12+ Different types of money laundering techniques ideas

Home » about money loundering Info » 12+ Different types of money laundering techniques ideasYour Different types of money laundering techniques images are available in this site. Different types of money laundering techniques are a topic that is being searched for and liked by netizens now. You can Download the Different types of money laundering techniques files here. Get all royalty-free vectors.

If you’re searching for different types of money laundering techniques pictures information related to the different types of money laundering techniques interest, you have come to the ideal blog. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Different Types Of Money Laundering Techniques. These techniques are powerful and are designed due to their inherent high-dimensionality to have the ability to fit in-sample with a great degree of accuracy. A non-exhaustive list of supervised learning techniques includes gradient boosting and its adaptations random forests and neural networks. Money laundering is a way for criminals to hide the cash proceeds of their illegal schemes. Different types of anti money laundering.

What Is Money Laundering And How Is It Done From jagranjosh.com

What Is Money Laundering And How Is It Done From jagranjosh.com

Also referred to as structuring it can be seen that this particular technique involves breaking significant sums of money into smaller chunks or multiple deposits. The idea of cash laundering is essential to be understood for those working in the monetary sector. Examples of money laundering techniques. Smurfing is one money laundering technique that is used in order to launder money. This can also be spread across various different accounts in order to avoid the risk of detection. Money laundering is a means of storing or transporting money while obscuring its true origin.

Increasing digitalization and new online payment and entertainment options have created new avenues for money launderers.

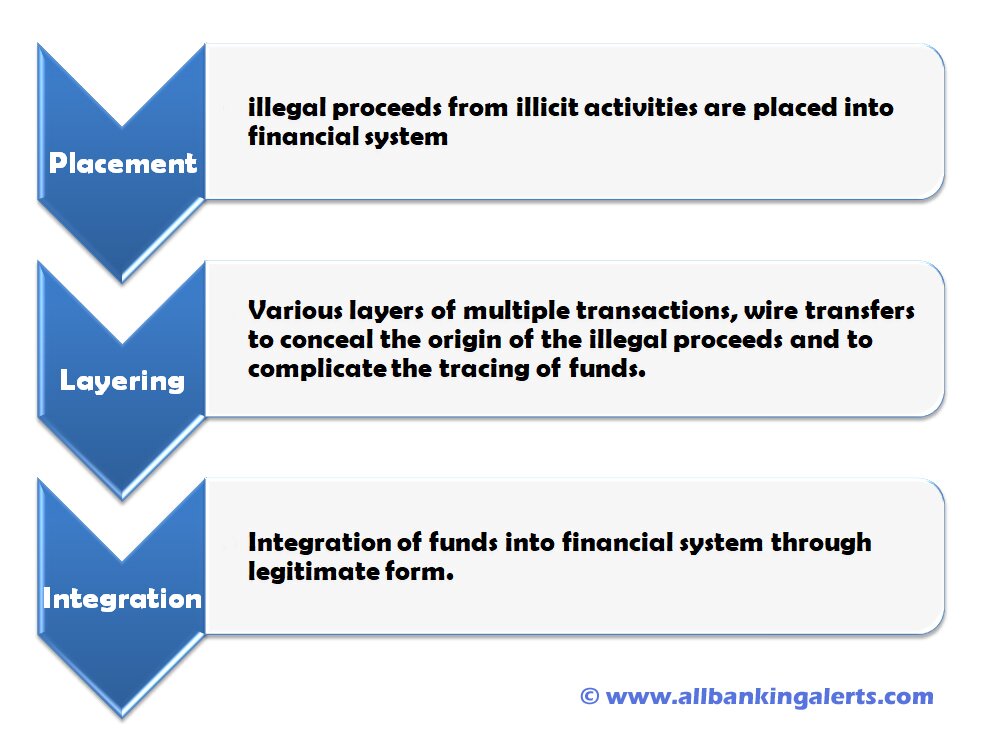

Criminals use different strategies to launder money. Placement layering and integration. They include bank methods smurfing or structuring currency exchanges and double-invoicing. Anti Money Laundering Compliance Program Steps To Mitigate Risks. They include using shell companies small bank deposits and regular consistent bank deposits. Bulk cash smuggling involves literally smuggling cash into another country for deposit into offshore banks or other type of financial institutions that honor client secrecy.

Source: efinancemanagement.com

Source: efinancemanagement.com

The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. Placement This is the movement of cash from its source. Also referred to as structuring it can be seen that this particular technique involves breaking significant sums of money into smaller chunks or multiple deposits. The idea of cash laundering is essential to be understood for those working in the monetary sector. Bulk cash smuggling involves literally smuggling cash into another country for deposit into offshore banks or other type of financial institutions that honor client secrecy.

Source: brittontime.com

Source: brittontime.com

The basic money laundering methods involve black market foreign exchange offshore banking business investments in fake or legitimate companies and smurfing. This can also be spread across various different accounts in order to avoid the risk of detection. Bulk cash smuggling involves literally smuggling cash into another country for deposit into offshore banks or other type of financial institutions that honor client secrecy. These money laundering methods can broadly be categorised into a few types. Smurfing is one money laundering technique that is used in order to launder money.

Source: calert.info

Source: calert.info

Anti Money Laundering Compliance Program Steps To Mitigate Risks. Examples of money laundering techniques. 1956 defines three specific types of criminal money laundering according to the DOJ. They recognize this and understand at the same time that the owner needs some. Domestic money laundering transactions 1956a2.

Source: bitquery.io

Source: bitquery.io

While land-based casinos are known to be used in the placement stage of money laundering in which currency is introduced into the financial system Internet gambling is particularly well-suited for the laying and integration stages of money laundering in which launderers attempt to disguise the nature or ownership of the proceeds by concealing or blending transactions within the. They recognize this and understand at the same time that the owner needs some. 1956 defines three specific types of criminal money laundering according to the DOJ. They include bank methods smurfing or structuring currency exchanges and double-invoicing. Its a process by which soiled cash is transformed into clean cash.

Source: allbankingalerts.com

Source: allbankingalerts.com

Simplified Customer Due Diligence For customers that you deem low-risk you can perform simplified CDD. Laundering Mechanisms A striking feature of money laundering is the number of different meth-ods used to carry it out. Simplified Customer Due Diligence For customers that you deem low-risk you can perform simplified CDD. Some of the more popular money laundering techniques include. Smurfing is one money laundering technique that is used in order to launder money.

Source: planetcompliance.com

Source: planetcompliance.com

Also referred to as structuring it can be seen that this particular technique involves breaking significant sums of money into smaller chunks or multiple deposits. Some of the more popular money laundering techniques include. Simplified Customer Due Diligence For customers that you deem low-risk you can perform simplified CDD. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. This can also be spread across various different accounts in order to avoid the risk of detection.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

This can also be spread across various different accounts in order to avoid the risk of detection. Anti Money Laundering Compliance Program Steps To Mitigate Risks. Placement layering and integration. While land-based casinos are known to be used in the placement stage of money laundering in which currency is introduced into the financial system Internet gambling is particularly well-suited for the laying and integration stages of money laundering in which launderers attempt to disguise the nature or ownership of the proceeds by concealing or blending transactions within the. Bank tellers are trained to be aware of large deposits and withdrawals and to look for signs these may be a part of a larger.

Money laundering is a means of storing or transporting money while obscuring its true origin. The idea of cash laundering is essential to be understood for those working in the monetary sector. They include using shell companies small bank deposits and regular consistent bank deposits. There are many forms of money laundering though some are more common and profitable than others. Different Types Of Anti Money Laundering on August 05 2021.

Source: jagranjosh.com

Source: jagranjosh.com

They include bank methods smurfing or structuring currency exchanges and double-invoicing. This involves using a business as a front to cleanse money. Domestic money laundering transactions 1956a2. Also referred to as structuring it can be seen that this particular technique involves breaking significant sums of money into smaller chunks or multiple deposits. Money laundering is a way for criminals to hide the cash proceeds of their illegal schemes.

Source: researchgate.net

Source: researchgate.net

Placement layering and integration. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often spread out over many different. The basic money laundering methods involve black market foreign exchange offshore banking business investments in fake or legitimate companies and smurfing. Its a process by which soiled cash is transformed into clean cash. This can also be spread across various different accounts in order to avoid the risk of detection.

Source: gov.si

Source: gov.si

How To Spot Micro Laundering. Laundering Mechanisms A striking feature of money laundering is the number of different meth-ods used to carry it out. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. A non-exhaustive list of supervised learning techniques includes gradient boosting and its adaptations random forests and neural networks. Placement This is the movement of cash from its source.

Source: allbankingalerts.com

Source: allbankingalerts.com

They include using shell companies small bank deposits and regular consistent bank deposits. Money laundering is a way for criminals to hide the cash proceeds of their illegal schemes. Placement This is the movement of cash from its source. They recognize this and understand at the same time that the owner needs some. The basic money laundering methods involve black market foreign exchange offshore banking business investments in fake or legitimate companies and smurfing.

Source: calert.info

Source: calert.info

Anti Money Laundering Compliance Program Steps To Mitigate Risks. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. Money laundering is a means of storing or transporting money while obscuring its true origin. A non-exhaustive list of supervised learning techniques includes gradient boosting and its adaptations random forests and neural networks. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often spread out over many different.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title different types of money laundering techniques by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas