14++ Different types of anti money laundering info

Home » about money loundering idea » 14++ Different types of anti money laundering infoYour Different types of anti money laundering images are available in this site. Different types of anti money laundering are a topic that is being searched for and liked by netizens now. You can Get the Different types of anti money laundering files here. Download all royalty-free photos and vectors.

If you’re searching for different types of anti money laundering pictures information connected with to the different types of anti money laundering topic, you have visit the ideal blog. Our site frequently provides you with hints for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

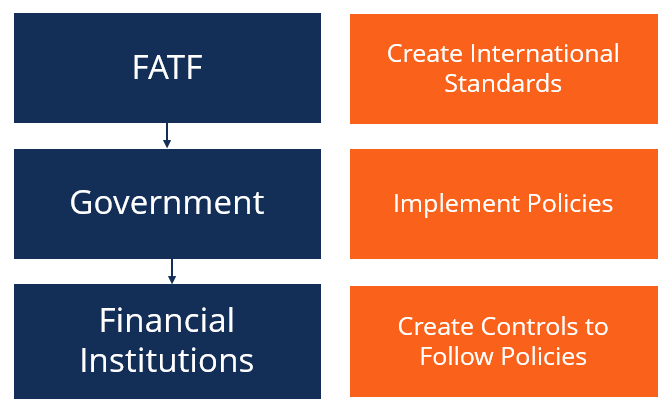

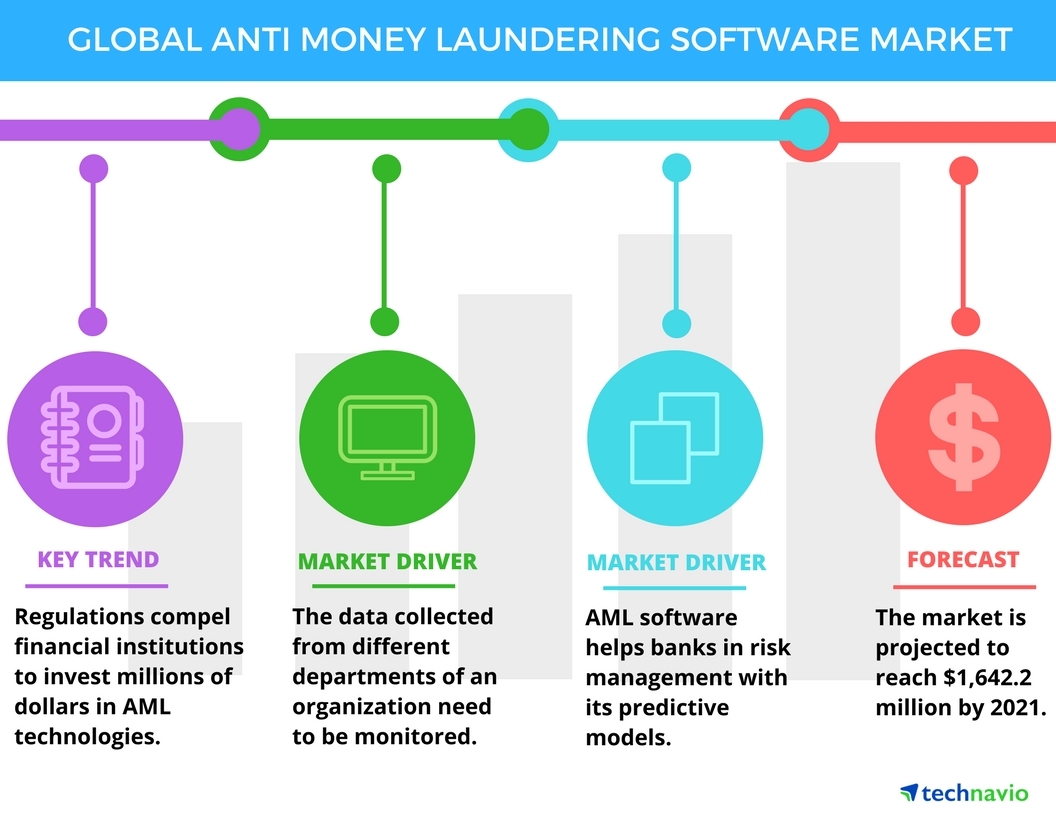

Different Types Of Anti Money Laundering. These two money-laundering statutes have broad application and can apply to companies and individuals who knowingly or with willful blindness conduct a prohibited financial transaction. Some different types of AML Software. They include bank methods smurfing or structuring currency exchanges and double-invoicing. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form From pinterest.com

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form From pinterest.com

Anti-money-laundering laws AML have been slow to catch up to these types of cybercrimes since most of the laws are still based on detecting dirty money as it passes through traditional banking. Latest research on Anti-Money Laundering Tools developing at a faster rate due to the current modernization and peoples limitless needs. There are many different types of anti-money laundering jobs including those of forensic accountant those of investigations. The Anti-Money Laundering Tools towards altering its product profile by bringing about alterations in the production techniques development platforms and product prototypes. Examples may include mechanics landscapers or hairstylists. When AML software is used correctly implemented monitored and reported AML audits can be more effective.

Latest research on Anti-Money Laundering Tools developing at a faster rate due to the current modernization and peoples limitless needs.

Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. There are 3 stages of money laundering. These two money-laundering statutes have broad application and can apply to companies and individuals who knowingly or with willful blindness conduct a prohibited financial transaction. Money laundering is a means of storing or transporting money while obscuring its true origin. The Anti-Money Laundering Tools towards altering its product profile by bringing about alterations in the production techniques development platforms and product prototypes. Latest research on Anti-Money Laundering Tools developing at a faster rate due to the current modernization and peoples limitless needs.

Source: rmahq.org

Source: rmahq.org

And this trend is predicted to continue from 2021 to 2027. There are various types of money laundering. Laundering Mechanisms A striking feature of money laundering is the number of different meth-ods used to carry it out. There are many different types of anti-money laundering jobs including those of forensic accountant those of investigations. What are the different types of money laundering.

Source: trulioo.com

Source: trulioo.com

It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. There are many different types of anti-money laundering jobs including. In the first stage money enters the banking system. Offshore accounts are the account which is located on different regions of the depositors residence. Money laundering is a means of storing or transporting money while obscuring its true origin.

Source: pideeco.be

Source: pideeco.be

Anti-money-laundering laws AML have been slow to catch up to these types of cybercrimes since most of the laws are still based on detecting dirty money as it passes through traditional banking. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Money Laundering is an act of act of disguising the illegal source of income. Instead of creating a shell company an alternative for money laundering may be to invest in a legitimate business such as a casino or bar. This involves directly smuggling cash and storing it into on banks in other countries.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Identify and verify the identity of clients monitor transactions and report suspicious transactions. Money laundering is a means of storing or transporting money while obscuring its true origin. Types of Money Laundering Bulk cash smuggling. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. These are called methods of laundering.

Source: in.pinterest.com

Source: in.pinterest.com

Different types of anti money laundering. These are called methods of laundering. Instead of creating a shell company an alternative for money laundering may be to invest in a legitimate business such as a casino or bar. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. They include bank methods smurfing or structuring currency exchanges and double-invoicing.

Source: pinterest.com

Source: pinterest.com

Different types of anti money laundering. There are plethora of software based on what you are trying to achieve in the AML world from CIP KYC CDD transaction screening and monitoring as well as profiling etc The list of vendors is long spread across the world delivering plugins po. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Examples may include mechanics landscapers or hairstylists. There are 3 stages of money laundering.

Source: pinterest.com

Source: pinterest.com

What are the different types of money laundering. Most of the times the deposits are made into offshore accounts or in companies which promise upheld secrecy. Clear answers for common questions About. Different types of anti money laundering. They include bank methods smurfing or structuring currency exchanges and double-invoicing.

Source: ppt-online.org

Source: ppt-online.org

Different Types Of Anti Money Laundering on August 05 2021. Different Types Of Anti Money Laundering on August 05 2021. This involves directly smuggling cash and storing it into on banks in other countries. Instead of creating a shell company an alternative for money laundering may be to invest in a legitimate business such as a casino or bar. There are many different types of anti-money laundering jobs including.

Source: bcfocus.com

Source: bcfocus.com

It is not necessary for the person or entity to know the specific unlawful activity that generated the illegal proceeds. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. International money laundering transactions. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways.

Source: veriff.com

Source: veriff.com

Risk- based approach software this type of software is based on risk to detect suspicious activity that includes. Different types of anti money laundering. Types of Money Laundering Bulk cash smuggling. Money laundering is a means of storing or transporting money while obscuring its true origin. In the first stage money enters the banking system.

Source: startus-insights.com

Source: startus-insights.com

Different types of anti money laundering. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Most of the times the deposits are made into offshore accounts or in companies which promise upheld secrecy. Examples may include mechanics landscapers or hairstylists. Domestic money laundering transactions 1956a2.

Source: acumen-corporate-services.lu

Source: acumen-corporate-services.lu

There are several types of Anti-Money Laundering Software that are available for use. The basic money laundering methods involve black market foreign exchange offshore banking business investments in fake or legitimate companies and smurfing. What are the different types of money laundering. These two money-laundering statutes have broad application and can apply to companies and individuals who knowingly or with willful blindness conduct a prohibited financial transaction. There are plethora of software based on what you are trying to achieve in the AML world from CIP KYC CDD transaction screening and monitoring as well as profiling etc The list of vendors is long spread across the world delivering plugins po.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Different types of anti money laundering. Some different types of AML Software. Increasing digitalization and new online payment and entertainment options have created new avenues for money launderers. These money laundering methods can broadly be categorised into a few types.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title different types of anti money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information