14+ Define laundering in banking information

Home » about money loundering Info » 14+ Define laundering in banking informationYour Define laundering in banking images are available in this site. Define laundering in banking are a topic that is being searched for and liked by netizens now. You can Get the Define laundering in banking files here. Download all royalty-free photos.

If you’re looking for define laundering in banking pictures information linked to the define laundering in banking interest, you have come to the right blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

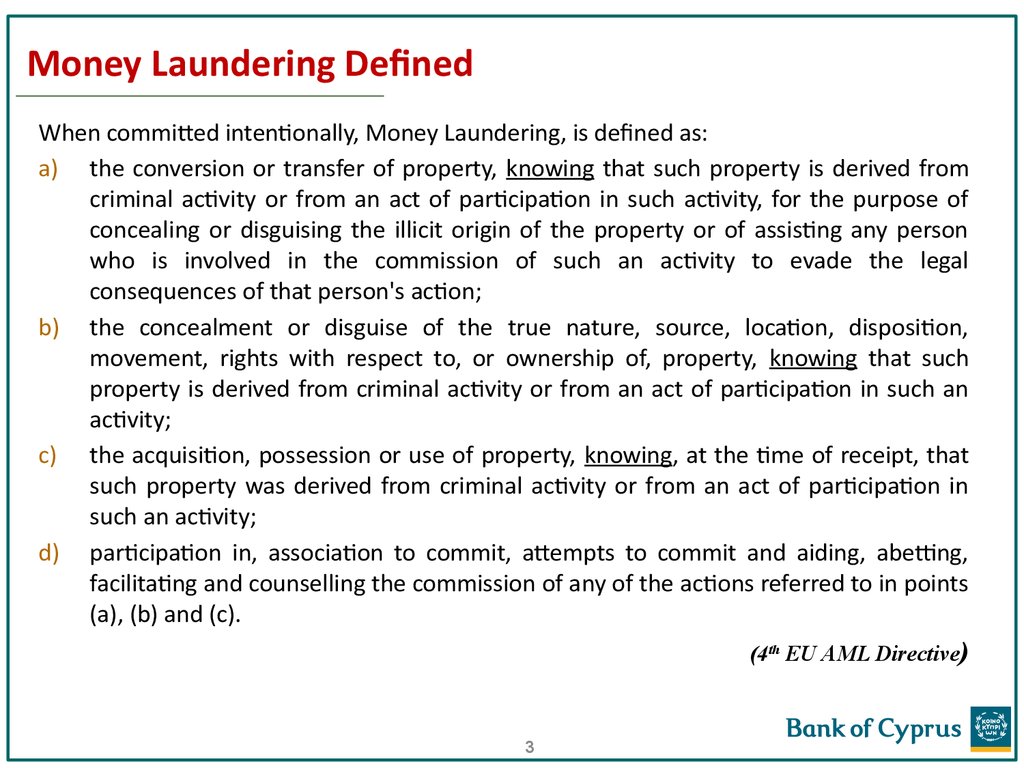

Define Laundering In Banking. The launderer can now enjoy their illegal wealth believing that the laundered money wont be traced back to them. Operational Processes and people. Define money laundering in banking. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

Pin On Banking And Finance News From pinterest.com

Pin On Banking And Finance News From pinterest.com

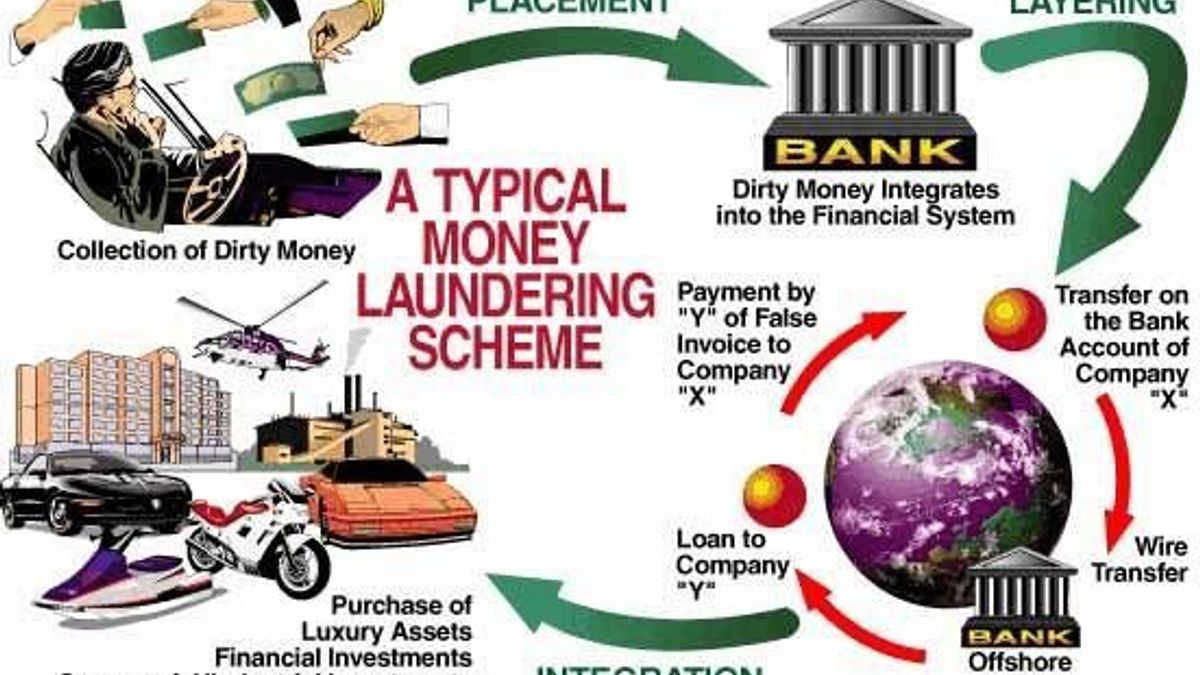

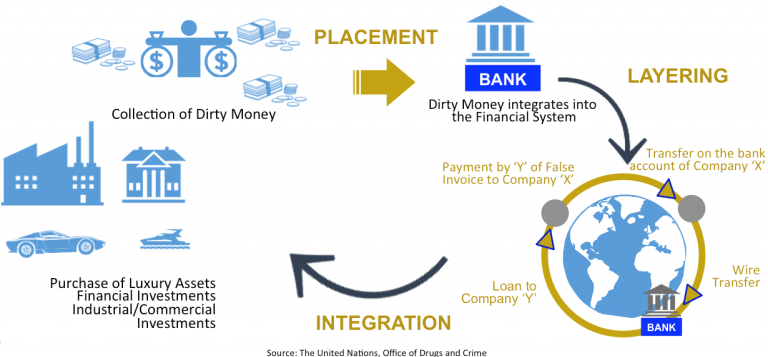

The illegal funds are first introduced into the legitimate financial system to hide their real source. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion. The nature the business has become such that these. Placement layering and integration. It is a worldwide problem with approximately 300 billion going through the.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source.

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. The process of taking the proceeds of criminal activity and making them appear legal. Anti Money Laundering Counter Financing Of Terrorism Aml Cft Ppt Download. Buried in the raft of new legislation private banking sits squarely as a higher risk factor in the specific proposal aimed at preventing the use of the EUs financial system for money laundering or terrorist financing. Placement layering and integration. The banking sector is involved in the enforcement of the third Money Laundering Directive through the introduction of disclosure requirements customer due diligence.

Source: es.pinterest.com

Source: es.pinterest.com

However it can also be the Achilles heel of criminal activity. At a minimum the anti-money laundering program should include. The system designed to assist institutions in their fight against money laundering and terrorist financing. How to define laundering money. The process of taking the proceeds of criminal activity and making them appear legal.

Source: pinterest.com

Source: pinterest.com

Money laundering is a threat to the good functioning of a financial system. Buried in the raft of new legislation private banking sits squarely as a higher risk factor in the specific proposal aimed at preventing the use of the EUs financial system for money laundering or terrorist financing. However it can also be the Achilles heel of criminal activity. Money laundering is a threat to the good functioning of a financial system. A simpler definition of money laundering would be a series of financial transactions that are intended to transform ill-gotten gains into legitimate money or other assets.

Source: in.pinterest.com

Source: in.pinterest.com

Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion. The process of taking the proceeds of criminal activity and making them appear legal. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. At a minimum the anti-money laundering program should include. Operational Processes and people.

Source: pinterest.com

Source: pinterest.com

In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Anti Money Laundering Counter Financing Of Terrorism Aml Cft Ppt Download. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds. Mr Chairman it is clear from the definition that money laundering is a tool that is used by people involved in illegal activities such as drug trafficking organised crime tax-evading political bribery and above all corruption.

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. It is a worldwide problem with approximately 300 billion going through the. Define money laundering in banking. The nature the business has become such that these. How to define laundering money.

Source: bi.go.id

Source: bi.go.id

Operational Processes and people. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds. In many jurisdictions government regulations require financial institutions including banks securities dealers and money services businesses to establish such programs. The nature the business has become such that these. The system designed to assist institutions in their fight against money laundering and terrorist financing.

Source: pinterest.com

Source: pinterest.com

Define money laundering in banking. At a minimum the anti-money laundering program should include. The process of taking the proceeds of criminal activity and making them appear legal. Money laundering is the process of making illegally obtained funds dirty money appear legal. Operational Processes and people.

Source: en.ppt-online.org

Source: en.ppt-online.org

The term money laundering defined by the Oxford English Dictionary as the process of concealing the origins of money obtained illegally by passing it through a complex sequence of banking transfers or commercial transactions seems to have first appeared in the early 1960s though it only became widely known during the Watergate. It is a worldwide problem with approximately 300 billion going through the. However it can also be the Achilles heel of criminal activity. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds.

Source: pinterest.com

Source: pinterest.com

Prohibition on Money Laundering The Banking Corporations Requirement regarding Identification Reporting and Record-Keeping for the Prevention of Money Laundering and the Financing of Terrorism Order 57612001 By virtue of the power vested in me under sections 7 and 32c of the Prohibition on. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. The system designed to assist institutions in their fight against money laundering and terrorist financing. The term money laundering defined by the Oxford English Dictionary as the process of concealing the origins of money obtained illegally by passing it through a complex sequence of banking transfers or commercial transactions seems to have first appeared in the early 1960s though it only became widely known during the Watergate. Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion.

Source: en.ppt-online.org

Source: en.ppt-online.org

Both anti-fraud and anti-money laundering departments of the bank need dedicated investigated teams who investigate each casealert that systems generate based on the severity level and category of the alert as per the defined processes of the bank. Money laundering is a threat to the good functioning of a financial system. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

Source: pinterest.com

Source: pinterest.com

Both anti-fraud and anti-money laundering departments of the bank need dedicated investigated teams who investigate each casealert that systems generate based on the severity level and category of the alert as per the defined processes of the bank. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Prohibition on Money Laundering The Banking Corporations Requirement regarding Identification Reporting and Record-Keeping for the Prevention of Money Laundering and the Financing of Terrorism Order 57612001 By virtue of the power vested in me under sections 7 and 32c of the Prohibition on. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. At a minimum the anti-money laundering program should include.

Source: jagranjosh.com

Source: jagranjosh.com

At a minimum the anti-money laundering program should include. Money laundering is a threat to the good functioning of a financial system. Define money laundering in banking. Both anti-fraud and anti-money laundering departments of the bank need dedicated investigated teams who investigate each casealert that systems generate based on the severity level and category of the alert as per the defined processes of the bank. At a minimum the anti-money laundering program should include.

Source: letstalkaml.com

Source: letstalkaml.com

The process of taking the proceeds of criminal activity and making them appear legal. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Operational Processes and people. It is a worldwide problem with approximately 300 billion going through the. Money laundering is the process of making illegally obtained funds dirty money appear legal.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title define laundering in banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas