11+ Declaration foreign bank accounts ideas

Home » about money loundering idea » 11+ Declaration foreign bank accounts ideasYour Declaration foreign bank accounts images are ready. Declaration foreign bank accounts are a topic that is being searched for and liked by netizens today. You can Get the Declaration foreign bank accounts files here. Get all free images.

If you’re looking for declaration foreign bank accounts images information connected with to the declaration foreign bank accounts topic, you have come to the right blog. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

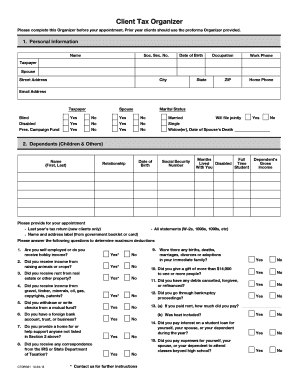

Declaration Foreign Bank Accounts. You report the accounts by filing a Report of Foreign Bank and Financial Accounts FBAR on FinCEN Form 114. Yes you do - this has nothing to do with where you earn income just that you must declare foreign bank accounts - as brian61 stated the Dual Tax Treaty now means the UK and French have the capability to exchange information. Les personnes physiques domiciliées ou établies en France sont tenues de déclarer en même temps que leur déclaration de revenus les références des comptes ouverts utilisés ou clos à létranger. Remember that youre taxable on your worldwide income profits and gains as a UK taxpayer so any interest payment and income you earn from offshore you should report in the UK to the tax authority.

16 Printable Fbar Form 114a Templates Fillable Samples In Pdf Word To Download Pdffiller From pdffiller.com

16 Printable Fbar Form 114a Templates Fillable Samples In Pdf Word To Download Pdffiller From pdffiller.com

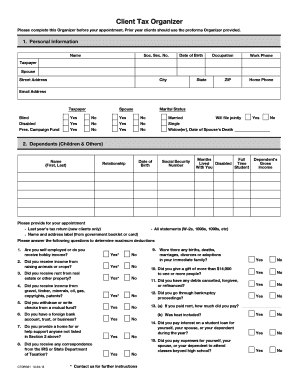

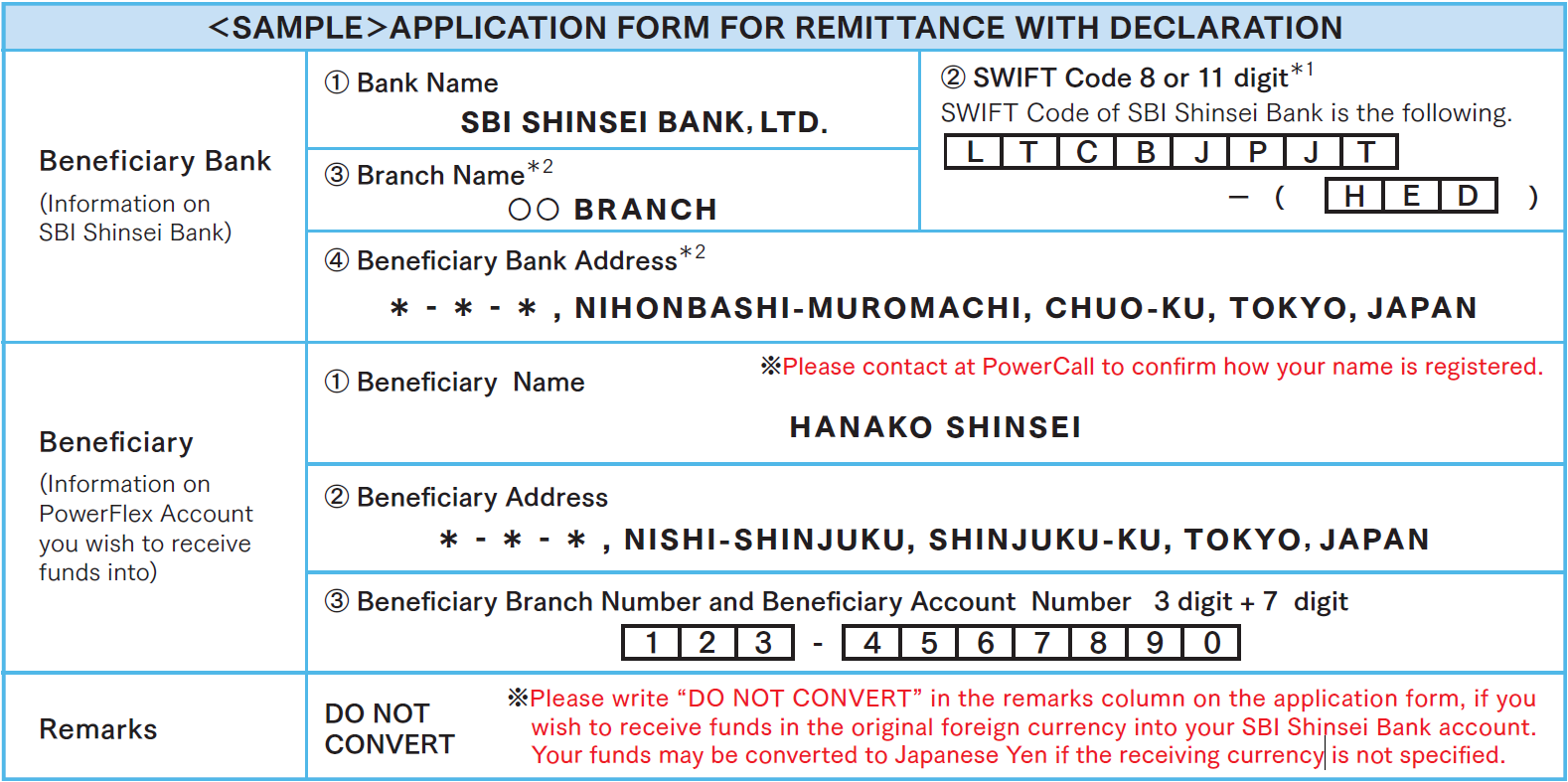

Yes you do - this has nothing to do with where you earn income just that you must declare foreign bank accounts - as brian61 stated the Dual Tax Treaty now means the UK and French have the capability to exchange information. The form used for the purpose is Cerfa n3916 Déclaration par un résident dun compte ouvert hors de Franc e. IBAN international bank account number. Treasury Department even if the accounts dont generate any taxable income. The tax administration can subsequently ask the taxpayer to provide her with all tax relevant information in relation to the declared bank accounts. The full line item instructions are located at FBAR Line Item Instructions.

You only spent less than 182 days overseas in that financial year then yes you need to declare your foreign asset and pay tax on them because the global income of Indian.

These restrictions are usually motivated by economic rather than anti-corruption concerns as a way to maintain a favourable balance of payment. Persons with foreign financial accounts to report their accounts to the US. The full line item instructions are located at FBAR Line Item Instructions. Every year under the law known as the Bank Secrecy Act you must report certain foreign financial accounts such as bank accounts brokerage accounts and mutual funds to the Treasury Department and keep certain records of those accounts. Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. You do not declare any amounts just the bank details - customer name account number bank name address.

Source: latefbar.com

Source: latefbar.com

Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. The IRS requires you to complete and e-File Form 114 Report of Foreign Bank and Financial Accounts FBAR through the Financial Crimes Enforcement Networks FinCEN BSA E-Filing System. This means that taxpayers have to tick the box to confirm that they hold a bank account abroad and that they have to mention the country where the bank account is held. You do not declare any amounts just the bank details - customer name account number bank name address. If you are resident in France and you hold a bank account abroad you are required to declare it each year with your tax declaration with Article 1649 of the tax code stating.

Source: pdffiller.com

Source: pdffiller.com

The tax administration can subsequently ask the taxpayer to provide her with all tax relevant information in relation to the declared bank accounts. The ATO already knows about your foreign bank account. The tax administration can subsequently ask the taxpayer to provide her with all tax relevant information in relation to the declared bank accounts. Reporting Foreign Bank Accounts You must report accounts you hold in foreign banks and other financial institutions if the total balance across all your accounts is 10000 or more at any time during the calendar year. You only spent less than 182 days overseas in that financial year then yes you need to declare your foreign asset and pay tax on them because the global income of Indian.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

No matter for what purpose you use your foreign bank account you must declare it to HMRC. Treasury Department even if the accounts dont generate any taxable income. Yes you do - this has nothing to do with where you earn income just that you must declare foreign bank accounts - as brian61 stated the Dual Tax Treaty now means the UK and French have the capability to exchange information. The IRS requires you to complete and e-File Form 114 Report of Foreign Bank and Financial Accounts FBAR through the Financial Crimes Enforcement Networks FinCEN BSA E-Filing System. The law requires US.

Source: goldinglawyers.com

Source: goldinglawyers.com

With bank secrecy laws crumbling around the world and the IRS pursuing tax evaders aggressively the odds are far greater that you will be caught sooner rather than later. In general such restrictions are not specific to politicians but apply to all residents of a. Reporting Foreign Bank Accounts You must report accounts you hold in foreign banks and other financial institutions if the total balance across all your accounts is 10000 or more at any time during the calendar year. If you are resident eg. Understand how to report foreign bank and financial accounts.

Source: shinseibank.com

Source: shinseibank.com

This obligation applies to individuals domiciled in France within the meaning of Article 4 B of the General Tax Code CGI whether they are account holders joint holders economic beneficiaries or beneficial owners. The form used for the purpose is Cerfa n3916 Déclaration par un résident dun compte ouvert hors de Franc e. Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. In general terms restrictions relating to opening and holding foreign accounts and property are imposed on citizens as part of a countrys foreign exchange control regime. Declaring foreign bank accounts and life insurance policies held abroad Who must declare.

Source: investopedia.com

Source: investopedia.com

The obligation in France to declare bank accounts abroad is commonly regarded as a one-off requirement. Accordingly if you are an Australian tax resident and if you have outstanding tax returns or if you have foreign bank accounts or foreign income that. Every year under the law known as the Bank Secrecy Act you must report certain foreign financial accounts such as bank accounts brokerage accounts and mutual funds to the Treasury Department and keep certain records of those accounts. The declaration must be made to the central contact point at the National Bank of Belgium NBB when the tax return is submitted at the latest. The full line item instructions are located at FBAR Line Item Instructions.

Source: americansoverseas.org

Source: americansoverseas.org

Understand how to report foreign bank and financial accounts. How to declare a foreign bank account in the Income Tax Declaration. No matter for what purpose you use your foreign bank account you must declare it to HMRC. The full line item instructions are located at FBAR Line Item Instructions. E-File your foreign bank and financial bank report via the link.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

Remember that youre taxable on your worldwide income profits and gains as a UK taxpayer so any interest payment and income you earn from offshore you should report in the UK to the tax authority. The identification of the account is done through. The IRS requires you to complete and e-File Form 114 Report of Foreign Bank and Financial Accounts FBAR through the Financial Crimes Enforcement Networks FinCEN BSA E-Filing System. If you are caught there are significant legal and financial consequences. Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

If you are caught there are significant legal and financial consequences. Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. Yes you do - this has nothing to do with where you earn income just that you must declare foreign bank accounts - as brian61 stated the Dual Tax Treaty now means the UK and French have the capability to exchange information. While owning a foreign bank account is not illegal failing to declare its existence is against the law. The IRS requires you to complete and e-File Form 114 Report of Foreign Bank and Financial Accounts FBAR through the Financial Crimes Enforcement Networks FinCEN BSA E-Filing System.

Source: pdffiller.com

Source: pdffiller.com

Remember that youre taxable on your worldwide income profits and gains as a UK taxpayer so any interest payment and income you earn from offshore you should report in the UK to the tax authority. While owning a foreign bank account is not illegal failing to declare its existence is against the law. In short Its not mandatory for an NRI taxpayer to declare its foreign assets or bank accounts while filing income tax returns but you should be careful while determining your residential status. Les personnes physiques domiciliées ou établies en France sont tenues de déclarer en même temps que leur déclaration de revenus les références des comptes ouverts utilisés ou clos à létranger. Which FBAR Filer Are You.

Source: pdffiller.com

Source: pdffiller.com

However strictly speaking the law requires that they be declared each year with your income tax return. Declaring foreign bank accounts and life insurance policies held abroad Who must declare. If you are resident eg. You do not declare any amounts just the bank details - customer name account number bank name address. This means that taxpayers have to tick the box to confirm that they hold a bank account abroad and that they have to mention the country where the bank account is held.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

In general such restrictions are not specific to politicians but apply to all residents of a. You do not declare any amounts just the bank details - customer name account number bank name address. Form 114 must be e-Filed separately from your Form 1040 by the Tax Deadline April 15 2021. How to declare a foreign bank account in the Income Tax Declaration. This obligation applies to individuals domiciled in France within the meaning of Article 4 B of the General Tax Code CGI whether they are account holders joint holders economic beneficiaries or beneficial owners.

Source: livemint.com

Source: livemint.com

The law requires US. This means that taxpayers have to tick the box to confirm that they hold a bank account abroad and that they have to mention the country where the bank account is held. No matter for what purpose you use your foreign bank account you must declare it to HMRC. Declaring foreign bank accounts and life insurance policies held abroad Who must declare. To declare accounts opened abroad they must be declared in Appendix J of the income statement identified in Box 11.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title declaration foreign bank accounts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information