13+ Danske bank money laundering explained info

Home » about money loundering Info » 13+ Danske bank money laundering explained infoYour Danske bank money laundering explained images are available in this site. Danske bank money laundering explained are a topic that is being searched for and liked by netizens today. You can Find and Download the Danske bank money laundering explained files here. Get all royalty-free photos.

If you’re searching for danske bank money laundering explained images information connected with to the danske bank money laundering explained topic, you have come to the ideal site. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

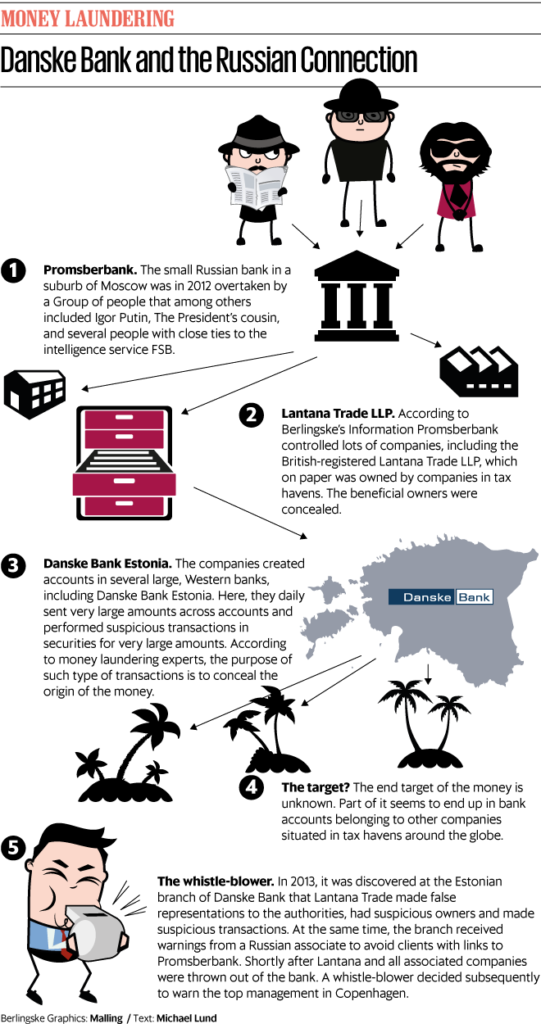

Danske Bank Money Laundering Explained. Danske Bank has run into trouble resulting from alleged money laundering in its Estonian branch. Danske Bank is far from the only offender here. Danske Bank violated anti-money laundering regulations for many years by operating high-risk money-laundering clients to make suspicious transactions through the bank. Danske Bank has been caught up in one of the largest-ever money laundering scandals.

Howard Wilkinson And Stephen Kohn Testimony At European Parliament Money Laundering Scandal Youtube From youtube.com

Howard Wilkinson And Stephen Kohn Testimony At European Parliament Money Laundering Scandal Youtube From youtube.com

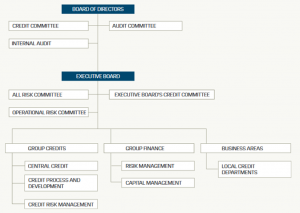

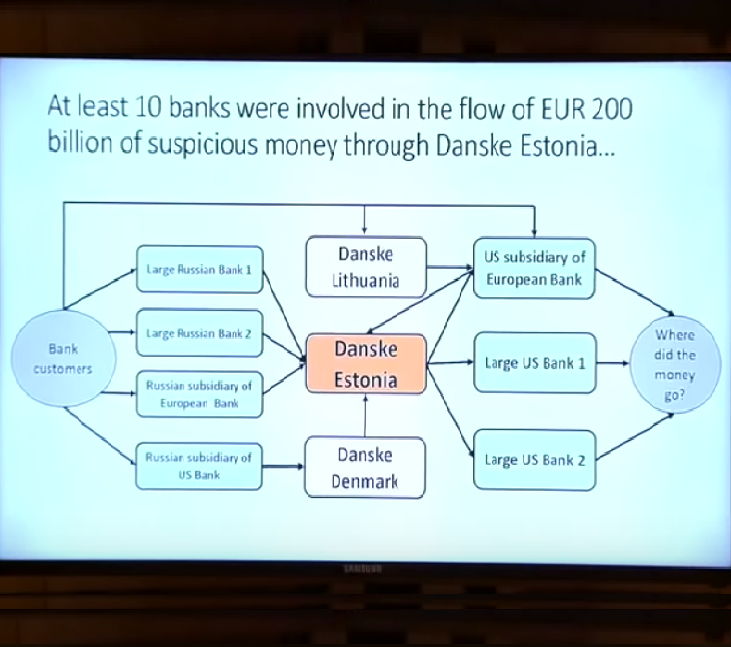

Danske Bank has run into trouble resulting from alleged money laundering in its Estonian branch. Large regulatory bodies as well as individual customers of the bank have questioned how much of the issue was excusable misunderstanding between the branch and Executive Board of the bank. So said Thomas Borgen CEO of Denmarks. Danske Bank has been caught up in one of the largest-ever money laundering scandals. The Danske Bank money laundering scandal arose in 2017-2018 around 200 billion of suspicious transactions that flowed from Estonian Russian Latvian and other sources through the Estonia -based bank branch of Denmark -based Danske Bank from 2007 to 2015. Danske Bank violated anti-money laundering regulations for many years by operating high-risk money-laundering clients to make suspicious transactions through the bank.

Given the scale of what was revealed quotes like 200bn mostly suspicious 10000 accounts are always likely to be at the top of the agenda for anyone.

Danske Bank until recently one of Europes most respected financial institutions is at the centre of possibly the worlds biggest money-laundering scandal. Large regulatory bodies as well as individual customers of the bank have questioned how much of the issue was excusable misunderstanding between the branch and Executive Board of the bank. In addition Danske Bank misled the Estonian public authorities by providing them with inadequate information and thus actually hampered their activities the FSA explained. New York regulators have fined Deutsche Bank 150 million after finding that the lenders compliance staff opened at least 40 accounts for billionaire financier and accused sex trafficker Jeffrey Epstein and failed to monitor millions of dollars in suspicious payments that followed. Reuters - Danske Bank DANSKECO is embroiled in a money laundering scandal that has triggered criminal investigations forced out its CEO and chairman and rattled investors in Denmarks. Given the scale of what was revealed quotes like 200bn mostly suspicious 10000 accounts are always likely to be at the top of the agenda for anyone.

In addition Danske Bank misled the Estonian public authorities by providing them with inadequate information and thus actually hampered their activities the FSA explained. Howard Wilkinson the whistleblower who first alerted Denmarks biggest bank to the problem testified before the Danish parliament on Monday. There are outstanding money laundering or transaction laundering cases open against numerous banks. The Danske Bank money laundering scandal broke in 2017 after it emerged that over 200 Billion in suspicious transactions had flowed through the Estonian branch of the bank over a nine-year period. In addition Danske Bank misled the Estonian public authorities by providing them with inadequate information and thus actually hampered their activities the FSA explained.

Source: s-rminform.com

Source: s-rminform.com

Danske Bank is far from the only offender here. Danske Bank has been caught up in one of the largest-ever money laundering scandals. The scandal surrounding Danske Bank is the most significant recent instance of money laundering with 236 billion in laundered money estimated to have passed through its Estonian branch. Reuters - Danske Bank DANSKECO is embroiled in a money laundering scandal that has triggered criminal investigations forced out its CEO and chairman and rattled investors in Denmarks. Danske Bank until recently one of Europes most respected financial institutions is at the centre of possibly the worlds biggest money-laundering scandal.

Source: 360storybank.com

Source: 360storybank.com

Howard Wilkinson the whistleblower who first alerted Denmarks biggest bank to the problem testified before the Danish parliament on Monday. So said Thomas Borgen CEO of Denmarks. In addition Danske Bank misled the Estonian public authorities by providing them with inadequate information and thus actually hampered their activities the FSA explained. It is clear that Danske Bank has failed to live up to its responsibility in the case of possible money laundering in Estonia. The Danske Bank money laundering scandal arose in 2017-2018 around 200 billion of suspicious transactions that flowed from Estonian Russian Latvian and other sources through the Estonia -based bank branch of Denmark -based Danske Bank from 2007 to 2015.

Source: sites.law.duke.edu

Source: sites.law.duke.edu

Morgan was the first to suspect that Danske Bank was laundering large amounts of Russian money through its Estonian branch and it broke off its banking relationship in 2013. New York regulators have fined Deutsche Bank 150 million after finding that the lenders compliance staff opened at least 40 accounts for billionaire financier and accused sex trafficker Jeffrey Epstein and failed to monitor millions of dollars in suspicious payments that followed. The Danske Bank money laundering scandal arose in 2017-2018 around 200 billion of suspicious transactions that flowed from Estonian Russian Latvian and other sources through the Estonia -based bank branch of Denmark -based Danske Bank from 2007 to 2015. Howard Wilkinson the whistleblower who first alerted Denmarks biggest bank to the problem testified before the Danish parliament on Monday. In addition Danske Bank misled the Estonian public authorities by providing them with inadequate information and thus actually hampered their activities the FSA explained.

Source: dw.com

Source: dw.com

Danske Bank until recently one of Europes most respected financial institutions is at the centre of possibly the worlds biggest money-laundering scandal. It is a key priority for us to strengthen and improve our efforts on an ongoing basis and cooperate closely with authorities and others to achieve as strong a defence as possible against the criminal networks. Danske Bank has previously concluded that it was not sufficiently effective in preventing the branch in Estonia from being used for money laundering in the period from 2007 to 2015. So said Thomas Borgen CEO of Denmarks. Danske Bank violated anti-money laundering regulations for many years by operating high-risk money-laundering clients to make suspicious transactions through the bank.

Source: sites.law.duke.edu

Source: sites.law.duke.edu

The Banks primary supervisor is the Danish Financial Supervisory Authority DFSA and the Banks operations within the European Union EU are subject to regulation and supervision by other national banking authorities. New York regulators have fined Deutsche Bank 150 million after finding that the lenders compliance staff opened at least 40 accounts for billionaire financier and accused sex trafficker Jeffrey Epstein and failed to monitor millions of dollars in suspicious payments that followed. Danske Bank has previously concluded that it was not sufficiently effective in preventing the branch in Estonia from being used for money laundering in the period from 2007 to 2015. Morgan was the first to suspect that Danske Bank was laundering large amounts of Russian money through its Estonian branch and it broke off its banking relationship in 2013. The Danske Bank money laundering scandal broke in 2017 after it emerged that over 200 Billion in suspicious transactions had flowed through the Estonian branch of the bank over a nine-year period.

The Danske Bank money laundering scandal arose in 2017-2018 around 200 billion of suspicious transactions that flowed from Estonian Russian Latvian and other sources through the Estonia -based bank branch of Denmark -based Danske Bank from 2007 to 2015. So said Thomas Borgen CEO of Denmarks. New York regulators have fined Deutsche Bank 150 million after finding that the lenders compliance staff opened at least 40 accounts for billionaire financier and accused sex trafficker Jeffrey Epstein and failed to monitor millions of dollars in suspicious payments that followed. Danske Bank has been caught up in one of the largest-ever money laundering scandals. Danske Bank violated anti-money laundering regulations for many years by operating high-risk money-laundering clients to make suspicious transactions through the bank.

Source: ft.com

The Danske Bank money laundering scandal broke in 2017 after it emerged that over 200 Billion in suspicious transactions had flowed through the Estonian branch of the bank over a nine-year period. Howard Wilkinson the whistleblower who first alerted Denmarks biggest bank to the problem testified before the Danish parliament on Monday. These illicit funds mostly originated from Russia Estonia and Latvia and the scandal shook the banking sector to its core. The Danske Bank money laundering scandal broke in 2017 after it emerged that over 200 Billion in suspicious transactions had flowed through the Estonian branch of the bank over a nine-year period. There are outstanding money laundering or transaction laundering cases open against numerous banks.

Source: comp-matters.com

Source: comp-matters.com

The scandal surrounding Danske Bank is the most significant recent instance of money laundering with 236 billion in laundered money estimated to have passed through its Estonian branch. It is clear that Danske Bank has failed to live up to its responsibility in the case of possible money laundering in Estonia. It is a key priority for us to strengthen and improve our efforts on an ongoing basis and cooperate closely with authorities and others to achieve as strong a defence as possible against the criminal networks. In the immediate aftermath of the publishing of Bruun Hjejles report into the Danske Bank Estonia money laundering debacle on Wednesday certain elements tended to grab the headlines. It is clear that Danske Bank has failed to live up to its responsibility in the case of possible money laundering in Estonia.

Source: sites.law.duke.edu

Source: sites.law.duke.edu

Danske Bank has been caught up in one of the largest-ever money laundering scandals. Howard Wilkinson the whistleblower who first alerted Denmarks biggest bank to the problem testified before the Danish parliament on Monday. Morgan was the first to suspect that Danske Bank was laundering large amounts of Russian money through its Estonian branch and it broke off its banking relationship in 2013. Each day we do what we can to make it as difficult as possible to use Danske Bank for financial crime including money laundering and it has never been harder than it is today. There are outstanding money laundering or transaction laundering cases open against numerous banks.

Source: youtube.com

Source: youtube.com

New York regulators have fined Deutsche Bank 150 million after finding that the lenders compliance staff opened at least 40 accounts for billionaire financier and accused sex trafficker Jeffrey Epstein and failed to monitor millions of dollars in suspicious payments that followed. Danske Bank until recently one of Europes most respected financial institutions is at the centre of possibly the worlds biggest money-laundering scandal. So said Thomas Borgen CEO of Denmarks. The Banks primary supervisor is the Danish Financial Supervisory Authority DFSA and the Banks operations within the European Union EU are subject to regulation and supervision by other national banking authorities. So said Thomas Borgen CEO of Denmarks biggest financial institution when he resigned after admitting that around 200 billion of questionable money flowed through the Danish banks Estonian branch from 2007-15.

Source: dw.com

Source: dw.com

In the immediate aftermath of the publishing of Bruun Hjejles report into the Danske Bank Estonia money laundering debacle on Wednesday certain elements tended to grab the headlines. It is clear that Danske Bank has failed to live up to its responsibility in the case of possible money laundering in Estonia. Given the scale of what was revealed quotes like 200bn mostly suspicious 10000 accounts are always likely to be at the top of the agenda for anyone. The Danske Bank money laundering scandal broke in 2017 after it emerged that over 200 Billion in suspicious transactions had flowed through the Estonian branch of the bank over a nine-year period. Howard Wilkinson the whistleblower who first alerted Denmarks biggest bank to the problem testified before the Danish parliament on Monday.

Source: youtube.com

Source: youtube.com

In the immediate aftermath of the publishing of Bruun Hjejles report into the Danske Bank Estonia money laundering debacle on Wednesday certain elements tended to grab the headlines. Given the scale of what was revealed quotes like 200bn mostly suspicious 10000 accounts are always likely to be at the top of the agenda for anyone. In the immediate aftermath of the publishing of Bruun Hjejles report into the Danske Bank Estonia money laundering debacle on Wednesday certain elements tended to grab the headlines. Danske Bank has run into trouble resulting from alleged money laundering in its Estonian branch. Danske Bank violated anti-money laundering regulations for many years by operating high-risk money-laundering clients to make suspicious transactions through the bank.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title danske bank money laundering explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas