11++ Customer risk rating guidance info

Home » about money loundering Info » 11++ Customer risk rating guidance infoYour Customer risk rating guidance images are ready in this website. Customer risk rating guidance are a topic that is being searched for and liked by netizens today. You can Get the Customer risk rating guidance files here. Get all royalty-free vectors.

If you’re searching for customer risk rating guidance images information related to the customer risk rating guidance interest, you have pay a visit to the ideal blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Customer Risk Rating Guidance. Further a spectrum of risks may be identifiable even within the same category of customers. CRM Guidelines have been written for service managers safety quality and risk officerscoordinatorsmanagers as well as staff involved in the risk management of day-to-day operations of clinical services the CRM Guidelines are relevant to all health employees to understand and employ within comprehensive clinical governance system. Your risk assessment must be in writing and include a description of how it. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool.

Liquidity Risk Management Framework For Capital Estimation Risk Management Asset Liability Management Management From pinterest.com

Liquidity Risk Management Framework For Capital Estimation Risk Management Asset Liability Management Management From pinterest.com

This includes the MLTF risk presented by your customer the products and services you offer and the countries you deal with. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. High Risk - Rating. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. When assessing risk it is important to distinguish between inherent risk and residual risk. CRM Guidelines have been written for service managers safety quality and risk officerscoordinatorsmanagers as well as staff involved in the risk management of day-to-day operations of clinical services the CRM Guidelines are relevant to all health employees to understand and employ within comprehensive clinical governance system.

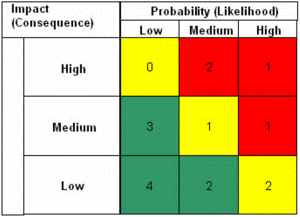

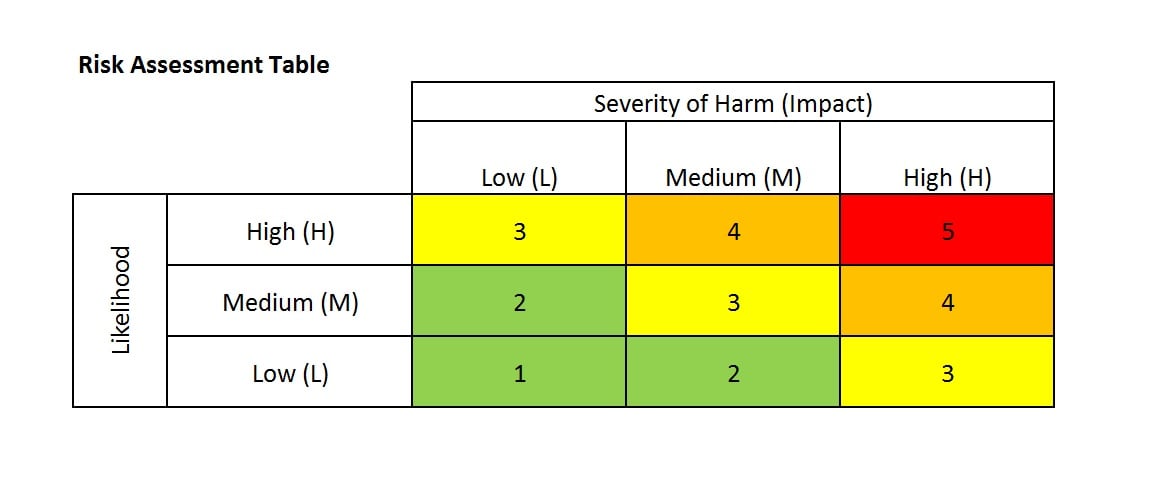

If the Rating Action Band is greater than 3 or 4 then you should review your existing SafetyControl Measures and add whatever Additional Control Measures may be necessary to bring the risk back to a Low or Minimal Risk.

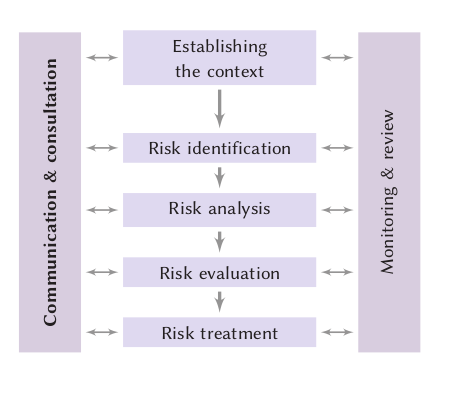

CRM Guidelines have been written for service managers safety quality and risk officerscoordinatorsmanagers as well as staff involved in the risk management of day-to-day operations of clinical services the CRM Guidelines are relevant to all health employees to understand and employ within comprehensive clinical governance system. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. To assessing the risk of a customer relationship then the financial institution should reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. It also covers different risk models with the parameters considered for assessing the risk a customer poses to a financial institution. Purpose of this document To provide guidance to industry when implementing Quality Risk Management.

Source: pinterest.com

Source: pinterest.com

The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. CRM Guidelines have been written for service managers safety quality and risk officerscoordinatorsmanagers as well as staff involved in the risk management of day-to-day operations of clinical services the CRM Guidelines are relevant to all health employees to understand and employ within comprehensive clinical governance system. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This includes the MLTF risk presented by your customer the products and services you offer and the countries you deal with.

Source: pinterest.com

Source: pinterest.com

Through customer due diligence CDD a financial institution gains an understanding of the types of transactions in which a customer is likely to engage. Commonly referred to as the customer risk rating. High Risk - Rating. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. The new CDD Chapter of FFIEC outlines the expectation to risk rate customers.

Source: pinterest.com

Source: pinterest.com

This includes the MLTF risk presented by your customer the products and services you offer and the countries you deal with. 43 - 61 M oderate 4. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. Your risk assessment must be in writing and include a description of how it.

Source: proxsisgroup.com

Source: proxsisgroup.com

Customer and entity risk is extremely complex. Further a spectrum of risks may be identifiable even within the same category of customers. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Scope PICS Guide to GMP Chapter 1 Clauses 15 and 16 describes QRM as a systematic process to proactively or retrospectively manage risk to product quality using.

Source: proxsisgroup.com

Source: proxsisgroup.com

Your risk assessment must enable you to determine the level of risk involved in relation to relevant obligations under the Act. When assessing risk it is important to distinguish between inherent risk and residual risk. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Your risk assessment must enable you to determine the level of risk involved in relation to relevant obligations under the Act. To assessing the risk of a customer relationship then the financial institution should reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating.

Source: pinterest.com

Source: pinterest.com

Medium Risk - Rating of 6 or 8. The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. Medium Risk - Rating of 6 or 8. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined. What is an RBA.

Source: risk-engineering.org

Source: risk-engineering.org

Medium Risk - Rating of 6 or 8. Commonly referred to as the customer risk rating. Any customer account may be used for illicit purposes including money laundering or terrorist financing. It also covers different risk models with the parameters considered for assessing the risk a customer poses to a financial institution. Your risk assessment must enable you to determine the level of risk involved in relation to relevant obligations under the Act.

Source: pinterest.com

Source: pinterest.com

The Wolfsberg Group believes that this Guidance will support risk management and assist institutions in exercising business judgement with respect to their clients. If you identify any hazard which after applying any applicable control measures is still rated as Medium then speak to a professional health and safety advisor. Corresponds to ICH Q9 Guideline on Quality Risk Management. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating.

Source: safety.unimelb.edu.au

Source: safety.unimelb.edu.au

Any customer account may be used for illicit purposes including money laundering or terrorist financing. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. Establishing BSA Customer Risk Ratings and CDD Guidance. Overall Score and Risk Rating After completion of the evaluation process an overall score and risk rating is automatically determined.

Source: ivtnetwork.com

Source: ivtnetwork.com

Medium Risk - Rating of 6 or 8. The Wolfsberg Group believes that this Guidance will support risk management and assist institutions in exercising business judgement with respect to their clients. To assessing the risk of a customer relationship then the financial institution should reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

However financial institutions on the basis of risk may choose to review. It also covers different risk models with the parameters considered for assessing the risk a customer poses to a financial institution. Functions of a Credit Risk Rating System. However financial institutions on the basis of risk may choose to review. Scope PICS Guide to GMP Chapter 1 Clauses 15 and 16 describes QRM as a systematic process to proactively or retrospectively manage risk to product quality using.

Source: pinterest.com

Source: pinterest.com

The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. This includes the MLTF risk presented by your customer the products and services you offer and the countries you deal with. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. 82 - 100 U ndoubted 2. This is the surest way to determine which clients present a higher risk to your company thus allowing you to avoid liability and ensure that these clients are monitored appropriately.

Source: ivtnetwork.com

Source: ivtnetwork.com

The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. 43 - 61 M oderate 4. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title customer risk rating guidance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas