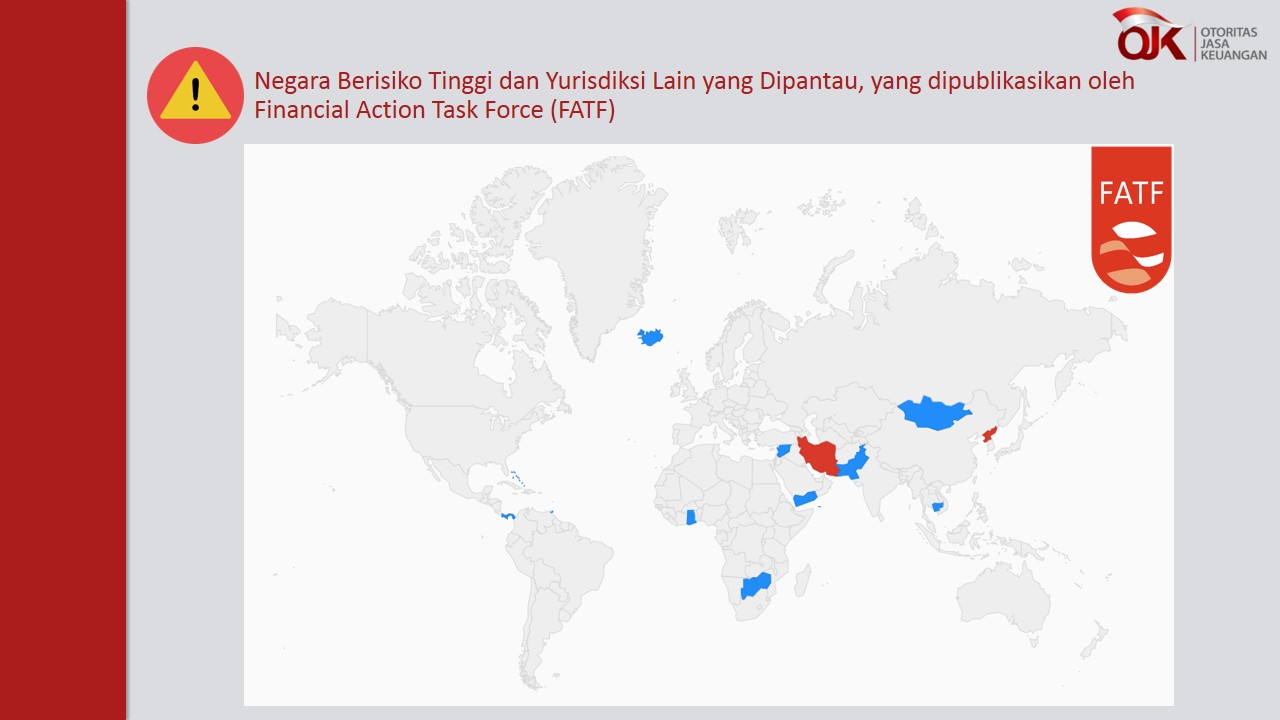

The customers awareness of a possible STR or investigation could compromise future efforts to investigate the suspected money laundering or terrorist financing operation. This involves prioritising and sequencing the implementation of MER recommendations on the basis of identified risksvulnerabilities and the 16 coreKey FATF Recommendations This will be updated as the FATF discussions evolve on this point and factoring in resourcing and capacity constraint issues. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. GOS Advisory 0001 2021 - FATF removes The Bahamas GOS Advisory 0002-2021. High-risk countries to MLTF have been identified by many regulatory and advisory bodies such as the Financial Action Task Force FATF World Bank Transparency International United Nations Office of Foreign Asset Control OFAC etc based on certain characteristics as stated below which can assist in understanding the level of risk such as the level of stability and corruption terrorist and criminal activity. 255 rows Key Assessment Factors.

Source: fatf-gafi.org

Source: fatf-gafi.org

Risk Factor Rating Score The area where the customer resides is considered high risk H 3 The area where the customer resides is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. WHAT IS THE RBA. RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers.

Source: ojk.go.id

Source: ojk.go.id

Is the client located in a known high crime rate. Client and Business Relationships. Money laundering risk from customer need not be reviewed. FATFs notices and guidance on the different jurisdictions can assist your institution in applying the proper countermeasures in accordance to. When assessing the MLFT risk posed by a customer a regulated entity should consider all known risk factors and include these in the customers risk profile making sure that any mitigating factors are documented accordingly.

Source: slideshare.net

Source: slideshare.net

Countermeasures that are balanced and up to date will help financial institutions mitigate regulatory scrutiny and monetary losses in the future. Being estimated at between US800 billion to US2 trillion every year money laundering is a serious problem for the global economy. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. When assessing the MLFT risk posed by a customer a regulated entity should consider all known risk factors and include these in the customers risk profile making sure that any mitigating factors are documented accordingly. Risks resulting from customer geographic presence and jurisdiction in which the customer is operating.

Source: ciphertrace.com

Source: ciphertrace.com

WHAT IS THE RBA. 8 are expected to identify assess and understand the MLTF risks to which they are exposed and take. The theory supporting risk assessment tools and templates is. SECTION I THE FATFS RISK-BASED APPROACH RBA TO AMLCFT. A RBA to AMLCFT means that countries competent authorities and financial institutions.

Source: pdfprof.com

Source: pdfprof.com

Is the client located in a known high crime rate. These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more. Money laundering risk from customer need not be reviewed. A risk exists that customers could be unintentionally tipped off when the financial institution is seeking to perform its customer due diligence CDD obligations in these circumstances. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile.

Source: fatf-gafi.org

Source: fatf-gafi.org

The risk assessment contains two elements - identification of risk factors and assessment of risk factors. Based on the customers risk score the KYC system determines the next review date. SECTION I THE FATFS RISK-BASED APPROACH RBA TO AMLCFT. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. Money laundering risk from customer need not be reviewed.

Source: slidetodoc.com

Source: slidetodoc.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. FATFs notices and guidance on the different jurisdictions can assist your institution in applying the proper countermeasures in accordance to. Based on the customers risk score the KYC system determines the next review date. Assessing Customer Risk.

Source: fatf-gafi.org

Source: fatf-gafi.org

A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. In order to make the assessment undertakings or persons must identify the risk factors relevant to the customer. Risk Factor Rating Score The area where the customer resides is considered high risk H 3 The area where the customer resides is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. The reproduction or modification is prohibited. Which may vary from customer to customer depending on their needs.

Source: ojk.go.id

Source: ojk.go.id

In order to make the assessment undertakings or persons must identify the risk factors relevant to the customer. Countermeasures that are balanced and up to date will help financial institutions mitigate regulatory scrutiny and monetary losses in the future. Is the client located in a known high crime rate. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Which may vary from customer to customer depending on their needs.

Source: issuu.com

Source: issuu.com

A risk exists that customers could be unintentionally tipped off when the financial institution is seeking to perform its customer due diligence CDD obligations in these circumstances. Some examples of what the customer risk. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. This involves prioritising and sequencing the implementation of MER recommendations on the basis of identified risksvulnerabilities and the 16 coreKey FATF Recommendations This will be updated as the FATF discussions evolve on this point and factoring in resourcing and capacity constraint issues. Undertakings must identify therefore disclose relevant risk factors in the customer relationship in order to perform sufficient customer due diligence procedures.

Source: fatf-gafi.org

Source: fatf-gafi.org

A RBA to AMLCFT means that countries competent authorities and financial institutions. 8 are expected to identify assess and understand the MLTF risks to which they are exposed and take. A risk exists that customers could be unintentionally tipped off when the financial institution is seeking to perform its customer due diligence CDD obligations in these circumstances. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. In order to make the assessment undertakings or persons must identify the risk factors relevant to the customer.

Source: ojk.go.id

Source: ojk.go.id

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. GOS Advisory 0001 2021 - FATF removes The Bahamas GOS Advisory 0002-2021. Is the client located in a known high crime rate. Need for New Customer Risk Rating Models. Money laundering risk from customer need not be reviewed.

Source: pdfprof.com

Source: pdfprof.com

These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more. RISK-BASED APPROACH GUIDANCE FOR THE BANKING SECTOR. The theory supporting risk assessment tools and templates is. The reproduction or modification is prohibited. The risk assessment contains two elements - identification of risk factors and assessment of risk factors.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer risk rating fatf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas