14++ Efcc money laundering act info

Home » about money loundering idea » 14++ Efcc money laundering act infoYour Efcc money laundering act images are available. Efcc money laundering act are a topic that is being searched for and liked by netizens now. You can Find and Download the Efcc money laundering act files here. Get all free vectors.

If you’re searching for efcc money laundering act pictures information connected with to the efcc money laundering act topic, you have pay a visit to the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Efcc Money Laundering Act. The Economic and Financial Crimes Commission EFCC Lagos Zonal office on April 10 2019 arraigned one Saheed Hammed Hussain alongside his companies SH Concept Limited and America House Hold Limited before Justice Mohammed Liman of the Federal High Court sitting in Ikoyi Lagos on a three-count charge bordering on money laundering. The commission is empowered to prevent investigate prosecute penalize economic and financial crimes and is charged with the responsibility of enforcing the praising of other laws regulating relating to economic financial crimes including. The commission accused the defendants of conspiring to commit an illegal act of accepting cash payments in the aggregate sum of N3388 million from the House of Assembly without going through a financial. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act.

The Money Laundering Act 1995 The Money Laundering Prohibition act 2004. ESTABLISHMENT ACT 2004 EXPLANATORY MEMORANDUM This Act provides for the establishment of the Economic and Financial Crimes Commission charged with the responsibility for the enforcement of all economic and financial crimes laws among other things. When was the EFCC established. The Establishment Act The Act mandates the EFCC to combat financial and economic crimes. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. The EFCC Act 2004 as well as a posse of other laws which the Commission has direct responsibility for their enforcement.

The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country.

MONEY LAUNDERING PROHIBITION ACT 2011 EXPLANATORY MEMORANDUM This Act- a provides for the repeal of the Money Laundering Act 2004 and enactment of Money Laundering Prohibition Act 2011. The EFCC Act 2004 as well as a posse of other laws which the Commission has direct responsibility for their enforcement. The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. ESTABLISHMENT ACT 2004 EXPLANATORY MEMORANDUM This Act provides for the establishment of the Economic and Financial Crimes Commission charged with the responsibility for the enforcement of all economic and financial crimes laws among other things. There are several notable money laundering cases in Nigeria. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC.

When was the EFCC established. While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts. The Money Laundering Act 1995 The Money Laundering Prohibition act 2004. EFCCs non-service of charge stalls arraignment of Oduah others. The EFCC was established on April 13 2003.

The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011. There are several notable money laundering cases in Nigeria. The Establishment Act The Act mandates the EFCC to combat financial and economic crimes. Of the Money Laundering Prohibition Act. MONEY LAUNDERING PROHIBITION ACT 2011 EXPLANATORY MEMORANDUM This Act- a provides for the repeal of the Money Laundering Act 2004 and enactment of Money Laundering Prohibition Act 2011.

Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme. According to the charge EFCC alleges that the defendants accepted cash payments above the threshold set by the Money Laundering Act without going through a financial institution. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act.

Source: learnnigerianlaws.com

Source: learnnigerianlaws.com

The Economic and Financial Crimes Commission EFCC Lagos Zonal office on April 10 2019 arraigned one Saheed Hammed Hussain alongside his companies SH Concept Limited and America House Hold Limited before Justice Mohammed Liman of the Federal High Court sitting in Ikoyi Lagos on a three-count charge bordering on money laundering. B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011. Of the Money Laundering Prohibition Act. The Establishment Act The Act mandates the EFCC to combat financial and economic crimes.

Source: slidetodoc.com

Source: slidetodoc.com

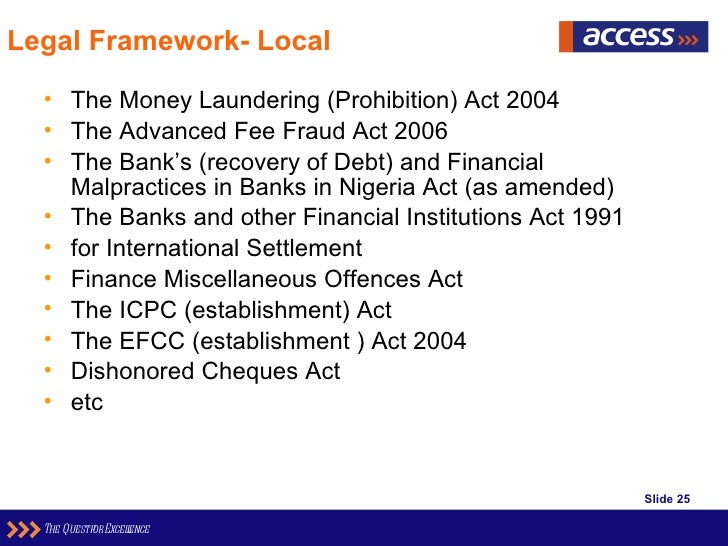

Some of the laws include the Money. The Money Laundering Act 1995 The Money Laundering Prohibition act 2004. The banking institutions like other business entities often pay lip service to the issue of compliance with anti-money laundering AML regulations. Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime. The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011.

Source: lawpadi.com

Source: lawpadi.com

The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. When was the EFCC established. EFCCs non-service of charge stalls arraignment of Oduah others. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act.

Source: slidetodoc.com

Source: slidetodoc.com

The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme. Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. The Money Laundering Act 1995 The Money Laundering Prohibition act 2004.

Source:

Source:

The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts. Of the Money Laundering Prohibition Act. Nigerias response led to the passage of the Money Laundering Prohibition Act 2004 currently 2011 ML P Act as amended and legally included Designated Non-Financial Institutions DNFIs in the anti-money launderingcombatting the financing of terrorism AMLCFT regime. The Economic and Financial Crimes Commission EFCC is a Nigerian law enforcement agency that is accountable for the investigation of economic and financial crimes such as advance fee fraud also known as 419 fraud money laundering and embezzlements.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The banking institutions like other business entities often pay lip service to the issue of compliance with anti-money laundering AML regulations. There are several notable money laundering cases in Nigeria. The EFCC Act is an Act mandates the EFCC to combat financial and economic crimes. Nigeria being a cash-based economy vested the supervisory. When was the EFCC established.

The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. Money Laundering Allegation. B makes comprehensive provisions to prohibit the financing of terrorism the laundering of the proceeds of a crime or an illegal act. While the EFCC relies on the Money Laundering Prohibition Act to lawfully supervise bank accounts of lawyers and to demand that lawyers use SCMUL for their bank accounts Lawyers rely on the Evidence Act and arguably the Constitution of Nigeria to lawfully demand that the EFCC and all other persons stay away from their Client-Attorney Relationships and their bank accounts. EFCCs non-service of charge stalls arraignment of Oduah others.

Source: stephenlegal.ng

Source: stephenlegal.ng

ESTABLISHMENT ACT 2004 EXPLANATORY MEMORANDUM This Act provides for the establishment of the Economic and Financial Crimes Commission charged with the responsibility for the enforcement of all economic and financial crimes laws among other things. The leading government agency investigating and prosecuting the offenses of money laundering in Nigeria is the Economic and Financial Crimes Commission EFCC. By the provisions of the Money Laundering Prevention Act MLPA 2011 and the AMLCFT Regulation 2009 as amended banks are expected to implement an effective compliance programme. The principal law governing money laundering in Nigeria is the Money Laundering Prohibition Act 2011. When was the EFCC established.

Such cases include infractions that are contrary to the provisions of the Commissions enabling law. Some of the laws include the Money. Of the Money Laundering Prohibition Act. According to the charge EFCC alleges that the defendants accepted cash payments above the threshold set by the Money Laundering Act without going through a financial institution. The Economic and Financial Crimes Commission EFCC Lagos Zonal office on April 10 2019 arraigned one Saheed Hammed Hussain alongside his companies SH Concept Limited and America House Hold Limited before Justice Mohammed Liman of the Federal High Court sitting in Ikoyi Lagos on a three-count charge bordering on money laundering.

Source: slideshare.net

Source: slideshare.net

The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. The EFCC was established on April 13 2003. The Money Laundering Prohibition Act 2011 The Act contains elaborate provisions for the combating of money laundering activities in the country. The Act gave a number of obligations to financial institutions and designated non-financial institutions geered towards achieving the objectives of the Act. Of the Money Laundering Prohibition Act.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title efcc money laundering act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information