14+ Define customer money laundering ideas in 2021

Home » about money loundering Info » 14+ Define customer money laundering ideas in 2021Your Define customer money laundering images are available in this site. Define customer money laundering are a topic that is being searched for and liked by netizens now. You can Get the Define customer money laundering files here. Get all royalty-free images.

If you’re looking for define customer money laundering pictures information connected with to the define customer money laundering interest, you have pay a visit to the ideal blog. Our website always provides you with hints for seeking the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

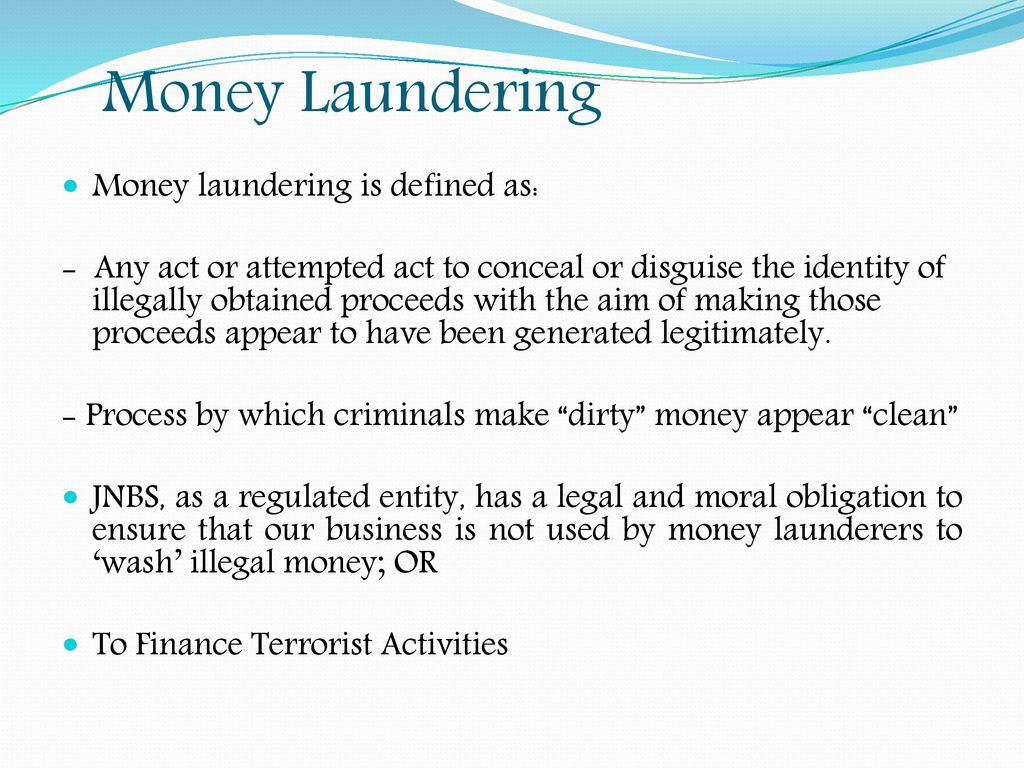

Define Customer Money Laundering. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Anti-Money Laundering AML meanwhile has a broader scope. The concealment or disguising of the nature of the proceeds. When you suspect money laundering or terrorist financing.

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute From lki.lk

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute From lki.lk

AML procedures are built with the goal of managing risk. Money laundering is the process by which persons with criminal intent or persons involved in criminal activity attempt to hide and disguise the true origin and ownership of the proceeds of their criminal. Criminals use money laundering to conceal their crimes and the. According to FindLaw embezzlement is defined. Money Laundering is the method criminals use to disguise the illegal origin and control of their wealth by passing it through a complex sequence of banking transfers or commercial transactions. In the first stage money enters the banking system.

1 AMLO 19 The term money laundering ML is defined in section 1 of Part 1 of Schedule 1 to the AMLO and means an act intended to have the effect of making any property.

Section 1956 a defines three types of criminal conduct. When you have doubts about a customers identification information that you obtained previously. The Company shall follow customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of reporting it to appropriate authority. The concealment or disguising of the nature of the proceeds. Criminals use money laundering to conceal their crimes and the. Money laundering is the process by which persons with criminal intent or persons involved in criminal activity attempt to hide and disguise the true origin and ownership of the proceeds of their criminal.

Source: ppt-online.org

Source: ppt-online.org

Know Your Customer KYC is an identity verification system used by banks to identify their clients. 1 AMLO 19 The term money laundering ML is defined in section 1 of Part 1 of Schedule 1 to the AMLO and means an act intended to have the effect of making any property. The concealment or disguising of the nature of the proceeds. The money laundering process can be broken down into three stages. Successful money laundering hides the illegal proceeds of a crime.

Source: gov.si

Source: gov.si

The concealment or disguising of the nature of the proceeds. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. In the first stage money enters the banking system. Along with some other aspects of underground economic activity rough estimates have been. 1 AMLO 19 The term money laundering ML is defined in section 1 of Part 1 of Schedule 1 to the AMLO and means an act intended to have the effect of making any property.

Source: calert.info

Source: calert.info

Money laundering is the act of disguising the original ownership identity and destination of the profits of a crime by hiding it within a legitimate financial institution and making it appear to have been acquired from a legal source. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. When you suspect money laundering or terrorist financing. 1 AMLO 19 The term money laundering ML is defined in section 1 of Part 1 of Schedule 1 to the AMLO and means an act intended to have the effect of making any property. KYC and AML are acronyms for Know Your Customer and Anti-money Laundering and refer to the set of activities that both financial institutions and regulated businesses must perform to verify the identity of their customers and obtain sensitive information from them as well as prevent money laundering from illegal activities.

Source: slideplayer.com

Source: slideplayer.com

When you suspect money laundering or terrorist financing. First the illegal activity that garners the money places it in the launderers hands. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. In the first stage money enters the banking system. Section 1956 a defines three types of criminal conduct.

Source: piranirisk.com

Source: piranirisk.com

Money Laundering is the method criminals use to disguise the illegal origin and control of their wealth by passing it through a complex sequence of banking transfers or commercial transactions. Such proceeds then seem to have appeared from a legitimate source and thus become legal money. The Company shall follow customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature for the purpose of reporting it to appropriate authority. There are 3 stages of money laundering. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. AML procedures are built with the goal of managing risk. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Second phase involves mixing the funds.

Source: bitquery.io

Source: bitquery.io

Money Laundering is the method criminals use to disguise the illegal origin and control of their wealth by passing it through a complex sequence of banking transfers or commercial transactions. Money Laundering is the method criminals use to disguise the illegal origin and control of their wealth by passing it through a complex sequence of banking transfers or commercial transactions. The money laundering process can be broken down into three stages. Know Your Customer KYC is an identity verification system used by banks to identify their clients. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Source: jagranjosh.com

Source: jagranjosh.com

Information collected from the customer for the purpose of opening of account shall be kept. When you suspect money laundering or terrorist financing. A that is the proceeds obtained from the commission of an. Second phase involves mixing the funds. The money laundering process can be broken down into three stages.

Source: lki.lk

Source: lki.lk

This stage is termed as placement. Anti-Money Laundering AML meanwhile has a broader scope. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Second phase involves mixing the funds. Money laundering is the act of disguising the original ownership identity and destination of the profits of a crime by hiding it within a legitimate financial institution and making it appear to have been acquired from a legal source.

Source: efinancemanagement.com

Source: efinancemanagement.com

Money laundering is the conversion or transfer of property. Information collected from the customer for the purpose of opening of account shall be kept. Watch Vinodji Explain The Concept Of Know Your Customer Kyc And Anti Money Laundering Aml In This Video Series Which Is Part Of A Customer Education Initia The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. It is important to mix the funds from illegal sources with legalIt is relatively very difficult to detect money laundering at this stage. First the illegal activity that garners the money places it in the launderers hands.

Source: conventuslaw.com

Source: conventuslaw.com

AML procedures are built with the goal of managing risk. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Section 1956 a defines three types of criminal conduct. Along with some other aspects of underground economic activity rough estimates have been. Second phase involves mixing the funds.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. The acquisition possession or use of property knowing that these are derived from criminal activity. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. Banks have a responsibility to know their customers and a banks KYC procedures help them do that. The policy is based on Anti Money Laundering AML standards.

Money Laundering Fraud Barristers We hope you now understand how to define money laundering what money laundering is and the three key stages of the money laundering process. Money laundering is the act of disguising the original ownership identity and destination of the profits of a crime by hiding it within a legitimate financial institution and making it appear to have been acquired from a legal source. Money Laundering is the method criminals use to disguise the illegal origin and control of their wealth by passing it through a complex sequence of banking transfers or commercial transactions. The concealment or disguising of the nature of the proceeds. Money Laundering Fraud Barristers We hope you now understand how to define money laundering what money laundering is and the three key stages of the money laundering process.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title define customer money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas