10+ Difference between kyc and cdd and aml info

Home » about money loundering Info » 10+ Difference between kyc and cdd and aml infoYour Difference between kyc and cdd and aml images are available in this site. Difference between kyc and cdd and aml are a topic that is being searched for and liked by netizens now. You can Download the Difference between kyc and cdd and aml files here. Find and Download all royalty-free vectors.

If you’re looking for difference between kyc and cdd and aml images information linked to the difference between kyc and cdd and aml interest, you have come to the right site. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

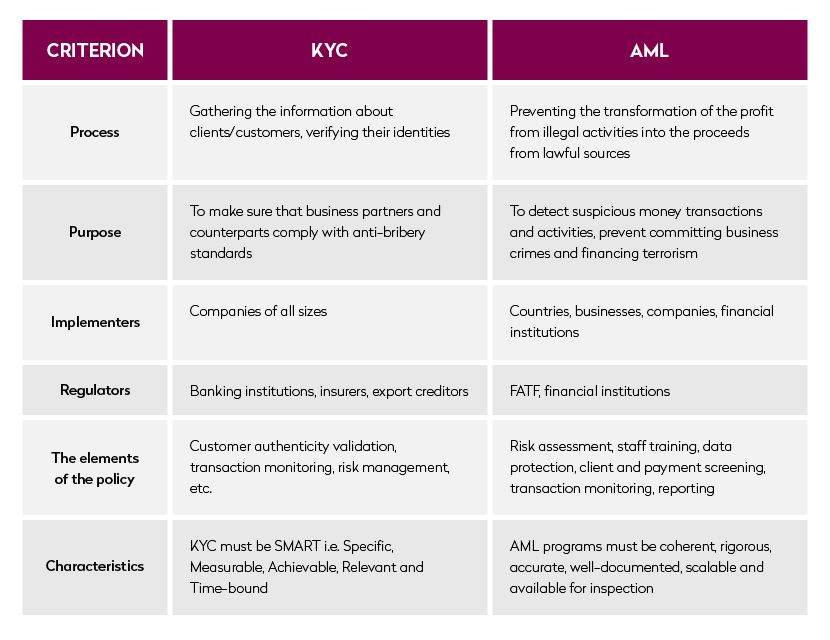

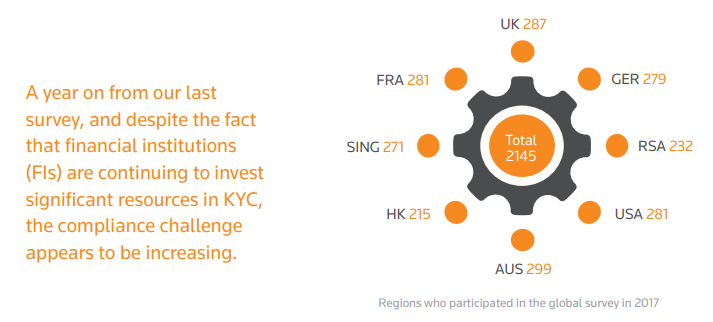

Difference Between Kyc And Cdd And Aml. AMLCDD applies to Financial Services Real Estate Lawyers Trusts Accountants and Tax Advisors. KYC stands for Know Your Customer. It is a term used to describe how a business identifies and verifies the identity of a client. Any institution with a good AML compliance department does well to keep their KYC information up to date.

What S The Difference Between Kyc And Cdd Blog From blog.covery.ai

What S The Difference Between Kyc And Cdd Blog From blog.covery.ai

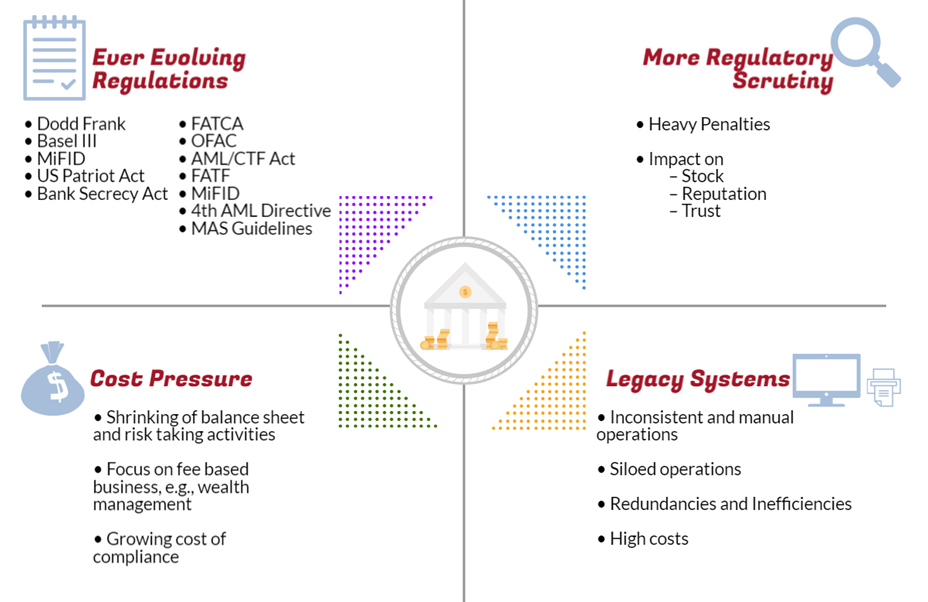

Ad AML coverage from every angle. Customer Due Diligence or CDD and Enhanced Due Diligence or EDD Customer due diligence CDD. MiFID II is about transparency in doing business. It is a term used to describe how a business identifies and verifies the identity of a client. Difference between KYC and AML. For customers that you deem low-risk you can perform simplified CDD.

Anti-money laundering softwares use AI to makes the verification and screening process more streamlined.

Customer Due Diligence CDD is a basic KYC process where customers data such as proof of identity and address is gathered and used to evaluate the customers risk profile. AMLCDD applies to Financial Services Real Estate Lawyers Trusts Accountants and Tax Advisors. KYC Know your client. In addition it provides a continuous assurance framework especially for organizations that handle many day-to-day transactions such as banks and real estate. Any institution with a good AML compliance department does well to keep their KYC information up to date. AML Anti-money laundering.

Source: blog.covery.ai

Source: blog.covery.ai

Ad AML coverage from every angle. Customer Due Diligence CDD is a basic KYC process where customers data such as proof of identity and address is gathered and used to evaluate the customers risk profile. Anti-money laundering softwares use AI to makes the verification and screening process more streamlined. Enhanced Due Diligence EDD is an advanced KYC procedure for high-risk customers. However there are situations in which you might decide to loosen or strengthen the Know Your Customer KYC and Anti Money Laundering AML measures.

Source: justcoded.com

Source: justcoded.com

This is understanding who your client is and what their goals are so you can advise them properly. An AML procedure will be something you have in place to prevent money laundering. Overview The estrangement between AML and KYC is that on the one deal AML anti-money laundering suggests an umbrella title for the full span of regulatory methods that firms need to perform in order to give out legitimate business while on the other side KYC Know Your Customer is a shorter element of AML that consists of firms confirming their customers personality. CDD Client due diligence. The SCOPE CDD Cloud Solution.

Source: tookitaki.ai

Source: tookitaki.ai

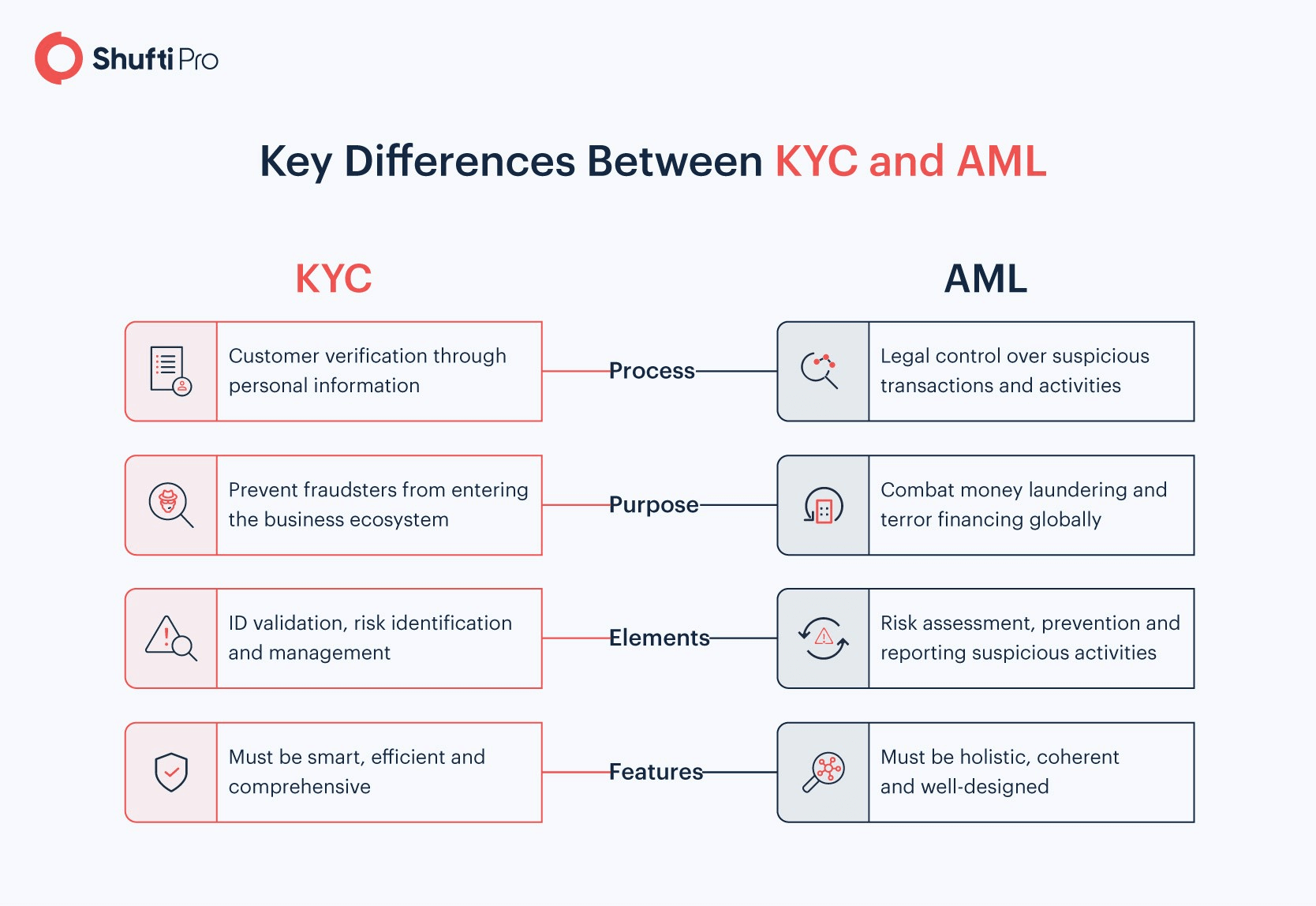

The difference between AML and KYC is that AML anti-money laundering is an umbrella term for the range of regulatory processes firms must have in place whereas KYC Know Your Customer is a component part of AML that consists of firms verifying their customers identity. CDD Client due diligence. The main difference between KYC and CDD is that apart from the emphasis on financing CDD controls are carried out in a process and communication with the customer continues. KYC is part of AML which stands for Anti-Money Laundering. Besides AML is more about governmental procedures and measures while KYC refers to the way companies and businesses comply with these.

Source: blog.covery.ai

Source: blog.covery.ai

Through this businesses will be able to conduct CDD Customer Due Diligence efficiently. Ad AML coverage from every angle. This is understanding who your client is and what their goals are so you can advise them properly. KYC Know your client. Simplified Customer Due Diligence.

Source: blog.complycube.com

Source: blog.complycube.com

Latest news reports from the medical literature videos from the experts and more. Difference between KYC and AML. Overview The estrangement between AML and KYC is that on the one deal AML anti-money laundering suggests an umbrella title for the full span of regulatory methods that firms need to perform in order to give out legitimate business while on the other side KYC Know Your Customer is a shorter element of AML that consists of firms confirming their customers personality. The difference between AML and KYC is that on the one hand AML anti-money laundering refers to an umbrella term for the full range of regulatory processes that firms must implement in order to carry out legitimate business while on the other hand KYC Know Your Customer is a smaller component of AML that consists of firms verifying their customers identity. Besides AML is more about governmental procedures and measures while KYC refers to the way companies and businesses comply with these.

Know Your Customer KYC KYC denotes the checks carried out at the beginning of a customer relationship to identify and verify that they are who they say they are. Generally customers who are classified under the high-risk category after CDD are prone to money laundering and financing of. Difference between KYC and AML. MiFID II is about transparency in doing business. In a financial context KYC and AML are often used together.

Source: shuftipro.com

Source: shuftipro.com

Latest news reports from the medical literature videos from the experts and more. Latest news reports from the medical literature videos from the experts and more. KYC stands for client verification and identification process implemented with different tools and software. It is a term used to describe how a business identifies and verifies the identity of a client. AMLCDD identifies the customer and gathers thorough knowledge of their network and all activities.

Source: medium.com

Source: medium.com

The SCOPE CDD Cloud Solution. The world of anti-money laundering AML is full of acronyms. KYC stands for Know Your Customer. The main difference between KYC and CDD is that apart from the emphasis on financing CDD controls are carried out in a process and communication with the customer continues. KYC Know your client.

Source: processmaker.com

Source: processmaker.com

AML Anti-money laundering. MiFID II is about transparency in doing business. AMLCDD also applies to art dealers for transactions over 10K. Does what it says on the tin. KYC stands for Know Your Customer.

Source: tookitaki.ai

Source: tookitaki.ai

The SCOPE CDD Cloud Solution. However there are situations in which you might decide to loosen or strengthen the Know Your Customer KYC and Anti Money Laundering AML measures. Customer Due Diligence CDD is a basic KYC process where customers data such as proof of identity and address is gathered and used to evaluate the customers risk profile. Does what it says on the tin. Difference between KYC and AML.

Source: medium.com

Source: medium.com

Customer Due Diligence is about assessing risks associated with doing business with a client within the framework of the Money Laundering and Terrorist Financing Prevention Act Dutch WWFT. Customer Due Diligence CDD is a basic KYC process where customers data such as proof of identity and address is gathered and used to evaluate the customers risk profile. This is understanding who your client is and what their goals are so you can advise them properly. An AML policy is a policy which sets out how you are going to prevent money laundering. AML Anti-money laundering.

Source: blog.complycube.com

Source: blog.complycube.com

The difference between AML and KYC is that on the one hand AML anti-money laundering refers to an umbrella term for the full range of regulatory processes that firms must implement in order to carry out legitimate business while on the other hand KYC Know Your Customer is a smaller component of AML that consists of firms verifying their customers identity. The world of anti-money laundering AML is full of acronyms. Overview The estrangement between AML and KYC is that on the one deal AML anti-money laundering suggests an umbrella title for the full span of regulatory methods that firms need to perform in order to give out legitimate business while on the other side KYC Know Your Customer is a shorter element of AML that consists of firms confirming their customers personality. Latest news reports from the medical literature videos from the experts and more. So while KYC is a key component of an AML program AML broadly covers how companies align their people processes and technology to uncover money laundering across the enterprise.

Source: justcoded.com

Source: justcoded.com

An AML procedure will be something you have in place to prevent money laundering. An AML procedure will be something you have in place to prevent money laundering. The SCOPE CDD Cloud Solution. KYC is part of AML which stands for Anti-Money Laundering. Customer Due Diligence CDD is a basic KYC process where customers data such as proof of identity and address is gathered and used to evaluate the customers risk profile.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between kyc and cdd and aml by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas