14+ Define layering in banking info

Home » about money loundering idea » 14+ Define layering in banking infoYour Define layering in banking images are available in this site. Define layering in banking are a topic that is being searched for and liked by netizens today. You can Find and Download the Define layering in banking files here. Download all free vectors.

If you’re looking for define layering in banking pictures information connected with to the define layering in banking interest, you have pay a visit to the right site. Our site always gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

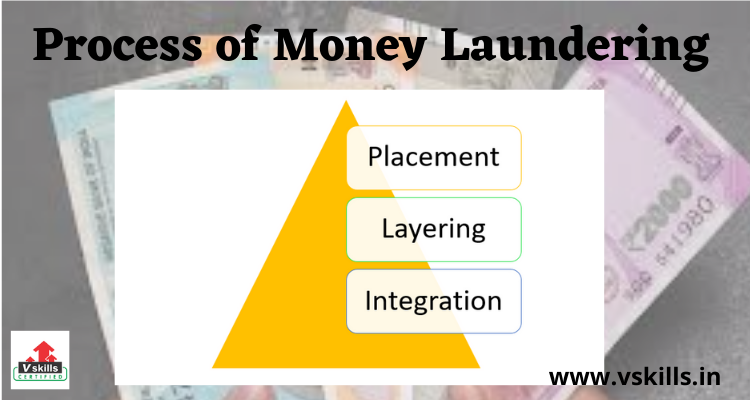

Define Layering In Banking. Placement layering and integration-aka hide move and invest Placement. Once cash has been successfully placed into the financial system launderers can engage in an infinite number of complex transactions and transfers designed to disguise the audit trail and thus the source of the property and provide anonymity. Sometimes this is negotiated down to either giving the original bank a right to play in any new deal but not a guarantee of payment or giving the original bank an amount of fees equal to what the alternative bank. The primary purpose of this stage is to separate the illicit money from its source.

Cryptocurrency Money Laundering Explained Bitquery From bitquery.io

Cryptocurrency Money Laundering Explained Bitquery From bitquery.io

If something goes wrong with the loan within six months of selling it Fannie or Freddie will audit it and there is a chance the bank would have to buy it back. After placement comes the layering stage sometimes referred to as structuring. Money laundering is the process used to disguise the source of money or assets derived from criminal activity. Layering involves sending the money through various financial transactions to change its form and make it difficult to follow. The primary purpose of this stage is to separate the illicit money from its source. For example a drug dealer in another country depositing cash from his illegal trade into a local bank.

Below are layered risk in manual underwriting considered by lenders.

Money laundering is the conversion or transfer of property. So this borrower will be a good candidate for manual underwriting approval. If something goes wrong with the loan within six months of selling it Fannie or Freddie will audit it and there is a chance the bank would have to buy it back. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. So although Fannie or Freddie are not asking for conditions some banks add more at times bizarre conditions to the approval and insiders call it risk layering. This is dissimilar to layering for in the integration process detection and identification of laundered funds is provided through informants.

Source: professional.dowjones.com

Source: professional.dowjones.com

The purpose of a layered security approach is to make sure that every individual defense component has a backup to counter any flaws or gaps in other defenses of security. The lower layer is comprised of all in-country banks that are used for local cash transaction requirements. Layers starting with layer 1 as the lowest layer and m oving up to layer 7. Money laundering is the conversion or transfer of property. Borrowers have 30000 in a bank account that can be liquidated anytime.

Source: complyadvantage.com

Source: complyadvantage.com

The higher layer is a group of networked regional banks or even a single global bank that maintains a separate bank account for each country or legal entity of the corporate structure. For example a drug dealer in another country depositing cash from his illegal trade into a local bank. Sometimes this is negotiated down to either giving the original bank a right to play in any new deal but not a guarantee of payment or giving the original bank an amount of fees equal to what the alternative bank. The Layering Stage Camouflage. The purpose of a layered security approach is to make sure that every individual defense component has a backup to counter any flaws or gaps in other defenses of security.

Source: in.pinterest.com

Source: in.pinterest.com

Or participating in or assisting the movement of funds to make the proceeds appear legitimate. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. The primary purpose of this stage is to separate the illicit money from its source. The purpose of a layered security approach is to make sure that every individual defense component has a backup to counter any flaws or gaps in other defenses of security.

Source: letstalkaml.com

Source: letstalkaml.com

Once cash has been successfully placed into the financial system launderers can engage in an infinite number of complex transactions and transfers designed to disguise the audit trail and thus the source of the property and provide anonymity. This borrower has compensating factors to offset the isolated period of bad credit and low credit scores. The acquisition possession or use of property knowing that these are derived from criminal activity. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure. Layering usually involves a complex system of transactions designed to hide the source and ownership of the funds.

Source: pinterest.com

Source: pinterest.com

Once cash has been successfully placed into the financial system launderers can engage in an infinite number of complex transactions and transfers designed to disguise the audit trail and thus the source of the property and provide anonymity. Refers to the initial point of entry for funds derived from criminal activities into the financial system. A high loan to value 95. Placement layering and integration-aka hide move and invest Placement. Layered security is a network security approach that uses several components to protect your operations with multiple levels of security measure.

Source: calert.info

Source: calert.info

Layering is essentially the use of placement and extraction over and over again using varying amounts each time to make tracing transactions as hard as possible. Below are layered risk in manual underwriting considered by lenders. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. Refers to the initial point of entry for funds derived from criminal activities into the financial system. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank.

Source: pinterest.com

Source: pinterest.com

The layering stage is the most complex and often entails the international movement of the funds. Layering involves the separation of proceeds from illegal source using complex transactions designed to obscure the audit trail and hide the proceeds. The layering stage is the most complex and often entails the international movement of the funds. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. Profit-motivated crimes span a variety of illegal activities from drug trafficking and smuggling to fraud extortion and corruption.

Source: slidetodoc.com

Source: slidetodoc.com

The layering stage is the most complex and often entails the international movement of the funds. A high loan to value 95. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. Money laundering is the process used to disguise the source of money or assets derived from criminal activity. If something goes wrong with the loan within six months of selling it Fannie or Freddie will audit it and there is a chance the bank would have to buy it back.

Source: bitquery.io

Source: bitquery.io

Layering involves the separation of proceeds from illegal source using complex transactions designed to obscure the audit trail and hide the proceeds. A provision in the Fee Letter that says that the investment bank that has committed to a Senior Secured Credit Facility or Bridge Facility will still get paid all or some of its agreed fees if the Borrower ends up funding the applicable facilities through a different bank. Layering involves sending the money through various financial transactions to change its form and make it difficult to follow. The layering stage is the most complex and often entails the international movement of the funds. Below are layered risk in manual underwriting considered by lenders.

Source: allbankingalerts.com

Source: allbankingalerts.com

This is dissimilar to layering for in the integration process detection and identification of laundered funds is provided through informants. So this borrower will be a good candidate for manual underwriting approval. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness. The lower layer is comprised of all in-country banks that are used for local cash transaction requirements. For example a drug dealer in another country depositing cash from his illegal trade into a local bank.

Source: vskills.in

Source: vskills.in

A high loan to value 95. Refers to the initial point of entry for funds derived from criminal activities into the financial system. Placement layering and integration-aka hide move and invest Placement. A bank overlay structure consists of two layers. Layering definition the wearing of lightweight or unconstructed garments one upon the other as to create a fashionable ensemble or to provide warmth without undue bulkiness or heaviness.

Source: youtube.com

Source: youtube.com

Or participating in or assisting the movement of funds to make the proceeds appear legitimate. Integration This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. This borrower has compensating factors to offset the isolated period of bad credit and low credit scores. Placement layering and integration-aka hide move and invest Placement. Money laundering is often described as occurring in three stages.

Source: calert.info

Source: calert.info

The primary purpose of this stage is to separate the illicit money from its source. The higher layer is a group of networked regional banks or even a single global bank that maintains a separate bank account for each country or legal entity of the corporate structure. The layering stage is the most complex and often entails the international movement of the funds. Placement layering and integration-aka hide move and invest Placement. Layering is the process of making the source of illegal money as difficult to detect as possible by progressively adding legitimacy to it.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title define layering in banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information