18++ Define professional money laundering ideas in 2021

Home » about money loundering idea » 18++ Define professional money laundering ideas in 2021Your Define professional money laundering images are available. Define professional money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Define professional money laundering files here. Find and Download all royalty-free images.

If you’re looking for define professional money laundering images information linked to the define professional money laundering topic, you have visit the ideal site. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

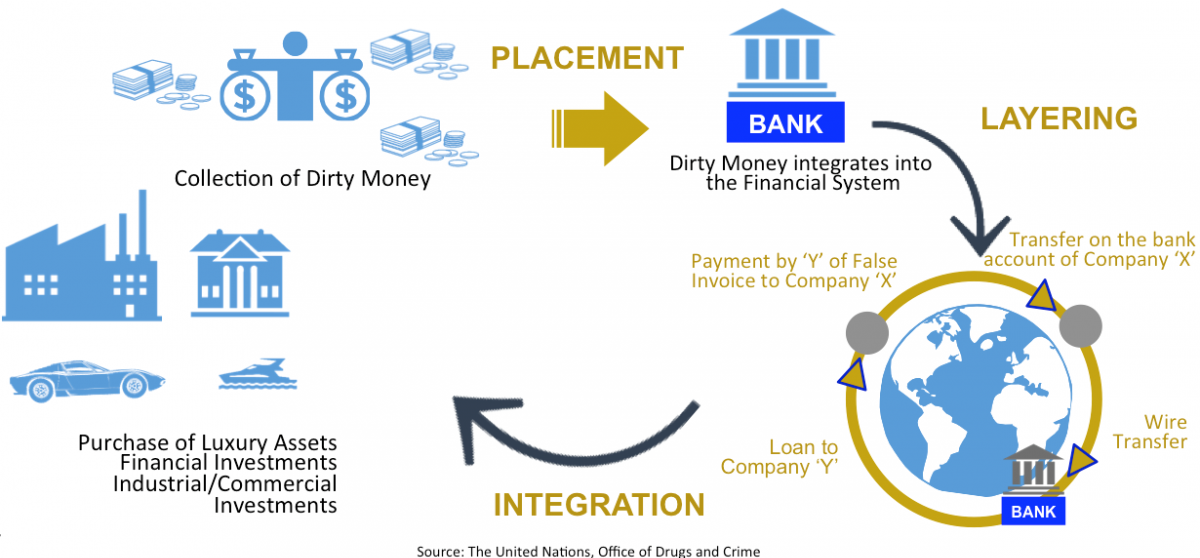

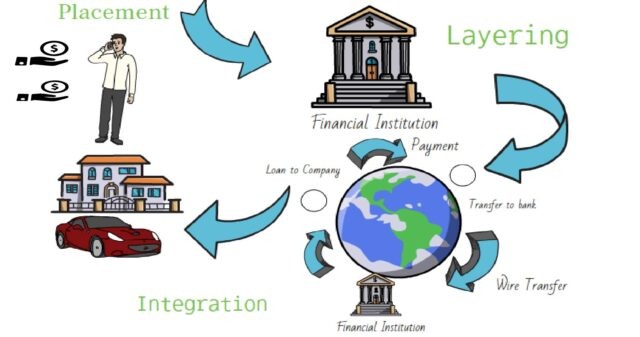

Define Professional Money Laundering. Money Laundering Fraud Barristers We hope you now understand how to define money laundering what money laundering is and the three key stages of the money laundering process. Its a course of by which dirty cash is transformed into clear money. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. The report aims to the describe functions and characteristics that define aprofessional money launderer namely.

Pdf International Anti Money Laundering Programs From researchgate.net

Pdf International Anti Money Laundering Programs From researchgate.net

The report aims to describe the functions and characteristics that define a professional money launderer namely. Professional Money Laundering Organisation PMLO a structured group or two or more individuals whose core activity is laundering funds. Section 1956 a defines three types of criminal conduct. This report looks at the techniques and tools used by professional money launderers to help countries identify and dismantle them. Money Laundering in todays world has carved itself a niche. Money laundering is a threat to the good functioning of a financial system.

The idea of money laundering is essential to be understood for those working in the financial sector.

Paris 26 July 2018 - Professional money launderers are individuals organisations or networks who for a fee help criminals launder the proceeds of crime. A money laundering risk assessment is an analytical process applied to a business. The sources of the money in actual are prison and the cash is invested in a approach that makes it appear like clean cash and hide the identity of the criminal part of the. The report aims to describe the functions and characteristics that define a professional money launderer namely. The acquisition possession or use of property knowing that these are derived from criminal activity. Or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Source: shyamsewag.com

Source: shyamsewag.com

How do you define money laundering. Generally speaking PMLs follow a three-stage process when executing a money laundering. Money Laundering in todays world has carved itself a niche. Professional Money Laundering Network PMLN usually operates globally as a collection of associates who work together to facilitate money laundering schemes. Professionals eye profits which this nefarious activity generates and are ever willing to scoop their shares of the loot.

Source: researchgate.net

Source: researchgate.net

Professional Money Laundering Network PMLN usually operates globally as a collection of associates who work together to facilitate money laundering schemes. Money laundering is the conversion or transfer of property. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Section 1956 a defines three types of criminal conduct. Money Laundering Fraud Barristers We hope you now understand how to define money laundering what money laundering is and the three key stages of the money laundering process.

Source: researchgate.net

Source: researchgate.net

Money Laundering in todays world has carved itself a niche. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. Professionals eye profits which this nefarious activity generates and are ever willing to scoop their shares of the loot. According to FindLaw embezzlement is defined. Despite mandatory anti-money laundering AML rules the securities industry is ripe for fraud and abuse of which money laundering is just one aspect.

Source: gov.si

Source: gov.si

The acquisition possession or use of property knowing that these are derived from criminal activity. Paris 26 July 2018 - Professional money launderers are individuals organisations or networks who for a fee help criminals launder the proceeds of crime. Money laundering is defined to mean an activity which has or is likely to have the effect of concealing or disguising the nature source location disposition or movement of the proceeds of unlawful activities or any interest which anyone has in such proceeds and includes any activity which constitutes an offence in terms of section 64 of this Act or section 4 5 or 6 of the Prevention Act. Money laundering has been practised for over 6000 years but the term itself comes from the prohibition era of american history. The report aims to the describe functions and characteristics that define aprofessional money launderer namely.

Source: researchgate.net

Source: researchgate.net

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. However it can also be the Achilles heel of criminal activity. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Professional money launderers PMLs that specialise in enabling criminals to evade anti-money laundering and counter terrorist financing safeguards and sanctionsin order to enjoy the profits from illegal activities. This report looks at the techniques and tools used by professional money launderers to help countries identify and dismantle them.

Source: ssbm.ch

Source: ssbm.ch

Professionals eye profits which this nefarious activity generates and are ever willing to scoop their shares of the loot. Section 1956 a defines three types of criminal conduct. The concealment or disguising of the nature of the proceeds. Simultaneous puts and calls representing mirror-image bets on a. However it can also be the Achilles heel of criminal activity.

Source: pinterest.com

Source: pinterest.com

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. One common securities-aided laundering scheme according to the Peterson Institute involves the use of stock option transactions. Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Section 1956 a defines three types of criminal conduct. What is Money Laundering.

Source: shyamsewag.com

Source: shyamsewag.com

Professional Money Laundering Network PMLN usually operates globally as a collection of associates who work together to facilitate money laundering schemes. Money Laundering Fraud Barristers We hope you now understand how to define money laundering what money laundering is and the three key stages of the money laundering process. A money laundering risk assessment is an analytical process applied to a business. The idea of money laundering is essential to be understood for those working in the financial sector. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible.

Source: bi.go.id

Source: bi.go.id

Almost every field has been infiltrated and it is as if Professional Money Laundering is gaining certain respectability in society. This report looks at the techniques and tools used by professional money launderers to help countries identify and dismantle them. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Professional money launderers PMLs that specialise in enabling criminals to evade anti-money laundering and counter terrorist financing safeguards and sanctions in order to enjoy the profits from illegal activities.

Source: thekeepitsimple.com

Source: thekeepitsimple.com

Money laundering is the illegal process of making large amounts of money generated by a criminal activity such as drug trafficking or terrorist funding appear to. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. N The process of hiding the source of illegal income by processing it through a large-turnover entity who takes a premium from it and then receiving the income from that entity to avoid suspicion. The report aims to the describe functions and characteristics that define aprofessional money launderer namely. The acquisition possession or use of property knowing that these are derived from criminal activity.

Source: researchgate.net

Source: researchgate.net

Money laundering is the conversion or transfer of property. Professional money launderers PMLs that specialise in enabling criminals to evade anti-money laundering and counter terrorist financing safeguards and sanctions in order to enjoy the profits from illegal activities. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. N The process of hiding the source of illegal income by processing it through a large-turnover entity who takes a premium from it and then receiving the income from that entity to avoid suspicion. The report aims to describe the functions and characteristics that define a professional money launderer namely.

Source: thekeepitsimple.com

Source: thekeepitsimple.com

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. The idea of money laundering is essential to be understood for those working in the financial sector. Professional Money Laundering Network PMLN usually operates globally as a collection of associates who work together to facilitate money laundering schemes. The report aims to the describe functions and characteristics that define aprofessional money launderer namely. Professional money launderers PMLs that specialise in enabling criminals to evade anti-money laundering and counter terrorist financing safeguards and sanctionsin order to enjoy the profits from illegal activities.

Source: in.pinterest.com

Source: in.pinterest.com

Its a course of by which dirty cash is transformed into clear money. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Professional Money Laundering Organisation PMLO a structured group or two or more individuals whose core activity is laundering funds. Money laundering is the conversion or transfer of property. How do you define money laundering.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title define professional money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information